Investing in tech today feels a lot like bargain-hunting on Rodeo Drive – rare, but possible with discipline, patience, and appropriate perspective. It is with this mindset that I attended one of the world’s largest semiconductor industry events – Semicon Taiwan.

This trip marked my second visit since the pandemic and reaffirmed a key takeaway: Taiwan offers compelling opportunities beyond the highly trafficked TSMC. Semicon Taiwan’s 1,200+ exhibitors and over 100,000 attendees underscored the incredible scale, breadth, and sophistication of the Asian semiconductor ecosystem. I left with renewed appreciation for its complexity and growing doubt about how easily such a supply chain could be replicated in the United States.

Key Themes From the Trip

AI hype is fueling the semiconductor boom

Memory is a cornerstone of AI infrastructure

Advanced packaging and testing are essential investments

AI Hype is Fueling the Semiconductor Boom

Despite elevated stock valuations and signs of froth reminiscent of the dot-com era, I was struck by the persistent optimism surrounding AI in most of my discussions with leaders throughout the supply chain. Confidence extended well into 2027, and most were unfazed when questioned about adoption timelines, practical use cases, or, most importantly, ROI. This undoubted enthusiasm is concerning. I began my career a few months before the dotcom bubble burst, and these conversations evoke memories of euphoria during the early days of the Internet.

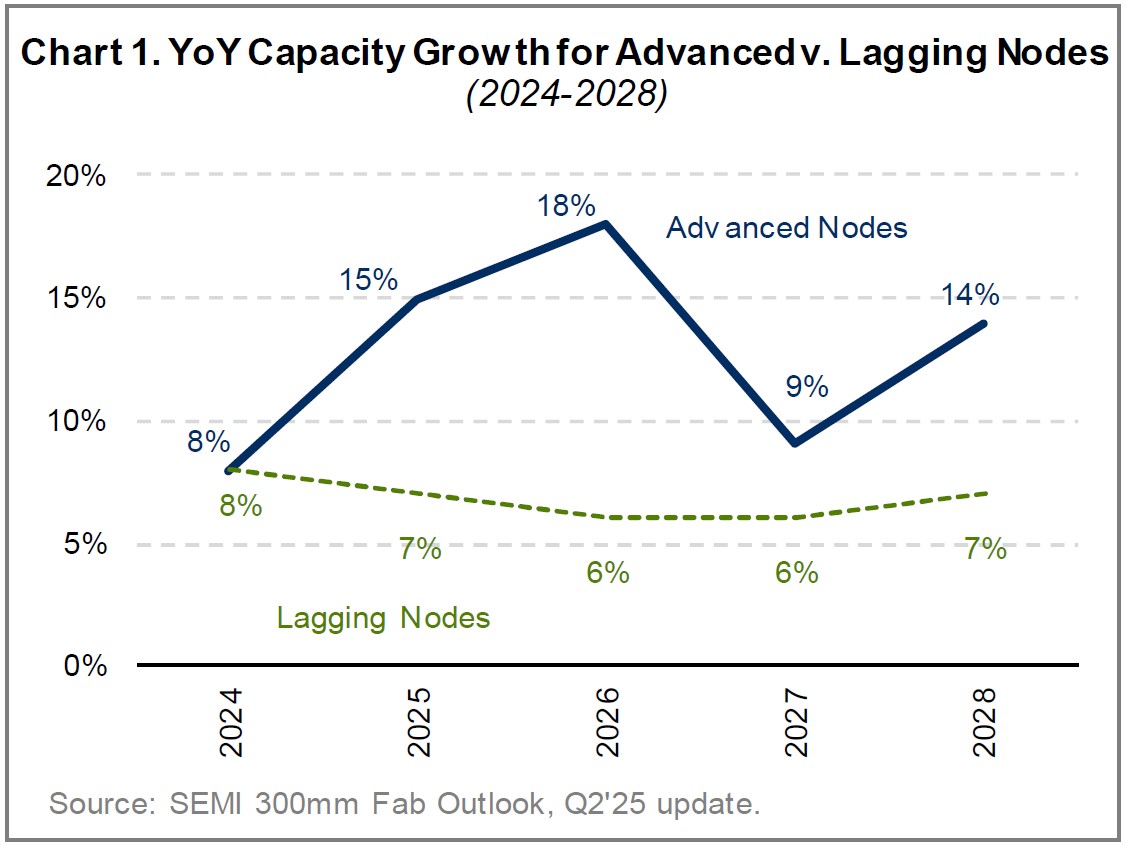

Most AI-focused investments within companies are concentrated on the cutting edge of semiconductor manufacturing (i.e., advanced nodes). For now, much of the chip industry’s growth hinges on this trend (Chart 1). Any slowdown in AI expenditure would create a significant headwind. Its lofty promise must be delivered to justify the hype.

Memory is a Cornerstone of AI Infrastructure

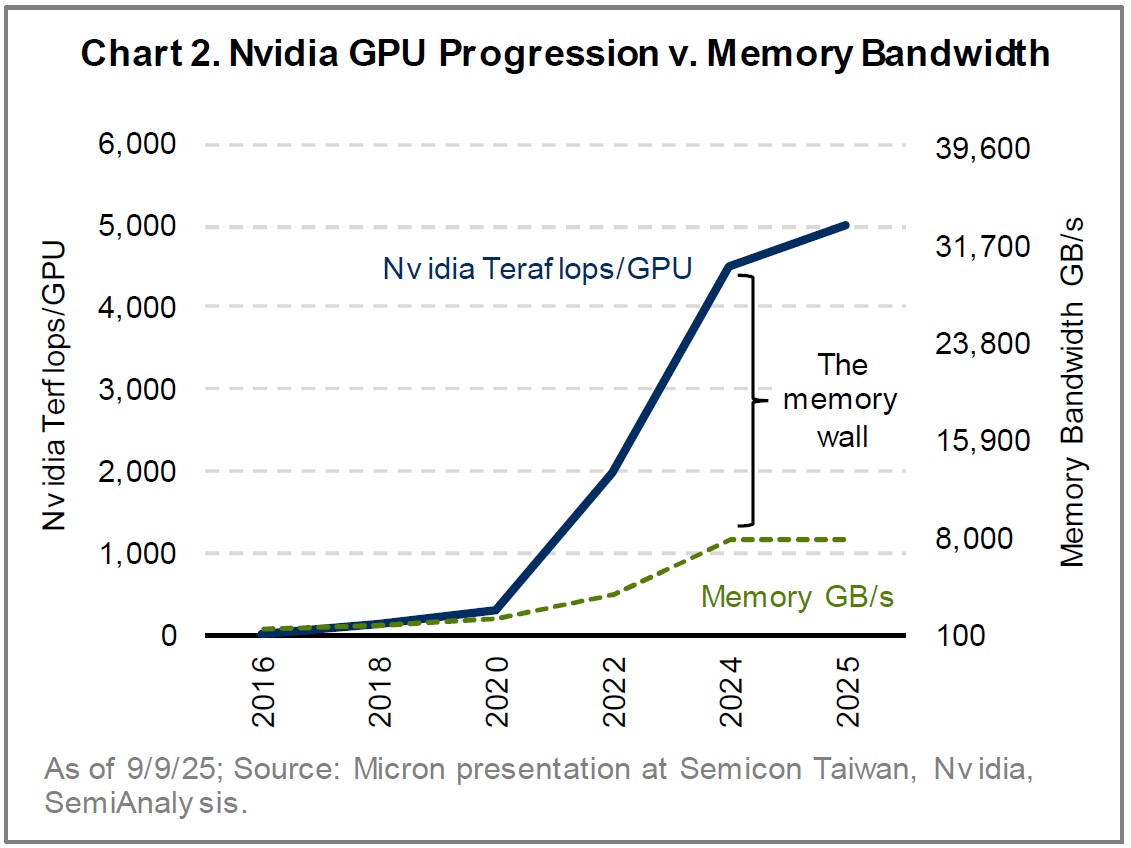

Large language models require vast high-speed memory, making high bandwidth memory (HBM) and GPU integration critical. At the Semicon Taiwan event, major memory makers, including one of our holdings1, Samsung, highlighted memory’s vital role in AI infrastructure. However, memory innovation has lagged advances in logic chips, in part because the memory industry is highly commoditized. While GPU performance (as measured by FLOPS2) is scaling at roughly 3x every two years, memory bandwidth is improving at 1.6x (Chart 2). Closing this gap will require significant innovation – and perhaps collaboration across the industry.

Advanced Packaging and Testing are Essential Investments

As Moore’s Law3 slows, chip performance increasingly depends on advanced packaging – i.e., how components are assembled. This has evolved into a specialized sub-industry with dedicated tools and processes. Testing has become essential at every stage to protect high-value chips and is now a key part of manufacturing design. These trends benefit semiconductor equipment makers, including Chroma ATE, which is held in our EM portfolio.4 This Taiwan-based leader in semiconductor power testing is seeing strong demand from AI chips and has begun expanding its reach with new advanced metrology tools.

Closing Thoughts

The market’s euphoric optimism around AI underscores the value of our disciplined approach and differentiated exposure. Trips like this one allow us to remain deeply engaged in the Asian supply chain and help us find those hidden gems.

Semicon Taiwan highlighted multiple opportunities for back-end5 semiconductor capital equipment vendors. The ongoing push to advance semiconductor performance – alongside the technical challenges it presents – reinforces the view that back-end semicap equipment is no longer just capacity-driven. Trends such as advanced packaging, next-generation metrology, and process innovation are expected to sustain strong demand for semiconductor equipment tools. Across our portfolios, we hold positions in several companies we believe are well positioned to benefit from increased investment in the semiconductor supply chain, including Chroma ATE, Hexagon, Sinbon Electronics, Samsung, and SMC Corp.6

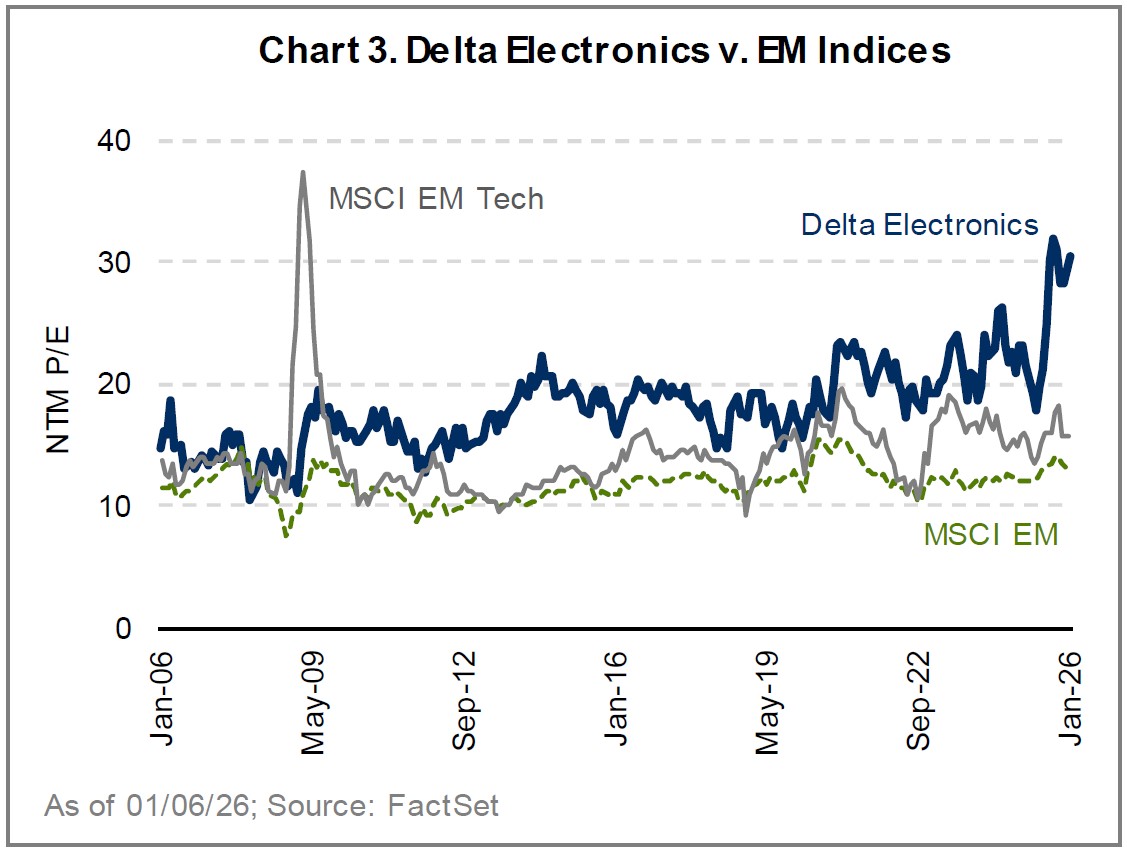

While we recognize the long-term promise of AI, current valuations often price in ‘best-case’ scenarios. A strong example of this is Delta Electronics – a leading power and cooling component provider for AI servers – whose valuation skyrocketed on rising AI capex expectations (Chart 3). At current levels, we see little margin for error or slowdown, prompting a full sale from our EM portfolio at the beginning of Q4 2025.

Looking specifically at the IT sector, we maintain an underweight positioning and have been trimming some existing positions. However, we are finding some compelling opportunities on the periphery of the AI boom. As enterprises ramp up their digital infrastructure to unlock AI-driven insights, select enablers stand to benefit. One such company is Advantech Co., a recent addition to our EM portfolio and one of the companies I had the opportunity to visit on this trip. As the global leader in industrial PCs, Advantech is well-positioned to capitalize on the rise of industrial IoT and AI-driven manufacturing.

Overall, I returned from Taiwan with additional support for my initial hypothesis – yes, bargains can still be found on Rodeo Drive!