Dear Investor,

Global Equity markets delivered strong gains in 2023, climbing 23.8% for the year and 11.4% in the fourth quarter, as measured in US dollars.1 These gains marked a reversal of 2022’s dismal market performance (-18.1%), as animal spirits returned with vigor. 2023 concluded with the VIX near multi-decade lows, bitcoin up over 150%, global high-yield bond spreads near 15-year lows2 , and equity investor bullishness near all-time highs.3

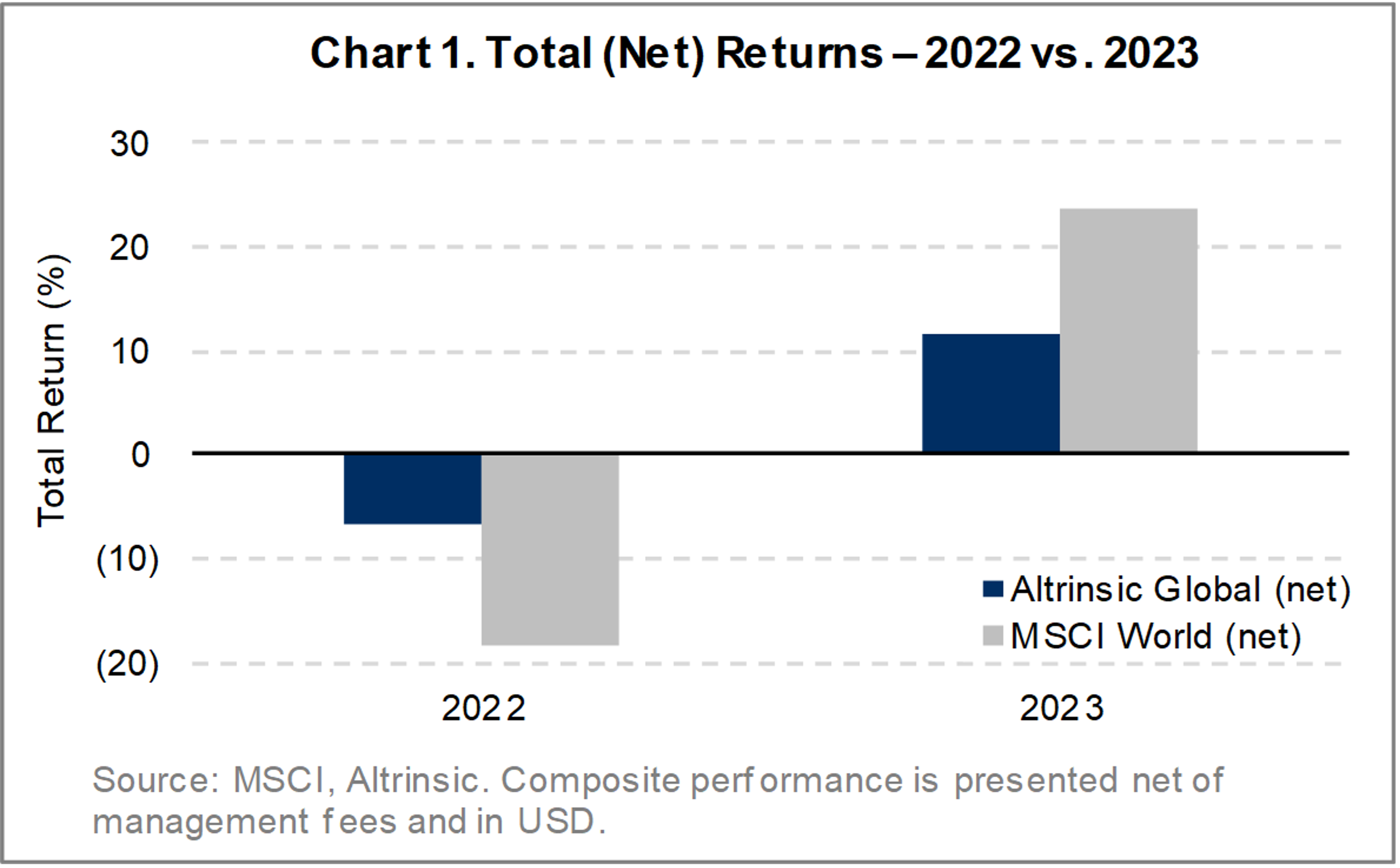

Many of the highly valued technology companies and cyclical stocks that were pummeled during 2022 led markets in 2023. Our underweight exposure to these areas – in some cases no exposure – was the primary source of our underperformance during 2023, as the Altrinsic Global Equity portfolio gained 12.8% for the full year and 8.4% in the fourth quarter gross of fees (11.9% and 8.1% net, respectively).i As shown in Chart 1, the outperformance delivered during the 2022 market decline was given back during the 2023 rally. We continue to see the greatest value and opportunity among less cyclical and more resilient businesses and among companies undertaking specific initiatives to unlock shareholder value that is not appreciated in the market. These investments provide scope for attractive returns and a margin of safety in an investment landscape that we consider dangerously complacent.

Performance Review

Equity markets experienced a robust recovery this year despite unsettling macro and geopolitical developments, including the most aggressive central bank interest rate increases since the 1980s, the third largest bank failure in US history, the collapse of the once-venerable Credit Suisse, a downgrade to the US credit rating, intensifying instability in the Middle East (amplified by the Israeli-Hamas war), and the ongoing Russia-Ukraine war. Massive fiscal spending, most meaningfully in the US, temporarily eased recessionary fears, while central bankers’ pivot to a more dovish interest rate outlook raised hopes for a potentially Goldilocks environment of a soft landing coupled with declining interest rates.

Leadership by the “Magnificent Seven” persisted during 2023. Median returns for the group exceeded 80%; the equal-weighted MSCI World and S&P 500 indices underperformed their market-weighted counterparts by the largest margin since the dot-com bubble. Unsurprisingly given this, growth stocks (MSCI ACWI Growth +33.2%) massively outperformed factor value (MSCI ACWI Value +11.8%) for the year.

Market broadening was primarily confined to cyclical stocks in Q4, as inflation and economic activity surprised positively. A policy pivot by US Fed Chair Jerome Powell in December seemingly gave an “all clear” signal to investors, providing a boost to long-duration growth stocks (technology +17.5%). Cyclicals (real estate +17.2%, industrials +13.8%) also delivered excellent returns, but defensive sectors (consumer staples +5.3%, health care +5.9%) and energy (-4.1%) lagged.4

Against this backdrop, the Altrinsic Global Equity portfolio underperformed largely due to below-market risk (current beta is 0.73) 5 , our “value” discipline in a market driven by “growth” stocks, and poor attribution by our exposures in the communication services, technology, health care, and financials industries.

Beta was the most powerful quantitative “factor” influencing market performance during 2023 and a source of headwinds for us. During the latter half of 2022, our value discipline led us to significantly increase our investments in cyclical businesses (and with it, our portfolio beta), as several stocks offered an attractive margin of safety. However, throughout 2023, many of our cyclical investments rallied sharply, leading us to sell them in favor of other opportunities

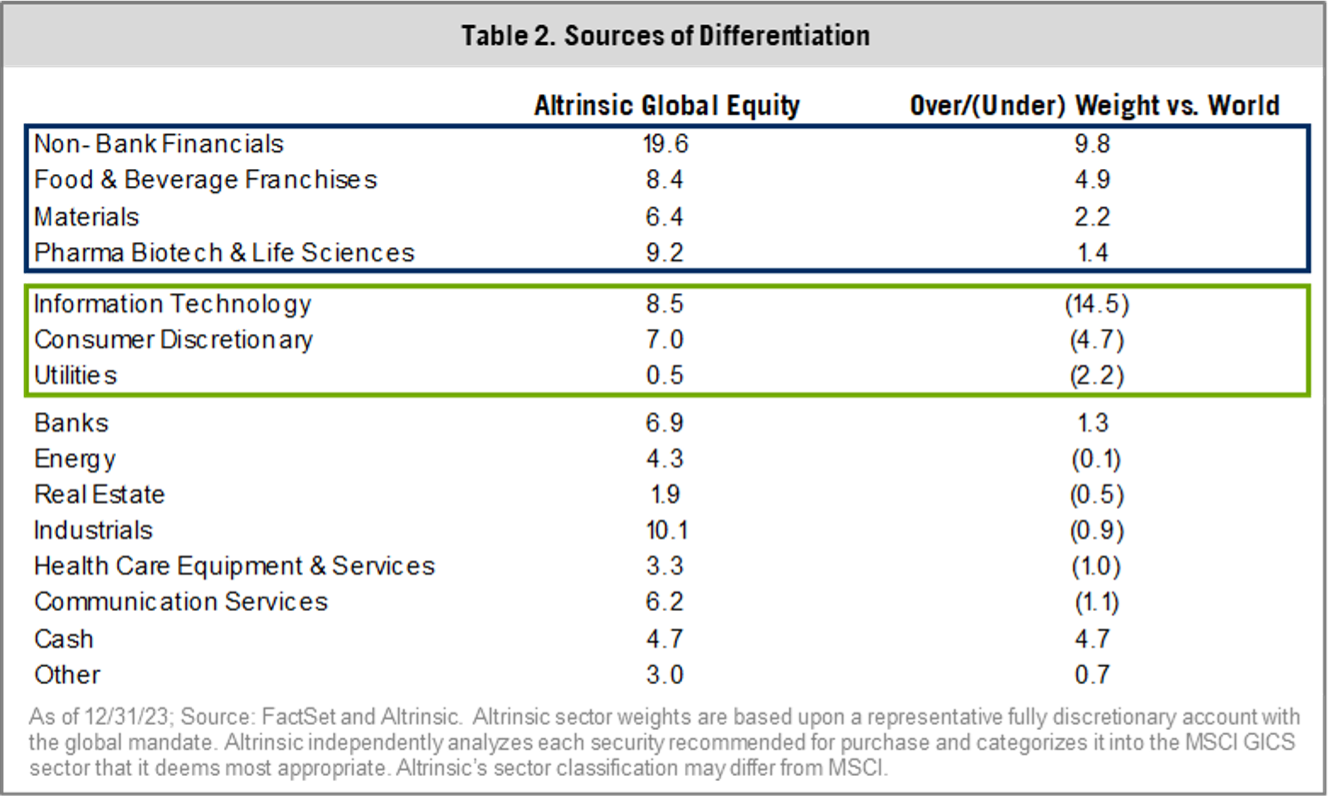

Our positioning versus benchmarks and most value peers is meaningfully different (Table 2). The portfolio is underweight the more leveraged and cyclical businesses that often dominate factor value indices. While these stocks may appear inexpensive at first glance, most are very expensive relative to their own history and are operating near peak profit margins, leaving investors exposed to a very poor asymmetry of returns if the market and/or economic environments worsen.

At a more granular level, and through the lens of traditional attribution analysis, the greatest sources of negative attribution were holdings in communication services, technology, health care, and financials. Charter Communications and Comcast shares were pressured as subscriber growth disappointed. While not ideal, cash flow continues to improve, and competitive moats remain underappreciated. Similarly, Baidu was pulled down by macro weakness in China despite strong profit growth and compelling artificial intelligence initiatives. Not owning Microsoft, Nvidia, and Broadcom weighed on relative performance in the tech sector. In health care, poor performance by Sanofi, Bristol-Myers, and GSK was largely due to disappointing cost guidance (Sanofi, Bristol) and lower growth profiles than market leaders. Minimal exposure to high beta banks and more exposure to durable insurance companies weighed on overall financials performance. The greatest sources of positive attribution were in materials, energy, and industrials.

Investment Activity and Positioning

Investment activity during the quarter included 1) trimming cyclical investments on valuation grounds, 2) adding to quality compounding franchises, 3) selling four investments (GoDaddy, New Relic, Sekisui House, Tokio Marine) as share prices neared our intrinsic value assessments, and 4) establishing four new positions (CNA Financial, Healthpeak Properties, Kerry Group, Sandoz). The new management team at US insurer CNA has dramatically turned around its underwriting over the last several years, and the company should benefit from significant interest rate tailwinds in the years to come; current valuations give little credit for these opportunities. Healthpeak, a US medical office REIT, has shifted its business to more resilient areas of the medical food chain; near-term supply/demand dynamics present manageable risks, and long-term fundamentals are intact. Ireland-based Kerry Group, a leader in flavor and ingredients for the food and beverage industry, is managing its way through soft industry dynamics, but its discounted valuation gives little credit for sustainable profitability and long-term market share opportunities. Sandoz, a Swiss generic drug manufacturer recently spun out of Novartis, has opportunities to improve margins and growth as it grows its biosimilar portfolio and improves its cost focus as a stand-alone entity under new leadership.

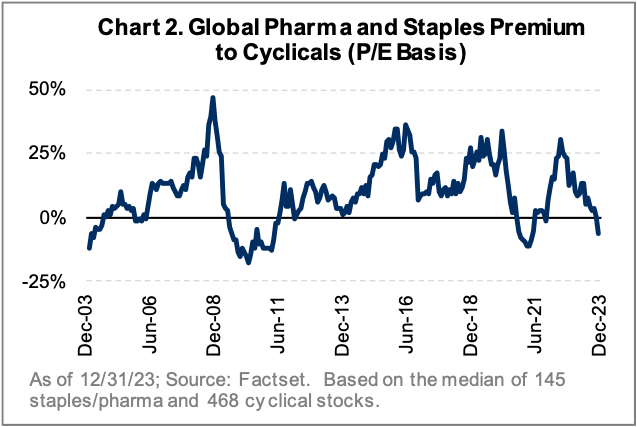

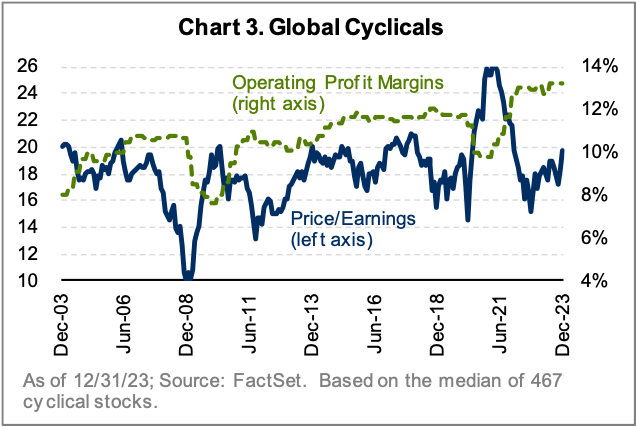

Throughout the year, we increased our exposure to pharma and staples companies due to a valuation disconnect. Chart 2 illustrates the extent to which cyclical valuations are stretched versus more defensive stocks, while Chart 3 shows that cyclicals now trade near all-time highs on trailing earnings with peak margins, providing an unattractive margin of safety should the Goldilocks outcome not come to pass.

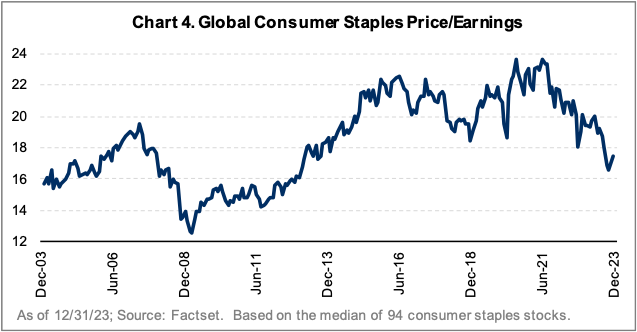

We recognize that staples companies are navigating through post-pandemic cost and price increases, leaving the near-term growth outlook uncertain. Anti-obesity drugs are further pressuring sentiment. Chart 4 highlights how valuations have collapsed. Low valuations and weak sentiment provide a favorable investment proposition for these durable franchises such as Nestlé, Heineken, and Danone.

Our investment approach typically leads us to opportunities outside of the mainstream, with positioning and risk exposures that are different from broad market indices. The greater the extremes in valuations and misperceptions involving risk, the more differentiated our investments, positioning, and risk exposures tend to be. As of the end of 2023, our portfolios are highly differentiated within all three categories.

Our investment approach typically leads us to opportunities outside of the mainstream, with positioning and risk exposures that are different from broad market indices. The greater the extremes in valuations and misperceptions involving risk, the more differentiated our investments, positioning, and risk exposures tend to be. As of the end of 2023, our portfolios are highly differentiated within all three categories.

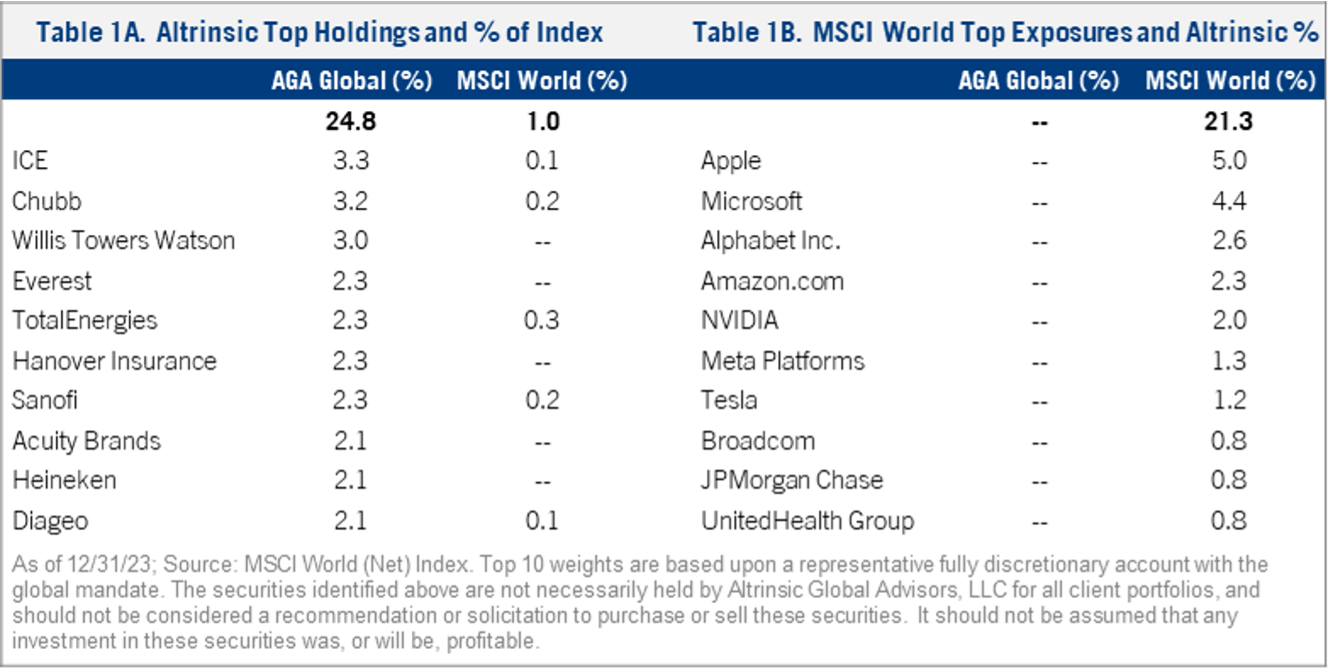

Table 1A illustrates our largest investments and their representation in the MSCI World Index. Table 1B ranks the largest positions in the index and our exposure to each. There is very little overlap. We have no exposure to the ten largest index constituents. Our top ten positions make up almost 25% of the portfolio while representing just 1% of the MSCI World Index. This has been a challenging environment to be different, but such environments are often the most prudent times to stray from the crowd.

Largest Overweight Sectors

- Non-Bank Financials – Mostly insurance, which has a strong outlook for demand and competition, along with enhanced business mix and cost cutting opportunities

- Food & Beverage Franchises – Strong category mix with premiumization, reopening, and cost cutting opportunities

- Materials – Idiosyncratic investments in packaging, chemicals, gold, paints, and building materials

- Health Care – Reduced patent cliff risk, investing heavily in innovative sciences, attractive valuations

Largest Underweight Sectors

- Information Technology – Risks around end demand, competition, and regulation are not reflected in valuations

- Consumer Discretionary – Many companies are expensive on normalized profitability with various disruption risks

- Utilities – Valuations present unappealing risk/reward considering regulatory and growth outlook

Perspectives on Risk

The level of risk embedded in our portfolio is not a targeted or top-down decision, but rather a by-product of where we find undervalued companies with the most favorable asymmetric skew of possible outcomes. Given the risks and excesses present in today’s market, we are quite comfortable with the low beta embedded in the portfolio. However, this has been a relative performance headwind.

Many of the obvious risks are well-telegraphed and featured on the front pages, so they are less likely to be disruptive. Given the complacency in markets, we are particularly mindful of interest rates, corporate earnings, narrow technology leadership, and evolving market structure dynamics.

Interest rate risk – Markets and pundits have embraced the dovish outlook, confident that the inflationary pressures are behind us, the economic landing will be soft, and rates will normalize. Asset prices appear to be reflecting a dovish scenario too, but there are a range of other outcomes that could be disruptive. Sources of disruption include a deteriorating credit cycle, supply/demand imbalances in bond markets during a time of massive US treasury issuance, and quantitative tightening, to name a few. This is all taking place in a world of high fiscal deficits and debt in many of the world’s largest economies, presenting very real economic and market implications.

Corporate earnings risk – We have highlighted that cyclical companies are operating near peak profitability levels. Simultaneously, the conventional wisdom is that the “Magnificent Seven” can do no wrong. Importantly, surprises on either front are not expected by the consensus. More broadly, economies and earnings have been resilient in the face of massive monetary tightening. Monetary policy works with a lag, and we are just entering the window where the delayed effects should be felt, right at the same time that massive fiscal spending is subsiding. Profits have also been buoyed by strong pricing power and a pullforward in demand that has offset goods inflation; a potential shift in both dynamics remains underappreciated.

Technology leadership and market structure dynamics – History tells us that narrow equity market leadership is the exception, not the rule, and 2022 should serve as a reminder that the unwinding of excessive conventional thinking can be very painful. Technology and popular growth stocks have climbed to their greatest-ever representation in market indices, but many of these companies have gone from nimble upstarts with low product penetration to industry leaders with large profit pools to defend. With this scale often comes greater government regulation; many of the largest technology companies are likely to be targeted by anti-trust and other regulatory actions. Passive and other index-oriented flows have presented an enormous virtuous cycle that could turn vicious if it unwinds. We continue to believe that a broadening out in equity markets is a more likely scenario and that differentiation and risk management will be prized portfolio attributes in the years to come.

Connected to all these risks is the fact that 2024 is among the biggest election years in history. The US, EU Parliament, Taiwan, and South Africa are top of mind, but elections will occur in countries representing 73% of the global equity universe (MSCI ACWI Index weighting) and 54% of the emerging markets universe (MSCI EM Index weighting).6 The outcome of elections in Russia and Iran are foregone conclusions, but protests and disruptions (internal and external) are possible, if not likely. Among many, three global election issues could heavily impact markets: 1) politicians’ approaches to dealing with large deficits and debt that have supported the world for 15 years, 2) how a slowing of the global economy could impact voter behavior, and 3) whether politicians turn to populist or anti-business rhetoric to gain votes.

Summary

Most macro forecasters were wrong about 2023, and nobody knows how markets will play out considering the existing excesses. We do not have a crystal ball and, therefore, only consider the macro dynamics in the context of risk. A likely scenario is softness among last year’s leaders, as they will need time for earnings to grow into lofty valuations, while markets broaden and recognize opportunities elsewhere. Other more disruptive outcomes deserve greater consideration than what pundits are suggesting. We believe that the likelihood of continued exuberance is low and that our positioning is prudent, enabling us to deliver on our clients’ objectives.

Please contact us if you would like to discuss these or other matters in detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick