Dear Investor,

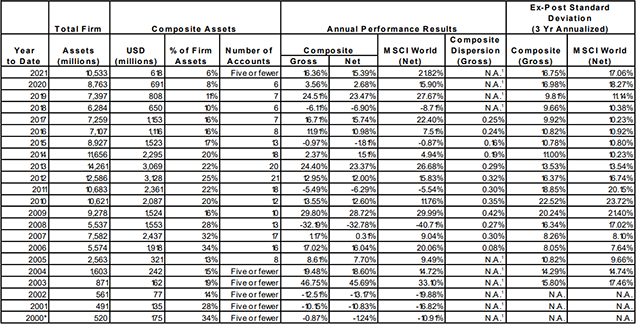

Global equities delivered their worst quarterly performance since the European sovereign debt crisis as uncertainty stemming from inflationary concerns, tightening central bank policies, and rising recession risk weighed on markets. The Altrinsic Global Equity portfolio declined 10.9% during the second quarter, outperforming the MSCI World Index’s 16.2% decline, as measured in US dollars.i Outperformance was derived from all major industry exposures except real estate, materials, and utilities. We take no consolation in our relative outperformance during this painful drawdown. Near-term macro data and corporate earnings will likely be disappointing, but we are confident in our positioning and encouraged by the investment propositions offered by a growing number of companies with strong long-term fundamentals and attractive valuations.

Perspectives

Over the past several years, the combination of low interest rates and subdued inflation provided a robust environment for long-duration growth equities and highly leveraged businesses. The tide has turned, and equity markets have corrected sharply, as investors now require a higher cost of capital and companies consider what it will take to compete in a new environment with greater uncertainty around growth, inflation, and policy. As we navigate a period of heightened risks, it is important to consider a few structural truths about investing. Regardless of one’s investment discipline, the three primary drivers of stock prices over the long term are fundamentals, valuation, and macro/risk factors. Within each category, significant changes are underway.

Macro/Risk Factors

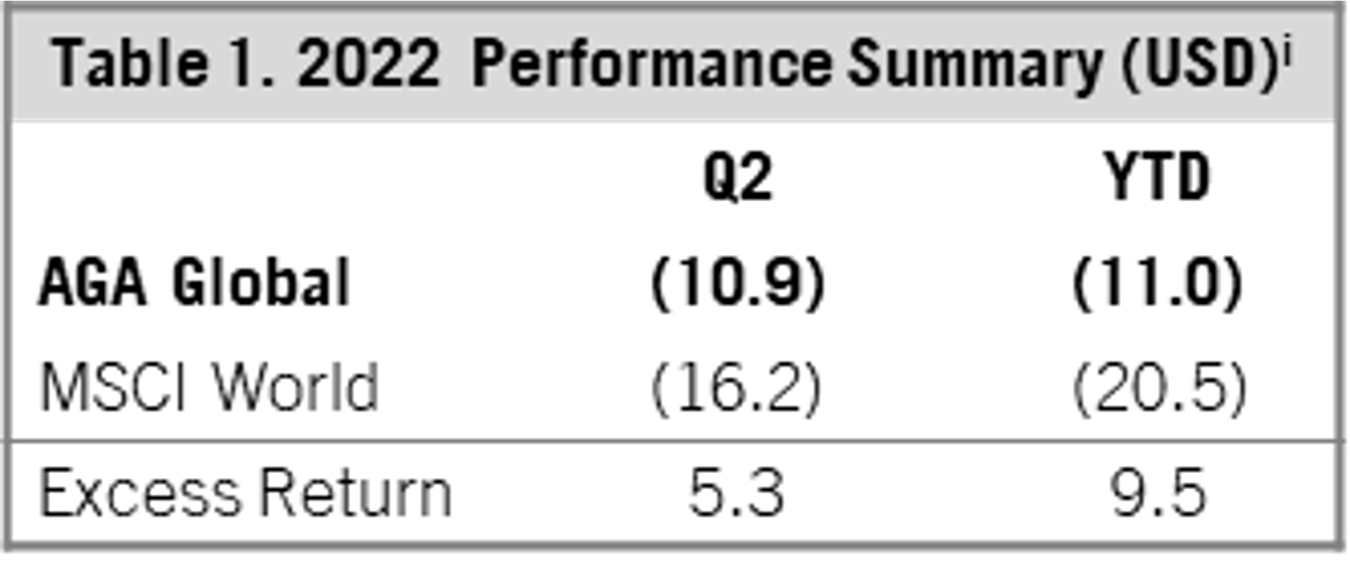

Macro and exogenous risk factors took center stage during the second quarter, as inflation proved deeper-rooted than many anticipated, forcing policymakers to tighten their monetary stance. Geopolitical and recurring pandemic issues exacerbated the inflationary impact. In response, short-term interest rates made their sharpest jump in several decades (Chart 1), and we may see further increases. Central bankers around the world are attempting to slow global inflation (currently at 6%) without engineering a recession, a rarity in modern history. A world of higher inflation and higher interest rates has particularly meaningful repercussions for leveraged businesses, government decision-making, supply-chain dynamics, and consumer behavior.

Rising rates and elevated inflation are already affecting several areas of the global economy, but the impact is likely to vary somewhat across the consumer, business, and government segments. In the consumer area, housing activity and consumption patterns have been early victims; weak results from Target and Walmart are just two recent examples. The good news is that household leverage in many developed markets remains unchanged or has improved over the last several years, and when combined with a tight labor market, it should help soften the economic blow (Chart 2). Meanwhile, corporates accrued more leverage over the last decade, and much of it was issued by higherrisk borrowers at variable interest rates.

Companies with significant leverage are particularly vulnerable to the changing interest rate and operating backdrop. Historically, leveraged businesses have underperformed in market drawdowns as economic outlooks worsen and concerns around credit risks and profitability repercussions mount (Chart 3). However, in 2022 these stocks have significantly outperformed, likely aided by a rotation out of expensive growth stocks. Rising rates and an economic slowdown are an especially bad cocktail for these companies, and this outperformance is likely to unwind in an environment of further economic weakness.

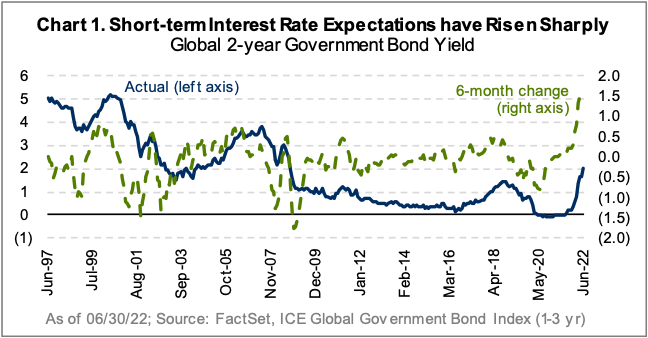

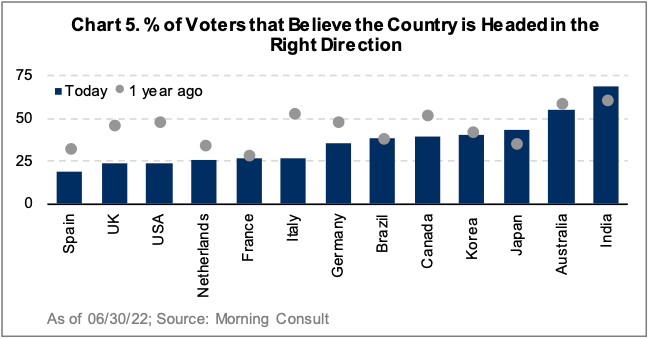

Governments accrued even more debt as they supported businesses and households during the Global Financial Crisis and COVID-19 pandemic. Deficits in most economies are well above historical levels (Chart 4), and heavy debt loads combined with a slowing economy and rising interest burden will require more fiscal tightening, most likely in the form of higher taxes. Unlike the last two recessions, individuals and businesses cannot rely on government support as economic reality bites. Approval ratings for most heads of state are also poor (Chart 5), providing an opening for populist decision-making. The banking and technology sectors are easy targets.

The economic and geopolitical situation in Europe is complicated and vulnerable. The region has always presented a multidimensional set of risks, which is undoubtedly still true today. Prior to the start of the Russia-Ukraine war, 40% of Europe’s gas supply came from Russia. The threat of Putin fully closing off the Nord Stream pipeline adds significant near-term risks to the continent. Germany faces particularly significant challenges given its heavy dependence upon Russian energy, especially leading into the winter months.

Outside of the war raging on in Eastern Europe and its associated effects, Italy’s outlook is particularly dire, as the country has twice the deficit as during the Euro Crisis, 20% more debt, and will face an election within the next 12 months, whenever Prime Minister Mario Draghi steps down. The relationship between Italy and the rest of Europe improved dramatically under Draghi’s 18-month tenure, aided by the considerable Euro-stimulus provided to the country. As Europe’s economy slows and Italy’s deficit comes under pressure, we could see anti-Euro posturing, especially given the combination of a fragmented political structure and forthcoming elections. Italy is a small part of the global equity landscape, but a crisis in Italian banking would reverberate across Europe.

Fundamentals

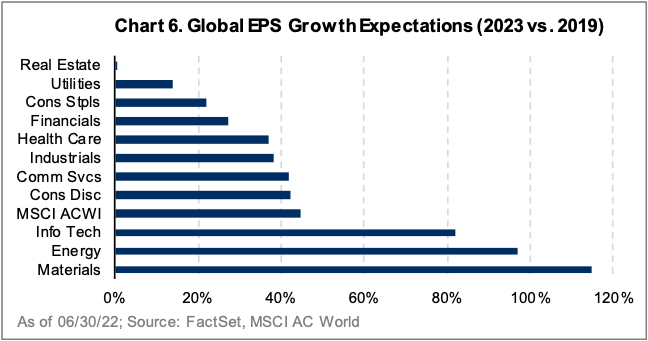

Fundamental conditions vary by region and sector, with risks pervasive amidst significant macro changes. As a result, our focus has been on companies less dependent on economic factors and/or those undergoing some form of change – ideally led by nimble, resilient, and aligned management teams. From a big picture perspective, returns on invested capital, earnings sustainability, and growth are among the broadest measures of business fundamentals. One of the greatest risks in equity markets, however, stems from the unrealistic earnings outlooks held by many investors and companies themselves. While equity markets have corrected, consensus earnings expectations have yet to adjust. Since December 2020, consensus has upgraded 2023 EPS expectations for Europe, the US, and Japan by 25%, 18%, and 15%, respectively, on the assumptions of robust demand and sustained all-time high profit margins. These upgrades have been made across industries, but expectations for technology and consumer discretionary look particularly optimistic at 82% and 42% above 2019 levels, respectively (Chart 6). Earnings expectations often lag markets, but current elevated levels could present risks for many stocks in the coming months

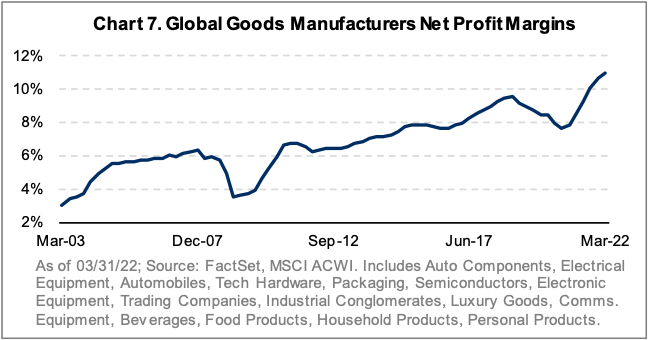

The likely evolution of supply chain strategies across industries over the medium-term only exacerbates the downside to lofty earnings expectations, given expected increases in operating costs. Globalization and technology utilization have been massive tailwinds to supply chain efficiency over the past 20 years. Just-in-time inventory management became a part of most manufacturers’ operating models, helping margins expand rapidly as companies improved the speed and cost of production (Chart 7). This trend began to slow due to trade disputes, populism, and employee backlash, and the slowdown has recently been exacerbated by a series of societal and geopolitical pressures: pandemic-related closures (particularly in China), shifting demand, the RussiaUkraine war, ESG considerations, and high energy costs.

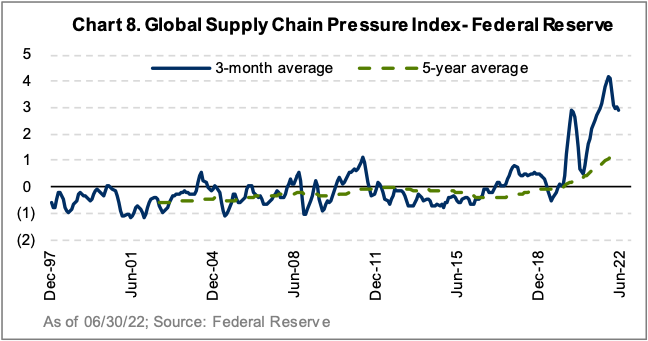

While some supply chain pressure has eased over the past few months, it remains far worse than historical averages (Chart 8). A recent Morgan Stanley survey of over 400 global manufacturers found that the majority of companies plan to adjust their supply chains (due in part to geopolitical risks), and those making long-term changes expect an average margin dilution of two percentage points. This is significant considering global goods manufacturing profit margins are 11%. While most headlines have focused on the negatives, there will certainly be beneficiaries of this shift; companies in automation and energy efficiency stand to benefit, and Mexico has been identified as an attractive region for more localized manufacturing and business operations. The ongoing shifts in supply chain dynamics and the associated costs to implement such changes contribute to our skepticism about the consensus assumption that companies can earn all-time high profit margins.

Valuation

There is no shortage of fundamental, geopolitical, and economic concerns, so, unsurprisingly, sentiment is weak. Bank of America’s Bull/Bear Indicator, which measures equity and bond positioning, is now at one of its most bearish levels in the last decade. Google search interest for the word “recession” is near all-time highs, only matched by March 2009 and March 2020. As we saw in both of those periods, the highly negative sentiment presented enormous buying opportunities.

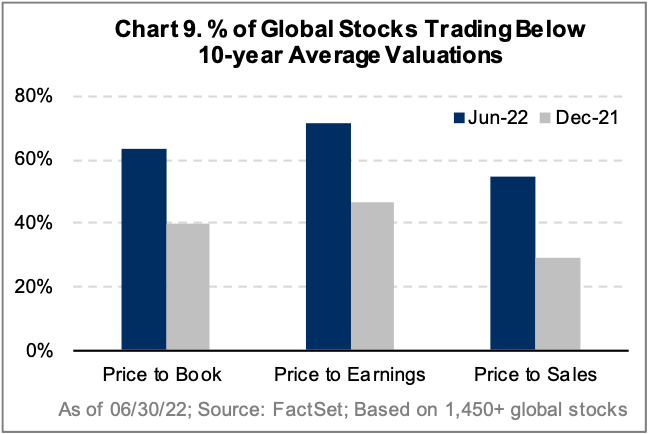

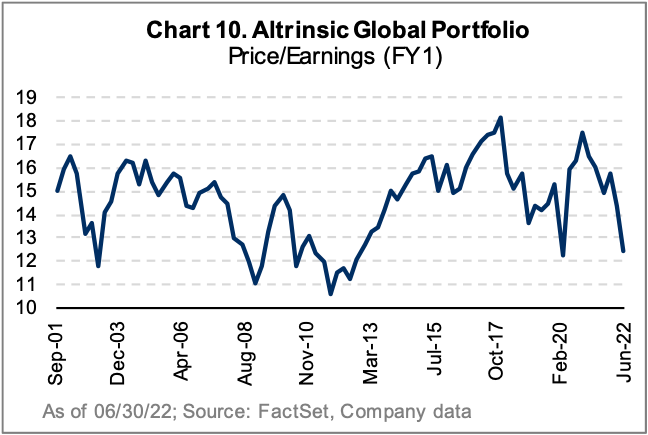

As sentiment has deteriorated, valuations have adjusted sharply, leaving a majority of global stocks trading at a discount to history (Chart 9). While many deserve this de-rating, the downdraft provides investment opportunities. Notwithstanding our skepticism about earnings expectations, the Altrinsic Global Equity portfolio’s aggregate P/E ratio is near historical lows (Chart 10). In our pursuit of attractively valued businesses, however, we have not sacrificed quality (whether defined by pricing power, management strength, and/or competitive moat) when compared to the past. While our holdings will not be immune to market gyrations, each investment has companyspecific opportunities to increase shareholder returns via improved efficiency, capital allocation, and demand dynamics.

Performance Drivers and Portfolio Positioning

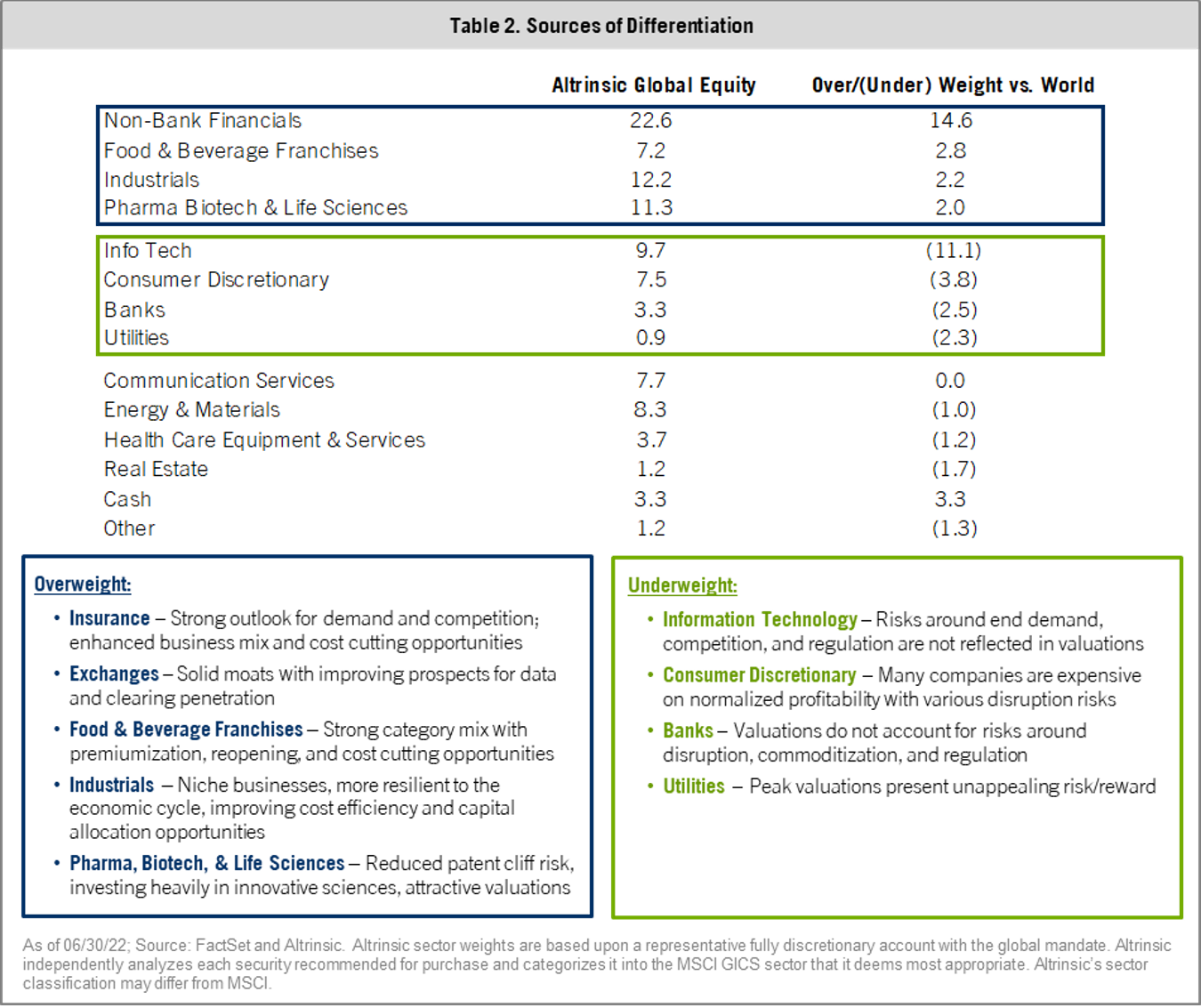

The Altrinsic Global Equity portfolio’s outperformance was broad-based with positive attribution derived from our differentiated positioning in the consumer discretionary, information technology, and communication services industries.

Positive attribution in the consumer discretionary sector was driven by our Chinese investments (Trip.com, Alibaba), which recovered from depressed levels on easing COVID-19 restrictions and an improving regulatory outlook. Outperformance within technology was due to a stock-specific story (Check Point, which operates with more defensive revenue characteristics) and our underweight allocation to expensive high-growth technology stocks. Our holdings in communication services outperformed, led by Baidu and Vodafone, which reported better than expected results and stand to benefit from potential easing of regulatory pressures. Materials and utilities were modest sources of negative attribution. Within materials, negative attribution was the result of Kinross, a Canadianbased gold miner, which faced Russian mine-related losses and is experiencing continued cost inflation. Utilities were a source of negative attribution due to our underweight exposure to the defensive sector.

New investment activity was modest during the quarter, as we initiated one new position – Deutsche Post AG (Germany) – and eliminated Siemens Energy (Germany).

Deutsche Post, commonly known as DHL, is a European logistics company previously prone to execution missteps. Management has transformed the company by improving its business mix and increasing cost efficiencies. No longer reliant on German post, express shipping is DHL’s key profit driver (50% of profits), and the company occupies the leading position in a three-player oligopoly with high barriers to entry. The current valuation assumes an excessive decline in DHL’s profitability once global freight capacity and rates normalize, and it undervalues DHL’s secular growth opportunities from increasing e-commerce penetration and supply chain complexity.

Siemens Energy was sold as we lost confidence in the company’s ability to offset significant cost inflation despite compelling opportunities in wind and other forms of low-carbon energy.

We took advantage of the equity market weakness to add to select cyclical businesses within our existing portfolio that offer a combination of structural integrity and improving business models: HDFC Bank (India), CRH (Ireland), Medtronic (Ireland), Siemens (Germany), Makita (Japan), and Akzo Nobel (Netherlands).

A summary of our most differentiated sectoral exposures is provided in Table 2.

Uncertainty Presents Opportunity

There is tremendous uncertainty affecting markets, economic growth, interest rates, and inflation, some of which we have not seen in generations. These conditions present new challenges for companies, governments, households, and investors and once again serve as a reminder to investors that the valuation and risk components of the risk/return equation are critical considerations. It will be more difficult than in the past for stocks to ride the economic, stimulus, or “story” tides. Therefore, attractively valued companies with paths to improving the quality and growth of their returns on invested capital should outperform over the medium-term. Our portfolio is well positioned for this environment. Thanks for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick