I recently returned from my first post-pandemic due diligence trip to Mexico. While virtual meeting platforms proved to be a blessing during travel lockdowns, nothing compares to the insights gained and relationships that can be developed during a quality research trip. Travelling across three major economic zones and two time zones, I visited with 15 companies, public and private, as well as a vast array of policymakers and political observers. Broadly speaking, the infrastructure improvements, economic environment, services industry recovery, and opportunities linked to an overarching trend of “nearshoring” were impressive. Regional challenges pertaining to droughts and water availability are real – probably the most common topic of conversation throughout my week. Overall, the Mexican people were neither upbeat nor downtrodden – generally neutral about the current state of affairs. The jam-packed week of meetings reaffirmed my cautiously optimistic outlook about the investment landscape in Mexico.

First Impressions

Mexico City’s infrastructure has vastly improved in recent years as evidenced by heightened cleanliness and organization, new construction, and more manageable traffic. To put things into perspective, four meetings per day would have been considered a successful schedule in the past; this time I accomplished six in one day! I was struck by the development of the city – many new modern, state-of-the-art skyscrapers and commercial centers. Last but not least, despite being on the (hopefully) tail end of the pandemic, I was pleasantly surprised by the level of compliance with sanitary recommendations. Virtually everyone was wearing masks, and when I visited government offices, including Banxico1 and Hacienda2, they proactively requested that all guests don a face covering.

Day-to-Day Observations

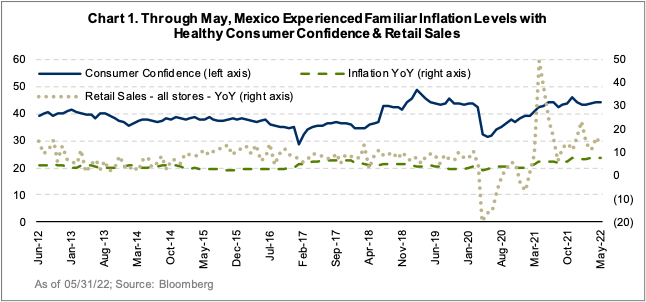

- So-So Attitudes & Outlook: The average Mexican citizen that I encountered at front desks, in corner stores, in cafes, and at airport counters was characteristically “ok” – not overly happy but not particularly negative either. Inflation is certainly affecting the food basket (and citizens’ outlooks and moods), but thankfully elevated energy prices have been somewhat offset by significant energy subsidies paid for by the resource windfall profits. Mexicans have seen episodes of high inflation in the past and are dealing with it relatively well this time around. Consumer confidence remains high and retail sales have continued unabated, despite high CPI levels (Chart 1).

- Water Shortages: One serious challenge – a frequent conversation topic during my visit to the northern portion of the country – is persistent drought-driven water issues in Monterrey and surrounding regions. Although Monterrey and the rest of the state of Nuevo Leon is one of the most vibrant and developed regions in Mexico, I saw firsthand the side effects of years of belowaverage rainfall. Beyond a visible dry bed of the Santa Catarina River, I also learned that residents have limited access to water throughout the day. Some of the infrastructure needs to be cleaned and dredged, but funds and expertise for that type of project are not readily available at the municipal, state, or federal level.

- Robust Travel: My flights were full (both domestically within Mexico and on the international flights to/from), the three airports I visited were very active, and all four terminals I visited were quite busy. All passenger categories – business, leisure, and visiting friends/relatives – are now experiencing good traffic flows. The Mexican air travel industry has thrived despite facing extraordinary regulatory changes in 2020 and 2021, and it has experienced one of the fastest post-pandemic recoveries globally. I was particularly impressed by the Tijuana airport, which has recently undergone a number of upgrades, renovations, and expansion of a new terminal, including automated check-in and security screening areas. The air travel industry recovery, combined with these airport enhancements, will contribute to higher flow and better utilization of the Cross Border Bridge. The airport, which is a key value-driving asset for one of our portfolio holdings, Grupo Aeroportuario del Pacifico (GAP), is now well positioned to capture both domestic and international travel from the US. The upgrades make it a prime candidate to become a bigger hub/transfer airport as well.

Business & Investment Implications

I returned home from Mexico impressed by the way businesses are managing amidst the current economic backdrop and by the opportunities ahead for Mexico. Relative to other Latin American economies, Mexican inflation has been managed more effectively, and the development opportunities linked to the global trend of “nearshoring” are attractive as an investor in the region. Meanwhile, the prolonged drought conditions and delayed infrastructure projects will continue to present risks.

On inflation… Mexico has managed inflation pressures much better than expectations. Most consumerpackaged goods companies I met with had healthy outlooks considering the economic environment and thus far have exhibited a stronger than average ability to pass through raw material cost increases. Operating margins have been rather stable, as shown in Chart 2, which is not particularly surprising given the defensive nature of the consumer staples sector. Even those facing more discretionary consumption have managed through the period using some creativity – namely managing product mix and narrowing focus to select SKUs and menus. Interestingly, three companies mentioned sending Mexican product managers and pricing managers to US operations to teach them about managing in high inflationary environments. This exchange/training program is a great example of an emerging market nation sharing best practices with developed market companies – quite remarkable. It underscores the unique skills of Mexican management teams and strong companies operating in Mexico!

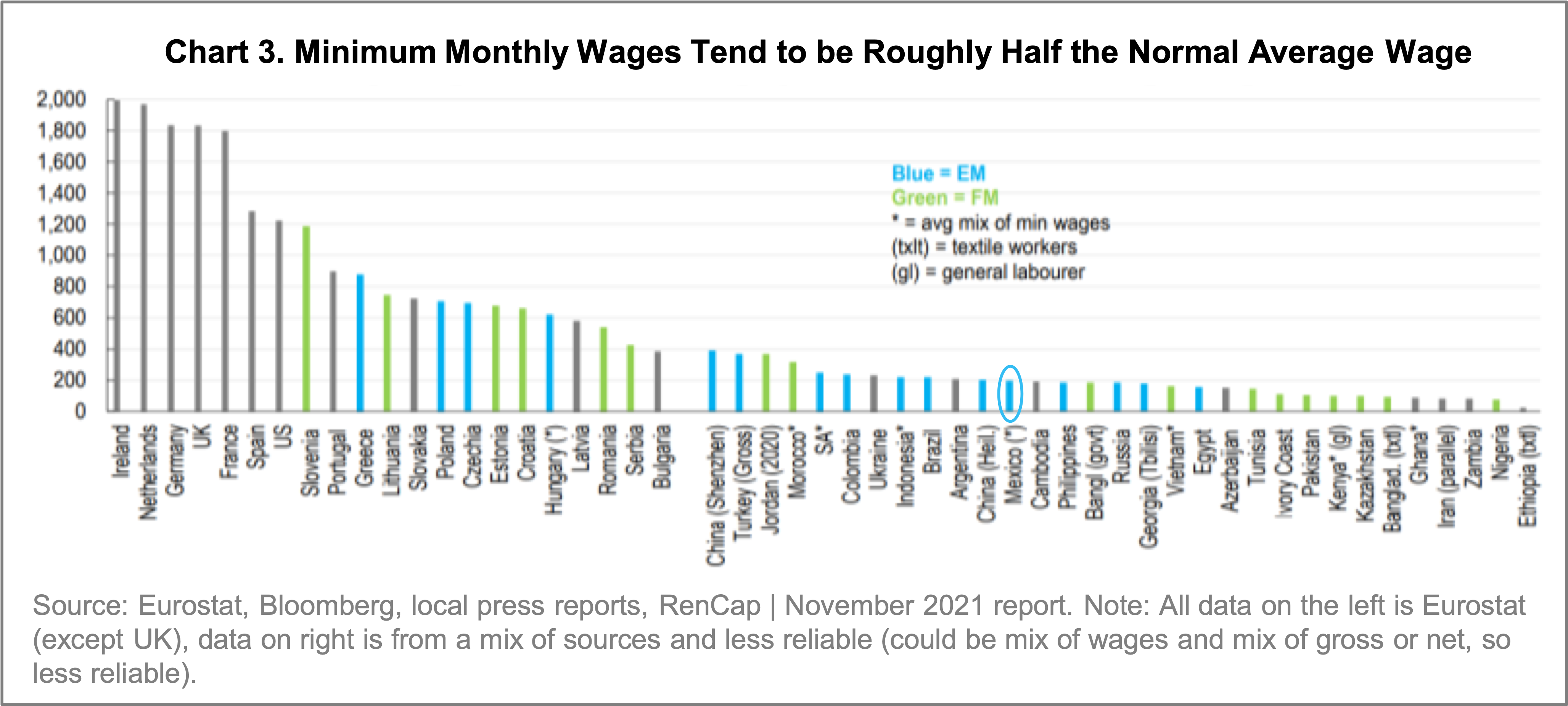

On nearshoring… this is top of mind across various constituents in Mexico. Triangulating messages from the Hacienda, developers, and SME financiers, I see encouraging development prospects in the north of the country for 2023. Many companies are considering increasing operations, despite possible protracted global supply chain recoveries. Beyond the benefits of localization, Mexico also looks attractive from a cost perspective (Chart 3). Coincidentally, my colleague Rich McCormick, who was travelling in Europe at the same time, heard from large European industrial companies that they have identified Mexico as an attractive location to build and/or transfer manufacturing capacity.

On water shortages… this is a problem today and will be an ongoing concern. In most of my meetings with companies in the northern region (specifically in Monterrey and the broader Nuevo Leon state), we discussed the water shortage issue from both an environment and social standpoint as well as a business operations lens. While these companies have not reported any material operational impact, many are partnering with local and federal governments to come up with solutions…which will come at a cost as the government starts asking them to contribute more. These partnerships are a logical approach, but we will continue to re-assess the cost risks as part of our holistic, integrated ESG framework.

Closing Thoughts: Mexico Has Tremendous Potential

Over the long-term, I see tremendous prospects in various areas of the Mexican investment landscape. The country is fortunate to have a “demographic dividend” (median age of about 29 years), and during my trip I found a vibrant fintech market and learned about some of the fastest growing consumer retail concepts in Latin America. Unique business models and resilient companies, paired with nearshoring-driven foreign direct investment (FDI), are supporting Mexico’s internal consumption, the key driver for economic growth. There are many risks and hurdles, notwithstanding general elections in two years and a polarized population, akin to many other countries in the region, but this trip reinforced my conviction that Mexico is a land of attractive investment opportunities. Our portfolio3 currently has approximately 5% exposure to Mexico via three companies – Grupo Aeroportuario del Pacifico (a national airports operator), Walmex (one of the largest retailers in Latin America), and Banorte (one of the largest commercial banks in Mexico). Our existing holdings have long runways for sustainable profit growth, and we look forward to adding opportunistically as attractive new investments emerge via our disciplined, bottom-up, intrinsic value approach.