Dear Investor,

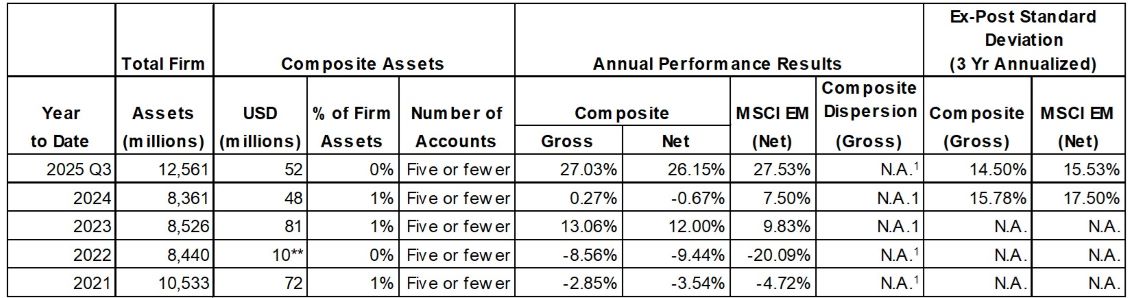

The Altrinsic Emerging Markets Opportunities portfolio gained 9.1% gross of fees (8.9% net) during the third quarter, compared to the 10.6% increase of the MSCI Emerging Markets (Net) Index, as measured in US dollars.i Emerging market equities continue to outperform developed markets, as many companies and countries defy trade-related concerns and continue to demonstrate economic resilience. As governance norms shift across developed and emerging markets, long-held assumptions about risk and data reliability are being challenged. Taken together, these dynamics set the stage for uncovering attractive yet undervalued investment opportunities outside mainstream narratives.

Perspectives

In an investment landscape increasingly dominated by AI-driven narratives, our research and frequent travel to emerging and frontier markets have revealed meaningful opportunities beyond the mainstream trends, reinforcing our belief that compelling investments are often found where others might not be looking.

“The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.”

– Marcel Proust

Living and working in a developed market while investing in emerging markets gives us a unique lens through which we can observe, analyze, and scrutinize evolutions in companies, governments, macroeconomic policies, geopolitical risks, and more. In our 1Q25 letter, we outlined a few major changes in financial markets and how each impacts our perceptions of risk. Now, the following three metrics are shaping our perspectives about the evolving risk landscape globally, and specifically in emerging markets relative to developed markets:

-

- VIX, a gauge of market risk and volatility, has improved notably in EM. As shown in Chart 1, emerging markets not only demonstrated lower relative volatility (versus the US) throughout much of 2025 but have also sustained lower absolute volatility levels since mid-2024 (versus historical averages). Given the commonly held belief that global trade wars lead to heightened market volatility in emerging markets, this achievement is even more remarkable.

- Gold prices surged in 2025, with overall demand matching the record levels of 2023. However, the composition of demand shifted; jewelry demand (typically the largest segment at about 40% of overall gold demand) fell by 18% in the first half of the year, while central bank and ETF purchases doubled to reach decade highs. These actions typically signal market unease and a flight to safety. As confidence in traditional currencies erodes, gold is once again serving its long-standing role as a safe-haven asset.1

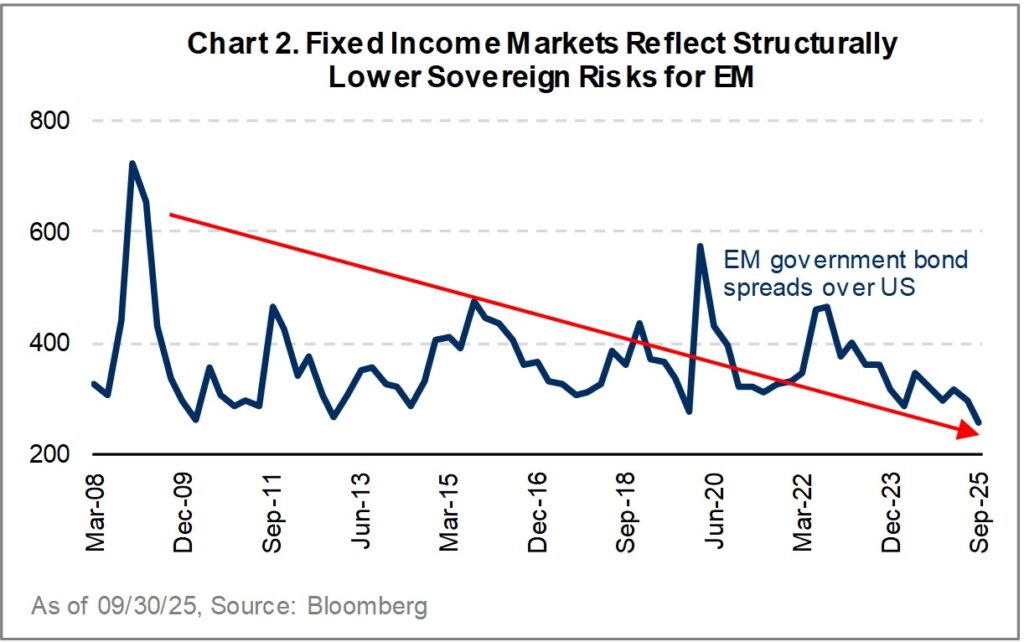

- Mixed signals from fixed income and equity markets suggest a potential disconnect in market expectations. Emerging market equities trade at a steep 32% P/E discount to developed markets. In contrast, EM sovereign and corporate credit spreads have hit 15- to 16-year lows (Chart 2), reflecting stronger balance sheets, more locally denominated debt, and higher relative confidence. While EM equity market valuations suggest continued elevated risk levels vis-à-vis developed markets, fixed income markets show that EM risks have actually compressed. Furthermore, US treasury bond yields are at 4.6% – levels not seen since before the era of zero interest rate policies – reinforcing the idea that investors might be viewing relative EM risk more favorably.

Taken together, these trends underscore the growing resilience, lower relative risk, and attractive valuations in emerging markets, making investment opportunities in these countries increasingly compelling for global investors.

Governance: A Leveling of the Playing Field

Emerging markets are often seen as dynamic, youthful, and brimming with potential. However, lingering concerns about governance standards – specifically, a history of unpredictable leadership, state intervention, coercive diplomacy, and/or questionable data transparency – have contributed to investor skepticism over time. A recent FT article2 draws parallels between the US and emerging markets. It simultaneously critiques recent US governance and offers a fresh perspective on how the EM landscape has evolved:

The stereotype of an emerging market basket-case is that el presidente defenestrates a hapless central bank governor — probably one he himself just appointed — every other weekend on some stupid pretext. But, while it’s all relative, emerging markets are now bastions of monetary policy orthodoxy – strict adherents to central bank independence, and cast-iron inflation targets.

Long-held views about EM have led to discounted valuations and higher risk premiums. However, 2025 has brought about a new era of governance in developed markets. A narrowing gap in governance standards between EM and DM invites renewed analysis of EM opportunities and may shift investor expectations across markets.

In Turkey, President Erdogan’s history of interference with the central bank has weakened the lira and depressed equity market valuations since 2018. His departure from conventional economic policy – pushing for lower interest rates, despite inflation risks – stands as a key example of state intervention. In 2025, similar unpredictable challenges to institutional independence appeared in the US, increasing equity volatility outside of emerging markets and raising questions about whether EM valuation discounts are still justified.

Emerging market governments have also been known to use economic pressure to influence regional affairs, forming strategic alliances beyond purely market-driven logic. In 2025, we have seen examples of political influence emerging in developed markets too. The United States imposed a 50% tariff on Brazilian imports, despite a long-standing trade surplus and strong bilateral ties, altering historic trade relations. Notwithstanding these policy shocks, Brazilian companies have shown strength and resilience, buoyed by their primary addressable markets – home-country buyers and intra-EM demand.

Trustworthy and accessible data is a cornerstone of market confidence. China has often faced scrutiny for lack of transparency; halting all reporting of youth unemployment data in 2023 is just one example.3 Some investors have even called China “uninvestable” due to these concerns. While data from the US has historically been seen as reliable and transparent, the unexpected and ongoing leadership vacuum at the US Bureau of Labor Statistics since August has raised concerns about data independence. The erosion of trust in official data levels the playing field for emerging markets by raising questions about how much data integrity really differs across regions.

As developed-market governance increasingly faces scrutiny, emerging markets stand out for their strong earnings growth and potential. Despite a weakening dollar, US equity valuations hover near 25-year highs. In contrast, EM equity markets are deeply discounted despite fairly valued currencies. This dynamic presents a compelling opportunity for investors willing to look beyond conventional market narratives.

Spotlight on Brazil: Our Discipline in Action

Shifts in global governance and the narrowing risk premia for emerging markets reveal new investment opportunities. In Latin America, for example, major bourses have vastly outperformed EM’s meteoric rise (+27.5%, in USD terms) in the first nine months of the year. More specifically, Brazil’s evolving political dynamics and undervalued equities present a compelling combination.

At first glance, Brazil seems to be plagued by high interest rates, high government debt levels, and a seemingly “business-unfriendly” government. Additionally, it now finds itself in the crosshairs of a protracted trade war with the US. With local elections less than a year away, political risks are being priced into Brazilian equity markets. This backdrop creates much volatility – but the kind that breeds opportunity.

For example, Motiva (infrastructure developer, initiated position at the end of 2024) and Grupo GPS (Brazil’s largest commercial services operator, initiated position in early 2025) both have strong project pipelines and a long runway for penetration growth while benefitting from strong capital discipline, free cash flow-generating business models, and best-in-class management teams. They also trade at meaningful discounts to global peers. Similarly, capitalizing on trade-driven volatility, we found RD Saúde (formerly known as Raia Drogasil), Brazil’s largest retail pharmacy chain, which was trading at a deeply discounted valuation. RD Saúde has recently faced earnings pressure due to challenges to its brick-and-mortar business, increasing competition, rising costs, and changing tax rules. However, the company’s strong balance sheet and top-tier strategy should allow it to benefit from Brazil’s growing health care demand, with potential for improved store growth and productivity. Beyond the quality of their business operations and appealing valuations, these companies also exemplify our core thesis of decoupling across emerging markets, as they are primarily powered by home-country demand, rather than global trade dynamics.

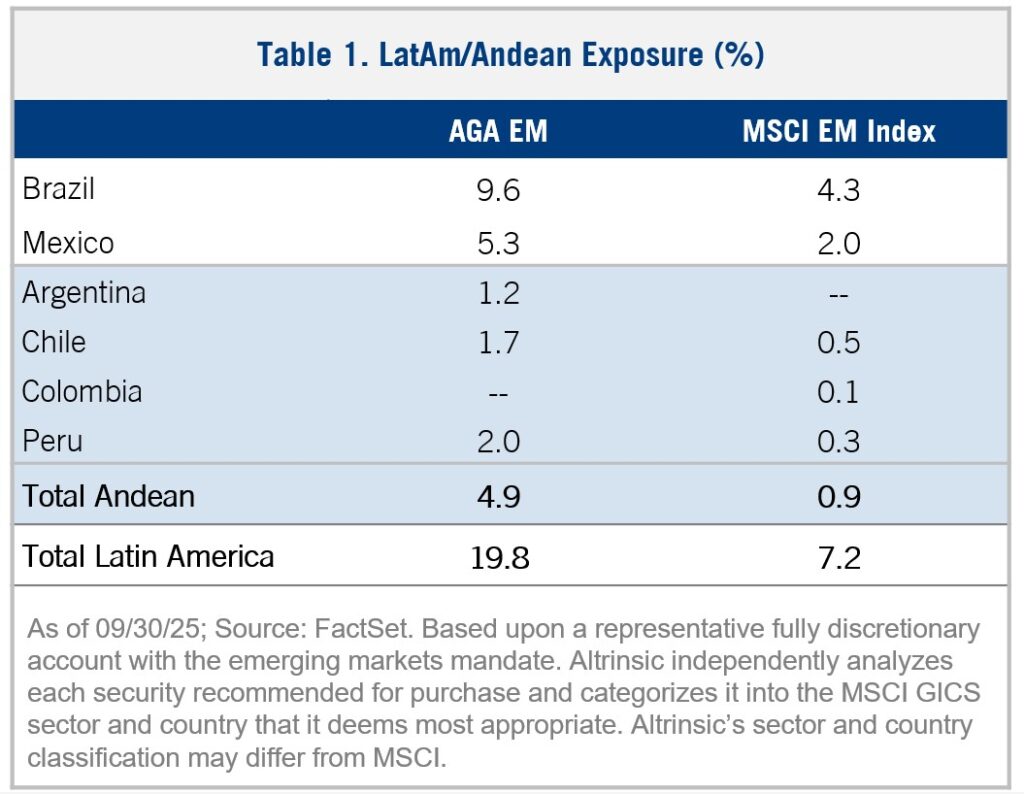

Our exposure in Brazil represents nearly 10% of the portfolio (Table 1). Broadening out, the totality of our Latin American investments represents about 20% of the portfolio, within which we have an overweight exposure to the less-trafficked Andean region (Altrinsic at 4.9% versus the MSCI EM Index at 0.9%).

The events of 2025 have created opportunities to invest in high-quality companies across sectors while maintaining our discipline around the price we are willing to pay. Despite persistent challenges and uncertainties related to governance, trade wars, and other geopolitical dynamics, Latin American companies’ strong year-to-date results prove that even in overlooked and undervalued markets, strong performance remains achievable, and value can endure.

Performance Review and Investment Activity

From an overall perspective, the technology sector, and semiconductor manufacturers, in particular, led emerging markets performance this quarter. Our underweight positioning in some of these areas contributed to our relative underperformance. Additionally, not owning select consumer stocks (Alibaba), our underweight exposure to select communication services companies (Tencent), and stock-specific weakness in consumer discretionary (Lojas Renner, Americana Restaurants), communication services (Krafton), and industrials (Airtac, Corporación América Airports S.A., Voltronic) weighed on relative performance. Stock-specific gains in information technology (Zhen Ding Technology, Delta Electronics, Chroma ATE), financials (Commercial International Bank, Credicorp), and real estate (Vinhomes) aided performance.

From a geographic perspective, gains in Taiwan (Zhen Ding Technology, Delta Electronics, Chroma ATE), India (HDFC), and Egypt (Commercial International Bank of Egypt, Anglogold Ashanti) were offset by our underweight positioning in Chinese stocks, company-specific results in South Africa (Vodacom, Bidvest, Sanlam), and macro concerns impacting the broader market in Brazil (Lojas Renner, Porto Seguro).

Portfolio activity this quarter involved three buys (Voltronic Power Technology Corp, Corporación América Airports S.A., RD Saúde S.A.) and one sale (Anhui Conch Cement Company Ltd.).

In the information technology sector, we initiated a position in a Taiwanese company, Voltronic, which is the leading manufacturer of uninterruptible power systems (UPS) and solar inverters. Voltronic benefits from structural outsourcing trends linked to long-term critical infrastructure growth, including data centers, telecom, and hospitals. We believe the market underappreciates the durability of the company’s vertically integrated business model, strong free cash flow profile, and attractive shareholder returns.

We also initiated a position in Corporación América Airports S.A. (CAAP), which operates over fifty airports across six countries, including Argentina, Brazil, and Italy. CAAP provides exposure to underserved aviation markets poised for long-term growth with additional upside from government-approved expansion plans in Italy, Armenia, and Argentina. The company’s strong balance sheet supports future acquisitions and new concession bids.

Finally, we initiated a position in RD Saúde, Brazil’s leading health and beauty retailer. Despite recent earnings pressure from rising costs and tax changes, the market undervalues the company’s ability to exceed modest growth and restore productivity. Supported by a strong balance sheet, RD Saúde offers attractive exposure to Brazil’s growing health care demand.

We exited our position in Anhui Conch, a Chinese cement manufacturer, as it continues to face persistent industry challenges and a more prolonged downturn, in favor of opportunities with a greater risk-adjusted reward.

Concluding Remarks

A quiet evolution in global governance trends is highlighting the attractive valuations of emerging market companies outside of technology, including those in Brazil and the Andes. While the market reflects a willingness to pay more for less (in terms of both productivity and quality) in the momentum-driven technology sector, we ask, “Why not pay less for more?” in underappreciated, off-the-beaten-path areas that offer robust financial productivity.

Our willingness to wander throughout the emerging markets landscape, beyond popular sectors and stocks, has led us to solid ground – undervalued companies with real earnings growth. Emerging market companies that demonstrate greater resilience and strength in a rapidly changing global landscape present compelling opportunities beyond conventional narratives. We believe overlooked potential can translate into enduring value. Traveling to the corners of the world and maintaining an open mind reminds us, as JRR Tolkien said, “all who wander are not lost.”

Sincerely,

Alice Popescu