Dear Investor,

The Altrinsic Global Equity portfolio gained 10.57% gross of fees (10.34% net) during the third quarter, as measured in US dollars. By comparison, the MSCI World index rose 6.36%.i Central bank policy actions, easing inflationary pressures, and expectations of a “soft” economic landing remained supportive for equities. Market leadership broadened away from a small subset of large-cap growth stocks and deep cyclicals, a trend both overdue and supported by fundamentals. Although a high degree of crowding, complacency, and lofty expectations remain in the areas that have led markets in recent years, elsewhere in global markets there are plentiful investment opportunities offering attractive value with more sustainable and/or improving earnings prospects. From our perspective, the greatest risks currently stem from macro and geopolitical dynamics, as well as corporate earnings disappointments in cyclical segments of the market.

Performance Review

Outperformance this quarter was primarily driven by stock-specific factors as well as the broadening out in equity markets. The greatest sources of positive attribution included investments in the information technology (Check Point Software, Genpact, Cisco), financials (Hanover, Intercontinental Exchange, Chubb), and consumer discretionary (Alibaba, Las Vegas Sands, Lojas Renner) sectors. Our underweight exposure to utilities was the primary source of negative attribution in the quarter.

Within information technology, Check Point and Genpact performed well, and not owning Microsoft, NVIDIA, and ASML also helped. Both Check Point and Genpact are successfully refining their product offerings, improving technological and marketing initiatives, and benefitting from clients’ continued increase in digitalization.

Our financials holdings were also strong, led by Hanover Insurance, Intercontinental Exchange (ICE), and Chubb. Hanover is improving their underwriting and sharpening pricing after facing significant claims inflation and more frequent natural disasters in recent years. ICE’s core trading and data business continues to perform remarkably well, and its struggling mortgage technology business should benefit from increasing activity in a lower US interest rate environment. Chubb remains a steady compounder, producing industry leading ROTE and low-double-digit sales growth through a combination of underwriting prowess, strong product demand, and improving cost control.

Outperformance in consumer discretionary was largely driven by Alibaba, Las Vegas Sands, and Lojas Renner. Chinese e-commerce leader Alibaba and casino operator Las Vegas Sands rallied on the back of China’s stimulus announcement, which should boost consumer sentiment and activity. Brazilian retailer Lojas Renner’s shares rebounded from trough levels following 2Q earnings that showed signs of improved operational efficiency (after years of investment) and positive sales growth momentum. Despite the rally, these stocks remain undervalued considering their growth and earnings potential.

Investment Activity

We initiated two new positions (Informa plc, WalMex) and eliminated six (Bankinter, Michelin, Haleon, Lowes, Sandoz, SAP) during the third quarter.

Informa is a leading operator of trade shows and conferences, a structurally attractive and growing form of engagement between buyers and sellers. The company has compelling cash flow dynamics, and we expect it to expand margins through improved pricing initiatives and increased adoption of its technology offerings. WalMex is the largest operator in the attractive Mexican retail sector. Alongside significant growth potential in its core retail operations, WalMex has other avenues for growth including media, e-commerce, mobile phone, and financial services. Its historical valuation premium has eroded amid near-term macro and political uncertainty, creating a buying opportunity.

All six of the positions we sold were due to share prices reaching or exceeding our base case intrinsic value estimates. Proceeds were redeployed into Informa and WalMex, as well as existing positions in consumer discretionary (Yamaha, Las Vegas Sands) and technology (Trimble, Cisco, Samsung), among others.

Perspectives

Central bankers (with the exception of Japan) showed greater willingness to ease monetary policy as economic data points continued to surprise negatively (Chart 1) and inflationary pressures eased. Market volatility, as measured by the VIX index, spiked from 12 to 40 against the negative backdrop before falling to 17 as dovish central bank messaging boosted markets. A soft landing now appears to be the base case embedded in market prices.

The glass-half-full view of the global economy has aided cyclical investments since the latest stage of the bull market began in late 2022.¹ But not all cyclical businesses are thriving, with early warning signs coming from the consumer sector. A well-documented economic slowdown in China has also detracted from demand globally. And while AI demand remains robust, our channel checks with AI corporate customers are pointing to potential demand risks ahead.

The Global Consumer

The seemingly unstoppable buying power of the global consumer, particularly in the US, appears to be running out of steam. Since the pandemic, consumers in many developed economies received a boost from a combination of fiscal outlays and wealth benefits from rising housing and equity markets. This was most evident in the US. The COVID stimulus has now ended, and savings have been drawn down, leaving consumers to contend with an uncertain jobs market and higher-priced goods and services versus only a few years ago. Dollar stores and branded staples began feeling the effects of slowing consumer activity first. Middle-to-upper-income consumers adjusted better, but spending was still curtailed from very high levels in the past. Outside the US, COVID stimulus measures, including direct outlays, were not as significant, so while most nations and consumers did not receive the same boost during the pandemic, they are also not experiencing the same depletion in excess savings now.

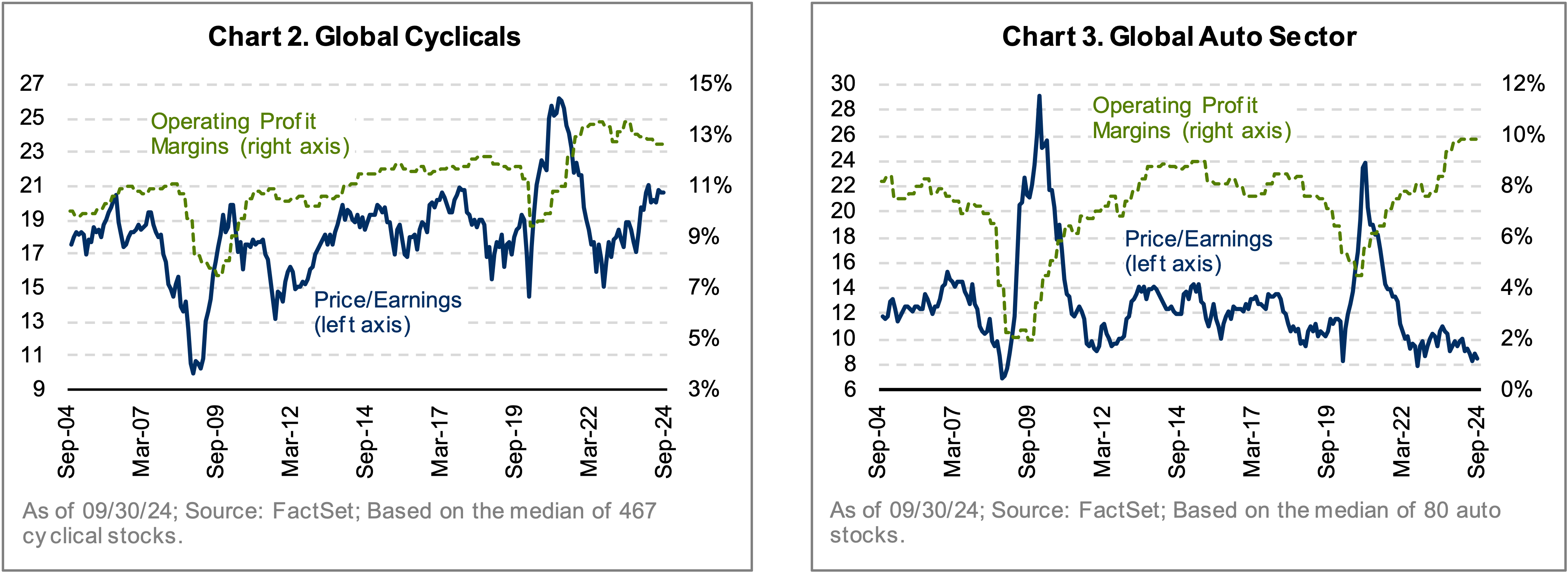

Since COVID, many companies, particularly in cyclical sectors, have generated strong profit growth as supply shortages supported robust pricing gains. Simultaneously, corporates managed costs well (particularly wages), and profit margins flourished. But with activity waning, companies are now contending with an environment of slowing growth, rising competition, and increased capital spending. The result over the last few months has been a steady flow of earnings downgrades, particularly in the automotive sector. While other cyclicals trade near peak valuations on peak margins (Chart 2), autos have materially declined, with many trading at levels that discount the expected slowdown (Chart 3). We have gradually increased our investments in select auto companies, but we are approaching the sector carefully given the short-term risks to cash flows and growth.

China, Stimulus, and Fiscal Deficits

During a mid-September trip throughout Europe, our analysts noted waning corporate confidence in both current Chinese macro trends and the evolving competitive landscape. A softening outlook on profits, investments, and growth in China was a common theme during many conversations. Near the end of the quarter, China announced meaningful monetary stimulus plans designed to boost consumer confidence and demand. At the macro level, the stimulus program is significant, but it is likely insufficient to provide the global economy with a major boost as it did during the GFC. The announcement did highlight a political urgency to stabilize the economy, revitalizing China’s stock performance; the MSCI China Index rose 20% in the final week of the quarter.

Unfortunately, there is no quick fix for China. The country’s aging population, political and supply chain disputes, ongoing property market challenges, meaningful debt levels, and an all-time-high fiscal deficit will likely keep a cap on economic growth in the medium term. More countries following China’s lead with large stimulus packages also seems unlikely, given their own deficit challenges. According to the IMF, developed market governments increased their deficits in 2023 by some of the largest margins outside wartime or recessionary periods. Now, most countries are contending with excessive debt and deficits, which is a particularly difficult task in a world of higher government interest payments. These issues and the related risks remain underappreciated in global markets today.

Artificial Intelligence Customers

Market optimism around AI technology providers softened² in Q3, but many industry pundits seem uniformly excited about the long-term prospects. We are quite hopeful about the potential for revenue and cost-saving opportunities from the evolving technology, but after two years of share price appreciation for the technology providers and the wider food chain, we think far more shareholder value will accrue to users of AI versus producers. The bar is set high for semiconductor companies, as market caps have doubled over the last two years,³ and price-to-earnings multiples, even excluding NVIDIA, are 60%+ above long-term average levels.

We continue to engage with corporate consumers of AI to learn how they are incorporating the technology and sizing the potential benefits. A simple question we often ask is, “Are the use cases you see looking transformational and worth significant investment?” Answers have been surprisingly less bullish than market activity might suggest; companies see opportunities, but the benefits largely appear to be incremental rather than transformational, at least in the medium term. A year ago, many companies sought to be industry leaders in developing AI; now, the sentiment on the ground is that more companies are happy to fall into the middle of the pack with a wait-and-see approach. They also increasingly describe the tech providers as “important but commoditized” and want more development power transferred into their own hands. The technology is continuing to evolve, and the feedback will as well, but if use cases are less compelling than originally hoped, we may see a softening in spending in the years to come – especially after a sharp bout of strong demand and limited supply.

In Closing

The companies in our portfolio are trading near some of the lowest valuations in years while simultaneously possessing a high degree of resilience and attractive earnings prospects. We are experiencing solid idea flow, and plentiful opportunities with highly compelling valuations exist beyond the large benchmark constituents, especially outside of the US. Margin of safety is always an important element of our investment process, but it is particularly significant now considering the mounting macro and geopolitical risks, many of which seem to be largely ignored by markets.

As a final note, after a 30-year career (including 20 years at Altrinsic), our partner Andrew Waight will be retiring at the end of the year. Andrew has been a terrific colleague, analyst, and friend. He will continue as an advisor to the firm on health care and scientific issues, but his primary focus will be on enjoying this next stage in life and pursuing his many interests. The companies for which Andrew had played the lead role in investing have been transitioned to other members of the team, consistent with the long-term planning and timing of his retirement.

Please contact us if you would like to discuss these or other matters in detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick