Dear Investor,

The Altrinsic Emerging Markets Opportunities portfolio finished the quarter virtually unchanged (+0.1%), outperforming the MSCI Emerging Market Index’s decline of 7.0%, as measured in US dollars.i Key contributorsii to our relative outperformance included our differentiated exposure to energy, financials, and communications services companies, our overweight exposure in key Latin American markets including Brazil, Chile, Mexico, and South Africa, and our significant underweight exposure in Russia and China.

Performance within the index varied significantly (Chart 1); small and mid cap stocks outperformed larger ones and regionally, Latin America (MSCI LatAm +27.3%) outperformed Asia (-8.7%) and EMEA (-13.6%). Currency performance in EM was diverse (EM FX Index +0.6%); major Latin American currencies including the Brazilian real, Peruvian peso, Chilean peso, and Mexico peso all rallied while the Turkish lira and Polish zloty struggled. South Africa is worth a special mention, outperforming both in market and currency terms.

The start of the year was marked by worry as investors wondered how emerging markets would react to interest rate normalization. We expected economic performance to diverge across EM countries based on policy decisions and asynchronous economic and pandemic recovery cycles. The ongoing military conflict in Ukraine has amplified the disparity in economic health. Markets with proactive monetary policies – including several Latin American economies – performed better than those behind the curve. Commodity exporters, including South Africa and Indonesia, also fared well as they stand to benefit from favorable terms of trade. China entered the year of the Tiger still ironing out its regulatory cycle on multiple fronts. All of these dynamics have heightened volatility across EM countries, but we remain cautiously optimistic about the trajectory of re-opening and recovery across these markets.

Year in Review

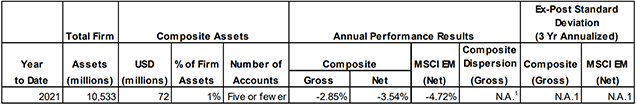

We started managing the Altrinsic Emerging Markets Opportunities strategy on April 1, 2021 with an objective to build a bottom-up, fundamentally-driven portfolio consisting of high quality, underappreciated companies across the cap spectrum, truly reflecting the DNA of the EM asset class. Today, as we assess how our differentiated perspectives and exposuresi,iii have played out, we find great alignment with our starting hypothesis:

-

-

- Geographic breadth: we found underappreciated gems in less popular, non-traditional EM countries

- Asset class DNA: we stayed true to the DNA of the assets class, finding more opportunities in the small and mid cap space than the index reflects

- Pandemic reality: our cautious stance on COVID recovery progress in emerging markets drove us toward value in forgotten telecom businesses

- Contrarian nature: our contrarian approach led us to stock-specific winners in a stormy and volatile sector – Chinese real estate

- Frontier exploration: our expanded universe and willingness to spend time identifying the path forward for off the beaten track economies allowed us to identify unique contributors in frontier markets

- The “Other” EMs – The passive reference for emerging markets, the MSCI EM Index, remains lopsided with concentrated exposure in three countries (China, Korea, Taiwan), vastly ignoring the diverse set of smaller countries also classified as emerging markets (Table 1).

-

These “other” countries have outperformed over the past quarter and year. Our assessment that the Chinese market was expensive and less attractive proved right given our ability to find more compelling investment opportunities in Indonesia, South Africa, and Mexico. Despite China’s underperformance, we continue to find more attractive prospects elsewhere (Chart 2).

- Small and Mid Cap, the True DNA of EM – Over the past year, we observed the underperformance of large cap EM – driven predominantly by Chinese mega caps – and the broader outperformance of small and mid cap companies (Chart 3). Our bottom-up security selections led the portfolio away from the Chinese mega caps that dominate the MSCI EM Index based on unattractive valuations and significant risks – and this underweight positioning contributed to about 50% of our outperformance over the past year. Instead, we found attractive opportunities in smaller companies reflecting the true DNA of the asset class where valuations were more favorable – and continue to be so today (Chart 4).

- Slow, Bumpy COVID Re-openings and Consumption Beyond – As we built our portfolio, we identified the likelihood for multiple un-synchronized pandemic waves and vastly different policy responses. Our conservative stance led us to identify new sustainable drivers for defensive businesses like telecom services, viewing them as enablers of digital services and consumption. Our investments in traditional communication companies provide a conduit to participate in developing macro trends of greater smartphone penetration and data consumption. In addition, we gain access to various ecosystems of services and benefit from frontier market exposure.

- Contrarian and Unafraid to Look at the Unloved – Our exposure to Chinese real estate companies has proven to be our most contrarian call. Beijing was tightening the screws on the sector, but despite this upheaval, we saw a clear dichotomy in company-specific performance across the sector, as discussed in our Q3 2021 letter. Healthy companies with solid balance sheets have the ability not only to survive, but also to thrive and capitalize on the regulatory headwinds. The market initially treated all participants the same way; we have been rewarded for our patient, bottom-up consideration.

- Frontier Markets Exposure – We have specifically defined our universe to incorporate frontier markets. We believe there is untapped potential within countries that are evolving toward “emerging” status, and over the past year, certain domestic policy updates, liquidity, and other factors are supportive. As an example, Vietnam has several regulatory tailwinds coming its way. Relaxation of intraday trading and foreign ownership limits, as well as a parliamentary review of the Law on Enterprises, are just a few ongoing projects that underlie current reviews by both MSCI and FTSE Russell to upgrade the market to “emerging” status over the next 12-36 months. In our portfolio, we have 3.7% direct exposure to frontier markets, and we continue to find new attractive investment opportunities.

Perspectives

Food for Thought

As the conflict continues in Ukraine, the dislocations created across various commodity markets are central to the welfare of many emerging market economies and will have a dramatic impact on their future economic activity and health. Looking at terms of trade, many EM countries (including South Africa and Indonesia) should experience sustained benefits over and above pandemic levels due to elevated commodity prices.

Entering the current year, emerging markets (excluding China, which has a significant current account surplus as shown in Chart 5) were in good shape financially compared to the past decade. There are, however, a few countries whose financial health has been adversely impacted by recent macro developments, primarily those running significant energy deficits (India, Thailand, Turkey).

Perhaps more importantly, a key pressure point in many EM and frontier countries is food inflation. The food price index has achieved record levels (Chart 6), pressuring consumers in countries with lower wages, as they spend a higher proportion of their income on food and suffer most when prices rise. Food inflation was on the rise before the start of the pandemic, as drought and other factors pressured supplies. The combination of prepandemic, pandemic-related, and Ukraine warbased factors suggests that many grain importing countries in the Middle East and Africa will be most affected.

Egypt, for example, imports 60% of its wheat from Ukraine and Russia. While this sounds concerning on the surface, Egypt – a young, populous country with a significant subsidized food program – has tackled the issue by taking a balanced approach. First, the government devaluated the currency, increased interest rates, and announced negotiations with the IMF for a loan program. At the same time, the government announced investments from the UAE, Saudi Arabia, and other foreign countries exceeding US$17B. Additionally, Saudi Arabia deposited US$5B into Egypt’s central bank, bolstering reserves. This multi-faceted solution cushioned Egypt and can serve as a playbook for other economies facing dramatic food inflation pressures.

While food has the largest weight in the CPI basket across many countries (Chart 7), South Asian countries, with a few exceptions, tend to be net food exporters (Chart 8). This underscores the ability of the Tiger Cubs1 to be more resilient than other EM regions. For other EM countries, the ability to tame food inflation is central to economic and, in particular, political stability. Recent protests in Pakistan, Sri Lanka, and Peru are reminiscent of the Arab Spring in 2011.

Within the Altrinsic Emerging Markets Opportunities portfolio, we are invested in companies that have strong procurement advantages (Yum China) and the ability to win with discount retail formats in inflationary environments (Walmex). We expect EM governments to focus on food security, while extended agricultural cycles will drive farm incomes. Together, these drivers will increase demand for agrichemical products that increase yields, support farm productivity, and support subsidized food programs. UPL, an Indian agrichemical producer in which we are invested, will facilitate and benefit from such drivers and goals.

Living with COVID-19

Our last letter highlighted that COVID-19 management policies can dramatically affect the performance of EM economies. With this in mind, the restrictive policies across many Chinese provinces are concerning from an investment perspective. As of this writing, 119 million people across several provinces in China are under some form of lockdown, and Beijing (with an approximate population of 22 million) has initiated a massive testing program. The effect on financial assets has been significant, punishing local and offshore China equities. Despite poor performance across Chinese equities, we remain skeptical about the prospects of the government relaxing the zero-COVID policy. At the same time, we know that local protests can be politically costly and do not believe Chinese authorities will tolerate dissent during an important political transition year.

The economic uncertainty associated with continued COVID-19 restrictions and other similar government policies is likely to keep the “China Plus One” strategy2 – an approach adopted by Western businesses that are reliant upon Chinese manufacturing and labor to diversify production and investments into other countries on the basis of cost, safety, and stability – top of mind for capital allocators. More widespread adoption of this strategy may further benefit the South Asian Tigers, as additional foreign direct investments (FDI) would flow their way.

Performance Drivers and Portfolio Positioning

Positive attribution this quarter was driven by stock-specific performance within the energy, financials, and communications services sectors, as well as our overweight exposure to Latin American companies. The sharp increases in commodity prices due to the war in Ukraine have reverberated throughout the portfolio; energy holdings PTT E&P and Tenaris were beneficiaries, rallying significantly during the quarter. Several of our financials investments across various EM countries, particularly in Latin America (Banco de Chile, BB Seguridade, Credicorp), have benefitted from local policy makers acting proactively ahead of the US Fed hiking cycle. Additionally, several of our communications services investments across different markets (Vodacom, Telkom Indonesia, Advance Info Services) performed well due to stock-specific idiosyncratic factors. Materials holdings (Polymetal and Vale S.A.) and utility holdings (Indraprastha Gas Limited and China Resources Gas Group Limited) were sources of negative attribution; concerns over rising raw materials costs affected the utilities stocks.

Geographically, our greatest sources of outperformance came from our overweight exposure to Latin America, namely Mexico (Grupo Aeroportuario Pacifico, Banorte), South Africa (Vodacom, Bidvest), and Brazil (BB Seguridade, Lojas Renner, Bradesco). Our significant underweight exposure in Russia and China also contributed to our strong relative performance. Conversely, our lack of exposure to sensitive oil plays, namely among countries in the Middle East, weighed on relative performance.

Portfolio activity was low during the quarter; we sold one full position and initiated one new investment. We sold our position in Polymetal, a private Russian goldminer. Fundamentally, we continue to see the company’s mining assets as best in class and appreciate management’s strong execution track record. However, the recent events in the region, combined with the resignation of half of the company’s board of directors, led to our fears being realized – a challenged ability to service its US debt and a change to its shareholder dividend policy. Additionally, given the strategic value of its core assets – gold mines – we see increased risk of the Russian government nationalizing these properties given dwindling access to hard currencies.

Aside from the reasons we decided to sell the company, our ability to fully liquidate our Polymetal position reflects an important component of our risk controls. Despite being a private Russian company, the stock has a primary listing in London and has traded with continued liquidity since the start of the conflict in Ukraine, both of which were important risk management considerations when we first initiated our position and proved important this quarter.

Meanwhile, we took advantage of volatility in the Chinese market and initiated a position in PICC, China’s largest property and casualty insurer. The main thesis relies upon the underpenetrated level of various insurance verticals (including health, property, and liability) along with the market underappreciating the significant improvements in the company’s balance sheet and digital capabilities.

Looking Ahead

With our long-term mindset and investment horizon, we frequently ponder what a new “world order” could look like and how that would impact the investment opportunities across emerging and frontier markets. After a brutal year for many Chinese stocks, we are starting to see value emerge in some pockets of this market. Discount rates embedded in Hong Konglisted Chinese stocks have reached decade highs, while local A-shares valuations are becoming more attractive (Chart 9).

Undoubtedly, the current lockdowns across many Chinese cities and provinces will have significant economic and business (profitability) consequences. However, we continue to seek unloved and undervalued gems in China and across our full investable universe, even as popular preferences turn. The last 12 months – and particularly the last three – proved that “emerging markets” from an investor’s perspective should be much more than a handful of North Asian countries (China, South Korea, Taiwan). By focusing on companies with high quality fundamentals in countries with solid macro foundations, we find no shortage of attractive investment opportunities.

Thank you for your support and interest in the Altrinsic Emerging Markets Opportunities portfolio. We would be delighted to discuss these or other matters of interest.

Sincerely,

Alice Popescu