Dear Investor,

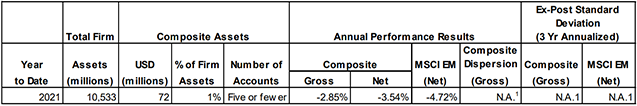

A confluence of factors, including inflationary pressures, tightening monetary policy, weakening economic growth, and intensifying geopolitical unrest, continued to challenge emerging markets (MSCI EM -11.6%) in the third quarter. The Altrinsic Emerging Markets Opportunities portfolio declined 8.2%, outperforming the MSCI Emerging Markets Index by 3.4%, as measured in US dollars.i Outperformance was derived from individual stock selection in the financials and consumer sectors, our differentiated and overweight positions in Brazil and Mexico, our underweight exposure to China, and specific stock selection in China.

Performance within emerging markets varied significantly (Chart 1), with China having a material impact given its 31.3% representation in the MSCI EM Index. The MSCI EM exChina index fell 5.6%, outperforming the broad index by 600bps. Small and mid-cap stocks also outperformed (-7.6%), as did frontier markets (-6.5%). Regionally, Latin America (3.6%), ASEAN (-1.9%), and EMEA (-5.3%) outperformed broad EM Asia (-14.0%).

Currency performance in EM was weak (MSCI EM Currency -4.5%), with notable exceptions being major Latin American currencies, including the Mexican peso, Chilean peso, and Brazilian real (as well as key Tiger Cub currencies, including the Indonesian Rupiah).

Spotlight on China

On October 16, China’s communist party will commence its 20th National Congress. At this event, held every five years, it is virtually assured that Xi Jinping will be confirmed to an unprecedented third term. Since becoming the leader of China in 2012, President Xi has attempted to tighten his grip on power, first through an anti-corruption campaign and more recently via the strict government-imposed zero-COVID policy. The latter has abruptly halted the country’s strong post-pandemic recovery, as it now finds itself stuck between health policies, missed growth targets, slowly trickling stimulus campaigns, and underappreciated execution risks. Looking further ahead, at the National People’s Congress in March 2023, the party will endorse new Politburo members. Unless a dramatic reversal occurs, economic policy will remain at odds with both political and health policies. Since the start of the COVID-19 pandemic, the latter two have taken precedence in China, a reversal of historical norms.

Mianzi 面子1 – Saving Face

As shown in Chart 2, China remains very restrictive in its COVID-19 response. China’s population has expressed significant vaccine skepticism due to the perceived low quality of the available vaccines. As a result, the Chinese government has held firm on its position to continue strict closures and bans in an effort to avoid catastrophic loss of life (and, importantly, associated harm to Xi’s reputation and legacy).

Eight vaccines are approved for use in China and 31 are in clinical trial2. Sinovac, a locally produced vaccine distributed in over 50 countries globally, offers increasing protection with each dose (although not as high as leading Western vaccines). Despite the options, China remains under-vaccinated. Just over 50% of the Chinese population was fully boosted as of April 2022, well below regional peers at nearly 70%, and a large part of the elderly Chinese population remains unvaccinated (Chart 3). Lockdowns over the summer did nothing to improve vaccination rates but severely affected economic activity (Chart 4) and both consumer and corporate confidence (Chart 5).

Barring a massive vaccination drive and/or regional vaccine mandates, it is tough to imagine a reversal of the zeroCOVID policy in the short to medium term. To save face (mianzi) means to continue with zero-COVID – and therefore, at least in the short term, the economy will remain pressured.

Follow the Stimulus

Despite the restrictive COVID-19 policies in China, there have been some efforts to prop up the economy:

- Chinese Vice Premier Liu He commented on unemployment risks in the spring and the need to jumpstart economic activity again in the summer.

- The beleaguered property sector has received multiple loan relaxation measures from various provincial and city financing programs.

- Policy rates and reserve requirements have been cut by the PBOC3.

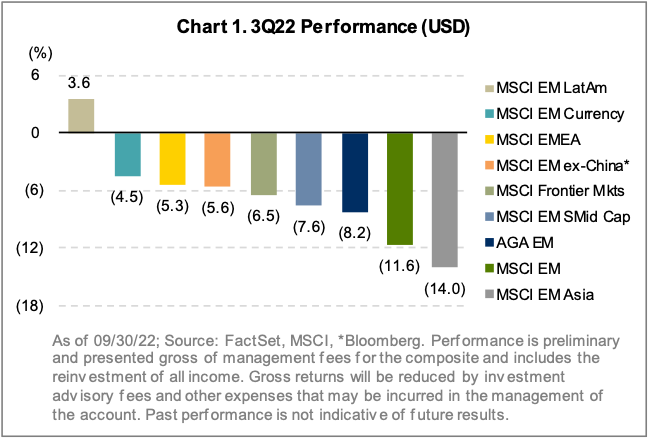

- As shown in Chart 6, there has been a large issuance of local government special bonds (LGSBs4) to stimulate fixed asset investment (FAI). Project funding has been strong since mid-2021, with ample liquidity for transportation infrastructure projects.

- Beijing required local governments to accelerate the usage of RMB 3.45 trillion worth of approved special-purpose bonds by the end of August.

Notwithstanding these attempts to jump-start the economy, funding for projects has been slowed by COVID-19 measures, leading to a growing backlog of projects. Ongoing engagement within our ecosystem confirms a hesitancy to invest capital until the zero-COVID policy is substantially relaxed and the stimulus is received. After the spring lockdowns were lifted in Shanghai, few companies rushed to sanction projects or commission new production lines; instead, they waited for project funding to flow through.

From cement producers to heavy machinery and construction materials manufacturers, there is an expectation of better FAI and infrastructure-focused activity after the conclusion of the political congress meeting late in October. While directionally positive, we believe 2022 consensus earnings expectations overestimate the scope of activity that can occur in just two months.

So Where is the Cash?

In the past, the transmission of government stimulus would take three to four months from announcement to disbursement. Since 2015, the period has almost doubled, as funding regulation, environmental permitting, and other bureaucratic red tape impeded implementation.

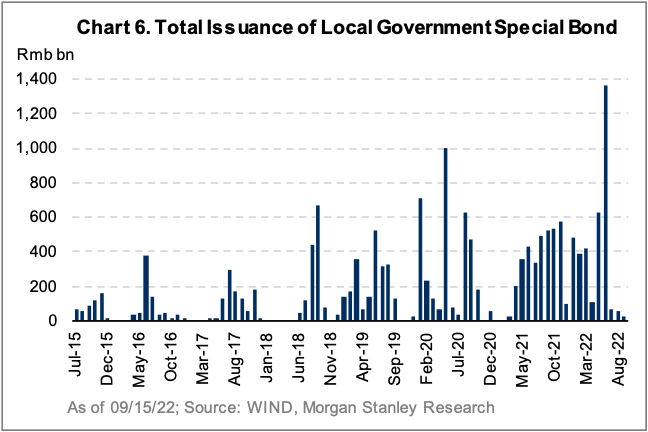

Fiscal deficits in local jurisdictions have further slowed progress in 2022 despite directives from Beijing. Local governments have been busy; one area of primary focus and spending has been implementing zero-COVID policies. Governments’ health expenditures increased significantly year-over-year (Chart 7) on everything from testing to building quarantine centers to subsidizing companies hit by the pandemic. As long as the strict COVID policy persists, significant deficits at the provincial level will remain5.

Recent press articles6 highlight another cash drain. Several major virus-testing companies reported receivables of $2B, an increase of 73% year-over-year. If companies aligned with the leading government policy are facing delayed payment issues, we wonder how companies associated with even larger scope (and cost) projects commissioned by Beijing will fare on cash collection. Sustaining the current COVID policy and delaying stimulus further increases execution risks.

Silver Lining – Valuations?

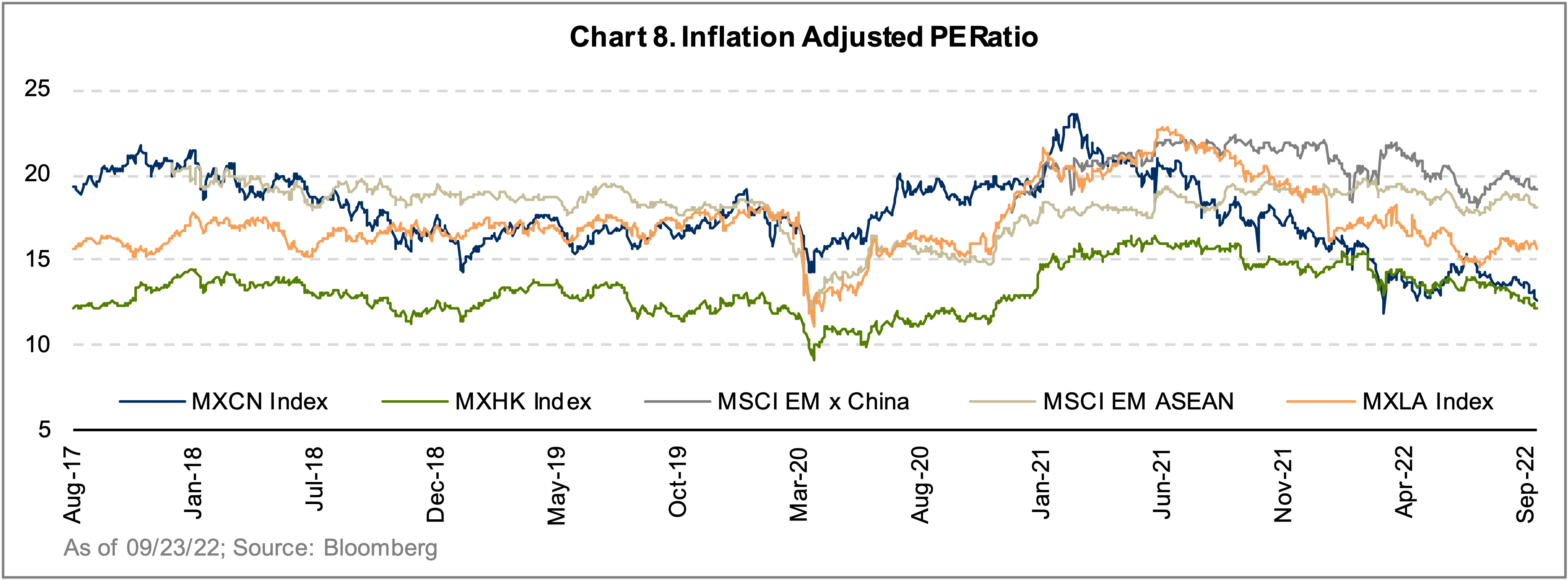

Given the strong support from Beijing, we believe only the largest state-owned enterprises (SOEs) will chase more significant projects. With projects increasingly driven by the central government (as opposed to local governments), there is greater scope for receivables risk, pressuring free cash flow generation. This will ultimately lead to lower productivity and returns. It is tempting to consider Chinese valuations attractive after an extended period of volatility; there are now more bottom-up opportunities than 12-18 months ago (Chart 8).

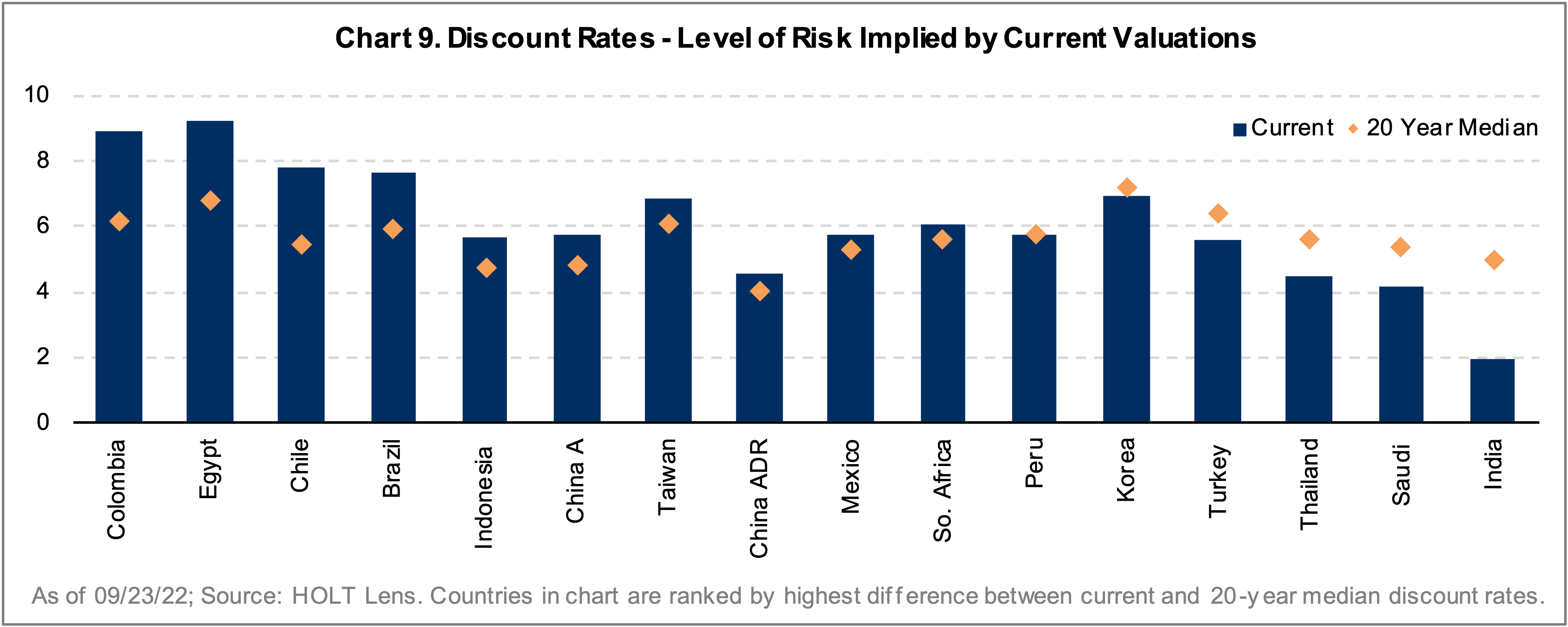

However, when we look at the risk/return trade-off embedded across wider emerging markets, we find a growing number of compelling opportunities in Egypt, Chile, Brazil, and Columbia. For example, Colombia is discounting the highest level of risk relative to its 20-year median, but it also has one the highest rates relative to other emerging markets today, as more fears are discounted here (Chart 9).

With that said, we have uncovered a handful of attractive Chinese investments through our bottom-up process. These holdings are well balanced/diversified across most sectors of the economy, trade at deeply discounted valuations, and provide differentiated exposure to secular trends in China and abroad. Fewer than 15% of our Chinese holdings face noteworthy receivables risks. We have invested in unique and differentiated companies, from low-cost handset manufacturers (such as Shenzhen Transsion), which dominate African markets, to property developer SOEs (including COLI and CR Land), which feature strong balance sheets and resilient cash flows. For the first time in many decades, economic policy in China is at odds with other politically motivated policies, and we do not expect this situation to change in the short term. It will take more time – likely including a period of more volatility than the market currently appreciates – before China can stabilize its economic performance.

Performance Drivers and Portfolio Positioning

Positive attribution this quarter was driven by individual stock selection in financials (Porto Seguro, Bank Mandiri, Axis Bank) and consumer discretionary/staples (Lojas Renner, ITC Limited). Detractors included one of our materials positions (Anhui Conch Cement) and one of our utilities holdings (China Resources Gas), which was impacted by the COVID-19 lockdowns in China.

Geographically, the greatest sources of outperformance came from individual stock selection and underweight exposure to China (Yum China, PICC Property & Casualty Co.), as well as our overweight exposure to Mexico (Banorte, Tenaris, Walmex) and Brazil (Porto Seguro, Lojas Renner, Banco Bradesco, BB Seguridade, Vamos Locacao de Caminhoes). Conversely, despite our overweight Indian exposure, more expensive companies we do not own in the country detracted from our relative performance.

Market weakness has presented us with additional investment opportunities this quarter. In Mexico, we initiated a position in Femsa, Latin America’s largest retail operator. This company is undergoing an internal strategic business review, and we believe that the market is vastly underappreciating two important components: 1) the long growth run rate of its highest return assets, the Oxxo convenience stores in Latin America, and 2) the recovery of its CocaCola Femsa division following a revised distribution agreement with Heineken.

We sold our position in A-living (China), identifying it as a source of funding for new portfolio investments with superior intrinsic value. A-living is an asset-light, high returns property manager in China with healthy underlying earnings progress but an impaired parent company overshadowing its fundamental operations.

Productivity Comeback

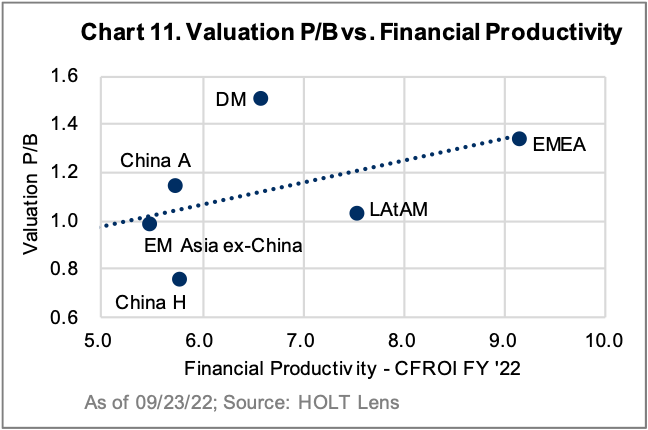

Relative to developed markets, we view emerging markets’ valuations to be extremely attractive. More importantly, we believe there is a truly underappreciated broad recovery in financial productivity underway, as exhibited in Chart 10.

For the first time in two decades, one of the widest divergences within EM has emerged, and markets outside of China are finally “breaking out.” Considering the Chinese productivity risks we highlighted earlier, the outlook for companies in these “other” emerging markets remains more compelling (Chart 11).

We continue to hunt for investments in all corners and frontiers of the world. Our bottom-up process is leading us to many opportunities, given the attractive valuation backdrop. With a busy travel season ahead, we look forward to uncovering many GEMs.

Thank you for your support and interest in the Altrinsic Emerging Markets Opportunities portfolio. We would be delighted to discuss these or other matters of interest.

Sincerely,

Alice Popescu