Dear Investor,

Global equities gained 2.6% (MSCI World Index, as measured in US dollars) during the second quarter as enthusiasm about artificial intelligence continued to propel a handful of mega-cap US stocks, most notably Nvidia, to new heights. We are believers in the AI renaissance and its long-term potential to drive productivity enhancements, but we also believe embedded expectations are excessive. The “obvious” has seldom been more crowded, and this is reflected in high valuations and expectations. Accordingly, our investments and risk exposures are meaningfully different from the major indices, which are dominated by these technology companies. This negatively impacted our performance as the Altrinsic Global Equity portfolio declined 3.3% gross of fees (-3.5% net).i

While the prospects for AI can be a catalyst for meaningful change for both companies and industries, prevailing conditions remind us of other episodes characterized by excess, including Japan (1989), the internet bubble (2000), and the run-up to the Great Financial Crisis (2007). During the latter two, our relative performance lagged as we avoided hyped stocks, but the subsequent episode was marked by significant outperformance. It may seem obvious to follow the crowd amidst the AI enthusiasm, especially given the compelling narrative, but as Joseph Schumpeter said, “Nothing is so treacherous as the obvious.”

We share Jeff Bezos’ view that AI is a horizontal technology that will benefit a wide range of companies. Observing value creation involving other transformative innovations – electricity, light bulbs, railroads, and the internet, to name a few – reveals that the greatest returns were realized outside of the companies that garnered the early excitement. Early hype led to excessive expectations that ultimately disappointed, while adjacent companies and industries capitalized on the new technologies and outperformed.

But for now, the market has voted that a few US large-cap technology stocks are the winners. These are great companies, but consider the following:

- Five new economy stocks (Nvidia, Microsoft, Amazon, Alphabet, and Meta) added $4 trillion in market cap this year alone, with approximately $2 trillion coming from Nvidia alone. According to Deutsche Bank, as recently as October 2022, Nvidia was the 18th largest company in the S&P 500, worth less than $300 billion.¹ In 20 short months, it overtook Microsoft as the world’s most valuable company. This amount of market cap expansion is unprecedented; beware the law of large numbers.

- According to a recent Sequoia Capital estimate, some $50 billion has been invested in Nvidia’s chips since the boom began, but generative AI startups have only generated $3 billion in sales.² Much is being wagered on the future.

- Based on a recent US Census Bureau survey, fewer than 7% of US companies plan to utilize AI in the next six months, unchanged from the start of the year.³ There are some obvious tasks in customer service and health care that will benefit from AI, but growth of this type relies on new, currently unknown tasks or a surge in productivity. This is possible in the long term but unlikely in the near term.

- AI’s progress is constrained by its enormous energy requirements. Expanding electricity grid capacity is a lengthy and cumbersome undertaking held back by regulatory reviews, construction constraints, and environmental concerns.

The current surge has all the hallmarks of inelastic supply meeting surging demand. However, enormous investment will ultimately boost supply while demand could prove more moderate and cyclical than currently thought. History is riddled with examples of great ideas that simply went too far, sometimes sowing the seeds of their own demise as disruptive new entrants arrived or valuations reached levels unsupported by underlying fundamentals. We believe AI is transformative, overhyped in the short term, and perhaps underhyped in the long term, with the eventual winners being different from those perceived as obvious today. Our investment philosophy and process – consistent since inception in 2000 – leads us elsewhere.

Performance Review

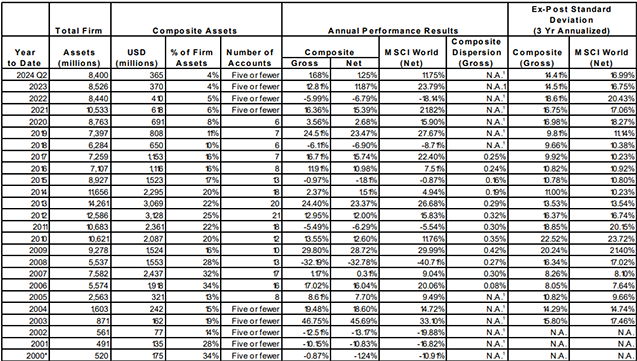

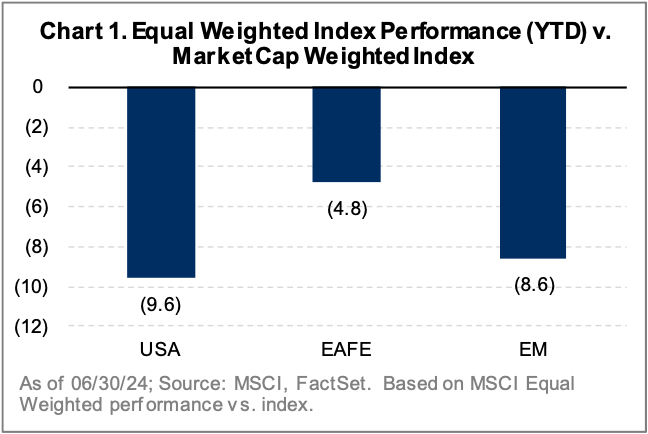

Broad index performance implies markets shrugged off rising geopolitical uncertainty and weakening economic data – but is this true? During the quarter, the MSCI World Equal Weighted Index was actually down 2.2% (USD basis). As shown in Chart 1, the average stock in the US, EAFE, and Emerging Market indices has underperformed its own index by staggering amounts this year. Essentially, the small subset of large-cap growth companies, often AIthemed, flattered the broad indices. As noted earlier, the Altrinsic Global Equity portfolio’s underperformance was primarily derived from our lack of exposure to market-leading US technology companies, coupled with poor performance among investments in the health care (Bristol Myers, CVS Health), communications services (Baidu), and consumer staples (Diageo, Pernod Ricard) industries.

Bristol-Myers was pressured as the company faces a large patent cliff and the success of some new drugs has been weaker than expected. The company’s current valuation doesn’t reflect the promising pipeline and significant cash on the balance sheet that can be utilized to boost innovation and accelerate growth. CVS Health has an attractive set of assets, but management has continued to make inexplicable execution errors. There is value to be realized should CVS better navigate the costly and complex US health care system, but for now, we do not believe management is up to the task, so we sold the position.

Our underperformance in communication services was primarily driven by weak performance from Baidu, as well as not owning Alphabet. Baidu shares were weak after the company gave disappointing revenue growth guidance. Similar to the commentary above, Baidu has yet to monetize AI enough to offset macro headwinds. Unlike other stocks that will benefit from AI, Baidu’s core search business remains severely undervalued.

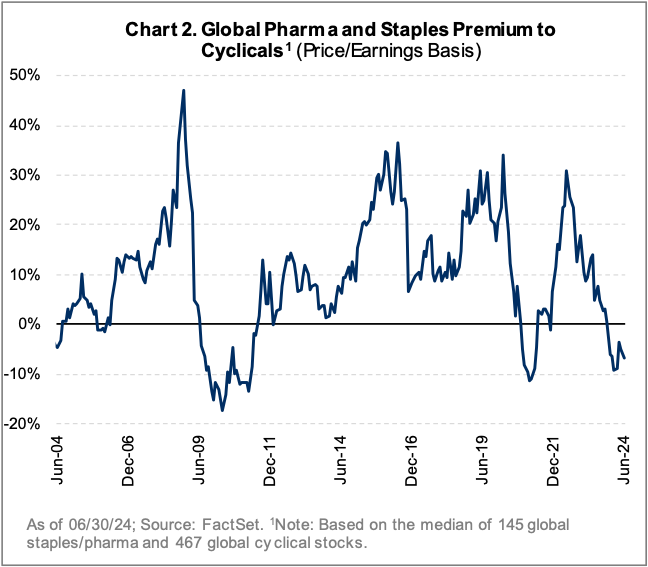

Consumer staples shares were pressured as they cycled through post-COVID volume and price volatility. Spirits companies, including Diageo and Pernod Ricard, have yet to show signs of a volume rebound as inventories are drawn down. With a 20-year track record of preCOVID volume and price growth, we expect growth to return as Western consumers retain a preference for spirits over beer and wine. From a broader perspective, a significant valuation gap has developed between more cyclical segments of the market and the least cyclical, with the latter at a historically high discount (Chart 2).

Investment Activity

As is frequently the case during periods of concentrated enthusiasm, we are finding value beneath the headlines and hype. As such, it is not surprising that investment activity picked up; we initiated six positions, four of which had been previously owned, and sold five positions.

Aon (insurance brokerage), Genpact (IT services), PPG (US industrial manufacturer), and Banorte (Mexican financial services) are well known to us and returned to prices that warranted re-engagement. Aon will continue to benefit from the rising demand for risk management and health care solutions in an increasingly complex and risky world and should capture further market share given its global expertise and attractive data franchise. Genpact is often viewed as a business at risk due to AI, but we foresee demand recovering as companies continue digitizing and increasing outsourcing to deal with cost pressure. Genpact is investing in AI and, given its significant expertise in managing processes, is positioned to become a partner to their customers along their efficiency journeys. PPG, a leading US paints and coatings company, stands to benefit from an aging US housing stock and improved efficiency despite near-term worries about weak end markets. Mexican-based Banorte generates high returns and cash flow, which should continue to compound as credit penetration in Mexico accelerates.

Yamaha Motor (Japanese marine and motor equipment), a first-time purchase, offers leading boat engine and emerging markets motorcycle franchises. We believe the company’s impressive turnaround, including rightsizing its developed markets motorcycle manufacturing function and improving its price discipline, is not reflected in its current valuation. Trimble, a US-based service provider to the transportation and construction industries, is increasingly shifting to be a software business, which will help improve returns on invested capital and recurring cash flows.

We sold CVS, Alight, BBVA, Makita, and Public Services Enterprise Group (PSEG) in the quarter. As discussed above, we sold CVS after losing confidence in management’s execution abilities. We owned Alight, a leading HR benefits administration firm, for its sticky cash flows and software transition opportunities, but we believe the company is struggling with pricing and demand in its core business, which are more than offsetting the positives. After recent management departures and a disappointing meeting with Alight’s CFO and CEO, we revised down our intrinsic value significantly and elected to sell the shares. Spanish bank BBVA has executed well, but we sold as the stock neared our intrinsic value despite announcing a controversial acquisition of Spanish peer Sabadell. Similarly, power tools manufacturer Makita approached our estimate of intrinsic value. While there could be more upside should margins continue to expand, a series of execution missteps and product quality questions led us to sell the shares. PSEG, a diversified energy company, has been an impressive execution story in the utilities space, but this was increasingly reflected in the share price after rallying sharply in 2024.

Positioning and Outlook

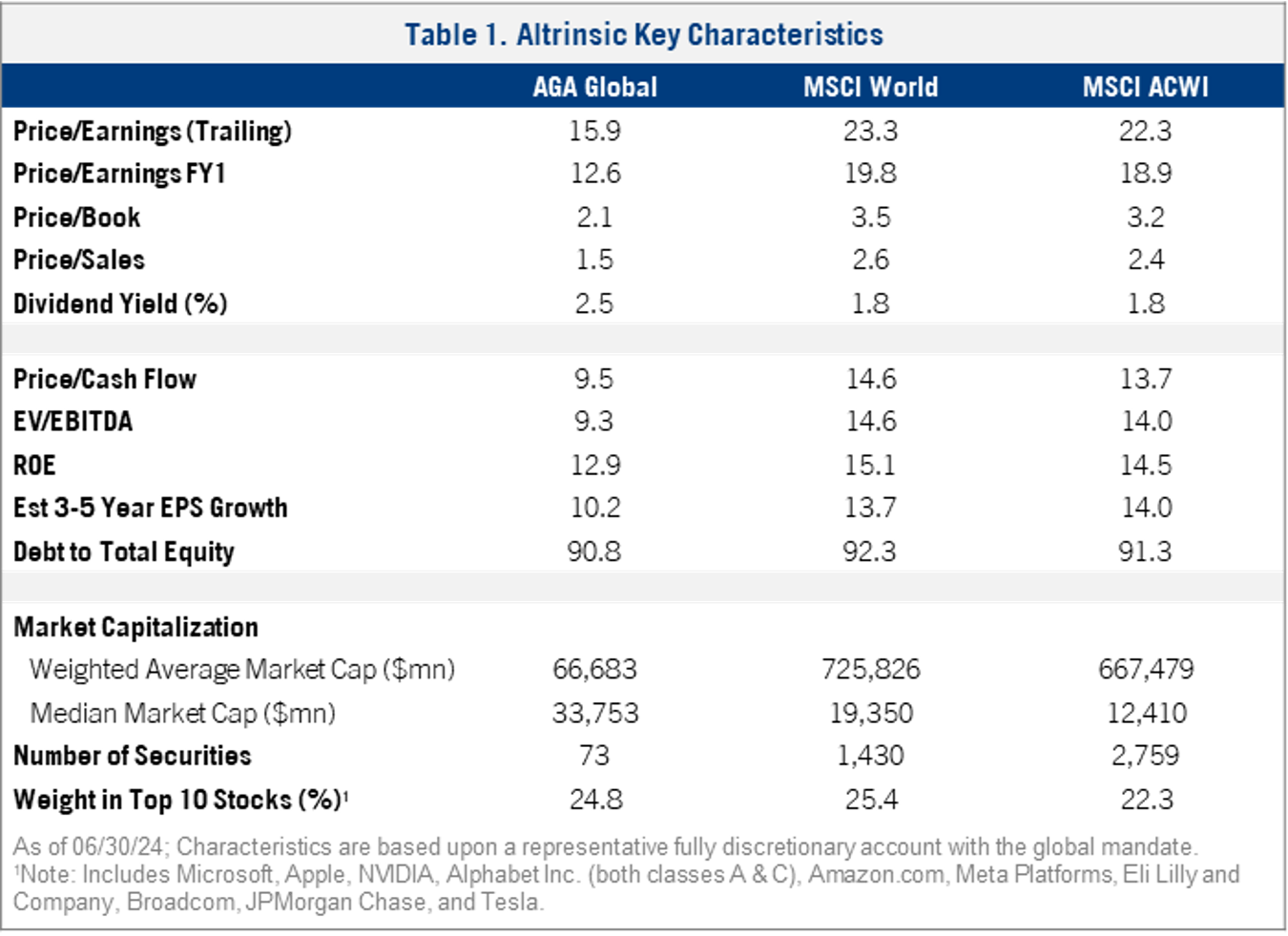

Our pursuit of value beyond popular and crowded stocks in the market has led to a portfolio that is meaningfully undervalued by almost any metric (Table 1). Additionally, the average discount to estimates of base case intrinsic value for our portfolio is roughly 20%. Perhaps more importantly, discounts to bull case valuations relative to bear case scenarios reflect a favorable asymmetric skew and substantial embedded value.

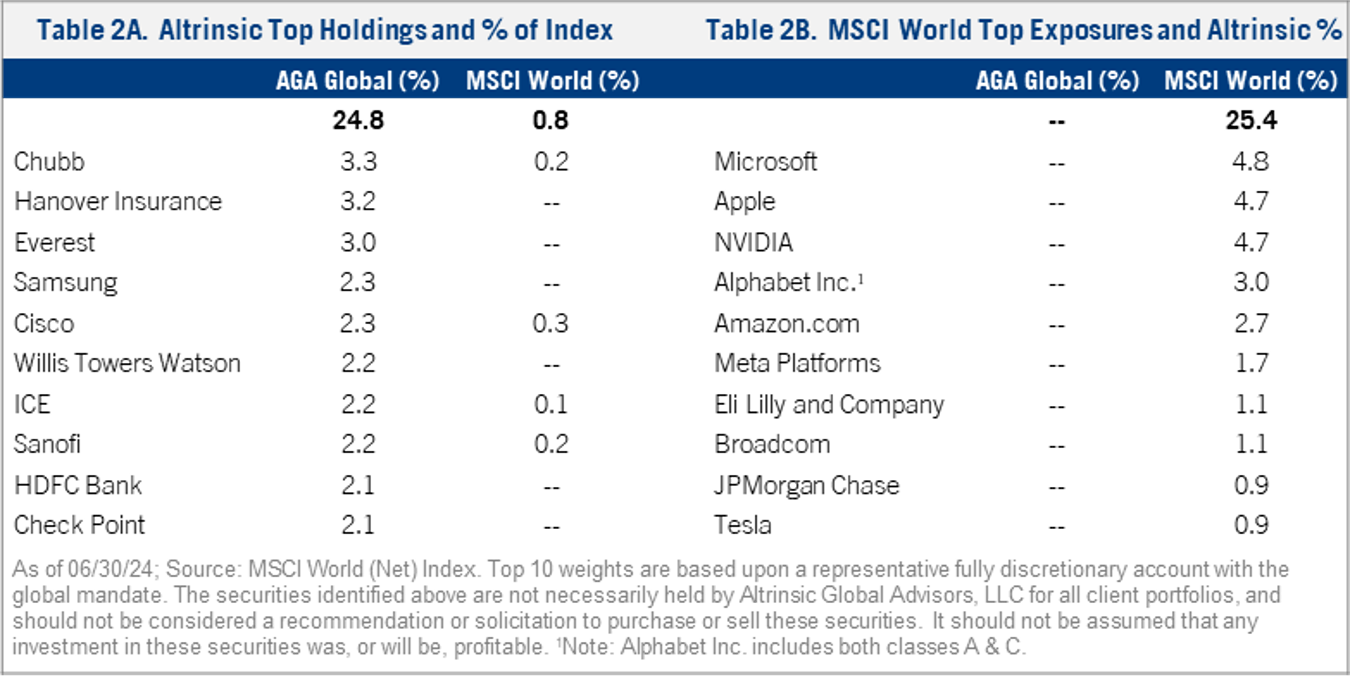

Not surprisingly, our positioning is also quite different from the broad indices. As seen in Tables 2A/2B, we have no investments in the MSCI World Index’s ten largest constituents. Rather, our ten largest investments represent only 0.8% of the index and include a range of attractively valued companies with solid and/or improving fundamentals. We certainly feel the pressure that coincides with underperformance, but our confidence tends to be greatest during circumstances and conditions that match the prevailing situation.

Summary

Headline index performance, dominated by a few large-cap growth stocks, is not indicative of the broader market returns. As we have seen in previous episodes of market exuberance, trees do not grow to the sky, and stocks do not go up forever. While there have been some disappointments, companies in our portfolio are performing better operationally than their stock prices would indicate. We are confident that the value being generated will be properly recognized.

Please contact us if you would like to discuss these or other matters in detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick