Performance Review and Investment Activity

Investments in the technology, financials, and communication services sectors were the primary sources of our outperformance during the third quarter. In technology, New Relic agreed to an all cash takeover offer from private equity, and Check Point Software smartly deployed some of its significant cash reserves by acquiring a cybersecurity business that further improves its competitive position in a fast-growing area of the market, highlighting management’s commitment to accelerating topline growth. Notable positive attribution in financials came from Chubb, Everest Group (formerly Everest Re), and Sumitomo Mitsui Trust, which all benefitted from a reappraisal of risk and growth prospects in the markets they serve and stand to benefit from higher rates. US cable businesses Charter Communications and Comcast drove our outperformance in communication services. Increased confidence that each company’s cable broadband revenues can continue to deliver growth, despite increased competition from fiber and fixed wireless access, benefitted the companies. Additionally, both companies’ recently launched wireless businesses continue to scale faster than expectations.

The consumer staples, industrials, and materials industries were the primary sources of negative attribution. Within consumer staples, Heineken’s sales and profits were negatively impacted by slowing growth in Vietnam, one of the company’s most profitable markets. Rather than slow spending in distribution and marketing, Heineken chose to continue investing ahead of an eventual recovery. We expect the company to be well positioned when this occurs, as Heineken is the premier beer in Vietnam (and dozens of other countries). RTX drove underperformance in the industrials sector after issuing a recall of its GTF engine to inspect for possible metal contaminants, delaying the expected profits for the engine’s ramp up. The engine’s superior technology remains intact, however, and RTX’s position in the duopolistic engine market creates ample opportunity for the company to satisfy the airline industry’s need for new aircraft capacity. In materials, Akzo Nobel was a notable laggard as it faced concerns over weak volume demand in key markets and higher oil prices. Akzo has successfully raised prices to offset input cost pressures, and its new CEO Greg Guillaume is targeting lower fixed costs. Upside optionality remains for volumes to recover off a severely depressed level.

Investment activity was robust, as we initiated positions in Ashland Inc., Sony Corporation, and Suzuki Motor Corporation and eliminated positions in Japan Exchange Group and Fidelity National Information Services.

Ashland, Inc. is a global specialty additives and ingredients company serving pharmaceutical, consumer, and industrial customers. CEO Guillermo Novo divested a number of divisions, brought in new division heads, and shifted focus to consumer markets where the company can add value through innovation. Improved operating and financial performance have re-rated the shares, but they still trade at an attractive 50% discount to peers. We believe this discount will narrow as strategic initiatives improve its organic growth profile.

Sony is a Japanese conglomerate with strong global franchises in gaming, music, film, and image sensing. The company has dramatically improved its business in recent years by shedding poor return assets, expanding recurring revenue in its high quality gaming and music segments, and operating with increased cost discipline and accountability. We see attractive growth opportunities in gaming monetization, increased music streaming adoption, and further digital camera penetration.

Suzuki is a Japan-based global auto manufacturer with strong market positions in Japan, India, and several emerging markets countries. After a period of record-high raw material costs, depressed auto demand, and market share pressures in India, profits are set to rebound. Avenues for further growth include normalization of auto demand in Japan and rising penetration throughout the emerging world. Net cash on the balance sheet provides optionality should internal or external investment opportunities arise.

We sold Japan Exchange after a period of rising cost pressures and poor market data monetization. Despite the poor fundamental performance, the shares rallied sharply amid robust trading activity and reached our intrinsic value. For these reasons, we sold the shares in favor of other ideas.

We sold Fidelity National Information Services shares as its payment processing business performed worse than our expectations. The company eventually sold a majority of the payment processing business to private equity but we lost confidence in management’s ability to create value in the rest of the business. We sold the shares in favor more compelling opportunities elsewhere.

Perspectives

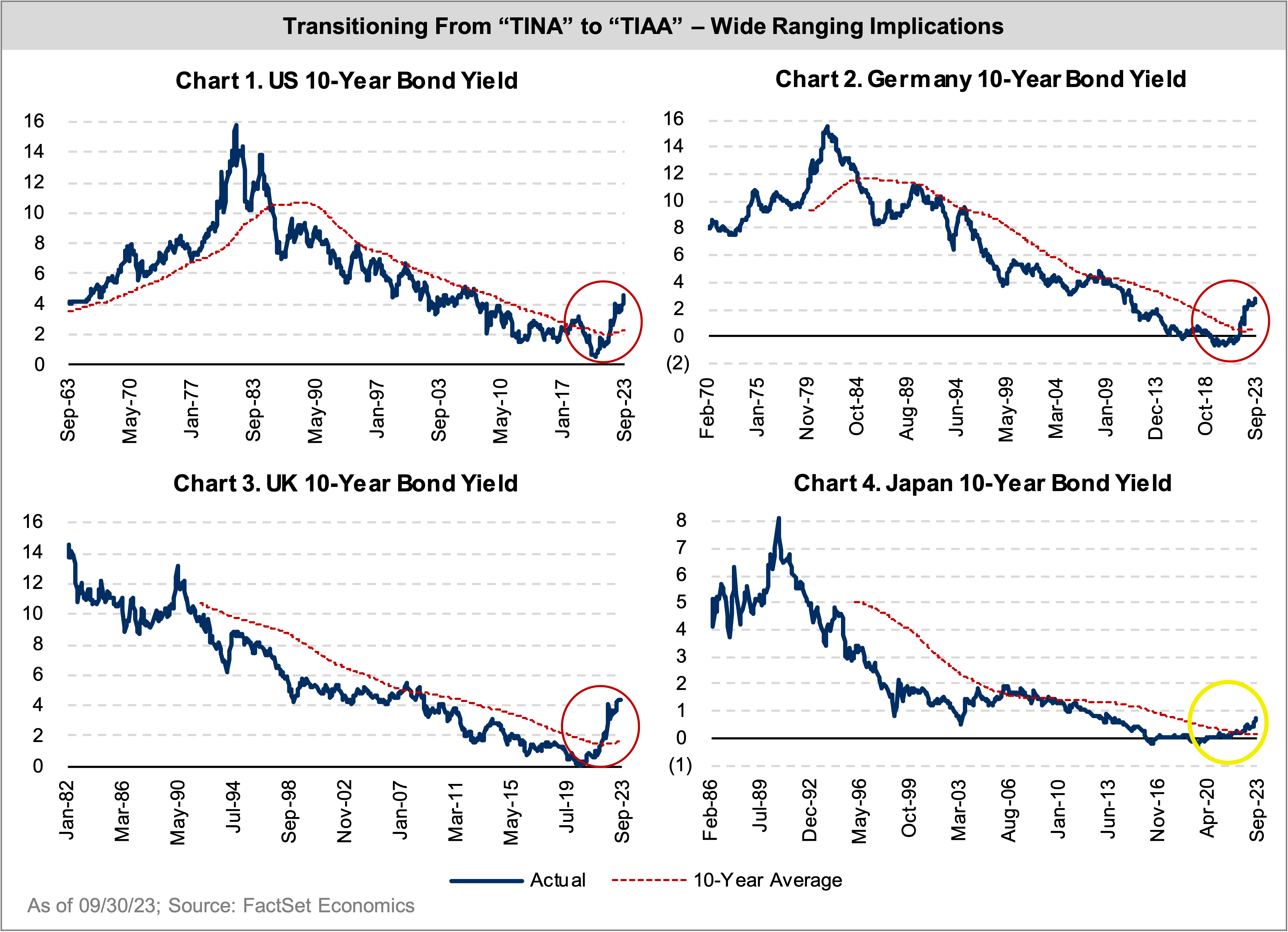

TINA, Crowding Out, and a Delayed Response

For several years, major central banks flooded markets with liquidity while authorities simultaneously embraced measures that suppressed interest rates near zero, or negative in many cases. Investors were motivated to move out the risk curve with a view that there is no alternative (“TINA”). Is anyone surprised that excesses emerged in many areas (SPACs, MEME stocks, crypto, profitless tech, etc.)? Largely in response to inflationary pressures and indications that inflation will likely persist, both policy- and market determined interest rates have spiked suddenly and aggressively. Now, there IS an alternative; investors can capture attractive risk-free rates and positive inflation-adjusted returns for the first time in years. This has broad implications for economies and markets.

Charts 1-4 illustrate the long-term trend in nominal bond yields in the US, UK, Germany, and Japan. At a fundamental economic level, the move higher in yields, coupled with bourgeoning fiscal deficits, increases government spending on interest. Ultimately, this “crowds out” money that could otherwise go to productive investments (infrastructure, services) or to lower taxes – and it typically reduces growth potential.

These conditions also result in a reappraisal of equity risk premiums, making investors less likely to buy into “stories” without supportive underlying fundamentals. Such transitions have often coincided with market dislocations. It is no coincidence that speculative assets and commercial real estate have been under significant pressure. While the impact of this aggressive tightening on global economic activity and corporate earnings has been less immediate than in previous economic cycles, it is underway.

A major source of the delayed response is pandemic-related fiscal transfers directly to individuals that boosted savings and then consumption. The pent up savings are now largely depleted. Perhaps less well recognized, but of great significance, is the structure of business and consumer debt in various nations. The impact of central bank policy in Europe has been more immediate than in the US due to Europe’s dependence on external energy sources and the structure of its debt, which is more dominated by floating rate instruments than in the US. According to Deutsche Bank research, roughly 70% of Eurozone business debt is bankbased and therefore far more likely to be variable rate, versus only about 25% in the US. US business debt is more likely to be fixed and financed via investment-grade and high-yield bond markets. Similarly, US household debt is more long-term and fixed rate compared with that in Europe (and most other developed markets). Regardless, the impact has simply been delayed – not eliminated – and is starting to flow through in economic and earnings results.

Even after this quarter’s drawdown, we believe corporate earnings risk is not properly reflected in the valuation of many companies, particularly those in more cyclical industries. Instead of suffering from higher input costs during the ramp-up in inflation, these companies have actually benefitted, as they used higher costs to justify higher prices – and customers were willing to pay. For some companies with weak corporate discipline and/or less robust market positions, this dynamic is eroding, exposing risks of slowing volumes and weakening pricing power, hurting margins and profits.

Pockets of excess still exist in many areas, but we are finding attractive investment opportunities. At the broadest level, the most compelling are in non-US companies, areas outside of large cap tech companies, and less cyclical industries.

The International Opportunity: More than Just Value

We are not the first to highlight the investment appeal of non-US stocks. Many simply point to the significant valuation gap and extended nature of global market dominance by a small number of large US growth stocks. We certainly share that view but believe the opportunity goes well beyond the simplistic perspective; there is also a fundamental case.

The most attractive companies today broadly fall into one or more of a few major categories: leading multinational compounders; innovation embracers going from good to great; emerging market growth beneficiaries; and shareholder value drivers.

I) Leading Global Franchises that Compound Value

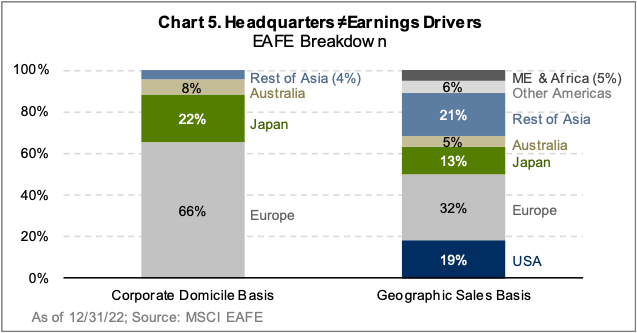

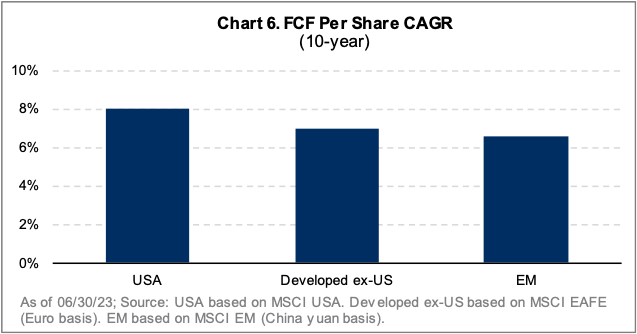

Many international companies are dynamic, high-quality multinationals with scope to grow outside of their home markets and compound returns. Investors often misperceive international equities as sleepy, slow-growth, domestic franchises. However, while 88% of developed market equities are headquartered in Japan and Europe, these regions account for only about 45% of economic exposure, as measured by sales (Chart 5). Diversified regional exposure provides a margin of safety should macro forces diverge. The growth profiles and brand strength of international companies are also often underappreciated. International equities grew free cash flow per share at a comparable rate to the US over the last decade (Chart 6), and half of the companies on Interbrand’s Top 100 Global Brands list are international businesses, including Samsung, Toyota, Mercedes-Benz, Louis-Vuitton, SAP, and Sony.

II) Innovation and Business Transformation is Taking Many Companies from Good to Great

International markets also feature companies going from “Good to Great,” a term coined in the famous book by Jim Collins. Like many American corporations, these international companies1 are incorporating technology and innovation to boost growth, reduce costs, and improve customer service and retention. For example:

- Siemens, a Germany-based global industrial company, has steadily shifted away from low-tech capital goods to become a leader in software and smart infrastructure, providing important products that will improve automation and digitization for its customers.

- Check Point, an Israel-based leader in security software, is utilizing innovative new products to reduce customer security risks and boost its free cash flow margins.

- Samsung, a Korean leader in memory products used in a range of technologies, is a key enabler of AI. The company has invested heavily in manufacturing technology, further boosting its competitive advantages.

- Under a new CEO, leading consumer brand Nestlé is utilizing technology and science to benefit consumers and its bottom line. Over the past five years, Nestlé has reduced product time-to-market by 60% and sugar usage by 50% and boosted coffee yields by 50% through drought-resistant technology.

- The pharmaceutical industry, including Novartis and Sanofi, is benefitting from improved data and analytics augmented by AI. McKinsey estimates that AI can boost pharma efficiency (and profits) by over 20% through improving drug discovery, customer documentation, and commercial content creation.

- BBVA, which operates a leading Mexican and Spanish banking arm, has invested heavily in digital infrastructure, which is just starting to bear fruit. Nearly two-thirds of its sales are now through digital channels, and the company has doubled its ROE in just five years.

III) Growth from Emerging Markets

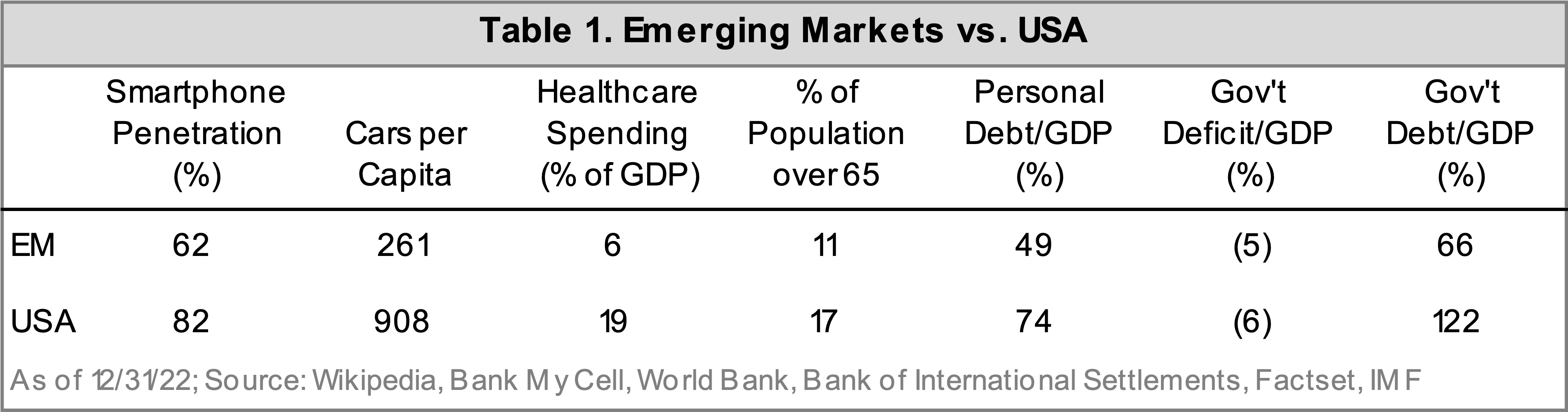

International equities provide access to attractive growth trends in emerging markets, both directly and through multinational companies domiciled in developed markets. EM is not just China. The longterm growth outlook in many emerging countries remains attractive given a young and growing population, low penetration across a range of products and services, and opportunities to expand financial services (Table 1).

Emerging markets’ monetary policy has also been far more proactive, given a well-earned healthy fear of inflation. The average EM inflation rate is only 3.5%2 , lower than the US, but EM short-term interest rates remain quite high. The most extreme case is Brazil, where interest rates are 13% despite a midsingle-digit inflation rate.

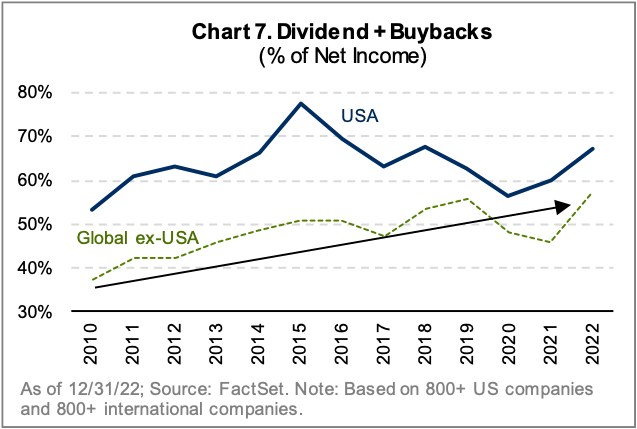

IV) Improving Shareholder Returns, including Dividends and Buybacks

International corporate leverage is now at multi-decade lows3, reducing risks but pressuring ROE. Stronger balance sheets are often a precursor to improved cash returns to shareholders (Chart 7). The average international company has increased its combined dividends and share buybacks by 150%4 over the last decade alone, and international equity dividend yields are now twice those of the US. Increased investor activism across international markets, particularly in Japan, should help unlock more value for shareholders. According to Nomura Research5 , there were nearly 20 times the number of activist investor campaigns in Japan in 2022 than in 2012.

Japan is particularly notable given the long overdue increase in focus on shareholders. After several false starts, Japanese corporates are increasingly focusing on financial efficiency metrics. Roughly 25% of Japanese companies6 are trading below book value per share, and over 50% have net cash on their balance sheets7, providing “low hanging fruit” for investors as more companies improve profit margins and capital allocation. That said, there are plenty of value traps as well, bringing to mind the old Russian proverb “trust, but verify.”

Summary

Transitions underway in policy and interest rate regimes combined with scope for earnings disappointments after a period of excess warrant a heightened degree of prudence and risk management. We see the greatest value in less crowded areas of the public equity markets amid companies with their own specific growth drivers supporting our investment theses. The result is a concentrated portfolio meaningfully different from benchmarks, with below market risk (as defined by beta). We will continue to be prudent while seeking to be opportunistic as long-term opportunities emerge.

Please contact us if you would like to discuss these or other matters in greater detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick