The valuation case for international (non‐us) equities is among the most compelling we have seen in years, but this is only part of the story. Several other themes bolster our conviction in the embedded quality and growth ahead.

The investment environment over the last several years was defined by steadily declining interest rates, benign inflation, and a strong US dollar. This backdrop, along with the rise of several mega tech platforms, disproportionately benefited US equities in general and a few US technology stocks in particular, leading to one of the narrowest global equity markets in decades. As these supportive factors fade, we expect markets to broaden, leading investors to place more consideration on valuation and risk amid greater uncertainty around growth, inflation, regulation, technology competition, and government policy.

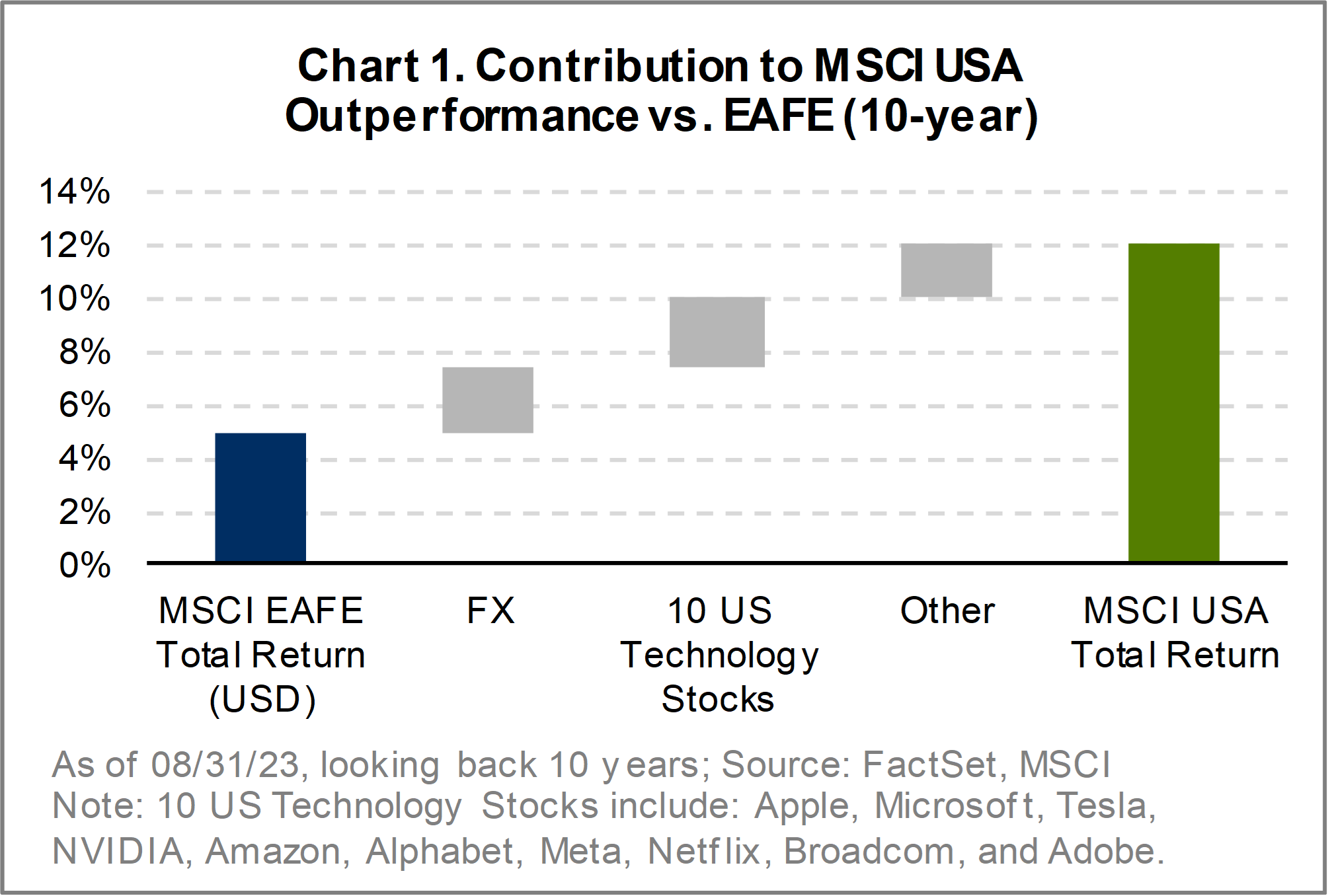

International markets present very compelling investment opportunities, particularly compared to US markets. Over the last decade, market leadership was incredibly narrow, with US market outperformance driven almost entirely by a strong US dollar and ten large-cap “new economy” stocks (Chart 1). This phenomenon is unlikely to repeat. Often perceived as either low-growth (Japan, Europe) or high-risk (emerging markets), international markets include a diverse array of investment opportunities offering access to timely and compelling themes, including:

- Leading multinational franchises that compound value

- Innovation and business transformation taking many companies from good to great

- Growth from emerging markets

- Intensifying focus on capital management, including dividends and buybacks

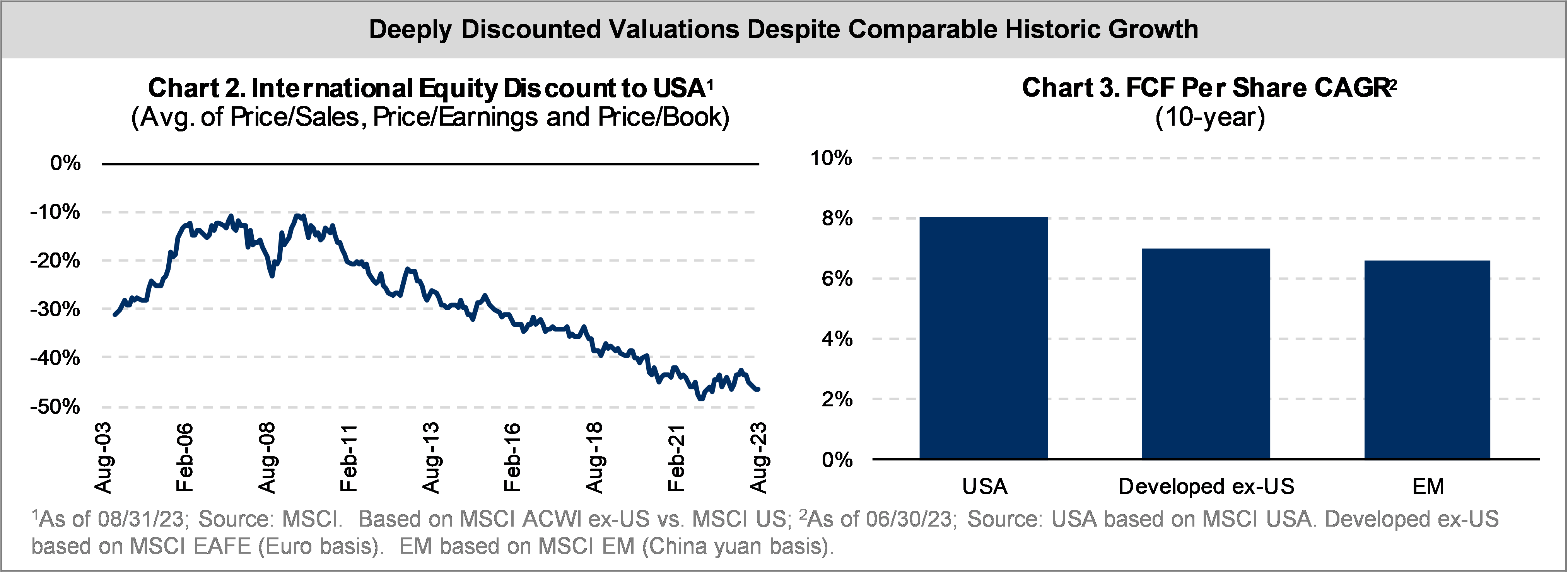

With the average international stock trading at discounted valuations versus both history and the US (Chart 2), we see opportunities for compounding value in the years to come.

US Market Leadership: Cyclical and Extended By Any Measure

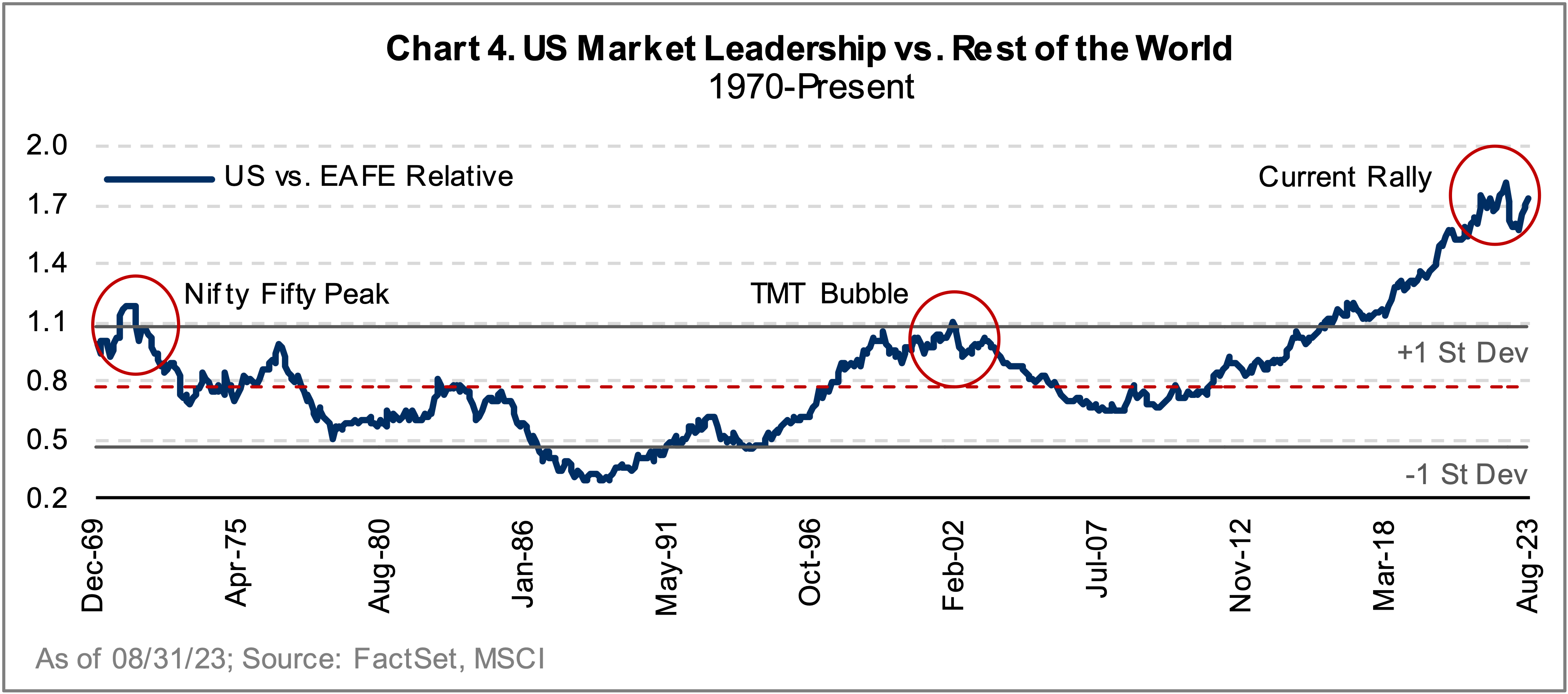

US equity markets have significantly outperformed international equities over the decade, accelerating over the last several years (Chart 4). Historically, US leadership ran in cycles, ending during periods of extended valuations (TMT Bubble, Nifty-Fifty) and giving way to multi-year international outperformance (85% outperformance between 2001 and 2007; 327% outperformance between 1982 and 1989)1.

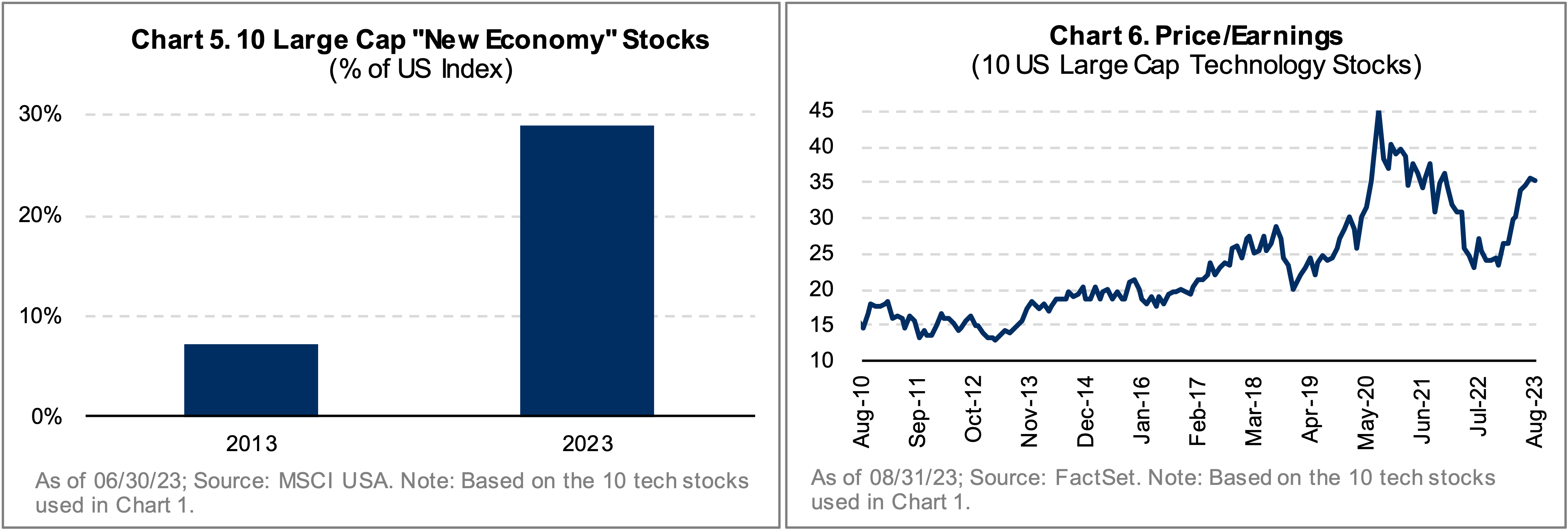

US equity indices are now extremely concentrated, with ten technology stocks accounting for nearly 30% of the MSCI USA index (Chart 5). At the same time, tech company valuations are elevated (Chart 6), requiring significant growth o a much larger base to justify current stock prices. The rise of AI has fueled renewed excitement about this narrow set of companies. While AI is certainly a compelling innovation, the market is looking past important risks to these tech leaders, including increased competition, greater regulation, demand pull-forward, high penetration in core businesses, and a higher cost of capital.

The other key factor to US equity outperformance, the US dollar, also runs in cycles. Major international currencies appear cheap relative to the US dollar today2 – based on purchasing power parity analysis – including the euro (25% undervalued) and Japanese yen (34% undervalued). Currency may provide further tailwinds to international outperformance in the years to come.

The Under appreciated International Opportunity

While there is opportunity in the US beyond the popular and crowded large-cap growth stocks, there are even more compelling prospects internationally. The opportunities typically fall into one or more of a few major categories:

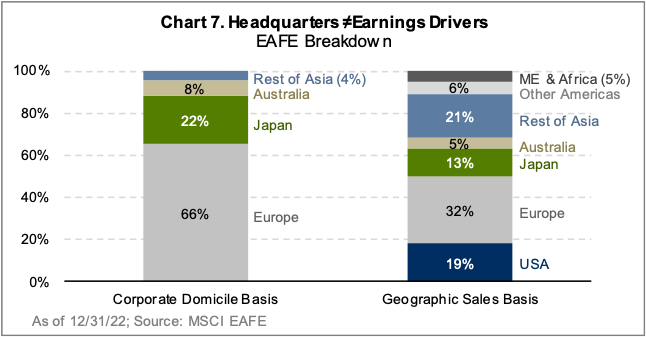

I) Leading Multinational Franchises that Compound Value: Many international companies are dynamic, high-quality multinationals with scope to grow outside of their home markets and compound returns. Investors often misperceive international equities as sleepy, slow-growth, domestic franchises. However, while 88% of developed equities are headquartered in Japan and Europe, these regions account for only about 45% of economic exposure, as measured by sales (Chart 7). Diversified regional exposure provides a margin of safety should macro forces diverge. The growth profiles and brand strength of international companies are also often under appreciated. International equities grew free cash flow per share at a comparable rate to the US over the last decade (Chart 3), and half of the companies on Interbrand’s Top 100 Global Brands list are international businesses, including Samsung, Toyota, Mercedes Benz, Luis-Vuitton, SAP, and Sony.

II) Innovation and Business Transformation is Taking Many Companies from Good to Great:

International markets also feature companies going from “Good to Great,” a term coined in the famous book by Jim Collins. Like many American corporations, these international companies are incorporating technology and innovation to boost growth, reduce costs, and improve customer service and retention. There are many examples, but below we list a few:

- Siemens, a Germany-based global industrial company, has steadily shifted away from low- tech capital goods to become a leader in software and smart infrastructure, providing important products that will improve automation and digitization for its customers.

- Check Point, an Israel-based leader in security software, is utilizing innovative new products to reduce customer security risks and boost its free cash flow margins.

- Samsung, a Korean leader in memory products used in a range of technologies, is a key enabler of AI. The company has invested heavily in manufacturing technology, further boosting its competitive advantages.

- Under a new CEO, leading consumer brand Nestlé is utilizing technology and science to benefit consumers and its bottom line. Over the past five years, Nestlé has reduced product time-to-market by 60% and sugar usage by 50% and boosted coffee yields by 50% through drought-resistant technology.

- The pharmaceutical industry, including Roche, Novartis, and Sanofi, is benefitting from improved data and analytics augmented by AI. McKinsey estimates that AI can boost pharma efficiency (and profits) by over 20% through improving drug discovery, customer documentation, and commercial content creation.

- BBVA, which operates a leading Mexican and Spanish banking arm, has invested heavily in digital infrastructure, which is just starting to bear fruit. Nearly two-thirds of its sales are now through digital channels, and the company has doubled its ROE in just five years.

III) Growth from Emerging Markets: International equities provide access to attractive growth trends in emerging markets, both directly and through multinational companies domiciled in developed markets. EM is not just China. The long-term growth outlook in many emerging countries remains attractive given a young and growing population, low penetration across a range of products and services, and opportunities to expand financial services (Table 1).

Emerging markets’ monetary policy has also been far more proactive, given a well-earned healthy fear of inflation. The average EM inflation rate is only 3.5%3, lower than the US, but EM short-term interest rates remain quite high. The most extreme case is Brazil, where interest rates are 13% despite a mid-single-digit inflation rate.

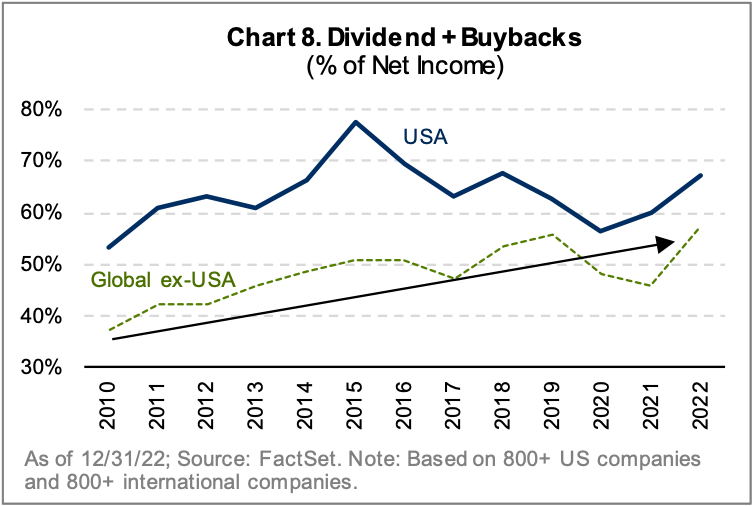

IV) Improving Shareholder Returns, including Dividends and Buybacks: International corporate leverage is now at multi-decade lows4, reducing risks but pressuring ROE. Stronger balance sheet are offer a precursor to improved cash returns to shareholders (Chart 8). The average international company has increased its combined dividends and share buybacks by 150%5 over the last decade alone, and international equity dividend yields are now twice those of the US. Increased investor activism across international markets, particularly in Japan, should help unlock more value for shareholders. According to Nomura Research6, there were nearly 20 times the number of activist investor campaigns in Japan in 2022 than in Japan in 2022 than in 2012.

Japan is particularly notable given the long overdue increase in focus on shareholders. After several false starts, Japanese corporates are increasingly focusing on financial efficiency metrics. Roughly 25% of Japanese companies7 are trading below book value per share, and over 50% have net cash on their balance sheets8, providing “low-hanging fruit” for investors as more companies improve profit margins and capital allocation. Change is taking place in Japan and throughout international markets, providing attractive catalysts for value creation.

Attractive Valuations

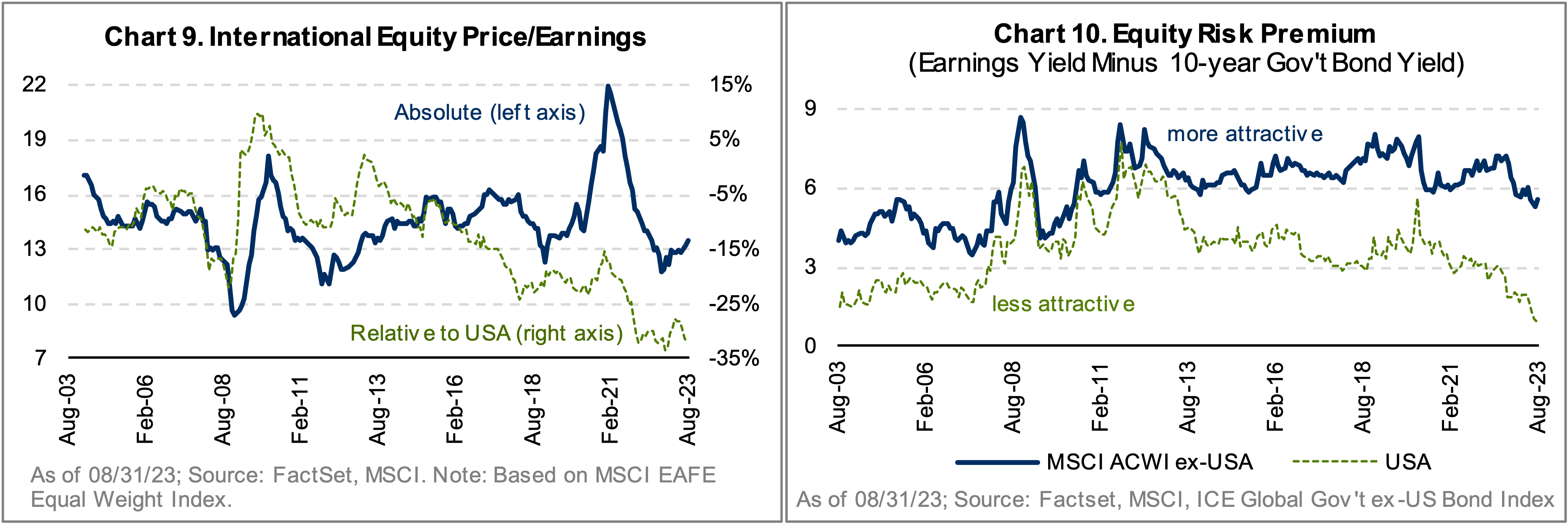

International stocks trade at a deep valuation discount to US stocks, providing investors with a more attractive implied equity risk premium9 of over 5%, well above the US at about 1% (Chart 10). On a price-to-earnings basis, international stocks trade below long-term averages (Chart 9) despite many companies operating with improving business fundamentals. This provides a particularly fertile hunting ground for bottom-up investors. That said, there are plenty of value traps as well, bringing to mind the old Russian proverb “trust, but verify.”

Conclusion

The valuation case for international equities is among the most compelling we have seen in years. In the short term, valuation has little predictive power; over the long term, however, it is overwhelming. The conventional wisdom is that non-US equities are cheap for good reason, but fundamentals are stronger than many investors perceive. We are in the early stages of improved operational performance that will lead to accelerating financial returns for many international businesses. The quality and embedded growth in international equities remain quite strong, providing an attractive outlook for investment risk/return in the years to come.