I spent two weeks in June traveling throughout Europe, engaging with a range of old and new contacts – political leaders, regulators, and management teams from over 40 companies in the insurance, banking, fintech, and industrial sectors. Throughout the trip and upon my return, I kept this journal of the most significant takeaways and implications for our portfolio positioning – some reinforcements to previouslyheld beliefs and a few surprises.

Quick Reflections

Europe’s geopolitical situation is intensifying, and the economic landscape is deteriorating due to a combination of Russia-related fallout, high deficits, supply-chain challenges, rising inflation, and interest rate pressures. Italy’s risks remain underappreciated given multi-decade high deficits, rising interest rates, a slowing economic growth outlook, and fresh elections early next year. Despite the challenges, periods of upheaval frequently deliver robust investment opportunities. Based on this trip, and considering the macro realities, I left Europe with three key perspectives about the investment landscape:

- I am more bullish on insurance.

Why? Rising global risks, such as natural disasters, are increasing insurers’ addressable market, while higher interest rates and improving competition should boost medium-term profits significantly.

- I am slightly more positive on European banks.

Why? Banks have discounted valuations and face easing fintech risks, but I see a greater likelihood that rising interest rate benefits will be either competed or regulated away.

- I believe industrials face a generational shift in operating models with big winners and losers.

Why? Rising inflation and changing supply chain dynamics will impact free cash flow and profit margins. The winners will be those companies providing automation and energy-efficient solutions and countries like Mexico that stands to benefit from significant nearshoring in the coming years.

I. Insurers are Paid to Worry, and Worry Abounds

The insurance business model is built to focus on risks; there were certainly plenty to discuss during my trip.

Rising inflation is boosting claims costs, but insurers are increasing their prices even more in many regions. Very few companies I met believe inflation is transitory; they are preparing their pricing and balance sheets for permanently higher inflation.

Credit risks are top-of-mind for most investors, but management teams are quite comfortable with their ability to navigate these risks given a combination of low leverage and low-risk credits (mainly government and A-rated corporate bonds).

Geopolitical issues relating to Russia/Ukraine – especially a shut-off of Russian gas – could present further insurance claims, but numbers appeared manageable given strong underwriting.

Cyber risks were a more consistent topic of conversation. Most insurers are adding explicit language to exclude cyber risks from future claims. More than one senior leader referred to cyber as almost uninsurable and “the next pandemic.” We share similar views and believe the risks are underappreciated, as detailed in our December 2021 white paper – The Next Global Pandemic: CYBERCRIME.

Throughout the trip, my key questions to company executives focused on their competitive discipline, which has improved significantly in recent years. In nearly all of my insurance meetings, I saw neither a change in this discipline nor a willingness to compete away the future investment gains brought about by higher interest rates. Importantly, previously aggressive private capital competitors (largely pension funds and hedge funds that structured insurance contracts as a form of “insurance” bond) are becoming less competitive as they demand higher returns and higher pricing in a higher interest rate world. All of this should combine to create the most supportive profitability environment the insurance sector has seen in several decades.

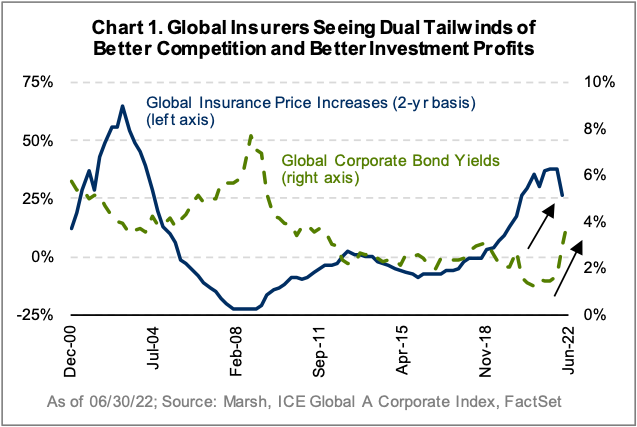

Implications: As illustrated in Chart 1, the global insurance industry is experiencing the best competitive environment in two decades, with the average commercial insurance policy seeing a 27% price increase over the last two years1. Additionally, insurers have a new opportunity on the horizon. While banks often receive all of the attention for their interest rate upside, insurers are big beneficiaries as well, given that typically half of their profits come from investment income. This profit pool has been a melting ice cube for years due to low interest rates but is set to change in today’s environment, with potential upside to profits of 10% to 50% depending on the company. Property and casualty (P&C) insurance has grown to be a significant part of our portfolio2. We like the combination of rising addressable markets in a risky world, low penetration, improving competition, better business mixes, rising interest rate opportunities, and undemanding valuations.

II(a). Tempered Optimism about European Banks

In building my meeting schedule for banks, I focused on Southern and Eastern Europe, given that these regions present the greatest levels of dislocation. Most banks were optimistic that upcoming European Central Bank (ECB) interest rate hikes, the first in a decade, would be a boon to profits. However, as I delved deeper into conversation with these management teams, I discovered several issues that might offset the gains:

1. Rising credit losses from a very low base

2. Wage inflation

3. Worsening competition

4. The potential for greater regulation and bank taxes on the horizon

The fourth point is a trend we are already witnessing in Poland, Hungary, and Spain, and I am increasingly concerned about its spread based on my recent interactions in Europe.

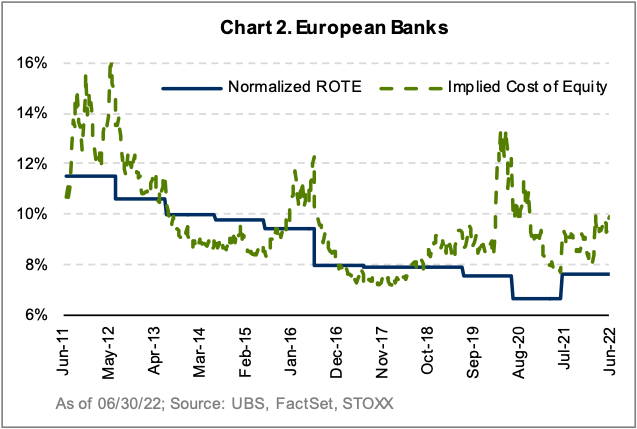

Implications: European banks have faced several years of heavy competition, technological and regulatory investment, balance sheet clean-ups, and low interest rate pressure, all of which hindered return on equity (ROE), and thus we have kept our portfolio significantly underweight. However, European banks now have greater capital levels, balance sheet liquidity, and lending collateral than in the past. Additionally, many banks shed their enormous stock of bad loans to private markets hungry for yield. Management teams appear understandably uncertain about credit risks but have taken comfort in Europe’s lack of excessive credit growth over the last decade, along with high savings and collateral levels. Today, European banks appear modestly undervalued on normalized profitability3 (Chart 2). While there are pockets of opportunity, insurance remains far more compelling at present.

II(b). Maybe Fintech is Not Such a Formidable Risk for Banks?

Spending time with fintech entities (both “digital banks” and payments platforms) helps broaden my perspective on the banking industry. I continue to believe they present risks, but I left Europe seeing them as a lesser threat than when I arrived. In many cases, the fintech upstarts understand user engagement and customer service better than their bank rivals, but it is becoming increasingly clear that their cost base is not differentiated enough to allow for markedly competitive pricing, which is paramount to gaining scale in a commoditized industry like banking. I also see more significant funding risks on the horizon, both liabilities and equity capital.

III. Nearshoring, Inflation, and Large Backlogs:

The Industrials Story Many industrial companies, and goods producers in general, were built on seamless supply chain assumptions, and many of my conversations with industrial leaders centered on this evolution. Management lamented that today even a minor hiccup – like a missing screw or a small chip – can delay a whole product, and while supply chain pressures have eased modestly in recent months, freight costs (both air and ocean) are still two to six times4 their pre-COVID levels. Additionally, the average shipping delay is nearly double pre-COVID levels at over six days5. High inflation and tight labor markets are also fostering much more contentious wage negotiations in recent months, with German unions now pushing for 8% wage hikes and many other countries discussing 4-5%.

To combat some of these pressures, management teams repeatedly said they are planning for higher inventory levels and far greater localization of manufacturing footprints (on-shoring or nearshoring) over the medium term. Unfortunately, this process will likely lead to greater management distraction and lower free cash flow and profit margins. Based on feedback during my trip, Mexico is viewed as a significant source of expanded production while China stands to lose. My colleague Alice Popescu, who just returned from a trip to Mexico, corroborated this point based on her on-the-ground discussions.

While challenges certainly abound, the discussions with industrial companies were not all negative. These firms are sitting on large order backlogs, and they seem confident about the monetization opportunity, given that capex in many geographies appears low. While input cost inflation is running at 20% (as measured by global PPI6 ), many higher-quality industrial firms are passing this forward and are resolved to continue doing so, likely aided by far more industry concentration and pricing power than several decades ago.

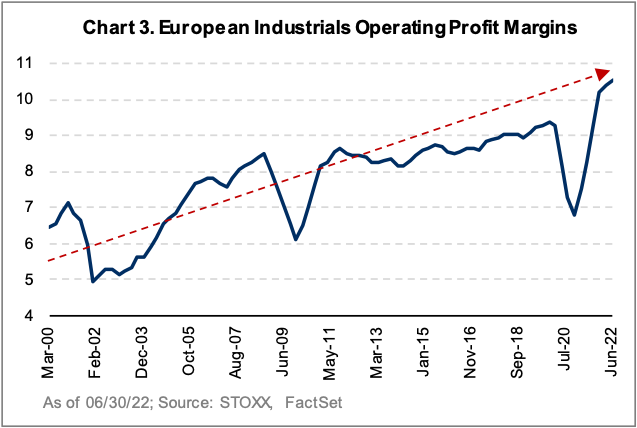

Implications: The last two decades were very supportive for European industrials, aided by rising globalization, increased industry concentration, improving automation technologies, and modest wage pressures. These circumstances helped the sector double its profit margins since the early 2000s (Chart 3). Industrial firms built their operating models on low-inventory management (justin-time production) and global, low-cost supply chains. COVID-19 shutdowns, cost inflation, chip shortages, rising shipping costs, and labor shortages have upended these models. Adapting to the new normal will require disciplined cost management, thoughtful localization, and effective leadership. Companies providing industrial automation and energy-efficient solutions offer a compelling opportunity set as they are still in the early stages of a multi-year demand cycle.

A Complicated Geopolitical and Economic Landscape

The economic and geopolitical situation in Europe is complex and vulnerable. The region has always presented a multi-dimensional set of risks, which is undoubtedly still true today. In the near-term, we are waiting to see whether Russia will decide to shut down its gas pipeline to Germany. Not only would this create immediate-term challenges for the people and government of Germany, but also it would introduce economic risks for the broader European Union given the region’s dependence on Russian energy, particularly leading into the winter months. Outside of the war raging on in Eastern Europe and its associated effects, I have concerns about Italy and the UK that I believe the market underappreciates.

After several illuminating discussions, Italy stands out as increasingly risky. The country has twice the fiscal deficit it did during the Euro Crisis with debt levels 20% higher. Its bond yields have expanded sharply near eight-year highs, creating further risks for deficits and economic growth. The ECB will do its best to soften the blow, but it will be a blow nonetheless, especially given my contacts at banks and insurers seemed unwilling to allocate more capital to Italian sovereign debt.

On the political front, Italy has experienced relative calm since early 2021, when former central banker Mario Draghi took over the role of Prime Minister. However, the stage is set for this to change:

- Elections return in nine months, and Draghi is expected to step down.

- Italy’s political leadership remains highly fragmented, and a combination of weak economic growth and high inflation could bring populism and anti-Euro sentiment back to the fore.

- During the pandemic, Europe was willing to provide significant support to Italy, but I question whether this will continue if higher interest rates, inflation, and Russia/Ukraine slow the region’s growth.

- Based on all of my investor conversations, Italy is low on the radar right now, creating further risks for negative equity surprises as the year progresses.

The UK is also facing greater political headwinds. Scotland is angling for a referendum within the next year as they again argue whether to split from England. The support for separation is much stronger than I had anticipated, especially as Scottish people seemed far less supportive of Brexit. In my opinion, this is another underappreciated risk over the next 12 months.

Closing Thoughts: Pockets of Opportunity in Europe

On-the-ground due diligence is paramount to our investment process. We believe that some of the best investment opportunities come during periods of change – at the macro, industry, and/or company level. There is certainly abundant change underway in Europe. Our European investments largely represent companies undergoing underappreciated business model transitions, improving their growth and returns on invested capital through initiatives such as cost efficiencies, enhanced sales monetization, and better capital allocation. We think these businesses can continue to differentiate from competitors and have the opportunity to outperform in a volatile world7.