Dear Investor,

The Altrinsic Emerging Markets Opportunities portfolio increased 3.0% gross of fees (2.8% net), compared to the 2.9% increase of the MSCI Emerging Markets Index, as measured in US dollars.i Stock specific gains in financials, real estate, and materials were partially offset by performance in consumer discretionary, utilities, and communication services. Our underweight exposure to India and Taiwan gave the portfolio a relative boost, while our overweight exposure to Indonesia and South Africa created some drag due to political volatility.

Emerging markets outperformed developed markets, even in the face of the uncertainty and early ramifications of President Trump’s tariff policies. Seismic shifts in governance, global trade, and appraisals of risk, combined with an evolving world order, warrant a renewed focus on this increasingly uncorrelated, undervalued, and overlooked asset class.

Perspectives

“To be uncertain is to be uncomfortable, but to be certain is to be ridiculous.”– Socrates

With structural uncertainty rising, emerging markets – historically a source of risk – now stand out as a source of refuge. Despite a nebulous backdrop, lower inflation and stronger policy tools put EM countries in a better position to control their growth. Risks persist – namely, the global trade war, political volatility, and governance – but a disciplined focus on undervalued, productive businesses uncovers opportunity.

Inflation Dynamics Amidst Trade War Uncertainty

Lately, not even penguins1 have been able to avoid the topic of tariffs. One of the key questions for investors is how the ongoing trade war will affect companies’ bottom lines. The United States’ actions have inflationary implications, both domestically and internationally. We believe sustained higher inflation could be a greater risk for the developed world than emerging markets.

Contrary to popular belief, inflation in emerging markets has fallen below developed market levels (Chart 1). Robust infrastructure development has lowered logistical barriers and operating costs, key drivers of structural inflation. Better managed capital accounts have helped to control imported inflationary pressures, too. Even in China, squarely in the center of the trade war, the conversation has been focused more on disinflation or outright deflation, with PPI2 printing new lows.

A high interest-rate differential between EM and DM (Chart 2), among other factors, suggests that emerging markets are better positioned to deal with an inflationary environment, should it develop. This is quite a different, and more positive, situation from prior episodes. EM currencies are fairly valued, and favorable demographics3, combined with strong internal consumption trends, allow policymakers to lower real interest rates to support or stimulate growth without fear of currency instability or devaluation.

In developed markets, tariffs will lead to more expensive sourcing and higher costs of goods sold. Some companies may absorb these costs, reducing margins and profitability, but not universally. Consumers will face rising prices and potential shortages, increasing inflationary pressure. Developing robust domestic sourcing and manufacturing capacity will take years, creating more sustained price pressures.

While we consider the prospects of stagflation in the US or a broader global economic slowdown, growth continues to be the base case for EM.

Local Politics Create Unique Opportunities

“It is not certain that everything is uncertain.”– Blaise Pascal

Domestic politics have again taken center stage in several emerging markets, notably Turkey, Indonesia, and South Africa. While South Africa’s events reflect the consequences of its unprecedented coalition government last year, developments in Turkey and Indonesia have surprised the market.

Unpredictable and questionable practices have long defined Turkey’s political environment. Over the last few years, the country has experienced an uncharacteristic period of political, economic, and financial market stability. However, recent political actions serve as a stark reminder to investors that governance and political risks loom large. Specifically, the arrest of President Erdogan’s main opposition rival, Istanbul Mayor Ekrem Imamoglu, on corruption and terrorism charges and the removal of his diploma reinforce that political volatility is the country’s reality.

Turkish equity markets have delivered strong relative returns over the short to medium term (35 years) in dollar terms, but the quality of underlying businesses has worsened, with volatile growth, declining operating profitability, and structurally deteriorating asset productivity/efficiency. A fragile macro backdrop punctuated by high inflation and punitive interest rates makes it increasingly difficult to tolerate a weakening rule of law. Considering these factors, we do not believe Turkey’s valuations are compelling.

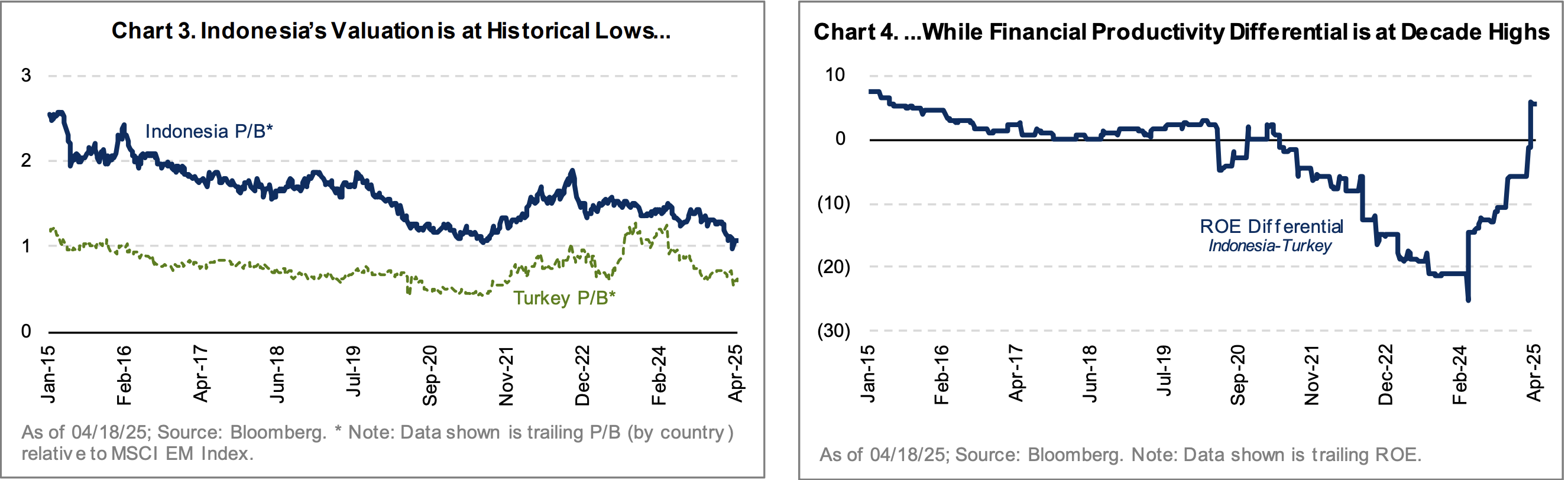

In stark contrast to Turkey, the changes to Indonesia’s political landscape were more surprising, and the opportunity is also greater (Charts 3 and 4). Three key concerns are weighing on Indonesia’s market outlook and valuations. First, the pursuit of populist campaign promises has fueled fiscal worries, despite no evidence of change versus the pre-election period. Second, there is a perception of increased power concentration and military influence, echoing global authoritarian trends. Finally, geopolitical tensions and trade war risks threaten to erase Indonesia’s gains from recent supply chain shifts.

Looking beneath the surface, however, we believe the opportunity in Indonesia is underappreciated:

- Resilient Growth Drivers: Despite being one of Asia’s most closed economies4, Indonesia has taken a pragmatic stance in the trade war, showing early willingness to engage with the US. Strength in nickel production will position the country to capitalize on the global EV/green energy transition. And, domestic consumption – driven by a large, young population5– remains the core growth engine.

- Improved External Stability: During past crises (e.g., 2013 taper tantrum), the Indonesian rupiah proved to be the weakest link. Now, the country has strong FX reserves, a nearly balanced current account6, and one of the most undervalued EM currencies7. Additionally, Bank Indonesia has actively defended the rupiah and has kept rates steady; meanwhile, bond yields have stayed flat, and CDS spreads are below GFC peaks.

- Political Credibility: Despite market rumors about eroding confidence in government, Indonesia’s deep bench of technocrats mitigates leadership transition risks. Legal reforms pertaining to SOEs (including Danantara8) have prompted board level changes, including adding experienced, well respected foreign members. These considerations paint a more positive picture of Indonesian governance than headlines might suggest.

Collectively, these dynamics created an attractive opportunity to invest in highly productive and undervalued Indonesian businesses offering exposure to a fairly closed off ASEAN economy – a favorable feature given the current trade war. The financial productivity of Indonesian companies remained stable over the last decade (unlike in Turkey), driven by stable asset turns and improving profitability despite a volatile business and top-line growth environment.

Indonesia’s ability to lower inflation and implement infrastructure changes has allowed for more efficient development and structurally lower operating costs, ultimately increasing profitability.9

The Altrinsic Emerging Markets Opportunities strategy has exposure to three Indonesian stocks, representing 3.7% of the portfolio (versus 1.2% in the MSCI EM Index). Each company is a leader in its respective sector with a strong competitive moat, exhibits a solid balance sheet (allowing for continued growth), and delivers high dividend yields.

Seismic Shifts Underway

“We learn geology the morning after the earthquake.” – Ralph Waldo Emerson

During the first quarter, we observed several large shifts across financial markets and the repricing of asset classes. Emerging market equities outperformed developed markets despite fears of a trade war, which continued post Liberation Day. Furthermore, the implied risk of emerging markets has diminished substantially over the last decade, considering both equity risk premiums and fixed income market spreads.

Governance has long acted as a de facto tax on emerging market valuations, driving risk premia. Persistent concerns related to state intervention, mandated investments in the name of national interest, and corruption, to name a few, have been used to justify valuation discounts. For most EM businesses, this challenging environment has become routine. EM company leaders have become accustomed to balancing confidence with caution, navigating complex governance risks alongside capital allocation decisions.

While questionable governance situations in emerging markets are somewhat routine, a few recent events point to an unprecedented shift in DM governance, affecting the relative cost of risk in EM:

- In February, the White House signed an executive order that stops enforcement of the Foreign Corrupt Practices Act, opening the door for heightened corporate misbehavior globally.10

- In March, after months of criticism from the White House about Chinese involvement in the Panama Canal, a consortium led by a US investment company agreed to purchase two key ports along the canal from a Chinese conglomerate. Since the Panama Canal is vital to US national security11, questions about the economic rationale of the deal may be dismissed.

- In April, the National Economic Council Director, a member of the Trump administration, commented in the media that the President is studying whether the Fed Chairman could be fired in order to implement lower interest rates. Regardless of the eventual outcome, the mere disclosure of such consideration alters the perception of ironclad independent monetary policy in the world’s largest economy.

All three examples reflect the type of sovereign and corporate behavior that typically occurs in EM and elicits valuation discounts. Traditional safe haven assets (US Treasuries, US dollar) have suffered due to instability in US policymaking, eroding developed market corporate confidence. Ultimately, the justification for governance driven risk premia in EM (relative to the US, which was previously the governance gold standard) has diminished. This is seismic.

Concluding Remarks

Only time will tell whether the global order is undergoing a fundamental shift or retracing a 1970s-style stagflationary path before reaching a new equilibrium. Either way, the current environment calls for a strategic pause, reflection, and patient, deliberate decision making by investors.

Emerging markets, with declining inflation, strong policy tools, and unique growth drivers, offer compelling investment prospects. As governance risks in developed markets shift, the relative attractiveness of emerging markets increases. Through this period of change, our focus remains on identifying and leveraging the seismic shifts that will define the future growth prospects for – and our optimism about – emerging market businesses.

Sincerely,

Alice Popescu

1Q25 Performance Review and Investment Activityi,ii

The Altrinsic Emerging Markets Opportunities portfolio increased 3.0% gross of fees (2.8% net) during the first quarter, compared to the 2.9% increase of the MSCI Emerging Markets (Net) Index, as measured in US dollars.i Stock-specific effects in financials (Porto Seguro, Banco de Chile, BB Seguridade), real estate (Vinhomes, China Resources Land), and materials (Anglogold Ashanti, UPL Limited), as well as our underweight exposure in India and Taiwan, contributed to our performance. These gains were partially offset by stock-specific performance in consumer discretionary (Sands China, Mr Price), utilities (China Resources Gas), and communication services (Tencent, PT Telkom Indonesia). Additionally, our overweight exposure to Indonesia and South Africa weighed on performance due to the effects of political volatility.

The beginning of the year presented a number of attractive buying opportunities, particularly as a result of the political volatility in Brazil. We initiated three positions – one in the Philippines (International Container Terminal Services, Inc.) and two in Brazil (Banco Itaú, Grupo GPS). We also sold two investments in Brazil (Vamos, Banco Bradesco).

International Container Terminal Services, Inc. (ICT) is a leading port operator with a strong presence in emerging and frontier markets. Leveraging its global operational expertise, digital capabilities, and low-cost base in the Philippines, ICT has built a solid track record of acquiring underperforming ports from governments and local authorities and turning them around through operational improvements. The recent news on global trade tensions created an opportunity to invest in this best-in-class operator, which is less correlated with global trade volume due to its origination and destination business model. We believe this company should deliver growth upside based on potential earnings accretive deals and yield hikes.

Through the political volatility observed in Brazil, we have seen the market indiscriminately impact high-quality companies. We took advantage of the market fluctuations to exit our lower-conviction positions and upgrade our positioning to include similarly valued, but much higher quality, businesses.

We exited Banco Bradesco, one of Brazil’s largest banks, due to shifting risk-reward dynamics. While we initially believed it could manage credit losses amid rising interest rates, increased competition drove aggressive lending at the lower end of the market. Despite Bradesco’s efforts to tighten underwriting and pull back, we found Itaú offered a more attractive and lower-risk opportunity. We sold Bradesco to initiate a position in Itaú.

Itaú is Brazil’s largest private bank. We expect sector credit losses to rise in the near-term due to higher customer leverage combined with significant interest rate pressure. However, we believe Itaú can partially offset these risks given its strong balance sheet, more conservative underwriting, best-in-class cost base, and strong underlying ROE. The political risks under the new populist Lula administration are more difficult to estimate, but we assume rising taxation and slower growth in the coming years. Itaú’s valuation metrics are near 20-year lows and imply an extreme financial crisis that we think has a low likelihood of transpiring, presenting an attractive risk-return skew.

We also sold Vamos, Brazil’s leading truck and machinery rental provider with about 80% market share. While the long-term thesis – low leasing penetration and strong growth potential – remained intact, the discount to intrinsic value narrowed significantly late last year due to weaker dealership profitability, slower rental growth, and share dilution. Despite the still compelling valuation, we saw a more attractive opportunity in Grupo GPS.

Grupo GPS, the largest commercial services outsourcing provider in Brazil, is well positioned to benefit from increased use of outsourced services in Brazil, where penetration is low relative to developed nations. The Brazilian outsourcing market is highly fragmented with opportunity for market share gains as GPS leverages their superior operating capabilities versus smaller peers. Additionally, management has a strong acquisition track record, and we expect them to continue to consolidate the market given their strong balance sheet and consistent cash generation.

Overall, our portfolio activity this quarter reflects our investment process and sell discipline, as we were able to identify companies with better risk-reward ratios and make thoughtful swaps in our holdings.