Dear Investor,

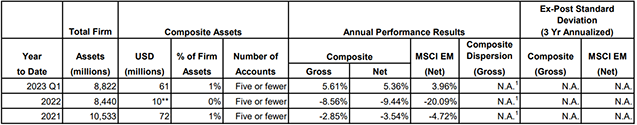

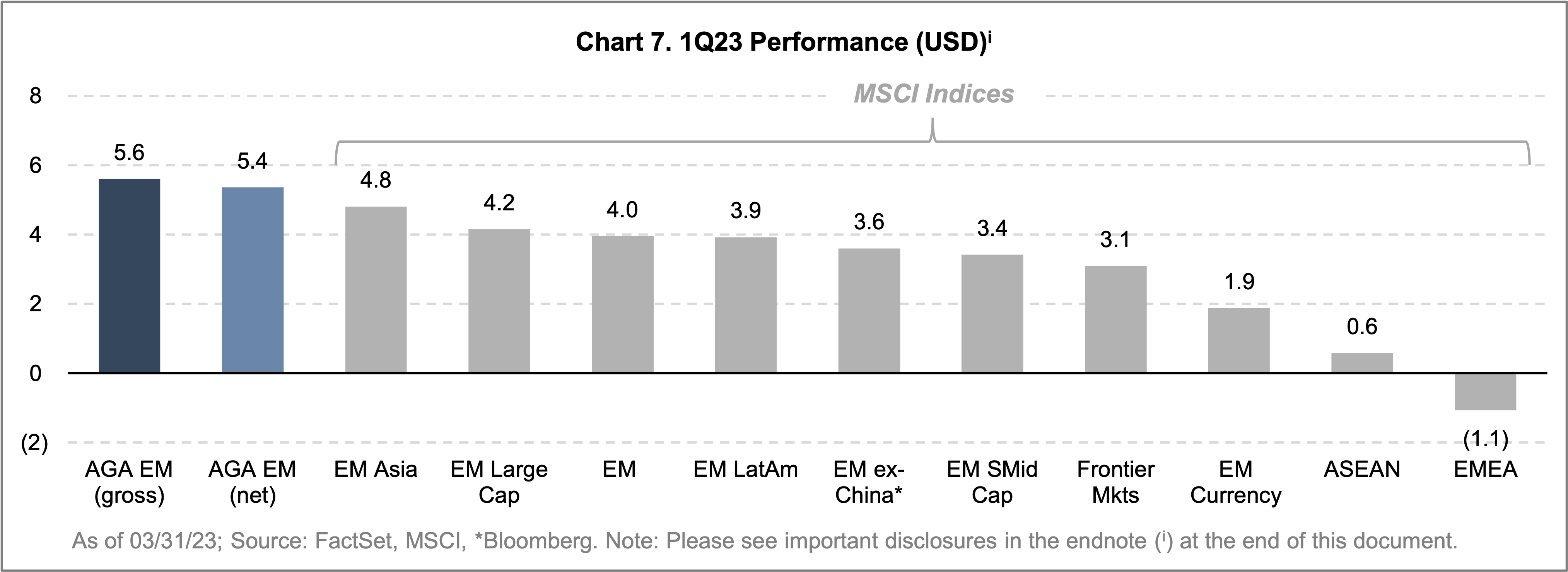

The Altrinsic Emerging Markets Opportunities portfolio gained 5.6% (5.4% net) this quarter, outperforming the MSCI Emerging Markets Index’s 4.0% return, as measured in US dollars.i Performance throughout the period varied markedly within emerging markets. The year began with strength in North Asian (China, Taiwan, and Korea) large caps on momentum from China’s reopening. The robust start tailed off as corporate scandals and political headlines drove underperformance in the large markets of India and Brazil. Additionally, turmoil in the global banking sector following the collapse of Silicon Valley Bank (SVB) made its mark on EM equities, though in a more subdued manner.

Perspectives

Earlier this year we commented on EM’s relatively favorable economic conditions, China’s reopening, and global emerging markets’ self-reliant nature as significant buildings blocks for a potential decoupling of EM from developed markets in the year ahead. Moves in the interest rate cycle, momentum in earnings, and accelerating intra-EM trade provide increasing evidence of such divergence taking shape.

Early Signs of Decoupling

Global economic growth expectations have been subdued since the beginning of the year, yet recent data points (including China’s internally driven recovery to 4.5% GDP growth) have surprised to the upside. Current year estimates by the IMF1 have lowered the growth outlook for developed economies to 1.2%. Meanwhile, emerging market countries are expected to deliver 3.9% GDP growth this year (similar to 2022) and a substantially faster economic growth rate in 2024 than developed markets.

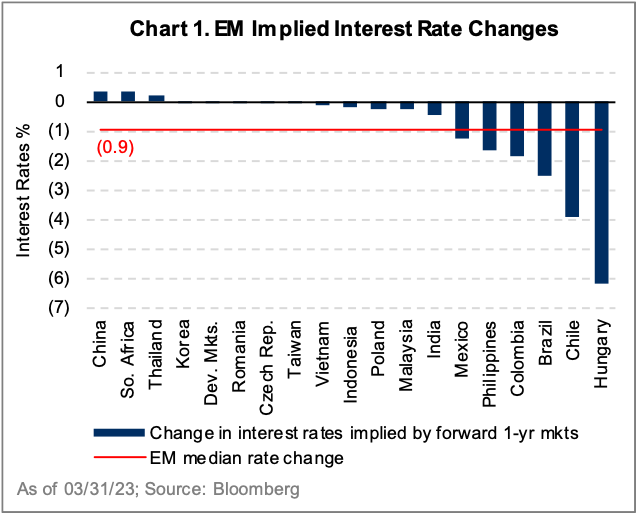

This interest rate cycle has presented early signs of emerging and frontier central bankers again leading the US Federal Reserve. Emerging markets policymakers were quicker to tighten policies as signals warranted such action, and they are now leading the rest of the world with more accommodative stances. Vietnam’s central bank cut rates in March, and policymakers in Indonesia and India have recently decided to hold interest rates steady.

Across many emerging markets, real interest rates are above developed market rates. EM central bankers are now expected to cut rates by an average of 100bps over the next year (up 20bps since January, as implied by forward markets), while many developed markets are still pricing in interest rate increases (Chart 1). Despite the expected rate changes, EM valuations remain at a massive discount to DM.

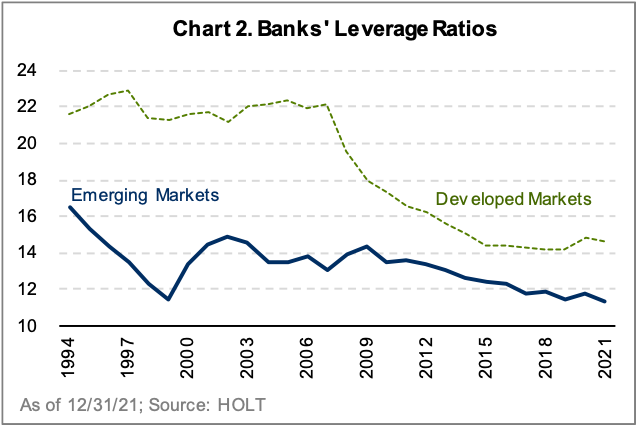

The financial system is another area exuding signs of an EM/DM decoupling. We believe the turmoil at the end of the quarter in developed market banks, sparked by the failure of SVB, actually highlights some of the progress – both relative to history and relative to developed markets – made in this area by various EM countries. Investing in lower duration assets, and with a lower leverage ratio in general, EM banks have been more conservatively managed than their developed counterparts (Chart 2). We also take comfort that EM regulators have been stricter and capital ratios have been fairly conservative across developing countries

Less reliance on short-term funding and more on sticky low-cost deposits, which is a common feature for EM banks, provides stability for many of our holdings, including Axis Bank (India), HDFC Bank (India), Banorte (Mexico), and Bank Mandiri (Indonesia). Chinese banks, where we currently do not have any exposure for several different reasons, currently have more questionable capital and credit risk.

The healthier economic backdrop and the underappreciated progress and strength of the financial system across the EM landscape should generate a degree of confidence in policymakers. These signals may ultimately lead central bankers to take a more accommodative stance and more systematically begin cutting rates across emerging markets.

Back on the Road…

Our team traveled extensively in the first quarter, including visits to India, Taiwan, and Brazil. Taking advantage of our vast networks across the world, we met with 86 companies including those held in our portfolio, those operating within the supply chain, and select competitors. These engagements helped confirm our investment theses and assess additional performance drivers and risks. We spent time with management teams discussing the impact of domestic economic trends on individual companies, as well as the expected impacts (challenges and/or tailwinds) of trade relations between EM countries (and China’s reopening) on particular sectors and companies. Importantly, the theme of an EM/DM decoupling, which we addressed above, was central to our collective travel takeaways.

We came back from India excited about several areas – particularly the financial services, energy, and utilities sectors. In our Q4 2022 commentary, we discussed how high quality private banks in India are trading at attractive valuations within India and relative to GEM peers while offering improved balance sheets and superior ROEs – both reflecting and enabling structural consumption growth. Pertaining to the energy sector and the green energy transition underway, India has a clear target of 15% natural gas within the country’s energy mix by 2030. This translates directly into short- to medium-term volume demand growth. Our holdings in the energy (Petronet LNG) and utilities (Indraprastha Gas) industries enable, and benefit from, structural rural growth as India shifts toward a cleaner energy mix with higher natural gas usage. We continue to believe corporate earnings in India will grow faster than the rest of emerging markets, driven primarily by domestic factors.

In Taiwan, our visits with many global supply chain companies fortified our positive view about the evolving automation landscape within Chinese manufacturing. One of the key companies positioned to benefit from this trend is Airtac, the leading pneumatics company in China. Structural growth in factory automation has the potential to double Airtac’s profitability by 2025. Additionally, direct management feedback during our visit suggests that a new upcycle for pneumatic equipment demand is underway. Pent-up demand from existing customers in the EV space, battery/auto and related sectors, and LED lighting segment is expected to further underwrite a strong growth story over the short to medium term.

Brazil, the South-South2 Trade, and the Road to Decoupling

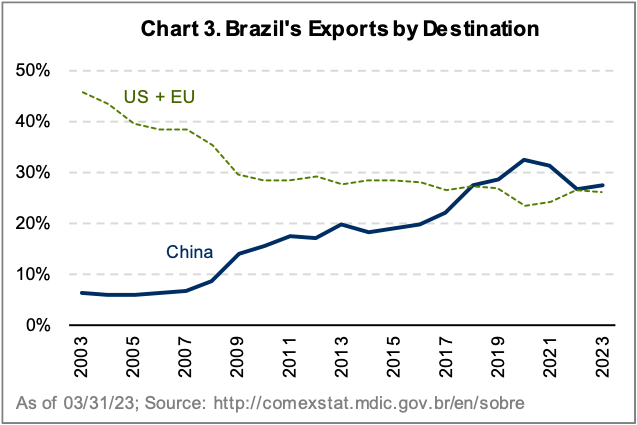

China’s reopening bears importance for the rest of EM; more specifically, we expect Brazil to be one of the key beneficiaries of China’s policy change due to the nations’ increasingly large trade relationship. Over the last five years, China has become Brazil’s single largest trading partner, even as trade volumes weakened through the COVID period (Chart 3). We view this as an enabler of growth and sustainability for many Brazilian businesses, presenting a series of compelling investment opportunities. By 2022, China represented 27% of Brazil’s total trade volume; importantly, however, the mix is evolving.

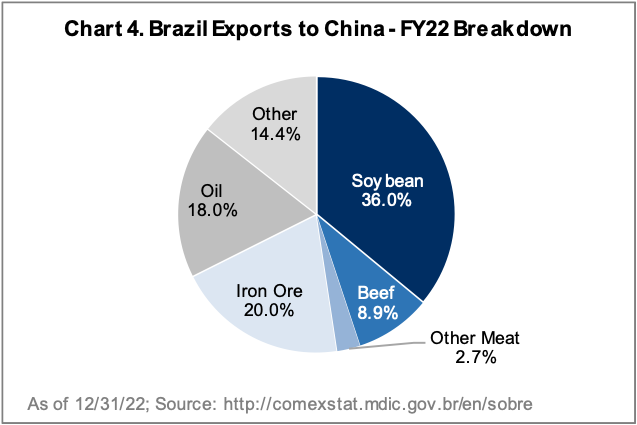

Whereas the Chinese real estate boom (and, to a lesser extent, infrastructure initiatives) drove strong demand for iron ore from Brazil over the past two decades, the current trade relationship is more heavily weighted toward agricultural products (about 50% in aggregate) including soybeans and beef (Chart 4). One-third of Brazil’s trade delegation that traveled to China over the past few weeks hailed from the agricultural sector, underlining the importance of this specific piece of the relationship for both nations and the role Brazil can play in China’s food security equation. We believe this shift in focus will prove sustainable, leading to a robust trade relationship between these nations over the long term.

Beyond the strengthening trade relationship between Brazil and China, we also expect to see a deepening of China’s investment interests in Brazil. China’s overall FDI in Brazil (valued at US$23 billion) is meaningful, but the growth potential is even more significant. As just one example, we learned firsthand from Shein (a leading private Chinese retailer operating in Brazil) that they intend to invest US$150 million in bringing Chinese textile automation systems to Brazil. This will help increase the production speed and efficiency of local textile manufacturers, lifting overall productivity. We believe this is just the beginning, and as additional FDI initiatives are announced, our thesis on the South-South trade will be reinforced.

Our expectations for continued decoupling, increased intra-EM trade activity, and prospects for interest rate cuts support one of our relatively recent purchases. Vamos Locacao de Caminhoes Maquinas e Equipamentos (Vamos Locacao De) is the dominant truck and machinery rental provider in Brazil with almost 80% market share and is positioned to benefit from all of these catalysts. Truck leasing penetration in Brazil is extremely low; in a challenging economic environment, we expect awareness of the favorable economics of leasing versus buying (15-30% cheaper to lease than to buy) to rise, creating significant growth potential for Vamos Locacao De. Additionally, truck leasing is an attractive business model with long-term contracts leading to predictable cash flows and attractive returns that are not overly reliant on the sale value of the used asset.

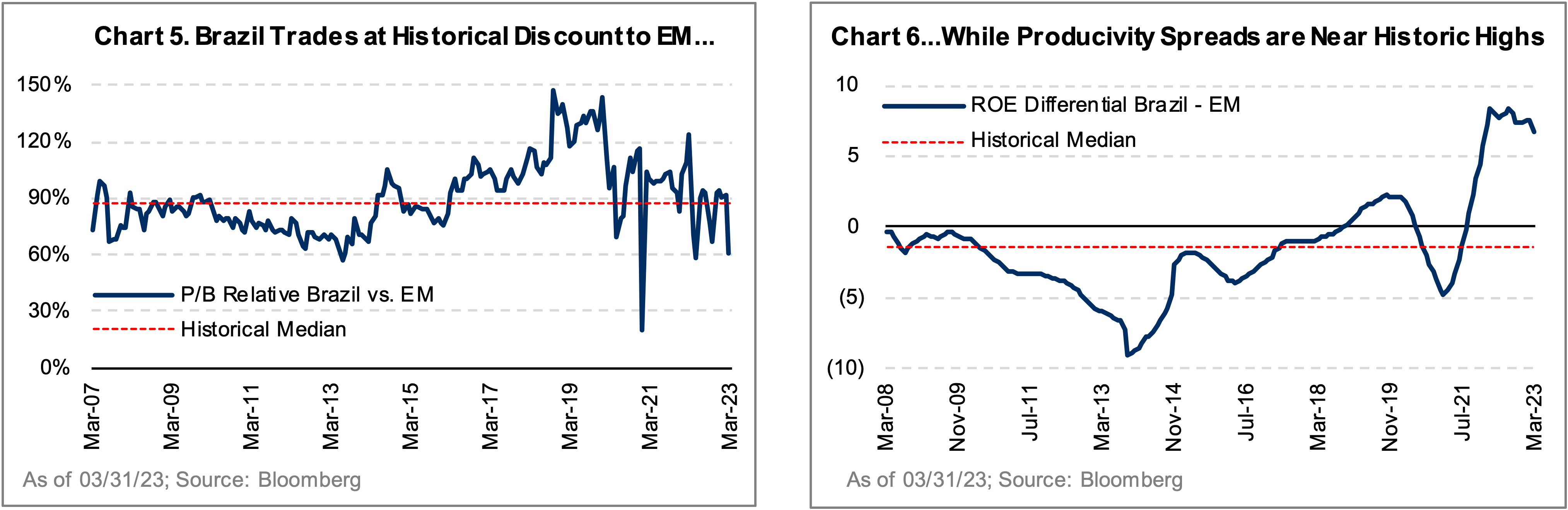

Brazil stands as a great example of the opportunity to find unique, undervalued businesses in a place where the investment community’s fears are deeply reflected in valuations. Notwithstanding the uncertainty around the country’s fiscal path in the medium term, the full impact of its impeding tax reform, and the elevated interest rates, we believe the market is overly pessimistic relative to the earnings power of many high-quality Brazilian companies. The Brazilian market is trading at one of the widest discounts relative to the broader emerging markets (Chart 5) and delivering a steady increase in ROE (Chart 6) that is vastly ignored by the broader markets.

As one of our largest overweight exposures relative to the MSCI EM Index, Brazil is a significant component of our differentiated positioning. At the end of the first quarter, the Altrinsic Emerging Markets Opportunities strategy had 7.0% of its portfolio directly invested in Brazil through five businesses including retailers, industrial transportation companies, and financial services firms.

Performance and Investment Activity

Overall, EM equities underperformed developed markets this quarter, but performance varied by individual markets and segments (Chart 7). Across the capitalization spectrum, large cap EM stocks outperformed the broad EM index. Despite weakness in India, EM Asia markets outperformed other regions, while EM EMEA lagged. The MSCI EM Currency Index remained near its historic highs with a broad rally across most currencies including the Mexican peso, Chilean peso, Hungarian forint, Colombian peso, and Brazilian real.

The Altrinsic Emerging Markets Opportunities portfolio outperformed the MSCI Emerging Markets Index this quarter. Key positive contributors were individual stock selections in the industrials (Grupo Aeroportuario del Pacifico, Yutong Bus, Airtac International Group), financials (PT Bank Mandiri, Grupo Financiero Banorte) and consumer staples (ITC Limited, Femsa, Wal-Mex) sectors.

Positive relative performance was slightly offset by our underweight exposure to information technology, which performed well this quarter, and our positions in energy (Tenaris, PTTEP), which were impacted by the volatility in underlying commodity markets.

Geographically, the greatest sources of outperformance came from our stock selection in India (ITC Limited, Petronet LNG) and China (Yutong Bus, Shenzhen Transsion, Netease Inc), as well as our overweight exposure in Mexico (Grupo Aeropotuario del Pacifico, Grupo Financeiro Banorte, Femsa). Minor detractors came from our exposure to Korea (Coway, Samsung Electronics), an underweight exposure to Taiwan, and our holding in Hungary (Richter Gedeon).

Portfolio activity was relatively low this quarter, establishing one new position and exiting none. We initiated a position in Ganfeng, the world’s largest producer of finished lithium products for batteries that are critical to energy transitions. While Ganfeng has plans to double production capacity over the next five years, the stock is under pressure due to concerns around short-term lithium demand amid high prices, rising interest rates, and planned expiration of electric vehicle subsidies in China. We believe Ganfeng’s stock, valued at a steep discount to history, now reflects these risks as well as the execution risk associated with growth, offering a compelling risk-reward skew.

Closing Thoughts

Throughout the first quarter, we continued to gain confidence in our decoupling thesis for EM. Signs of economic growth are beginning to re-emerge in certain areas, especially relative to developed markets, and forward-looking expectations place EM in a leading position despite tempered predictions globally. With China reopening post COVID, we have seen both strong recovery of economic activity and intentions to increase trade with many partners, including other emerging markets. For many EM countries, growth is being driven more by internal demand than external factors, and valuations are heavily discounted relative to history. Fresh data points and perspectives from our extensive travel through the emerging markets contribute to our conviction in the opportunity set and fuel our bottom-up process to uncover compelling and contrarian investments to add to the portfolio.

Sincerely,

Alice Popescu