Dear Investor,

The Altrinsic Emerging Markets Opportunities portfolio gained 5.2% gross of fees (5.0% net) during the fourth quarter, outperforming the 4.7% increase of the MSCI Emerging Markets (Net) Index, as measured in US dollars.i Emerging market equities continued to outperform developed markets, as many EM companies and countries defy trade-related concerns and continue to demonstrate economic resilience.

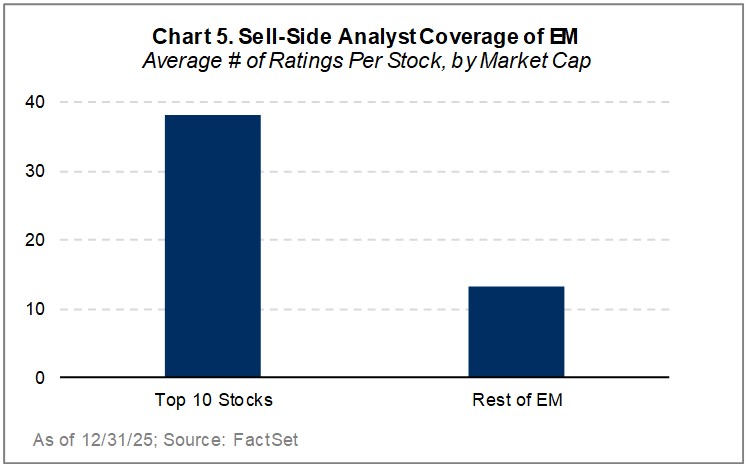

As AI capex grabs the spotlight and investment crowds into tech megacaps, we see attractive upside outside of the technology sector among companies that can deliver durable growth and financial productivity. Many of these businesses, notably in Latin America or the non-AI tech space, receive limited sell-side analyst coverage (see Chart 5 in The Future is Active section) and are exhibiting increasing strength in efficiency, innovation, and long-term value creation.

Perspectives

As the Winter Olympics approach, we are reminded that true success stems from the dedication, discipline, focus, and hard work going on behind the scenes. Like aspiring, unsung Olympians, many lesser-known emerging market companies possess the qualities needed for long-term success, even if they have yet to gain widespread recognition.

Capital is flowing into AI at a rapid pace. While flashy, supersized tech capex announcements command attention and have contributed to the growing dominance of the theme in major benchmarks, broader capex trends reveal exciting developments that support long-term, sustainable growth prospects in companies beyond the tech sector. With markets largely overlooking the risks associated with possible disappointment in the AI growth narrative and valuations that continue to rise, we are looking beyond the crowded, popular parts of the market to identify competitors currently flying under the radar but deserving of much more investor attention.

Olympic Mindset

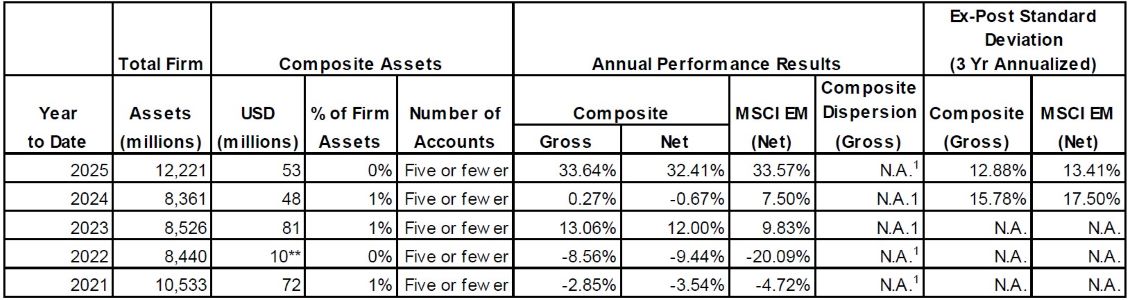

Investors are directing substantial capital toward AI, viewing it as the frontier for growth and innovation. We agree that the potential longer-term impact of AI on companies, industries, and countries is substantial. However, we believe that other factors, including non-AI capex, will drive substantial, differentiated growth opportunities for companies outside the tech ecosystem. For investors, getting swept up in the AI narrative risks missing out on many underappreciated, financially productive investments. As shown in Chart 1, relative valuations for the tech sector have reached two-decade-highs, while near-peak profitability differentials show non-tech companies keeping up.

“I skate to where the puck is going to be, not where it has been.”

– Wayne Gretzky, NHL All-Star & Olympian

Across our portfolio, outside the technology and financials sectors, companies are investing in capital expenditures that drive structural improvements, advance technology and energy transition initiatives, and expand addressable markets, maintaining focus and discipline amidst the AI frenzy:

-

- Efficiency and Optimization – Many companies have shifted their focus to investing in better cost control measures and efficiency initiatives as a means of boosting returns. In Brazil, Lojas Renner is focused on logistics efficiency, while Motiva has been investing in operational efficiency.

- Digital and Tech Transformation – IT system upgrades, 5G networks, and enhanced omnichannel retail capabilities are just a few examples of places companies have been directing capital in order to remain competitive. In South Africa, Clicks Group is digitizing dispensary operations and executing on an ambitious omnichannel integration plan across its network. In Thailand, Advance Info Service is pivoting from expansion to intelligence by investing in autonomous networks that self-optimize to control operational costs.

- Energy Transition – Significant capital has been deployed toward solar gigacities and other new energy ecosystems. In India, our holding, Reliance Industries, is building solar cells and energy storage systems to support its carbon-neutral ambitions.

- Geographic Expansion – Airport operators (including Argentina’s Corporacion America Airports, “CAAP”) are directing capital toward securing new investment concessions or, in the case of Mexico’s Grupo Aeroportuario del Pacifico (“GAP”), increasing airport terminal building space.

These differentiated, and arguably necessary, capital spending areas present vast underappreciated growth opportunities for EM investors willing to stay focused on fundamentals.

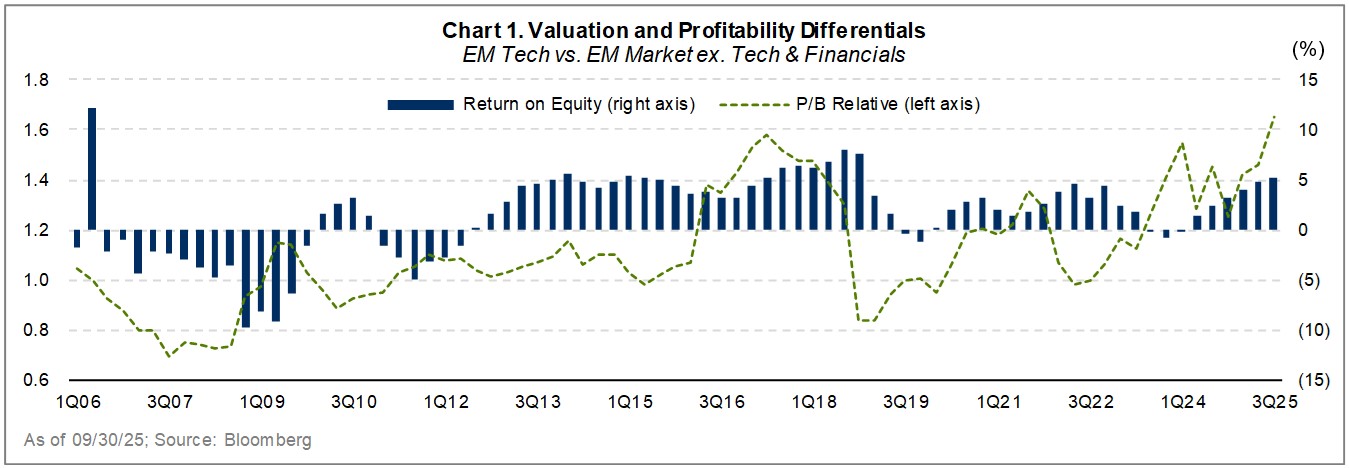

Capex is often touted as a harbinger of future growth via increased productive capacity. As shown in Chart 2, capex intensity (capex as a percentage of sales) has been rising in non-tech sectors of the market since the beginning of 2023, while peaking and subsequently declining in the technology sector over the last two years. This convergence has left the two groups on nearly equal footing as of the end of 2025, yet nearly all the attention has been directed toward the tech sector.

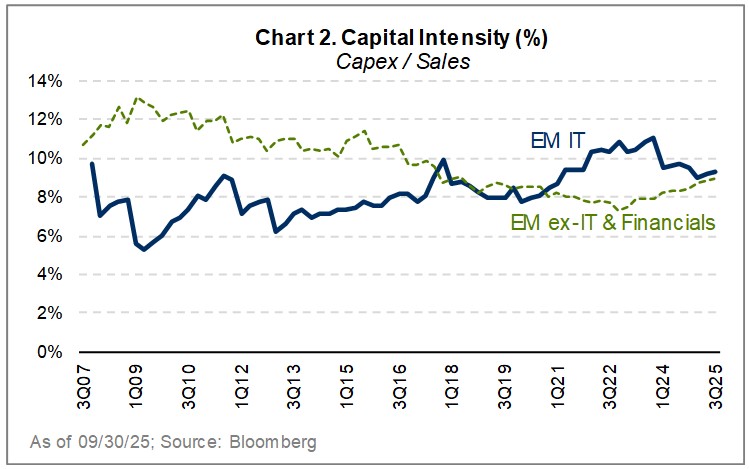

As capex intensity rises within a company, it is critical to ensure it does not come at the expense of meeting investors’ capital return expectations. Leaders must carefully balance capital allocation between reinvestment for future growth and delivering consistent returns to shareholders. Perhaps surprisingly, as non-tech companies’ capital intensity has risen over the past five years, cash returns (buybacks and dividends) have actually increased too (Chart 3); by contrast, shareholder returns from the tech sector have declined, even as capex moderated.

With cheaper valuations and stronger prospects for rising asset turns, capacity expansion, and earnings growth, we believe that many companies outside of the technology sector offer compelling investment opportunities. Meanwhile, within the hardware-dominated technology sector, we expect the recovery of future financial productivity to be slow, as capex cycles are ever extended by chip and memory giants that rely heavily on the EM “underground stack.”1

To borrow Wayne Gretzky’s wisdom, if we choose to overlook or discount non-AI capex, we risk skating to where the puck is now. This is potentially a safe bet, but at what expense? We believe that real, compounding value can also be found further down the ice and not solely tied to one star player.

The Future is Active

2025 was an extraordinary year for EM equities – not just for the strong absolute returns overall (+33.6% MSCI EM Index2), but, perhaps more importantly, for the breadth of strong performance. Taiwan, which is heavily weighted toward tech and AI (the 2025 market darlings), marginally outperformed the broad market, but more than half of the countries in the EM universe also outperformed (and by wider margins). All Latin American countries, as well as South Africa, delivered outsized returns, and neither region was boosted by any meaningful tech or AI-related investment plays. From an industry perspective, the heavily trafficked information technology sector outperformed the market, but so did three other sectors (materials, communication services, and industrials).

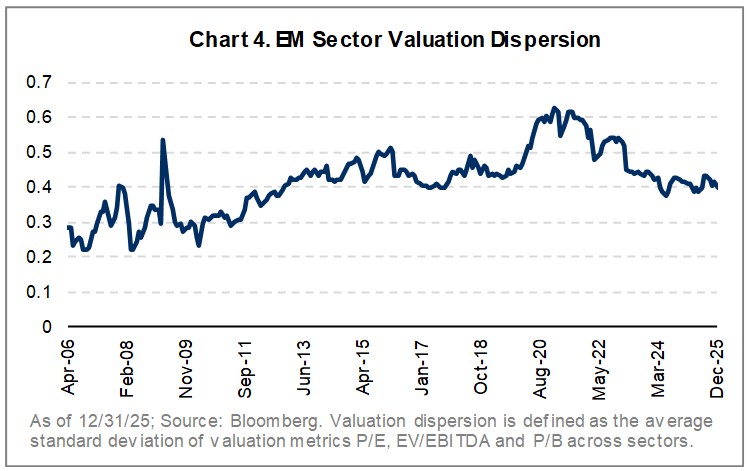

From a structural perspective, sector valuation dispersion remains very high (Chart 4). Simultaneously, sell-side analyst coverage of emerging markets remains heavily skewed toward the mega-caps, in line with the concentration of the indices (Chart 5). This attention bias increases information arbitrage opportunities for those investors dedicating sufficient time and research attention to the broader market cap segments.

Combined, these factors create an environment ripe for bottom-up, active investors to identify overlooked and/or mispriced companies and generate significant alpha.

“You miss 100% of the shots you don’t take.”

– Wayne Gretzky

In this market characterized by widespread outperformance, persistently high valuation dispersion, and limited sell-side coverage, we strive to put in the work and, as Wayne Gretzky would say, “take the shots” on companies that are being overlooked by many others but have the underpinnings of successful long-term investments: quality franchises with strong management teams, solid balance sheets, and sustainable growth potential. Our portfolio activity from late 2024 into early 2025 included establishing new positions in the attractive but largely-ignored industrial businesses of the Latin American region (CAAP, Grupo GPS) and among “forgotten” industrial technology companies in Taiwan, focused on power efficiency (Voltronic), specialty cables and connectors for the medical, auto, green energy, and industrial sectors (SINBON Electronics), and electronic paper (E-Ink), which has the potential to expand into large-format digital signage and other power-sensitive use cases.

Performance Review and Investment Activity

From an overall perspective, all sectors except information technology contributed to our outperformance this quarter. The greatest sources of positive attribution were industrials (CAAP, Yutong Bus, Airtac International Group), communication services (PT Telkom Indonesia, Vodacom Group, Reliance Industries), and financials (Banco de Chile, Standard Bank Group, PT Bank Mandiri). Negative attribution came primarily from our relative underweight exposure to, and positions in, information technology (Shenzhen Transsion, Zhen Ding Technology, Samsung Electronics Co).

From a geographic perspective, gains in China (Yutong Bus, Ganfeng Lithium Group Co., Airtac International Group), India (UPL Limited, Reliance Industries, HCL Technologies Limited), and Argentina (Corporacion America Airports SA) were offset by our underweight exposure to, and select positions in, South Korea (Samsung Electronics, Krafton Inc., Coway Co), specific Taiwanese holdings (Zhen Ding Technoloyg, SINBON Electronics), and some of our Brazilian stocks (Lojas Renner, Porto Seguro), which were negatively impacted by a bout of political volatility impacting markets.

Portfolio activity was elevated this quarter, with six buys (Smartfit Escola de Ginastica, BYD Company Limited, Lenovo Group Limited, E-Ink, Advantech, Alinma Bank) and seven sales (Yutong Bus, Minth Group, PICC Property & Casualty, BB Seguridade, MR Price, Delta Electronics, Hangzhou Robam Appliances).

In Brazil, we established a position in Smartfit, the leading gym operator in Latin America, with a proven high-value, low-price model that supports scalable growth in a low-penetration, highly fragmented market. Its scale and attractive store economics drive operating leverage and margin expansion, while its corporate wellness platform represents an underappreciated growth lever that could unlock value.

In China, we initiated a position in BYD, a leading EV manufacturer with strong in-house capabilities and a proven ability to incubate higher-return growth drivers. While recent underperformance reflects concerns around market-share limits and high EV penetration in China, we see an opportunity as BYD pivots to higher-margin growth in ex-China markets, batteries, and electric commercial vehicles, with the current reset period setting up catalysts from new model launches in early 2026.

Also in China, we purchased Lenovo, a leading global PC and smartphone brand. The company leverages scale and a diversified portfolio to gain share, while server restructuring under new leadership and growth in software and solutions support medium- and long-term margin expansion. The market underappreciates Lenovo’s brand strength, and successful execution could drive a valuation re-rating toward peers.

In Taiwan, we invested in E-Ink, the industry pioneer in electronic paper technology, a low-power display solution with a broad range of end-market applications. Currently, electronic paper serves as a foundational technology for electronic shelf labels and e-readers, with growing potential to expand into large-format digital signage and other power-sensitive use cases. We believe the market continues to underappreciate the versatility and scalability of this technology.

Also in Taiwan, we initiated a position in Advantech, an industrial PC leader. The company offers a well-diversified product portfolio and a customer base well-positioned to benefit from ongoing industry digitization and infrastructure upgrades. Coming out of the current downcycle, we expect investments in factory automation, industrial IoT, and edge AI to accelerate as global supply chains undergo restructuring. The company should continue to deliver mid-teens free cash flow and earnings growth over the medium term.

Finally, we established a position in Bank Alinma, a leading Saudi bank with strengths in corporate finance and project lending, as well as a growing retail franchise. Aligned with the Kingdom’s Vision 2030, a massive, multi-billion-dollar economic transformation plan, the bank stands to benefit from many large-scale, flagship development initiatives. At the same time, new management is driving digital leadership and retail expansion to boost profitability. We believe the shift toward retail and SME banking, supported by a strong management track record, positions Alinma to better withstand macroeconomic volatility and lower oil prices.

Six of the seven sales this quarter (Yutong Bus, Minth, PICC , BB Seguridade, MR Price, Delta Electronics) were due to stocks reaching or exceeding our estimates of intrinsic value (in some cases trading near or above our bull case scenario, i.e., Yutong Bus and Delta Electronics), with limited support to justify revising our estimates higher. Governance concerns (Minth) and underappreciated risks (PICC, BB Seguridade, MR Price) further supported our decision to exit these positions, generating the cash needed to fund new purchases with better risk-reward trade-offs. We sold Hangzhou Robam as fundamental drivers remain challenged, with the demand pull-forward from the 2025 home-appliance trade-in policy elevating earnings risks in 2026.

Concluding Remarks

“My routines involve high difficulty, but the key is consistency and

disciplined execution – if I can land every jump, I know I can win gold.”

– Xu Mengtao, Olympic Gold Medalist in Women’s Aerials

As capital expenditure debates tilt heavily toward AI and technology, the more compelling opportunity for emerging market investors lies beyond the obvious. We believe successful EM investing means embracing complexity, staying vigilant, maintaining discipline, and continually searching for the next opportunity – even when the path is less traveled. Overlooked companies with limited analyst coverage continue to grow steadily, rewarding a hands-on, active approach to uncovering value where others are not looking. The scarcity of coverage only heightens the potential for discovery.

Sincerely,

Alice Popescu