Dear Investor,

In an eventful first quarter, the Altrinsic International Equity portfolio gained 8.6% gross of fees (+8.3% net), as measured in US dollars.i International markets (EAFE +6.9%) significantly outperformed US equities (S&P 500 -4.3%), and markets broadened out from the narrow technology stock leadership. Uncertainties stemming from President Trump’s tariff policies, the release of DeepSeek’s AI model, and mixed economic data were catalysts for this transition in market leadership. Against this backdrop, sources of our outperformance were broad-based, most notably from our differentiated positioning and investments in the consumer discretionary, technology, and health care industries.

2025 began with a strong consensus that the prolonged period of US economic and market “exceptionalism” would persist, early AI beneficiaries would continue their unencumbered momentum, and the price paid for access to these themes did not matter. In short order, however, this environment of supreme confidence and perceived certainty gave way to significant uncertainty, prompting a substantial reappraisal of risk and asset values.

The most prominent and immediate source of uncertainty stems from Trump’s tariff policies, how other countries respond, and the extent of escalation. Borrowing from Donald Rumsfeld’s terminology, the “known unknowns” and “unknown unknowns” far exceed the “known knowns.” Consequently, many CEOs have halted major investment plans, mergers and acquisitions, and other strategic initiatives, as too much policy is in flux.

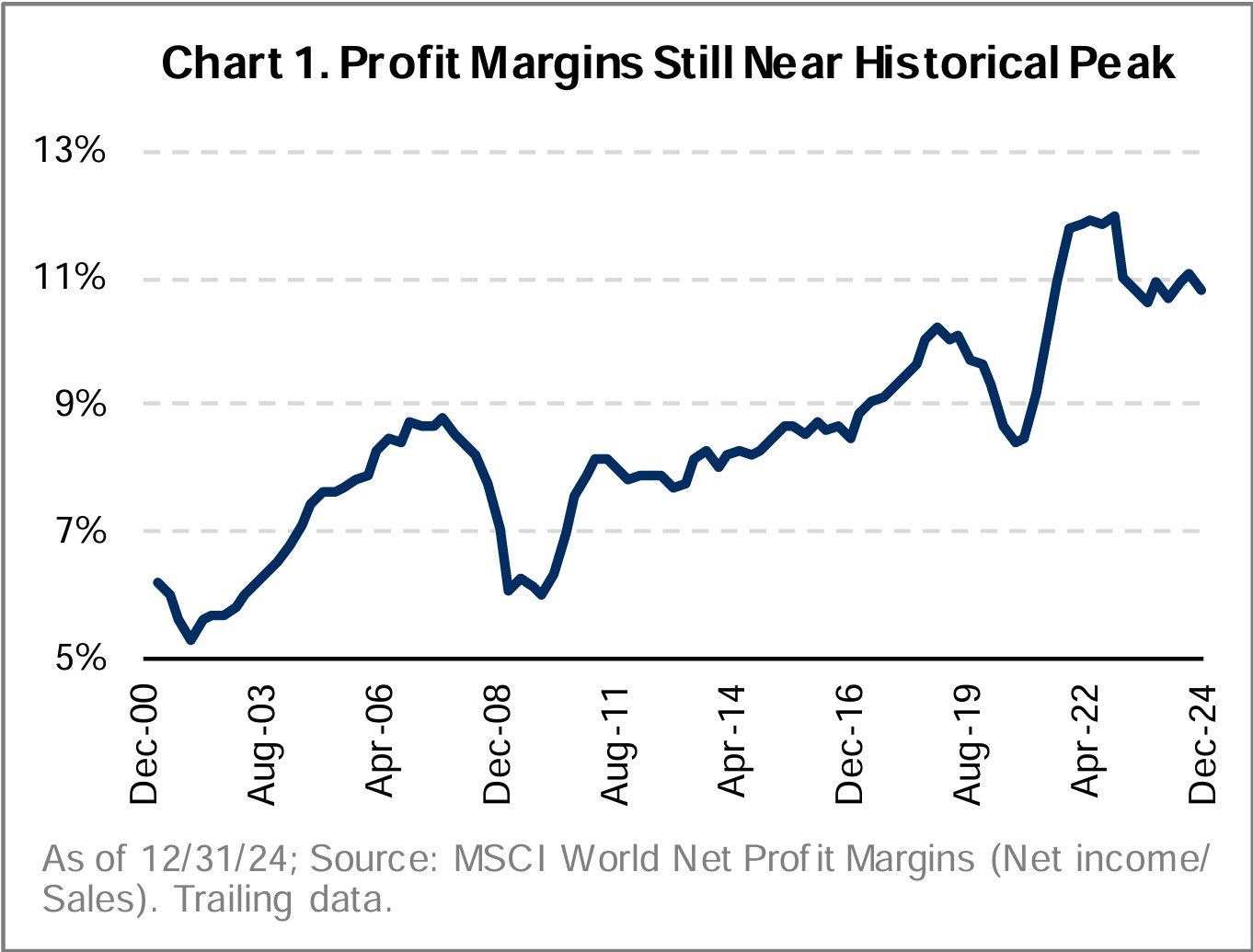

Increased tariffs typically result in slowing activity, a one-off increase in prices, and adjustments in currencies. We understand our companies’ exposures by cost, revenue, and earnings sensitivity to various outcomes; however, the actual outcomes are unknown. A reasonable base case scenario is a further slowdown in sales prospects, margin compression, and lower earnings. Declining profit margins are most underappreciated following a long period of declining labor costs, efficient global supply chains, supportive tax regimes, and confident consumers willing to pay rising prices. Profit margin risk is present in many stocks across industries, but most notably in cyclical sectors where current operating margins are at or near historic peaks.

We were already concerned about valuations, margins, and earnings expectations in many areas, particularly in technology and traditional cyclicals (industrials and materials), prior to the tariff issues. With relatively low exposure to these areas in favor of companies with modest but durable growth prospects and those with more idiosyncratic risks, our portfolio has a lower overall beta profile. Given severe share price movements, we are being opportunistic among companies where tariffs might be causing cyclical weakness but are not likely to have their business models meaningfully upended. We remain disciplined in evaluating fundamentals versus price paid.

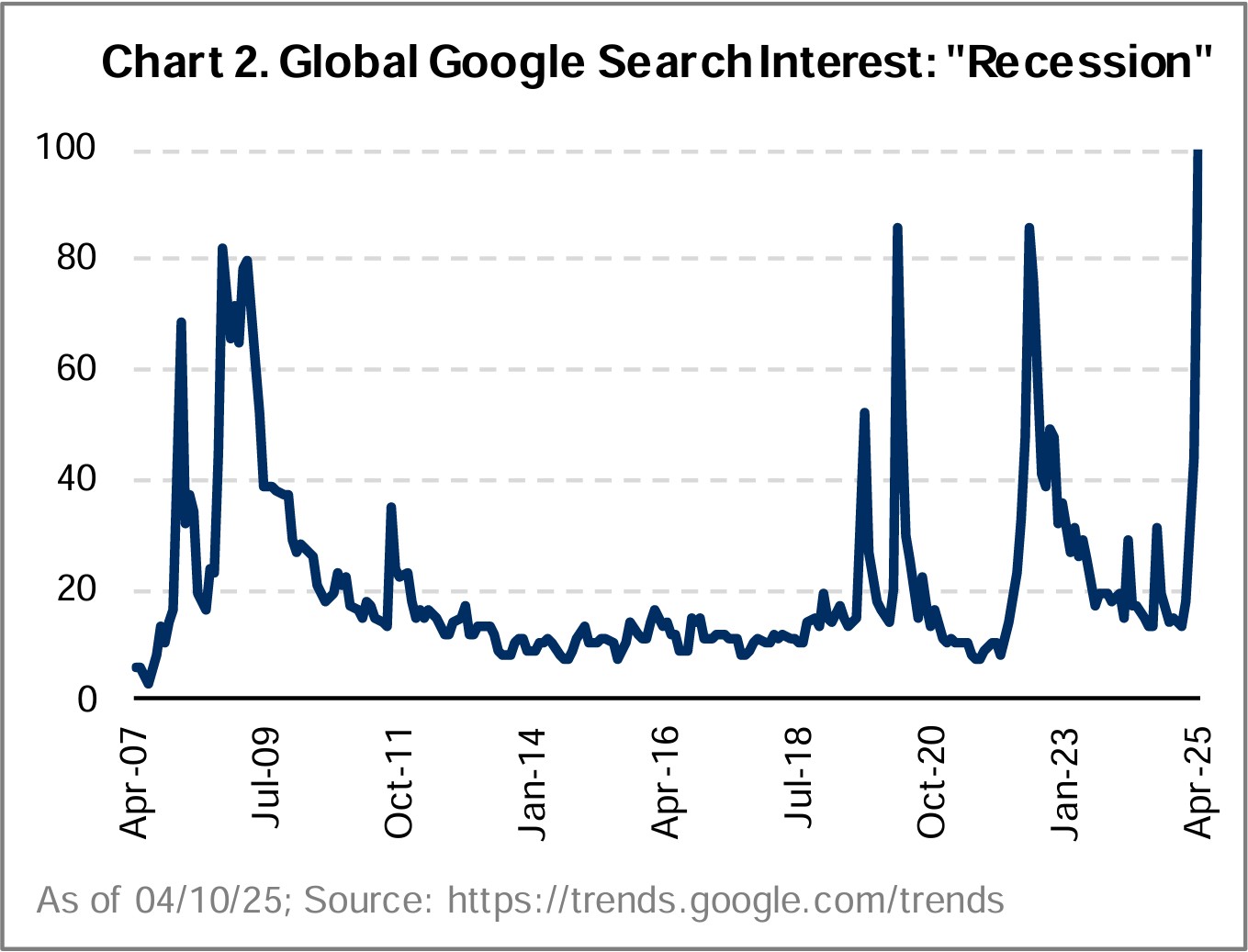

Media attention has focused on whether tariff policies and the responses will trigger a global recession. We were likely entering a recession, if not already in one, before these events occurred. It is important to recognize that GDP data is a lagging indicator; recessions are typically proclaimed long after the economic pain is felt. Similarly, asset prices typically recover long before economic activity does. While expectations, as reflected in growth estimates and valuations, have risen too high in areas that have led markets during the last decade (namely, the US market and, more specifically, many technology companies), expectations in other areas (notably the EU, Japan, and emerging markets) have fallen.

The US has benefited from enormous fiscal and monetary stimulus since the GFC, a major drawdown on savings, and the wealth effect from rising asset prices. Now, fiscal impulse is reversing, and excess savings have been depleted. Hard data such as GDP and reported earnings have been holding up, but leading sentiment indicators, including CEO confidence, consumer confidence, and messages we hear in our interactions with company executives, are more indicative of economic weakness.

An unintended benefit of Trump’s policies and the prevailing geopolitical environment is a major strategic pivot in Europe. Some are drawing parallels to Germany’s reunification. Europe’s economy has long suffered structural challenges of fragmentation, excessive regulation, bureaucracy, high energy costs, and overly constrictive policy handcuffs. Trump’s actions may have spurred the EU to address key issues needed to become a true union with autonomy and less reliance on the US. Announcements relating to fiscal stimulus, including massive increases in defense spending, removing internal barriers, and capital market unification are constructive.

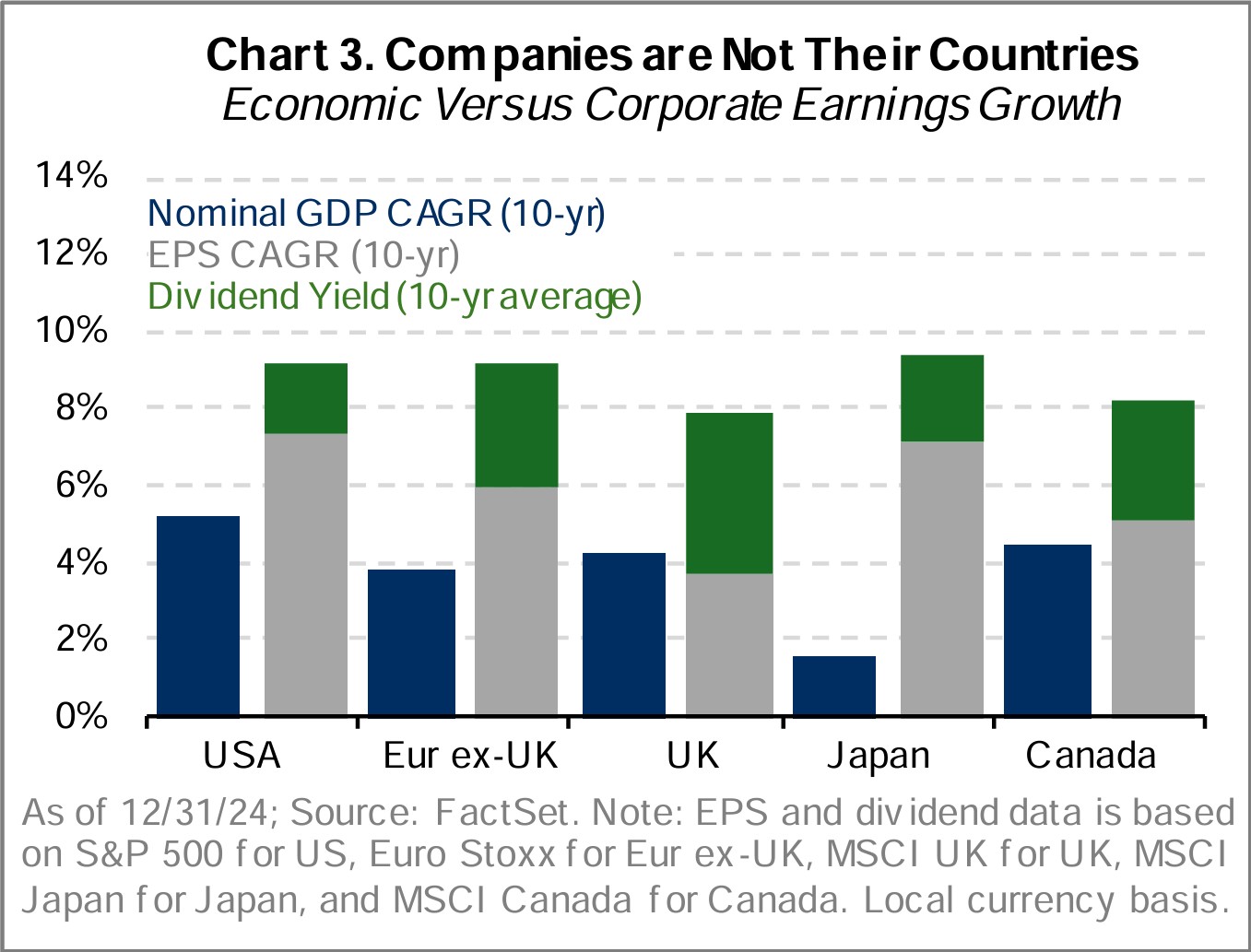

At the company-specific level, many European companies have been delivering solid EPS growth and shareholder value creation, but there is much more that can be unlocked. Undervalued equities with low expectations, improving fundamentals, and an increasingly supportive policy environment contribute to the appeal of European stocks. Accordingly, our greatest regional overweight is to investments headquartered in Europe.

Japan, like most of Asia, is extremely sensitive to trade policy, but we believe the common interests of the US and Japan will prompt a reasonable and manageable outcome. Japanese companies have heightened their focus on creating shareholder value in recent years. While this is unfolding at an incremental pace, the evidence is clear in the data – ROE has improved, M&A activity and activism have increased, and buyback and dividend policies have become more shareholder-friendly. More recently, local wage negotiations and bond yields suggest that Japan may have broken out of its deflationary spiral. Our exposure in Japan, however, remains measured as many companies are still highly exposed to macro gyrations, a strengthening yen, and investor expectations that change will happen quicker than corporate Japan can handle.

Within emerging markets, the impact of the tariffs could be less severe than many fear. Over the last 25 years, there has been a noticeable shift in EM trading patterns and their dependencies on developed markets. Notably, EM has increasingly de-coupled from DM supported by lower intra-EM trade barriers, the relocation of global supply chains, internal consumption trends, and geopolitics. Trade between EM ex. China companies and China has increased 2.6x faster than with the US over the same 25 years.1 At a company-specific level, many EM firms have been venturing into other emerging and frontier markets in pursuit of profitable growth avenues. So much so that over 70% of their top-line growth is derived from emerging markets regions.2

China remains a source of tremendous risk and opportunity. Trade policy could have a major impact, but it is completely unknowable as we write this. Importantly, China’s negotiating position is not as weak as President Trump may believe; they can take a very long-term view, they hold more than $1T of US treasuries, they control 90% of rare earth metal processing,3 and exports to the US represent roughly 3% of their GDP.4 China’s recent political and economic congress in Beijing came with confirmation of consumer support underpinning improving expectations for corporate China earnings. Although no large bazooka-type stimulus was presented, additional measures supporting consumption, housing market stability, and a focus on self-sufficiency have already been beneficial. China-related risk remains high but so is the opportunity among a growing number of companies with direct and indirect exposure to China.

Recent developments both during and after quarter-end remind us once again that unexpected things happen all the time. Change is underway, corporates will adapt, and there are many attractively priced companies in areas that have not been top of mind in recent years. As value investors, we are drawn to the fear and uncertainty increasingly embedded in stock prices. Those companies with durable competitive advantages, balance sheet strength, adaptable management teams, and valuations that already discount recessionary conditions are particularly of interest.

We are pleased to share that our partner Rich McCormick’s role is being expanded, and he will serve as Co-Chief Investment Officer. We put tremendous effort into developing talent and recognize individuals who embody our cultural values, take initiative, and demonstrate exceptional performance. Rich has excelled in each of these areas and has proven to be a strong leader. The progression of Rich’s role since joining the firm in 2009 reflects our unceasing pursuit of growth and improvement, as a team and as individuals.

Thank you for your interest in Altrinsic. Please contact us if you would like to discuss these or other matters in detail.

Sincerely,

John Hock

John DeVita

1Q25 Performance Review and Investment Activityi

The Altrinsic International Equity portfolio gained 8.6% (+8.3% net) in the first quarter, outperforming the MSCI EAFE Index’s return of 6.9%, as measured in US dollars. Positive attribution was broad-based but led by positioning and investments in consumer discretionary (Alibaba), information technology (Check Point), and health care (Medtronic, Sanofi, GlaxoSmithKline). Negative attribution was mainly driven by positions in the consumer staples (Diageo, Pernod Ricard) and communication services (Informa) sectors and our underweight exposure to the utilities sector.

Within the consumer discretionary sector, Alibaba benefited from improved operating performance in its core eCommerce business, better than expected progress on AI model development, improving macro economy, and better domestic political environment.

Information technology was supported by solid performance from Checkpoint specifically and more broadly by our underweight to highly valued AI-related chip companies. Check Point Software was relatively resilient as new CEO Nadav Zafrir’s plan to accelerate sales growth while maintaining profitability is showing signs of progress.

In the health care sector, Medtronic shares performed well as the company secured Medicare reimbursement for its new renal denervation product, highlighting its significant growth potential. Global pharmaceutical companies Sanofi and GlaxoSmithKline delivered solid operational results and good pipeline advancement to the surprise of many skeptical investors. We welcome their commitment to more disciplined capital allocation policies; however, government regulation remains a persistent overhang for the sector.

Positive performance was partially offset by weakness in the consumer staples sector, particularly spirits makers Diageo and Pernod Ricard. Fears that secular alcohol consumption trends have structurally slowed were exacerbated by tariff fears pushing valuations toward 15-year lows. We believe the companies offer several avenues of earnings growth through emerging market demand, continued premiumization, and cost improvements. Negative attribution in the communication services sector was driven by shares of B2B trade show operator Informa declining due to macroeconomic uncertainty and potential impacts on trade show demand; however, we view these risks as overstated. Additionally, management has improved its portfolio, pricing power, and cost flexibility, which are not reflected in current valuations.

We initiated new positions in three companies (Intertek, Murata Manufacturing, and SMC) and exited two positions (Liberty Global, Lojas Renner).

Intertek is a leading testing, inspection, and certification provider benefitting from rising regulation and safety standards. Near-term cyclical headwinds for some of its end markets provided a compelling entry point. Similarly, Murata and SMC face end-market growth volatility, but each manufactures complex electrical components showing structural growth and industrial automation and efficiency programs accelerate.

Following the spin of their Swiss asset Sunrise, Liberty Global shares were trading at fair value with limited growth potential in the rest of their portfolio, and we exited our position. We also exited our holding in retailer Lojas Renner as we anticipate continued disappointing Brazilian discretionary consumption hampering the company’s growth efforts.