Dear Investor,

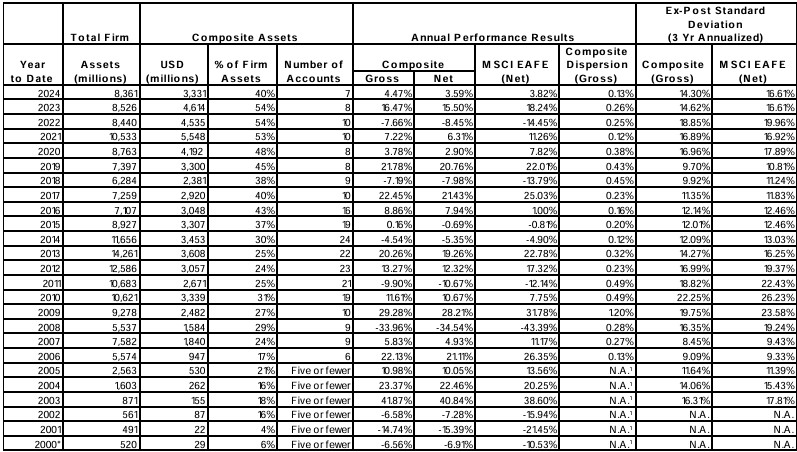

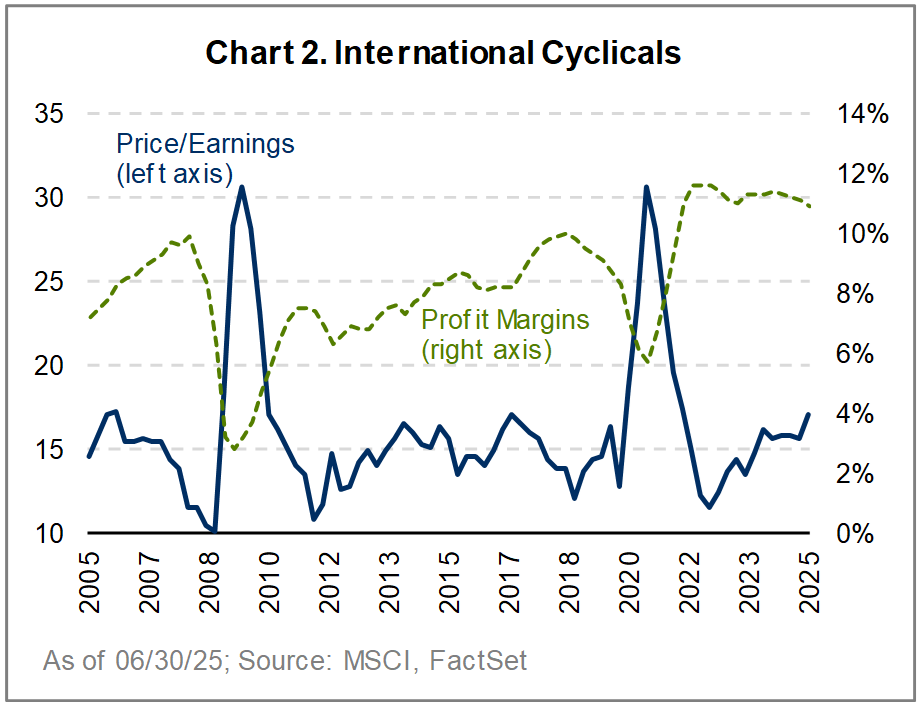

The Altrinsic International Equity portfolio gained 7.1% gross of fees (6.8% net) in the second quarter, bringing year-to-date gains to 16.2% (15.7% net), as measured in US dollars. By comparison, the MSCI EAFE (Net) Index gained 11.8% and 19.4% over the same periods.i

President Trump’s quick backtrack on his “Liberation Day” tariffs, resilient global economic growth, and rapid de-escalation of the conflict in Iran fueled a historic Q2 rally and largely eroded our Q1 outperformance. Even with CEOs flagging tariff-related concerns, business investment held firm, and supportive consumer spending underpinned strong economic data. Budding stagflationary concerns subsided during the quarter, but lingering trade uncertainty, geopolitics, slowing growth, and rising debt levels in large economies present risks. We continue to see the greatest opportunity away from the large major market constituents, among companies with more durable profit outlooks and those embracing technology to improve operating and financial productivity.

Perspectives

The second quarter started with a sharp correction following the implementation of the most aggressive trade measures in modern US history. The S&P 500 and MSCI EAFE indices each declined approximately 11%1 in USD terms, while the VIX Index—Wall Street’s benchmark for market volatility—spiked to levels not seen since the onset of the COVID-19 pandemic. Amid rising fears of a severe economic downturn, President Trump postponed the “Liberation Day” tariffs just seven days later. This reversal triggered a furious rally, led primarily by technology, momentum, and cyclical stocks. By quarter-end, the S&P 500 and MSCI EAFE indices had each rebounded by nearly 25% from their April lows, ending up approximately 11% and 12%, respectively. The MSCI EAFE Index’s gain was a more modest 4.8% in local currency terms but was aided by a 7% appreciation in EAFE currencies relative to the US dollar.

The US dollar (as measured by the DXY Index) ended the quarter at a three-year low, marking its weakest start to a year since 19732. The greenback was weighed down by trade policies, expansive deficit spending, and repeated challenges to the Federal Reserve’s independence. While the dollar’s decline has reversed a long-term trend, it has been a manageable decline and provided a tailwind to non-US dollar-denominated assets. A true test will come if the dollar does not rise in a ‘risk-off’ market environment – as has historically been the case. While currency markets are notoriously difficult to predict, we incorporate various scenarios into our company-specific analysis with an emphasis on both risks and opportunities.

Europe delivered solid gains (+11%)3, as stocks were supported by improving economic data, optimism surrounding potential US trade agreements, and rising fiscal support. Excessive regulation and a lack of sufficient economic cohesion have long weighed on the continent, reflecting more of a loose confederation of independent states than a true European Union. The steep discount at which most EU-domiciled companies trade versus US peers reflects this reality. However, change has been underway, and Trump’s initiatives have created greater urgency. There is justified optimism that a broad movement toward fiscal stimulus and reforms will further boost growth.

The German government took a large step toward implementing a fiscal regime shift with a historic reform of its debt brake. The government coalition agreed to borrow almost €500B to raise the defense budget to NATO’s new target of 3.5% of GDP by 2029. Recent NATO meetings have increased targets to 5% in some cases. Additional infrastructure and other fiscal spending could amount to nearly 20% of GDP. An enormous long-term potential opportunity is Europe’s burgeoning Savings & Investment Union, which aims to mobilize Europe’s €33T in savings assets in ways that would be far more productive for growth and returns in the country.

We expect European M&A activity to pick up as both corporates and private equity firms capitalize on improving fundamentals, attractive valuation levels, and improving liquidity, all amid a backdrop of easing regulation. Major PE firms have been calling out the opportunity in Europe, with Blackstone announcing it intends to invest up to $500B in Europe over the next 10 years. We see a similar situation unfolding in Japan, but given societal and market conservatism, it will happen at a slower pace.

Emerging markets posted strong gains, with the tariff postponement, favorable currency movements, and central banks’ credibility serving as key tailwinds. Korean stocks rallied 33%4 as President Lee Jae-myung’s election calmed political instability. His pledge to support stablecoins backed by the Korean won fueled a further surge in blockchain and fintech-related stocks.

Chinese equities were impacted by pronounced trade volatility, as tariffs on Chinese imports surged to 145% by mid-May, compounded by the elimination of de minimis treatment for low-value imports. A US-China trade deal was eventually reached, lowering US baseline tariffs to 30%; an improvement but still elevated compared to 10% for most other nations.

Performance Review and Investment Activity

The Altrinsic International Equity portfolio underperformed the benchmark during the second quarter, largely due to below-market beta, lack of exposure to highly valued tech and communications companies, and underperformance by our large insurance holdings.

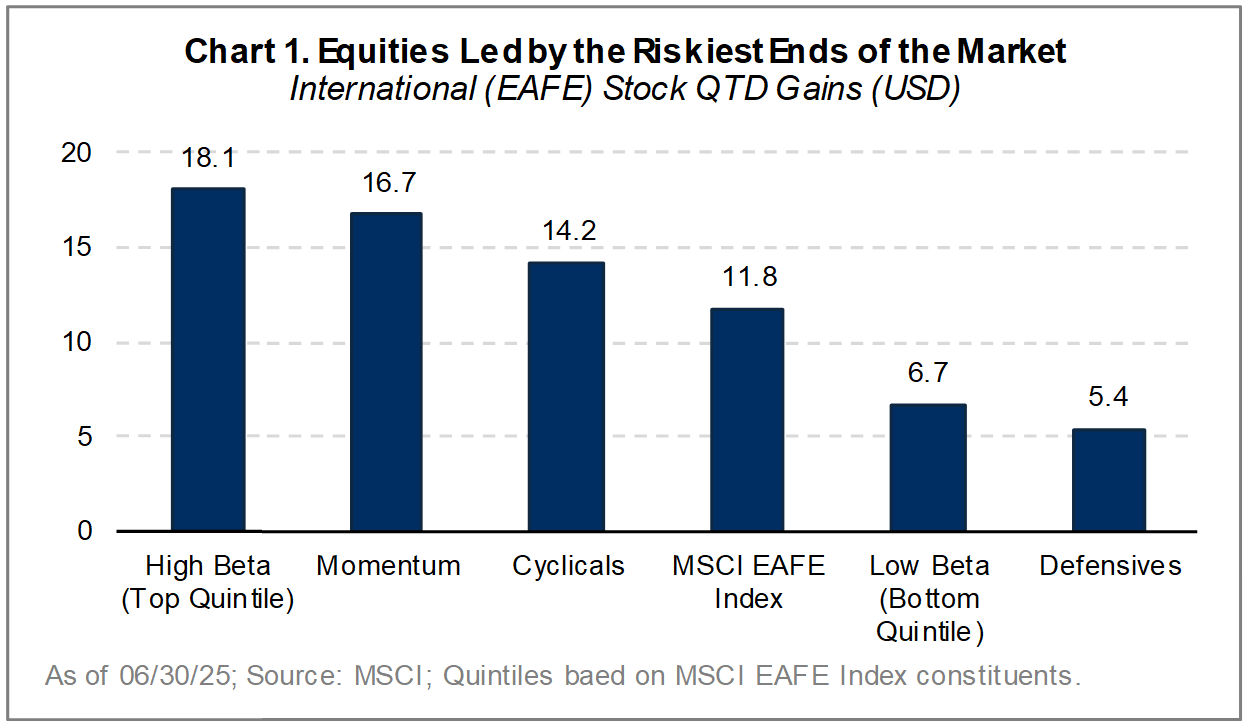

As seen in Chart 1, momentum and beta were the dominant factors driving markets. Those with the highest beta (risk) gained 18%. Chart 2 shows international cyclicals’ valuations are elevated and profit margins could be vulnerable. This category is largely made up of cyclical and AI-related stocks, the same ones that suffered during Q1. The valuations of cyclical stocks are beginning to dip into extended territory versus more defensive companies. There are certainly controversies in both categories, but in general, the premium placed on companies forecasting high growth, relative to more modest (albeit durable) growth, is stretched. We have been prioritizing growth durability and earnings resiliency, which happen to be where attractive valuations exist today.

The IT and communications sectors delivered strong performance, driven by cyclical demand and particularly strong gains among companies tied to AI infrastructure. Valuations and expectations in this segment reflect a robust growth outlook. Our lack of exposure to highly valued technology companies tied to AI largely drove our underperformance. Our views on AI-related stocks have not changed. We are big believers in the future of AI; however, we believe the greatest and most underappreciated beneficiaries will be the consumers and adopters of AI – companies embracing it to transform their operations.

Investments in the insurance industry have been a major source of positive attribution and compounders of value for us over the years, driven by a growing addressable market, rising penetration, and an improving competitive landscape. We expect this to continue, but they were major laggards during the quarter. During 2025’s market turbulence, these holdings provided a margin of safety while their core businesses grew in value. In Q2, the value of the businesses continued to grow (as measured by book value), but investors began to question the sustainability of this growth, causing many insurance stocks to decline modestly while markets rallied sharply.

Our insurance investments can be bundled into best-in-class property and casualty insurers (Chubb, Zurich), other non-life insurers going through transitions that will lead to higher and more durable returns on equity (Everest, Axis), and insurance brokers that will continue seeing rising demand for their services in an increasingly complex world (Aon, Willis Towers Watson). These investments are long-term compounders of value, and they tend to perform with lower correlation to the broad market, especially during major gyrations (in both directions). We continue to believe these holdings provide the portfolio with very attractive risk/return characteristics.

Trade activity was balanced, as we added five new positions (Admiral Group plc, Sandoz, Smith & Nephew, Sandvik, Techtronic) and eliminated five (B3, Baidu, Euronext, Singapore Exchange, Barry Callebaut). UK personal insurer Admiral Group combines low costs with superior technology to drive profitable growth. Sandoz is a global leader in biosimilars, well positioned to capitalize on the shift towards lower-cost alternatives to branded biologics. Smith & Nephew is a major player in growing medical device markets with strong sports medicine and wound management franchises as well as significant optionality to improve its orthopedics business. Although Sandvik (capital goods provider) and Techtronic (toolmaker) are exposed to cyclical demand trends in industrials, mining, and construction, the companies have leveraged their leading competitive positions to further expand market share through downturns and improve internal efficiencies along the way.

Baidu and Barry Callebaut were each sold as our theses failed to materialize as expected. Despite low headline valuation levels, we exited in favor of other positions cited above. B3, Euronext, and Singapore Exchange have executed growth initiatives well, and valuations approached what we consider bull-case scenarios.

Summary

The resiliency of the global economy, particularly the US, has been impressive. Valuations in many segments of equity markets suggest significant trend extrapolation embedded in share prices. Although we are long-term bulls, we believe price paid matters and continue to be drawn to opportunities away from the crowded and more cyclical segments of the market. Looking forward, inflation will likely be more volatile due to de-globalization, government fiscal expansion, geopolitical risk, and energy price volatility. When a market is overly focused in one area, it often pays to look the other way. Our attention remains on companies with durable competitive advantages, attractive valuations, and the ability to compound value through various market cycles.

Please contact us if you would like to discuss these or other matters in greater detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick