Dear Investor,

The Altrinsic International Equity portfolio gained 5.5% gross of fees (5.3% net) during the third quarter, as measured in US dollars. By comparison, the MSCI EAFE (Net) Index gained 4.8%,i driven by subsiding tariff concerns and resilient macroeconomic data. International markets continue to be led by the riskier segments of the equity universe – especially companies with more cyclical characteristics. Our team continues to find attractive investments in less crowded areas that offer much more favorable return prospects, with a superior margin of safety.

Circularity, Concentration, and AI Dependency in Global Markets, Economies, and Wealth

Recent media attention has highlighted the growing “circularity” within the AI ecosystem, as a small number of technology companies are simultaneously customers, investors, and vendors to each other. These interwoven financial arrangements – reminiscent of vendor financing schemes prevalent at the height of the TMT bubble – have raised concerns about sustainability and systemic risk. These developments are certainly worth monitoring. However, we believe other sources of concentration and circularity are likely more consequential, not fully appreciated, and deserving of greater consideration as investors assess global economic and market risks.

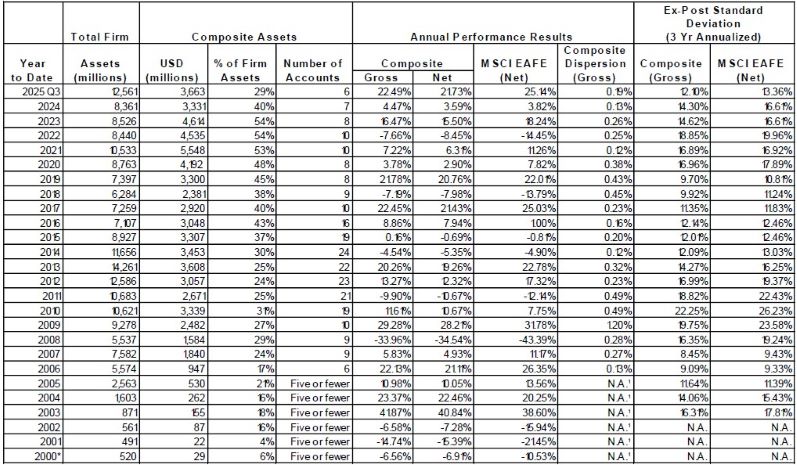

Rarely has so much economic and market performance depended on so few companies and households. The data below focuses primarily on the United States, but the effects have enormous repercussions on the rest of the world. Consider the following (Chart 1):

- US stocks have grown to represent an all-time high 65% of the global equity market.1 Additionally, the total value of the US stock market has reached an all-time high 232% of US GDP.2 Further, 10 stocks represent an all-time high 38% of the US market.3

- The US economy represents 27% of the global economy, with 70% of its GDP driven by consumption; half of that consumption comes from the wealthiest 10% of the population.2

- That same 10% of the population owns approximately 87% of the US stock market.2

These levels of concentration in markets and the economy – and their interconnectedness – support a self-reinforcing and circular dynamic; increasingly concentrated markets are led by a small number of technology companies, thus fueling a “wealth effect” for affluent Americans, who are subsequently driving consumption in the world’s largest economy.

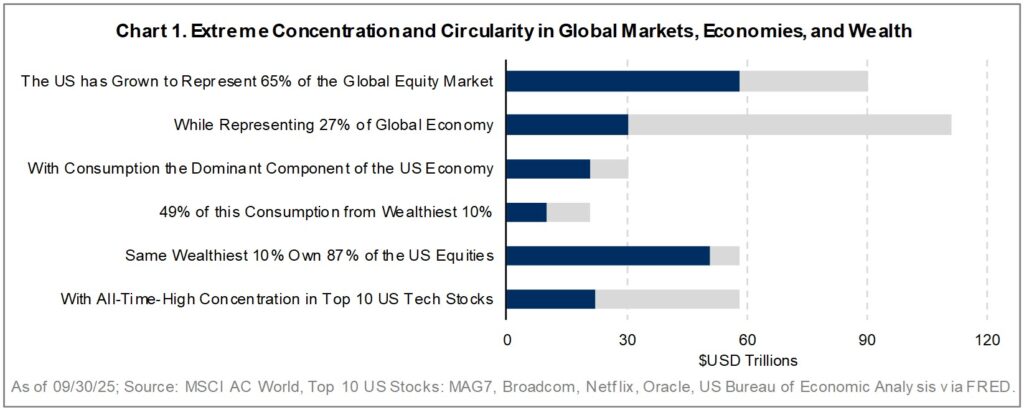

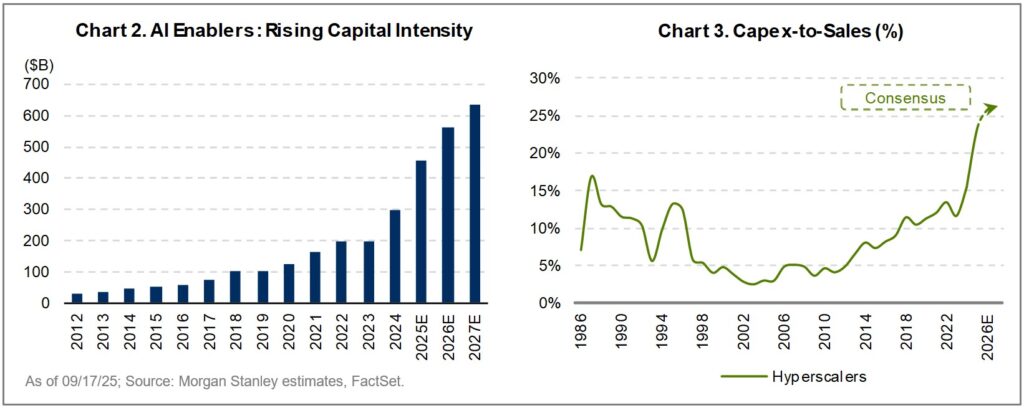

Surging investment in technology capex has been the other driver of recent economic growth. Harvard economist Jason Furman has calculated that the spike in investment in information processing equipment and software is equivalent to 4% of GDP but was responsible for 92% of GDP growth in the first half of this year. Charts 2 and 3 illustrate the enormity of investment coming from the major AI companies.

For now, markets are rewarding the aggressive capex with ever-rising stock prices. This is adding to the intensifying FOMO, or fear of missing out, among companies competing in this space. At some point, markets and investors are going to expect a return on these massive expenditures. At the same time, companies will need to address several important unknowns – notably, energy availability and associated costs. If high expectations are not met, FOMO could quickly pivot to FOL – fear of loss.4

To draw a parallel to the Y2K TMT episode, consider Cisco and Corning. Each benefited substantially from the hype and infrastructure investment of the era, as their stock prices climbed from approximately $9 and $13 to $80 and $113, respectively, within two years. They subsequently lost approximately 85% and 99% of their value, respectively.5 Other early enablers did not fare so well either, and many no longer exist. The fiber these companies laid in the ground is still there (and largely in use), and other corporations and society as a whole came out ahead. Amazon, for example, was ultimately a beneficiary of the Y2K tech/fiber bubble – even if the stock fell from $113/share to $6/share during the year 2000 alone.

At Italian Tech Week 2025, Jeff Bezos commented on the current situation,6 claiming that AI is an industrial bubble, not a financial one. He went on to explain why this is an important distinction:

“The [bubbles] that are industrial are not nearly as bad – they can even be good – because when the dust settles and you see who are the winners (sic), society benefits from those inventions…That’s what is going to happen here, too. This is real. The benefits to society from AI are going to be gigantic.”

We concur that society will be the greatest beneficiary of AI as long as the technology, its use, and societal implications are responsibly governed.

Without a doubt, AI is a transformational technology, and current market leadership could persist. However, we believe the range of outcomes for many of the AI-themed stocks is highly unfavorable relative to investment opportunities elsewhere in the broader equity landscape. Just as the concentration and circularity discussed above have contributed to a supercharged virtuous cycle, these same dynamics can work in reverse.

During periods of major technological disruption, early economic beneficiaries are often concentrated among a handful of innovators. This was true with the lightbulb, railroads, automobiles, and the TMT boom – and we see it again now, with enormous value accruing to the AI enablers. However, history shows that capital inevitably chases these outsized returns, eventually eroding value over time. Lasting value typically comes from the broader diffusion of new technologies, which drives innovation, efficiency, and productivity gains across the economy and industries. We believe the same dynamic is unfolding today.

It is still early days in AI implementation – in fact, researchers from the MIT Media Lab estimated that 95% of organizations have seen little to no revenue return on AI pilot programs.7 However, the breadth of potential applications and use cases is compelling and exciting for companies that think strategically about enterprise integration plans, implement AI education, and alignment of resources against the areas of greatest ROI.

While current enthusiasm and expectations are highest for a select few AI enablers, we see tremendous potential among AI adopters across industries (e.g., insurers, healthcare, industrials) where AI has the potential to materially improve business performance – but is not yet reflected in valuations.

Performance Review and Investment Activity

Despite our underweight exposure to cyclicals, which have continued to drive market performance, our outperformance was led by stock-specific strength in our consumer discretionary (Alibaba, Suzuki Motors, Sands China), health care (GSK, Smith & Nephew), and information technology (Samsung, Murata) investments. Financials (Deutsche Boerse, Chubb), consumer staples (Heineken), and industrials (SMC) were the primary sources of negative attribution.

Strong performance in consumer discretionary was driven by stock-specific factors. Alibaba’s shares climbed on strong results and optimism over sustained e-commerce growth, faster cloud expansion, and expected declines in food delivery losses in the coming quarters. The stock’s gains accelerated through the quarter as investors recognized the company’s strategic position as a key provider of AI models and infrastructure. Suzuki is gaining market share in both India and Japan, supported by the launch of new models. However, investors continue to assign minimal value to the business, outside of its ownership stake in Indian subsidiary Maruti. Lastly, Sands China defended its market-leading position in Macau, where gaming demand is recovering from an extensive post-pandemic downcycle.

In health care, positive attribution was driven by gains in GSK and Smith & Nephew, along with our underweight positioning in pharmaceutical companies, which are facing intensifying global regulatory pressures. GSK shares rose on the announcement that Chief Commercial Officer Luke Miels will succeed Emma Walmsley as CEO next year. Meanwhile, Smith & Nephew advanced their turnaround efforts, delivering better-than-expected margin performance. Despite shifting regulatory environments, we find compelling opportunities in companies that are sharpening focus, driving innovation, and improving efficiency.

Within information technology, Samsung’s shares rose after it qualified its High Bandwidth Memory (HBM) products with key customers. The company is poised to benefit from impending supply shortages in memory semiconductors driven by surging AI demand. Murata Manufacturing provided stable performance in its core ceramic capacitor division, which also benefits from AI server growth.

In financials, share prices of several of our large insurance and exchange holdings declined due to a combination of growth slowdown concerns and growing investor disinterest in companies with more defensive qualities. We continue to have high conviction, however, as these holdings are long-term compounders supported by strong moats, growing addressable markets, and the ability to benefit from an increasingly risky world. When combined with attractive valuations, we see a highly compelling range of outcomes.

Consumer staples, primarily alcohol-related businesses, continue to face volume headwinds due to a combination of cyclical (weak consumer sentiment) and structural (health-related consumption reductions) factors. Our portfolio includes best-in-class brands and retailers that offer significant upside as consumption trends normalize. Valuations remain at multi-year lows for most of our staples holdings.

SMC weighed on our industrials performance, as North American customers pushed back orders due to tariff uncertainty. SMC’s pneumatic controls remain integral for many of its manufacturing customers, and we see a long runway for growth given the ongoing need to reduce costs and improve manufacturing automation.

We continue to see a wide investment opportunity set, as highlighted by elevated portfolio activity this quarter. Our four new holdings in financials (DNB Bank, PT Bank Mandiri, Japan Exchange, Standard Bank Group) all trade at attractive valuations despite operating best-in-class franchises with significant opportunities to improve penetration of new products while targeting greater cost efficiency. We also initiated positions in Hexagon, Siemens Healthineers, and ICON. Under new leadership, industrial hardware and software provider Hexagon is transforming its business toward higher-margin software verticals, which should close the valuation gap with peers. Siemens Healthineers’ structurally growing medical equipment businesses are temporarily overshadowed by the company’s efforts to right-size its struggling diagnostic division; the company remains a compounder that is deeply embedded in its customers’ operations. ICON is a leader in drug development outsourcing, which has hit a recent soft patch; we continue to believe in the structural penetration opportunity ahead and see its services as being integral to its customers long-term. Lastly, Sony Financial was spun out of our Sony Group holding at the end of September.

We exited our positions in BioNTech, Credicorp, and Sompo Holdings as the companies executed well and discounts to fair value narrowed, allowing us to allocate capital to greater risk-adjusted reward opportunities. We also exited our positions in Roche and Yamaha Motor as we believe regulatory and competitive pressures, respectively, will make it increasingly difficult for both companies to sustain profitability in line with management’s projections.

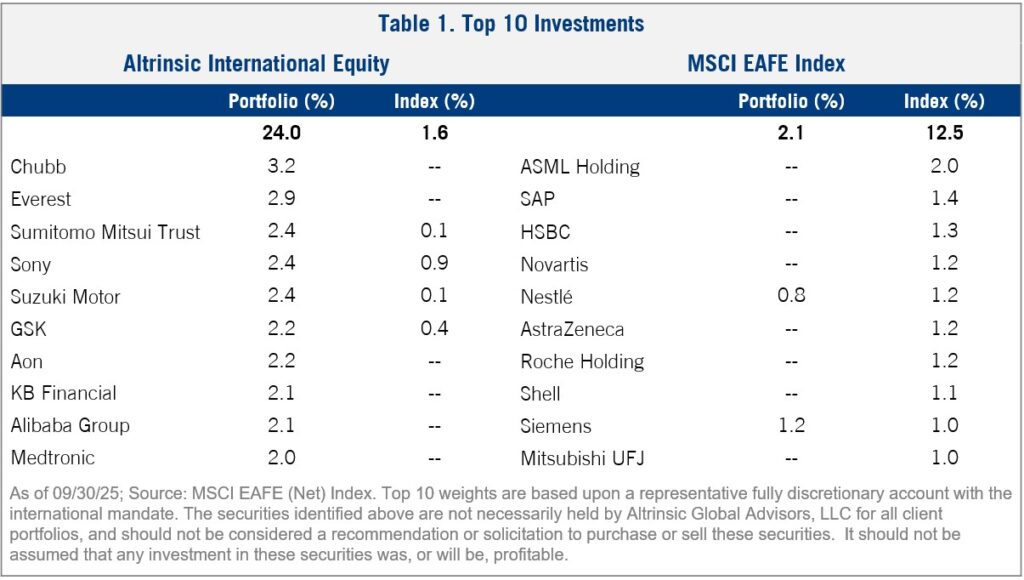

As shown in Table 1, our investments and the resulting risk exposures are materially different from market indices. By almost any measure (sector, region, stock, factor), we are an outlier versus benchmarks and other investors. We believe this is timely and prudent. With few distressed valuations – or “fat pitches,” to use the baseball analogy – available in the market, our current investments include many high-quality “singles” and “doubles”, offering an attractive margin of safety. In our view, the more cyclical areas that have been leading the market carry “home run” expectations, yet offer an unfavorable range of outcomes given current valuations and earnings prospects.

Closing

In investing, it is usually most important to be different when it is most painful to do so. Venerable investor Lee Cooperman recently shared a Warren Buffett quote from 1999:

“Once a bull market gets underway, and once you reach the point where everybody has made money, no matter what system he or she followed, a crowd is attracted into the game that is responding not to interest rates and profits but simply to the fact that it seems a mistake to be out of stocks.”

Now is one of those times when people seem afraid to miss out and are acting accordingly. We believe AI is a transformational force with the potential to deliver broad societal and industry-specific benefits. However, we believe the current market enthusiasm overlooks key risks, particularly around these companies’ ability to monetize their investments, energy constraints, capital efficiency, and the sustainability of “early enabler” valuations.

Our core objectives have remained the same since inception: grow clients’ capital while delivering superior risk-adjusted performance. Our role in clients’ portfolios has also remained consistent: employing a bottom-up intrinsic value philosophy that results in differentiated investments, risk exposures, and performance drivers, delivered with liquidity and transparency. We build our portfolios from the bottom up, company by company, with high regard for both micro and macro risks. This approach helps us maintain a long-term focus on what matters – quality AND price paid. Statistically, our portfolios have exhibited below market risk (as measured by beta), and we focus heavily on identifying companies with more idiosyncratic drivers of performance. We believe that investing in less conventional corners of the market – including attractive AI adopters – offers a compelling long-term risk-return tradeoff and enhanced downside protection.

Please contact us if you would like to discuss these or other matters in greater detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick