Dear Investor,

Divergence in the performance between AI-led US markets and the rest of the world accelerated in the fourth quarter, fueled by optimism after the Trump election victory and a strong US dollar. The MSCI EAFE index fell by 0.6% in local currencies and by 8.1% in US dollars. The Altrinsic International Equity portfolio declined by 7.3% gross of fees (-7.5% net), as measured in USD.i

Perspectives

“US exceptionalism” continues to be the mantra in markets, and this has certainly been reflected in equity market performance, elevated valuations of the ‘Magnificent 7’ stocks, and the premium afforded to most US companies relative to their international peers. Innovation and growth have only been outpaced by the enthusiasm surrounding these companies. The US dollar has also benefitted, gaining 7.6% against the DXY basket of foreign currencies, with the recent rise reflecting interest rate differentials, anticipation of tariffs, and the associated changing terms of trade. In the case of both stocks and currencies, valuations have evolved from a stage of fundamental support to one driven by narratives and momentum, presenting risks for subpar returns among popular and crowded segments of the global equity landscape.

The situation in international markets is quite different: less loved, less crowded, lower expectations, compelling valuations, and undervalued currencies. This combination results in more favorable long-term return prospects. Successful long-term investing ultimately stems from the right blend of valuation (price paid), earnings and free cash flow (FCF) growth, and the appropriate appraisal of risks surrounding the investment. Reevaluating these pillars gives us confidence that the outlook is particularly compelling in non-US markets.

1. Valuations

Valuation levels matter very little in the short term, but they matter overwhelmingly in the long term. Benjamin Graham famously said, “In the short run, the market is a voting machine, but in the long run it is a weighing machine.” Sentiment, momentum, emotion, and liquidity often prevail in the short term, with narratives surrounding stocks offering new and “transformative” ideas (AI, advanced robotics, GLP-1 drugs) contributing to lofty valuations. The proliferation of passive strategies and increased index concentration (Charts 1 & 2) have further exacerbated the procyclicality. But procyclicality works in both directions.

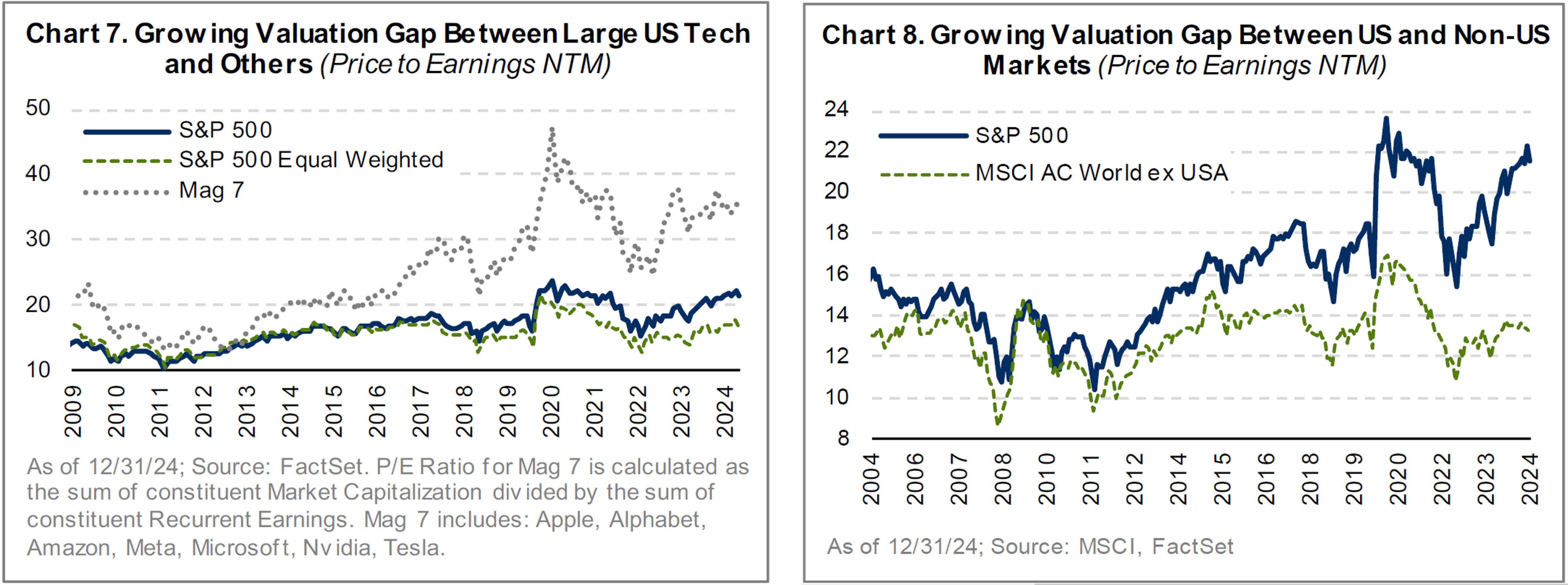

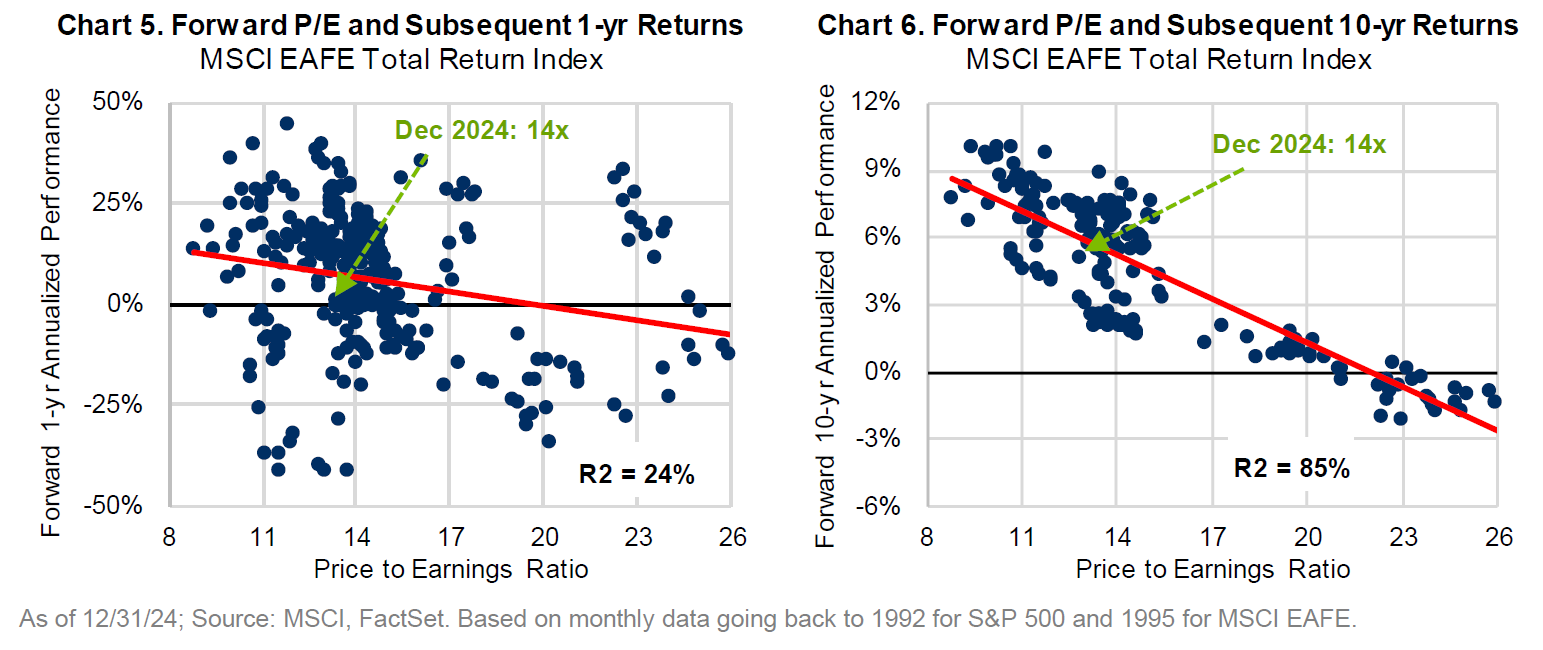

Over the long term, valuation has an outsized influence on returns. Charts 3 & 4 (S&P 500) and Charts 5 & 6 (MSCI EAFE Index) illustrate this relationship by looking back at the last 30+ years of data; the dots represent the level of annualized returns earned on the respective indices based on the price/earnings multiple paid at the time.

Over the long term, valuation has an outsized influence on returns. Charts 3 & 4 (S&P 500) and Charts 5 & 6 (MSCI EAFE Index) illustrate this relationship by looking back at the last 30+ years of data; the dots represent the level of annualized returns earned on the respective indices based on the price/earnings multiple paid at the time.

Valuation Has Had Little Predictive Power in the Short Term, Overwhelming in the Long Term

On a short-term basis, the correlation is very low, but over a 10-year period, it is over 85%. Based on this relationship, the 10-year forward annualized returns are much more favorable for the MSCI EAFE Index.

On a short-term basis, the correlation is very low, but over a 10-year period, it is over 85%. Based on this relationship, the 10-year forward annualized returns are much more favorable for the MSCI EAFE Index.

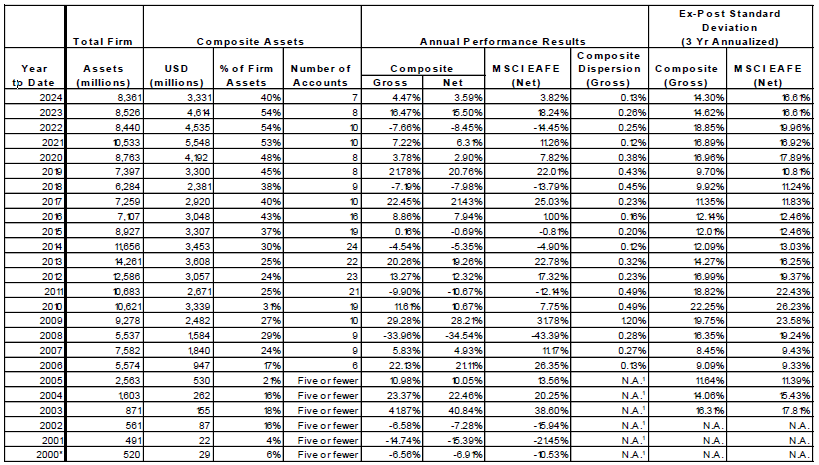

As we assess the narrow market leadership that is extended by most measures and by historical comparisons, we believe that, while possible, it is unlikely that many companies, particularly those in the US, can deliver on the long-term expectations embedded in their valuations. The likely best-case scenario is for them to tread water or experience a form of purgatory until fundamentals catch up with valuations. Chart 7 reflects the gap in valuations between the small sub-set of leading US tech stocks, the large-tech-dominated S&P 500 Index, and the broader equal-weighted S&P 500 Index. Chart 8 illustrates the growing spread between US and non-US markets. Looking beyond the small subset of market darlings, there is a lot of value in today’s markets, with the most compelling dislocations outside of the US.

2. Earnings and Free Cash Flow

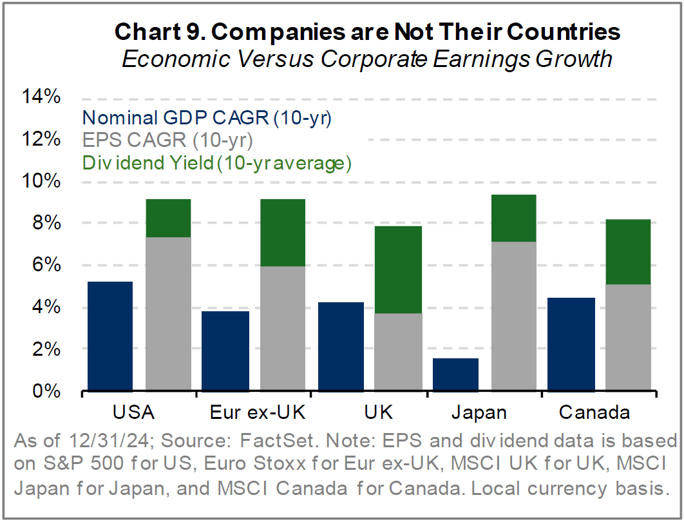

Valuation is unequivocally important, but focusing on it without regard to quality is fraught with its own dangers, typically leading to lower quality, highly cyclical, and/or overleveraged companies. It is a common misperception that non-US companies are domiciled in countries that are ‘economic basket cases’ and therefore do not grow. However, investments are made in companies and not countries, so ultimately, underlying EPS (as opposed to GDP) is most reflective of the investment landscape.

Chart 9 provides a broad perspective of economic and corporate earnings results over the last 10 years. US economic and earnings growth has outpaced most other nations, with productivity, a confident consumer, low interest rates, lower tax rates, buybacks, and massive fiscal stimulus playing supportive roles. Internationally, economic growth has been more muted, yet EPS growth has been solid and perhaps underappreciated. When also incorporating dividend yields, the value accrued to shareholders in the US versus outside the US has been comparable. Further, many of the best non-US companies have diversified their businesses with large and sometimes overwhelming amounts of revenue generated outside their home market. After a period of massive outperformance in the US, expectations for many US companies are elevated, particularly among the large market constituents. From a long-term investment perspective, we currently find the most compelling opportunities among companies with modest yet durable growth prospects, embracing change/AI/digitization to improve growth and profitability, and/or incorporating more productive capital allocation than markets are recognizing. These investments did well during the second half of the year (in local currency terms), but they have been unable to keep up with leading US growth stocks.

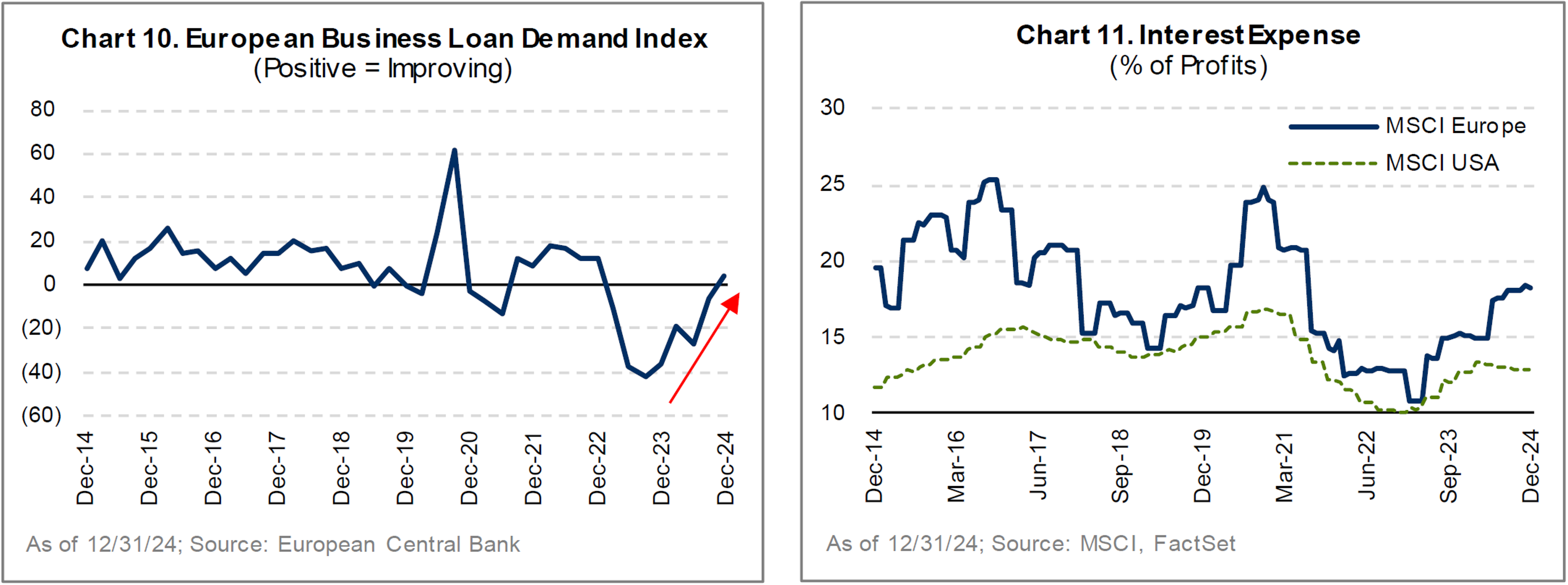

From a regional perspective, companies in Europe, Japan, South Korea, and other emerging markets have expectations that are low and likely to be surpassed. Europe’s macro environment has been particularly weak, as politics, energy, Chinese demand, and uncertainly surrounding US trade policy have weighed on sentiment. However, financial conditions in Europe have been improving. Loan demand is finally turning positive (Chart 10), and European banks have stopped tightening lending standards for the first time in years. Just as important is the structure of debt in Europe. As highlighted in Chart 11, interest costs are a higher proportion of profits relative to the US, and variable rate debt is far more prevalent in Europe than in the US. Thus, while the US benefitted over the last few years from longer duration debt structures, Europe now stands to benefit in the current rate environment.

In Asia, earnings expectations are undemanding in Japan and South Korea. Shareholder-friendly reforms should boost earnings growth beyond levels that one might expect in otherwise mature economies. Historically, many Japanese and South Korean corporates have prioritized social initiatives and/or focused on top-line growth with little regard for financial productivity (i.e., ROE). Now, meaningful change is emerging, which is improving the investment opportunity set in both countries.

3. Risks

A multitude of interrelated risks span the world today, including geopolitical, policy-related, macroeconomic, credit, and excess leverage, to name a few. In theory, these considerations should be reflected in interest rates, risk premiums, and currency movements. At times, however, they can be overemphasized or underappreciated, presenting opportunities. Geopolitics took center stage in 2024, as more than 70 elections were held in countries representing more than half of the world’s population. While many were highly charged, we believe The Economist said it best, claiming 2024 “…affirmed the resilience of capitalist democracies, including America’s.”1 We believe that US and Chinese policies relating to trade, security, and economic growth (particularly in China) will be the most consequential in the year(s) ahead. Currently, market consensus is overwhelmingly against China’s ability to endure a second Trump presidency and/or stimulate domestic consumption. An end to the prolonged war in Ukraine could be a major boost to the EU. President Trump’s policies, notably deregulation and tax cuts, have been greeted favorably by markets. Others, including deportation and tariffs, could stoke inflation and slow economic activity.

Deglobalization, necessary infrastructure spending, energy transition, aging labor forces, slowing immigration, excessive stimulus, high debt levels, and persistent fiscal deficits in major economies are supportive of sticky inflation and long-term interest rates remaining higher for longer despite slowing growth. In the US, for example, the ten-year Treasury bond yield ended last year nearly one percentage point higher than when the Federal Reserve began easing in September. Sovereign bond markets finally appear to be tuned in to the potential ramifications of excessive deficit spending and high government debt levels. Higher long-term rates and slowing economic activity are among the greatest risks in major economies, including the US. Corporate credit markets, however, do paint a more optimistic picture, with credit spreads declining to some of their lowest levels in decades (Charts 12 & 13).

Performance Review

The Altrinsic International Equity portfolio marginally outperformed the MSCI EAFE Index in the fourth quarter. Positive attribution was led by financials (Sompo, Willis Towers Watson, Axis Capital), materials (Agnico Eagle, CRH), and our underweight exposure to health care. Negative attribution was mainly driven by industrials (Deutsche Post, Kubota), consumer staples (Heineken, Pernod Ricard), and information technology (Samsung).

In financials, Sompo continues to improve its capital allocation by reducing cross-shareholdings, and the company is in a strong position to expand return on equity through better domestic underwriting practices. Willis Towers Watson’s efforts to revamp its personnel and utilize its global scale are bearing fruit through accelerating organic revenue growth and margin expansion. We see plenty of opportunities for further free cash flow improvement closer to peer levels as earnings quality continues to improve. Lastly, Axis Capital’s shift away from volatile reinsurance segments and toward its strong specialty insurance businesses is driving higher returns. We believe its CEO Vincent Tizzio’s strategy supports a more profitable, less risky business model that is still underappreciated by many.

In materials, Agnico Eagle and CRH provided strong operating results amidst robust gold prices and infrastructure demand, respectively. The outlook for CRH, in particular, remains very strong given its improving asset portfolio and legislated spending in the US.

The health care sector grappled with weak demand and pricing pressure in China, as well as volatility among highly valued pharmaceutical companies exposed to weight-loss drugs. Our investments are concentrated among companies prioritizing innovation and business improvements that are not well reflected in current valuations.

Performance was adversely affected by trade tariff concerns following the election of Donald Trump, and depressed consumer demand. In industrials, we believe the risk of tariffs overlooks DHL’s ability to help clients navigate even more complex global trade networks. Kubota’s cost-cutting measures and growing demand in Asia remain significant tailwinds for their bottom line. In consumer staples, we find compelling value in global businesses, including Pernod Ricard and Heineken, where there are doubts about a return to growth post COVID. In information technology, Samsung is actively addressing recent missteps in AI-focused products, which should reaccelerate sales growth and allow the company to resume its market-leading position within memory semiconductors.

Investment Activity

We initiated two positions (Koninklijke Philips, B3) and exited three positions (Seven & I Holdings, SAP, Eisai) during the quarter. We established a position in medical device maker Koninklijke Philips following recent lawsuit settlements that will allow the company to refocus on improving profitability closer to peer levels. Philips operates in growing, oligopolistic medical device markets with high barriers to entry and has a strong track record for improving operating leverage. We also initiated an investment in Brazil’s dominant exchange, B3, which offers a resilient business model with diversified avenues of growth across many asset classes.

We sold Seven & I as its valuation rose in anticipation of a takeover by either Alimentation Couche-Tard or the Ito family. We exited our position in SAP after it successfully navigated the shift to the cloud, which accelerated earnings growth toward our bull case scenario. We also exited Eisai, as we are increasingly concerned about the company’s complex rollout of its main Alzheimer’s drug, Leqembi.

Closing

Most objective measures (valuations, credit spreads, and bullish investor sentiment, among others) suggest a high degree of complacency in markets. A deeper look highlights how much of this complacency is concentrated in a small number of widely held stocks with exciting “stories” and valuation levels reflecting this enthusiasm. We see the best opportunities outside of the headlines and, most notably, in international markets. Our investments and overall positioning are quite different from popular indices, and we believe it has seldom been more important to be so.

Thank you for your interest in Altrinsic. Please contact us if you would like to discuss these or other matters in detail.

Sincerely,

John Hock

John DeVita

Rich McCormick