Dear Investor,

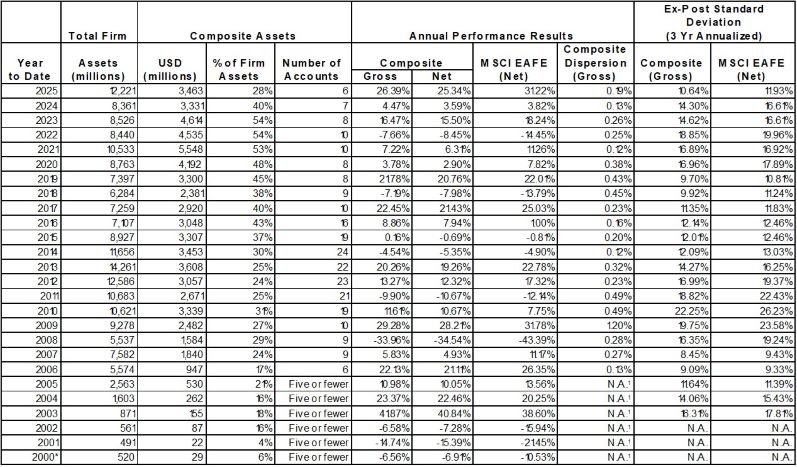

AI optimism, supportive fiscal and monetary policies, and resilient economic growth contributed to strong equity market performance in 2025. Full-year results, however, obscure a far more volatile path. Markets suffered steep declines leading up to “Liberation Day” in April before rallying sharply as tariff concerns eased and investor confidence returned. The Altrinsic International Equity portfolio gained 3.2% gross of fees (3.0% net) in the fourth quarter and 26.4% (25.4% net) for the full year. By comparison, the MSCI EAFE (Net) Index gained 4.9% and 31.2%, respectively.i

Perspectives

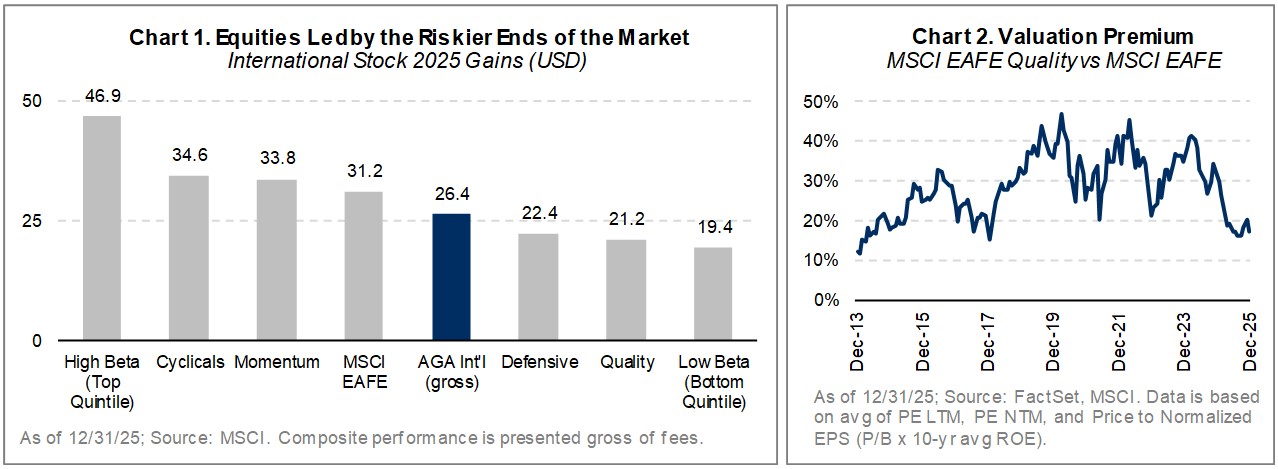

2025 was a challenging year. While absolute gains of over 26% exceeded our expectations, our outperformance during the early-year drawdown was more than offset by underperformance later in the year. As shown in Chart 1, high-beta and cyclical businesses led market performance in 2025, while higher-quality companies lagged. Chart 2 illustrates the extent to which valuations in MSCI’s EAFE Quality Index (which comprises companies with strong returns on equity, low profit volatility, and low financial leverage) have fallen to historically low levels relative to the broader market. In contrast, valuation premiums for companies with more aggressive and uncertain growth expectations are increasingly stretched.

Although AI growth narratives and cyclicality fueled market leadership in 2025, we believe quality, value, and differentiation will be key themes in the coming years.

We enter 2026 with a portfolio heavily exposed to quality businesses featuring durable earnings growth prospects, strong balance sheets, and attractive valuations. These investments are complemented by undervalued companies undertaking strategic initiatives to further improve financial productivity from depressed levels. While these companies lack the lofty “growth” narratives associated with AI-enablers or stimulus-driven revenue spikes, they are supported by sound fundamentals, attractive long-term return potential, and greater margin of safety.

Most of our investments are “AI-adopters,” embracing AI to enhance productivity, efficiency, customer experience, and competitive positioning. Chubb, one of our largest investments and arguably the world’s premier non-life insurance company, is a good example. The company has compounded shareholder value for years and is embracing AI to boost efficiency, underwriting capabilities, customer experience, and long-term profitability. Over the next few years, Chubb plans to use AI to automate 85% of major underwriting and claims processes, while reducing headcount by 20%.1 We believe that AI adopters such as Chubb will deliver strong long-term performance while offering a more compelling risk-return trade-off compared to popular AI enablers.

More broadly, we expect M&A activity to be among the many catalysts to unlock value in our investments, given the meaningful valuation gaps between share prices and their intrinsic value. Growing confidence among corporate executives, reduced tariff uncertainty, and an abundance of dry powder held by private equity firms should support demand from both strategic and financial buyers for well-capitalized businesses with durable cash-flow dynamics. Global M&A rose 36% in 2025 to $4.8T2 and is poised to accelerate further in 2026.

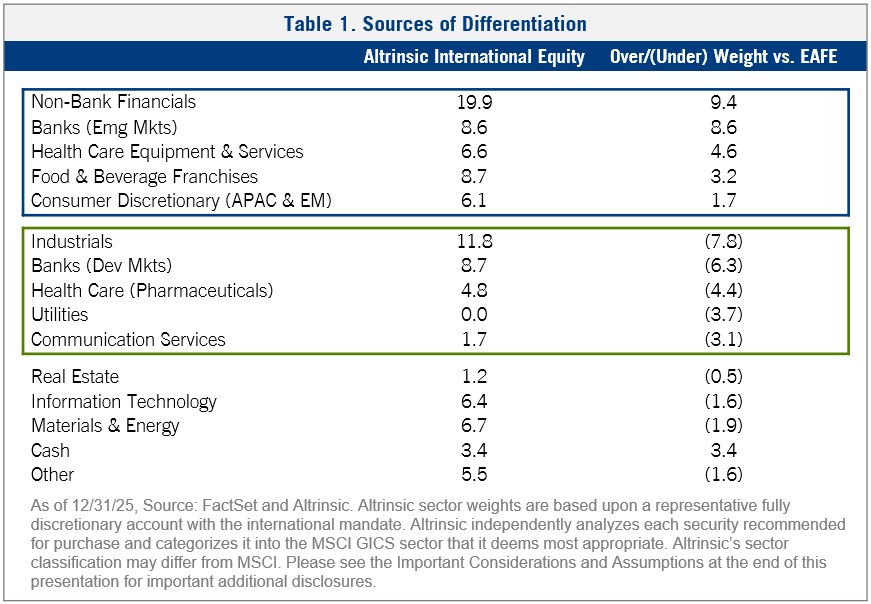

As shown below in Table 1 (in the ‘Portfolio Positioning’ section), our portfolio is materially different from any benchmark index. From a long-term perspective, it is as important as ever to be different, considering historically high levels of market concentration, near extreme valuations and elevated expectations in the largest benchmark constituents, the procyclical market dynamics fueled by non-fundamental buyers (i.e., passive), and increased participation by retail and short-term investors. However, in the short term, many investors face strong disincentives to deviate from the crowd due to career risk and pressure to meet near‑term relative performance expectations. This dynamic is reflected in a recent Merrill Lynch survey showing institutional investors view AI disappointment as among the greatest risks in markets – yet they are almost universally overweight AI enablers. As large investors in our own funds and believers in time-tested processes, our thinking is clear and long-term, and our interests are aligned with our clients.

Risks and Disruptive Forces

Among the many prevailing risk considerations – from micro to macro – it is important to account for well-documented issues (e.g., elevated geopolitical risks) while searching for those not adequately reflected in market discourse. Two that warrant particular attention are: 1) potential disappointments in the AI narrative and 2) implications of rising long-term interest rates – most notably in Japan, a key source of global liquidity.

Given the significant impact of AI enthusiasm on equity markets and the global economy more broadly (through wealth effects and fixed investment), any disruption to the prevailing AI narrative could have far-reaching consequences. AI enablers and hyperscalers comprise approximately 32% of the S&P 500 and 23% of the MSCI World Index.3 Yet, numerous uncertainties remain, including the pace of end-market demand, supply-side constraints (energy and semiconductors), the timeline for translating investment into economic returns, capital intensity, borrowing capacity, and potential social and political disruption. Regarding this latter point, we believe social and labor implications of AI will be a surprisingly large issue during the US mid-term elections and those in the coming years. Without a doubt, AI is a generational, transformative technology, but there is also little room for disappointment in any aspect of its captivating narrative.

As for rates, media attention has focused on short-term policy rates – most notably at the US Fed and the corresponding political tensions. However, in the long term, market-determined interest rates are ultimately more consequential. These rates reflect sovereign conditions, underpin the cost of capital, and significantly influence asset prices. Global bond markets are exhibiting signs of stress. In the US, elevated debt levels, persistent fiscal deficits, heavy issuance, and questions surrounding Federal Reserve independence could place upward pressure on long-term yields (not to mention dollar instability). Similar dynamics are emerging in Europe, as governments embark on expanded deficit spending to support both defense and social priorities.

Japan warrants special attention at both the short- and long-end of the yield curve. During its multi-decade period of low interest rates and aggressive quantitative easing, Japan was a major source of global liquidity. According to Deutsche Bank, Japanese investors have accumulated more than $3T in foreign assets, including an estimated $1.1T in US Treasuries. As domestic yields become more attractive, a reversal of these flows could reduce demand for non-Japanese bonds and other global assets. At the short end, rising rates also increase the risk of an unwinding of yen-funded carry trades, which could destabilize global markets.

Performance Review and Fourth-Quarter Activity

High-beta and cyclical businesses led market performance in 2025, especially during the post-Liberation Day rally. Keeping up proved difficult. In international markets, European banks and defense-related equities dominated performance during the remainder of the year, as higher-beta exposures attracted strong thematic inflows. Our portfolio has favored steady compounding businesses or those with idiosyncratic drivers and lower overall risk (beta) over deep cyclicals and highly valued market leaders driven by optimistic growth narratives. This positioning was valuable leading up to Liberation Day and during other market disruptions, but has weighed on our relative results during this late-cycle high-beta rally.

In the fourth quarter, our largest sources of negative attribution were consumer discretionary (Alibaba, Sony Group) and financials (Everest Group, Willis Towers Watson). Importantly, we maintain high conviction in these businesses. Positive attribution came primarily from industrials (Deutsche Post), information technology (Samsung), and our underweight positioning in communication services.

Despite strong operational execution, Alibaba shares declined following reports of weak holiday-season sales in China. While the company is not immune to broader macroeconomic headwinds, it continues to make meaningful progress toward becoming China’s leading AI-driven cloud provider and strengthening its core e-commerce franchise. Investor sentiment for Sony was pressured by near-term concerns about rising memory prices impacting PS5 hardware margins. However, Sony’s profitability is increasingly being driven by software and network subscriptions. Shares remain attractive, with ongoing simplification and efficiency initiatives underpinning a multi-year improvement in Sony’s margins and cash flow. Everest Group and Willis Towers Watson lagged more cyclical financials amid concerns about softening insurance growth; however, both companies operate resilient businesses that benefit from rising insurance demand and an improved competitive backdrop, which will help them sustain attractive profit growth over the medium-term.

Strength among our industrial holdings was led by Deutsche Post, which continued to improve cost efficiency through initiatives to simplify its corporate structure and enhance accountability. These changes are driving higher returns on invested capital and improved earnings power despite a subdued transport environment. Among our technology investments, Samsung outperformed, as it improved its high-bandwidth memory (HBM) positioning more rapidly than investors anticipated while maintaining supply discipline in conventional DRAM within a three-player oligopoly.

During the quarter, we initiated two new investments (Euronext, FinecoBank) and exited four positions (Henkel, MinebeaMitsumi, Sands China, Sony Financial). Euronext has invested significantly to strengthen its pan-European exchange platform, which we believe will enhance competitive positioning and earnings durability. FinecoBank combines a leading Italian digital banking franchise with a differentiated financial-advisor network, offering best-in-class service and attractive long-term market share potential.

We exited MinebeaMitsumi and Sands China as their shares approached our estimates of intrinsic value, limiting further upside. We sold Henkel due to persistent challenges in achieving volume growth in its consumer division and a reassessment of the structural advantages of its adhesives business. Finally, we exited Sony Financial following its spin-out from Sony Group, as it has higher balance sheet risk and limited share liquidity relative to our standards.

Portfolio Positioning

Table 1 illustrates our core underlying industry exposures and where our portfolio differs most meaningfully from benchmark indices.

Overweight: Non-bank financials (property & casualty insurers, insurance brokers, exchanges); select emerging-market banks; health care equipment; food and beverage franchises; and consumer discretionary companies operating in structurally attractive markets.

Underweight: Cyclical industrials and developed-market banks; pharmaceutical companies; utilities; communication services; and select technology segments.

From a risk perspective, the portfolio exhibits meaningfully lower systematic risk than the broader market and positioning that differs substantially from benchmark indices. We believe this stance is prudent and positions us well to deliver superior risk-adjusted returns over time.

Closing Thoughts

AI-driven innovation is reshaping industries and creating remarkable long-term potential. At the same time, the pace of investment and elevated expectations around the AI theme, paired with the implications of rising long-term interest rates, introduce meaningful risk for markets. Against this backdrop, many high-quality international businesses with durable earnings, strong balance sheets, and reasonable valuations remain underappreciated. Our focus on fundamentals and margin of safety helps us to uncover opportunities beyond crowded parts of the market. We believe our disciplined approach and positioning – while challenging to be different now – provide a strong foundation for long‑term value creation and an attractive client experience through various market environments.

Please contact us if you would like to discuss these or other matters in greater detail. Thank you for your interest in Altrinsic.

Sincerely,

John Hock

John DeVita

Rich McCormick