I recently returned from Japan after meetings with more than 30 companies across multiple industries. The trip reinforced my view that meaningful change is coming, though the path forward will be complex. I have traveled to Japan and watched its steady progress over many years, and while risks remain, this was among my most productive research trips.

Japan now has the highest inflation rate in the developed world. After decades of deflation and heavy central bank intervention, Japanese bond markets are unshackled and markedly volatile. We believe the implications remain underappreciated. Bond market stress and lagging AI adoption are key medium-term risks, but opportunities are also emerging, driven by improving capital allocation, narrow Japanese market leadership, and a significant upcoming corporate management transition. As Japan unlocks value, bottom-up fundamental research matters more than ever.

Opportunities Beyond Narrow Market Leadership

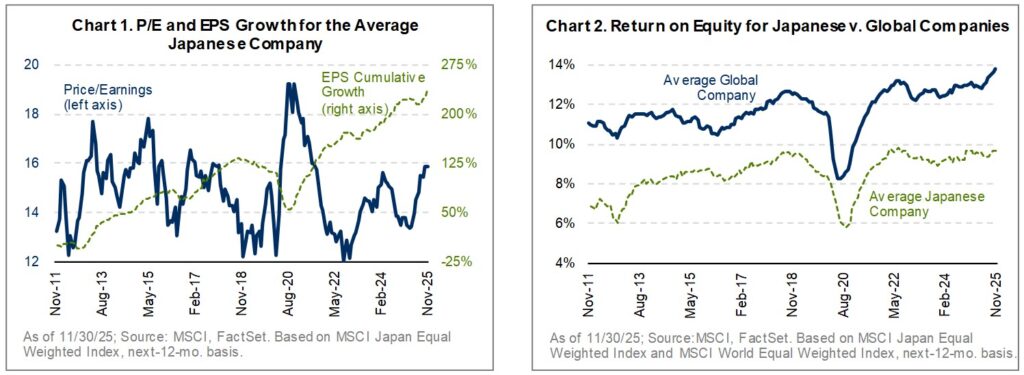

Narrow leadership has defined global equity markets for years, and Japan is no different. Over the last five years, just 20 stocks accounted for nearly all of the MSCI Japan Index’s gains, while more than half of index constituents declined. This divergence is creating opportunity, however, as the average Japanese company continues to grow earnings at a double-digit rate and is steadily improving return on equity.

At first glance, Japanese equities do not look cheap. Valuations are near cycle highs (Chart 1) and broadly in line with global peers. However, I met several companies with credible plans to close the ROE gap versus international competitors (Chart 2). Management teams are increasingly focused not just on costs and balance sheets, but on innovation and growth. During a deep discussion on pricing and innovation with one of our holdings, Murata Manufacturing, management emphasized using scale and manufacturing expertise to capture a larger share of customers’ next-generation technologies, particularly in AI. These areas of innovation rarely show up in simple screens; instead, they emerge through sustained, on-the-ground research.

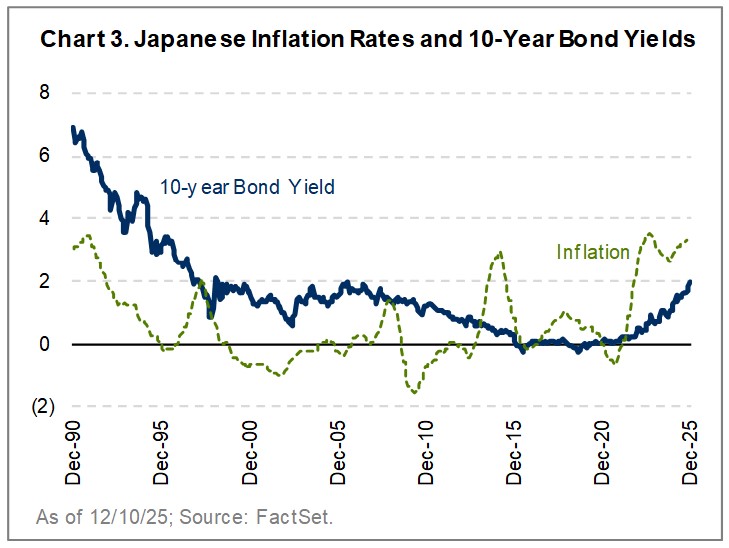

Inflation and Interest Rates – a Regime Change

Japan is undergoing a regime change in inflation and interest rate policy. The consequences will be far-reaching, as Japan’s credit market is the world’s third largest, with over $16T in assets. Higher global inflation, a tight labor market, and a weak yen have pushed domestic inflation to its highest level in nearly 35 years (Chart 3). Additionally, leadership teams believe that wage growth is now structural. During a meeting with Resona Bank, a regional bank long known for cost discipline, leaders expressed a willingness to boost salaries by 5%, consistent with what I heard across many companies. Steady salary inflation will be key to Japan ending deflation for good, but low-margin businesses with limited pricing power may struggle with profitability and recruitment.

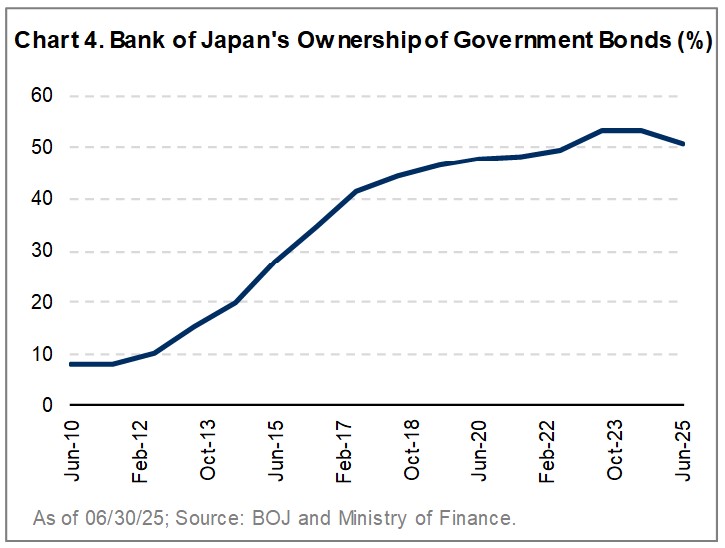

Years of deflation expectations and aggressive BOJ easing suppressed bond yields. The BOJ now owns more than half of outstanding government bonds (Chart 4) and has limited capacity to intervene further. Yields are rising quickly: 10-year yields have nearly doubled this year, and 30-year yields are at a 25-year high. My sense on the ground was that investor and corporate uncertainty was elevated, a view reinforced by the CEO of Japan Securities Clearing Corporation, the leader in interest rate derivative clearing. Demand for their products, which help hedge interest rate risk, has increased sharply, with volumes up nearly 50% year-to-date versus 2024.

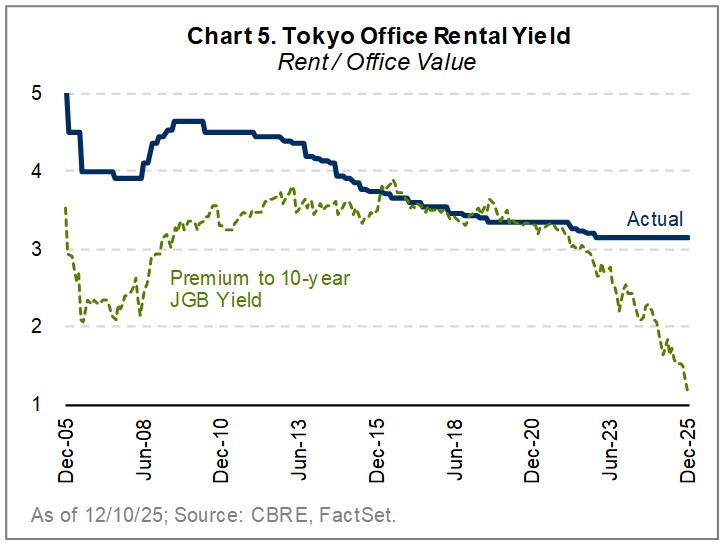

Higher yields will affect many sectors, especially real estate. Japanese commercial real estate has enjoyed strong price appreciation amidst negative interest rates and low vacancies, with Tokyo office prices nearly doubling over the last decade alone. That dynamic is now reversing. Average rental yields are just 3.2%, only a modest premium to 10-year bond yields (Chart 5). A return to historical spreads would imply price declines of more than 35%. Europe’s experience could be instructive; commercial property prices fell 14% after rates normalized in 2022.

On a positive note, an end to deflation may finally push the enormous stockpile of household deposits into equities and other investments, providing a tailwind for markets. Japanese households hold roughly half of their financial assets – over $7T – in cash and deposits, nearly matching the total market value of Japanese equities. Tax incentives have improved, and now that households are losing money in real terms by holding cash, the tide may turn. On the ground, the data are encouraging. Mutual fund inflows are rising, and Japan Exchange Group’s CFO confirmed a spike in household equity trading (+55% YoY). If sustained, this would be a meaningful tailwind for Japanese equities.

Behind the Curve on AI Adoption

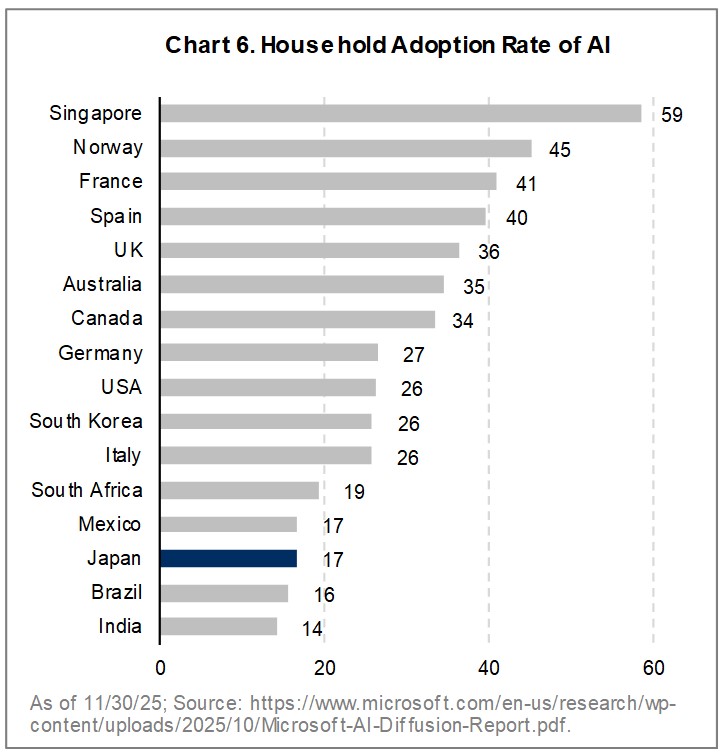

Japan’s slow adoption of artificial intelligence poses a longer-term risk to growth and competitiveness. Household AI usage is well below that of other developed markets, which feeds into weaker corporate adoption. Microsoft’s AI Diffusion Index shows Japanese household AI usage at roughly half the level seen in the UK, Australia, and Canada, among others (Chart 6).

This adoption gap was also evident in my recent discussions across industries. Most management teams are well behind global peers in all forms of AI, often still in early pilot stages and struggling with data and technology infrastructure. Anthropic’s AI Usage Index ranks Japan 28th globally in business AI adoption – utilization is less than half the US level and below much of Europe. I believe Japanese companies will attempt to catch up, but starting several years behind could have lasting competitive consequences.

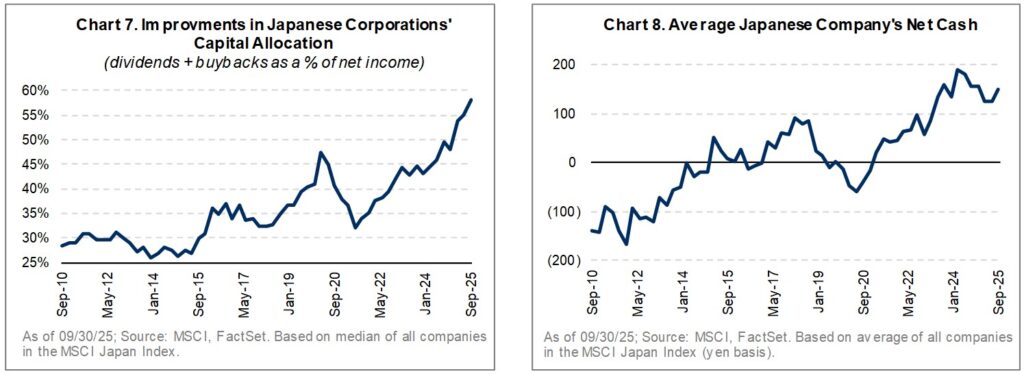

Capital Allocation is Improving – Slowly

Corporate governance and capital allocation continue to improve in Japan. Dividends and buybacks have risen from 30% to nearly 60% of net income over the past decade (Chart 7), in line with global norms. R&D spending is also up nearly 60%, suggesting a new heightened focus on innovation. Still, inefficiencies remain, with many companies allocating capital across too many non-core businesses. For example, during a meeting with Canon Group, the team showed little interest in narrowing a highly diversified portfolio – everything from inkjet printers to in vitro diagnostics to digital cameras – despite sub-5% net margins. Also, while shareholder returns have improved, hoarding excess capital also remains common, with the average company holding roughly $1B in net cash (Chart 8). We believe progress will continue…but gradually.

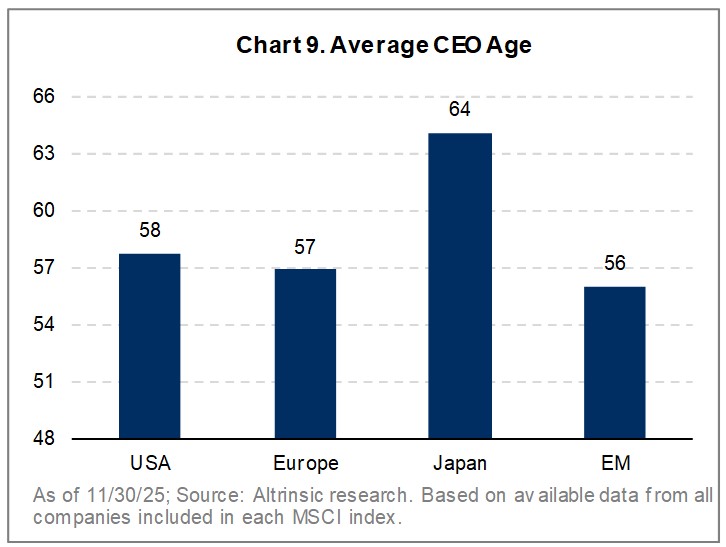

A Major Leadership Transition Ahead

Japan faces a significant corporate leadership turnover during the next three to five years. The average Japanese CEO is now 64 – well above US, Europe, and EM averages (Chart 9) – up from 55 two decades ago, and nearly half are over 65. In preparing for my trip, I found that many of the companies I would be meeting had CEOs aged 65+, so the growing issue of succession planning was high on my agenda. We believe the next few years will be marked by a transition to a generation of corporate leaders who cut their teeth during the Abenomics era. While not all will pursue bold reform, many are likely to place greater emphasis on shareholder value, simpler business structures, and improved returns on capital.

Closing Thoughts

At the dawn of Abenomics in 2012, the investment opportunity set in Japan was considerable, with most stocks trading below their book value and offering myriad ways to improve costs, capital allocation, and innovation. Fast forward to today, and many companies have progressed, but valuations have as well, with the average Japanese company now trading over 1.5x price-to-book. Successful investing in Japan over the coming decade will require even more conviction in new leadership and their ability to execute strategically amid rising uncertainty. As in other regions, Japan’s concentrated market leadership is creating abundant investment opportunities beyond its largest firms. This may lead to greater portfolio differentiation in the short term, but we believe it is the right long-term approach for our clients.