Ninety-eight percent of manufacturers in the United States do not use any form of robotics, according to Jordan Kretchmer, co-founder and CEO of Rapid Robotics. As the world ages, working populations shrink, skills gaps widen, and supply chains fragment, we believe that automation will be increasingly important. Equally, evolving trends related to supply chain dynamics and technological innovation are poised to transform the corporate landscape and consumer experience. This provides significant opportunity for companies and investors worldwide.

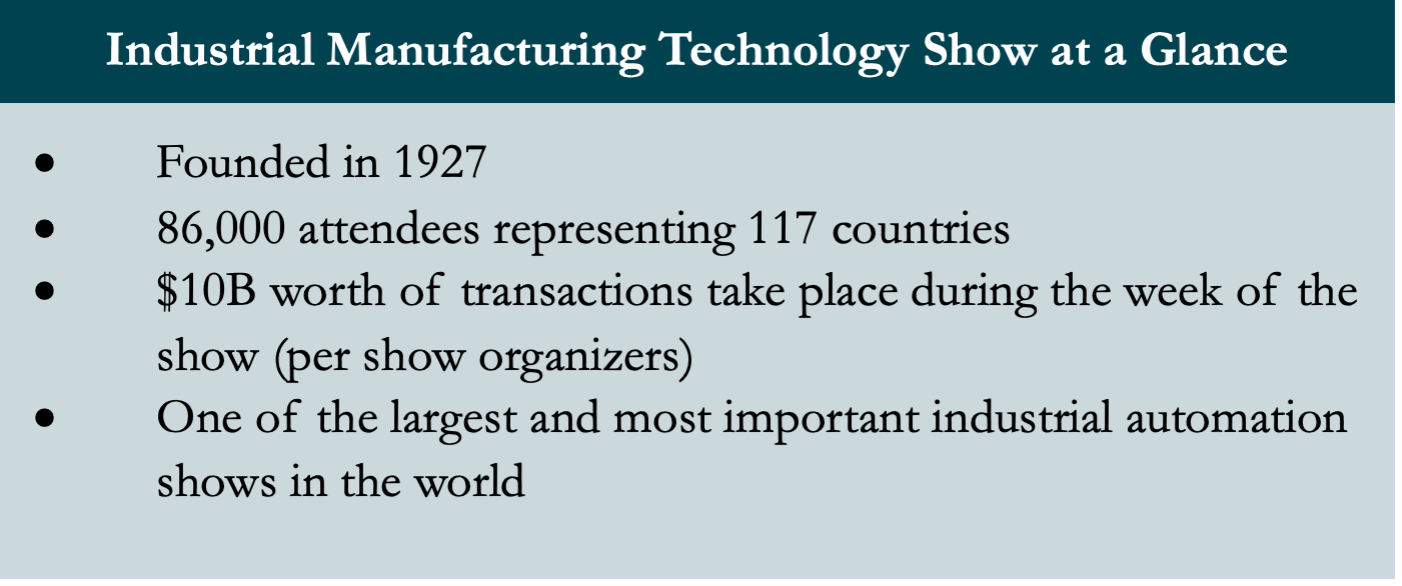

I recently attended the Industrial Manufacturing Technology Show (IMTS) in Chicago to gain further insight into this industry ecosystem. This venue provided an excellent opportunity to gain a 360-degree perspective on the industry and emerging trends. Meetings included companies and buyers that spanned the value chain from highly innovative startups to 150+ year-old machine tool manufacturers. I also spent time with venture capitalists and private equity investors, representatives from the Department of Defense, and executives in charge of automation from prominent manufacturers worldwide.

Discussions at the show reinforced a number of key themes that we have independently identified through our bottom-up research. Specifically:

- Automation: The shortage of skilled labor was cited as the #1 issue facing companies. This is increasingly viewed as a “generational issue,” spurrifng innovation and investment. The required capital investments remain a hurdle, but long-term demand trends are favorable.

- Supply Chain Fragmentation: Supply chain re-shoring is becoming an issue of national security. The Department of Defense wants to ensure that the United States has both the technological prowess and capacity to manufacture key systems on its own soil. Rather than seeking a purely economic return, governments are investing to further long-term policy goals. As a result, supply chain investments are likely to remain elevated while efficiency is likely to decline. The resultant cost increases have negative implications for companies operating at, and being valued on, peak margins.

- Integration of Technology: Improvements in technology are slowly reshaping the industrial landscape. Innovation has reached 30-year highs, but the impacts will take many years to flow through. Winners are likely to emerge among the large players that can acquire and integrate new technologies to expand the breadth of their offerings, in addition to new, innovative technology startups.

In our view, companies throughout the world stand to benefit from these trends. In Chicago, Japanese companies showcased advanced technology, which, coupled with a reputation for quality, could give them an edge. Meanwhile, European industrial companies displayed a wide breadth of products, making them particularly well placed to drive innovation and evolve their business models. We own several companies poised to benefit, including Siemens, Assa Abloy, Deutsche Post, and MinebeaMitsumi.

Technology impacts every industry, including industrial automation and the end markets where this is applied. Innovation is critical to address secular labor shortages, fragmenting supply chains, and rising costs. Companies that embrace technological change will gain the opportunity to expand market share, evolve business models, and improve financial productivity. This presents an opportunity for significant value creation. As long-term investors with a global focus and commitment to deep industry engagement, we are well positioned to capitalize on these emerging value opportunities.