Earlier this spring, I traveled to South Africa (SA) to search for new investment ideas, deepen our local network, and test our investment theses across several companies and industries. Ten days on the ground allowed me to visit numerous ports, infrastructure sites, manufacturing and distribution facilities, and retail assets from Durban in KZN¹ to Cape Town to Johannesburg and surrounding areas. I also met with several ministry officials and contacts at the South African Reserve Bank (SARB – South Africa’s central bank) to further inform our views on the policy and regulatory fronts. I rounded out the trip with 24 meetings with companies’ senior executives.

During my visit, I also attended one of the oldest investing conferences in the country, which has been running for 25 years. We were one of only a handful of North American investors at the event, which draws less than 25% of its audience from foreign countries. Our conclusion: South Africa continues to be ignored by many global investors.

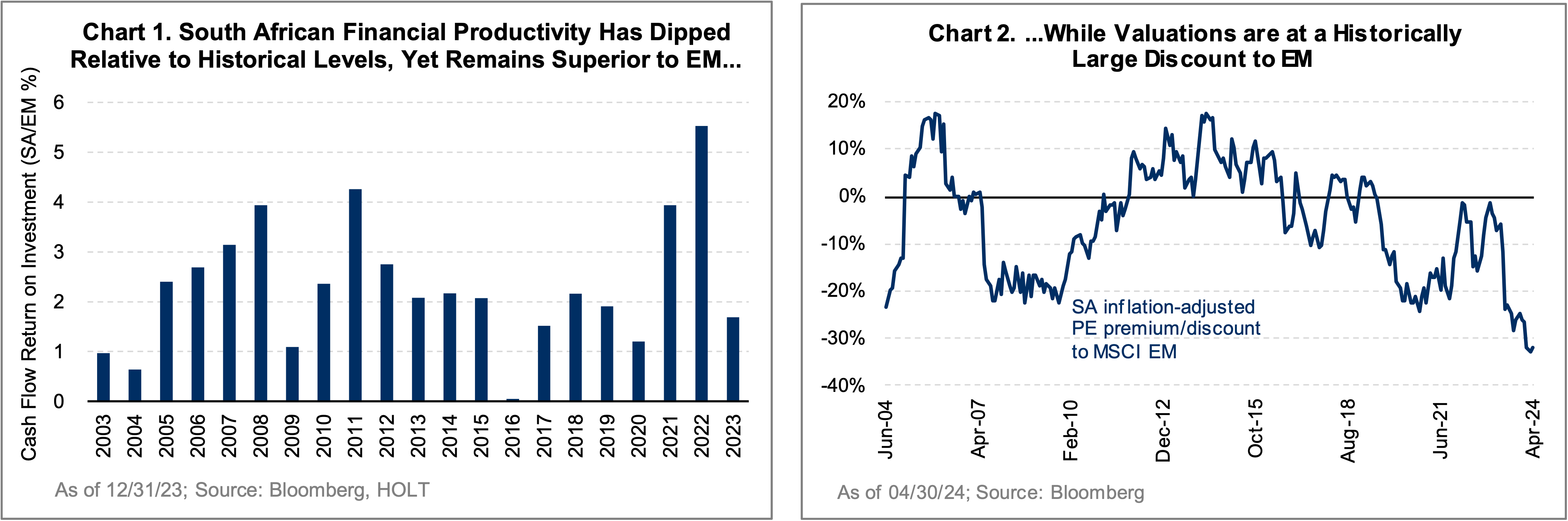

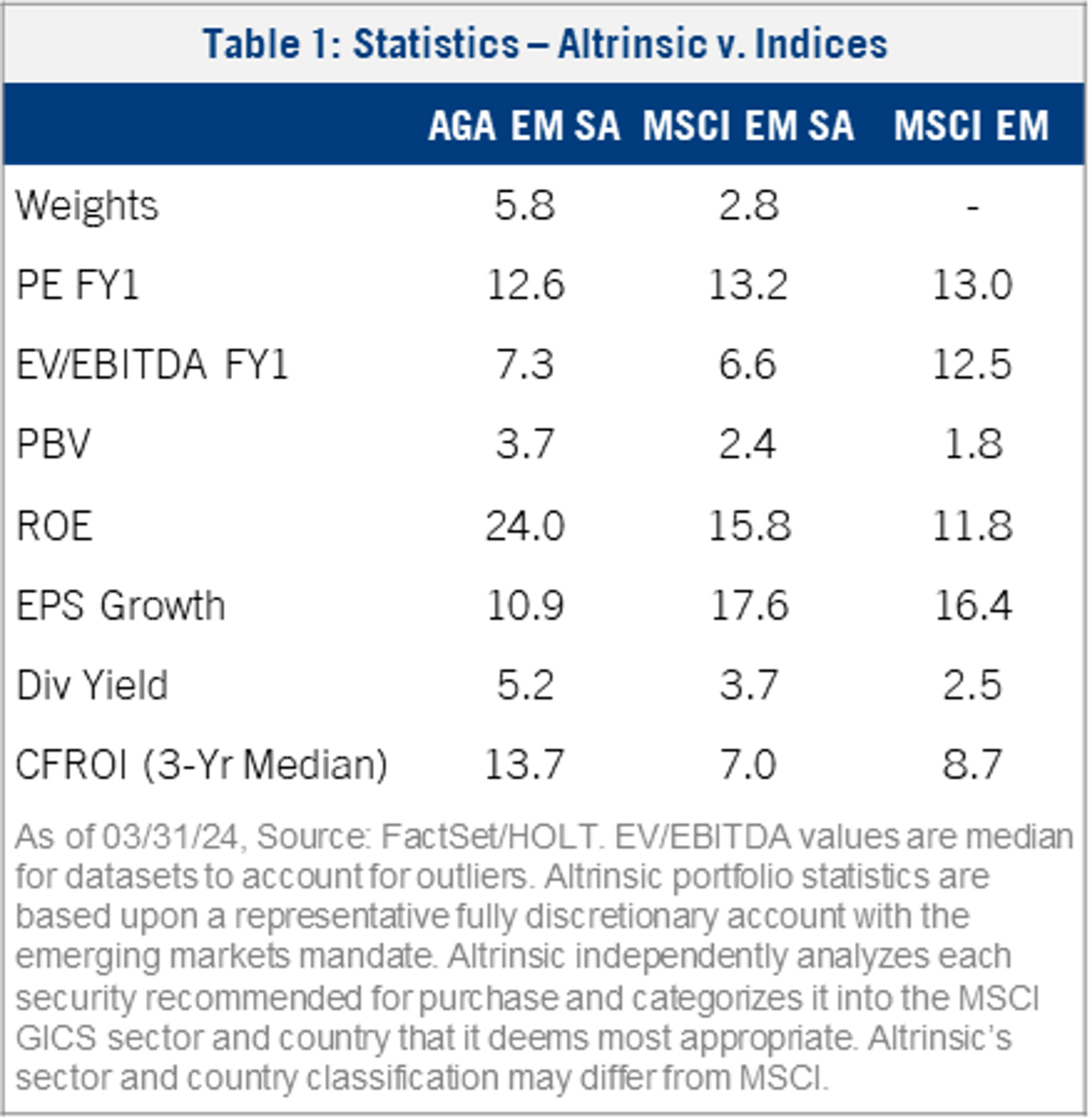

Leading EM indices allocate less than 3% to South Africa. Why, then, is this an important destination for us (beyond the beautiful nature and parks full of exotic wildlife)? Since the inception of the Altrinsic Emerging Markets Opportunities strategy in April 2021, we have uncovered many highly productive yet undervalued companies (Charts 1 and 2). Currently, we are invested in six companies across industries, amounting to a 5.8% exposure – one of our largest, most differentiated, and most contrarian exposures relative to the MSCI EM Index².

The trip reinforced many of our holdings’ investment theses, and four key takeaways stand out: a) encouraging infrastructure trends; b) sustainable developments in renewable energy; c) early adoption of technology; and d) South Africa’s strategic position as an African/frontier portal.

1. Encouraging Infrastructure Trends…But Still Work to be Done

The feedback from private players, including infrastructure development and construction materials companies, logistics providers, freight companies, and port operators, suggests that engagement with the government on private sector participation and investment is limited and not perfect…but moving along.

Over the last two quarters, there has been increased tendering activity and ongoing negotiations. In some cases, contracts with the government are ready to be signed. Everyone I met was optimistic about the new Transnet³ CEO and the stability she should bring to government-backed infrastructure ecosystem. One of our holdings, Bidvest (BVT), a South African-based conglomerate with a diversified portfolio of industrial service businesses, is poised to benefit from such infrastructure improvements, which should unlock higher levels of growth and profitability through better efficiency.

From multiple vantage points in Durban – the plane, my hotel, various locations around the city – you can see at least fifteen ships waiting offshore for port slots to open so they can dock and unload. Durban is an important port, not just for SA but also for the broader Southern Africa region. For example, copper and cobalt exports from Congo and Zambia are also exported from here.

Unfortunately, the port facilities in Durban currently represent a missed opportunity for South Africa. The geopolitical choke points created in the Red Sea and the resulting cargo/shipping diversion around Africa could have been a pivotal moment for Durban, but the sub-par road networks and associated logistical inefficiencies have added further complexity into an already-challenged supply chain, rather than serving as a release valve. During this period, Durban benefitted from its ability to serve as a refueling location, but the potential benefits could have been much more extensive had it been prepared to better manage a higher volume of activity. This represents an opportunity for South Africa, as it is a critical piece of the country’s infrastructure and one that would allow it to stand out among other EM regions.

Companies including Mr. Price, Vodacom, and Clicks, all of which source products or components from abroad, have experienced extended working capital cycles and have been forced to manage their free cash flow more tightly. The improved discipline around working capital management – a key driver of sustainable long-term financial productivity – was apparent in conversations with company executives at all of these organizations. If the government continues to take steps to improve infrastructure throughout the country, this will serve as a further tailwind for these organizations.

2. Sustainable Developments in Renewable Energy

Almost a year ago, we wrote about the electricity shortage in South Africa and how much we believed the market was overlooking the progress being made. During this latest trip, we experienced a two-to-three-hour load-shedding window while in Durban, but less than 15% of our conversations touched on the energy topic – a stark departure from last year when it was very top of mind. Most of our conversations this time centered around alternative energy plans and the contingencies that most private businesses have put into place.

During our discussion with Bidvest executives, we learned that retail volumes continue to be strong, driven by installations of solar panels on rooftops, but the key demand driver is emerging from commercial and industrial projects. BVT operates a commercial product line in renewables, and its order book has been growing, with future growth prospects also looking very compelling. Power generation by independent producers doubled over the last three years, and it is expected to double again over the

next seven to ten years. Associated repair and maintenance cycles should also provide more visible and profitable cash flows.

Overall, the broadening and maturing renewable sector presents a more sustainable operating model for South African corporates, underpinning the ability to grow and operate despite foggy and limited improvements at the key state-owned electricity generator, ESKOM.

3. Early Adoption of Advanced Technologies

A recurring topic during our meetings and site visits was the early adoption of advanced technologies and, in many cases, AI. As an operations enhancer, AI can be used to optimize cost management practices and make smarter (and faster) business decisions. We observed several instances of AI being used in ways that make standard developed markets practices look quite outdated.

In the retail sector, AI is used to control operating costs (electricity, energy) in pharmacies (Clicks) and to identify popular trends in apparel fashion and adjust supply chain and working capital responses more rapidly (Mr. Price (MRP)). To deepen our perspective about MRP and to see firsthand how technology is used within this innovative company, we visited with MRP’s Group Logistics Director and Head of Distribution at their Hammersdale Distribution Center, the only one of its kind in Africa.

In the health care sector, hospital operators are using AI to enhance their super app, engage customers, and draw traffic into their facilities, therefore addressing asset turns. And in the education sector, companies are using AI to track and benchmark the productivity of teachers and the progress of students across schools, allowing for targeted improvement plans. Despite being tucked into one of the world’s most remote corners, it was exciting to see first-hand that South African companies are relatively agile and advanced in applying many of the latest technologies. This rapid adoption ultimately supports better efficiency and drives margins, which are key components of the financial productivity story in SA.

4. South Africa Cements its Role as an African/Frontier Portal

South Africa’s geographic position and numerous ports make it an attractive option as an international trade and transit hub for businesses based in nearby countries. While all our SA holdings are driven by strong internal, hyper-regional demand, they also stand to benefit from important and impactful earnings drivers linked to the Greater African regions – frontier markets. Two key examples are Standard Bank and Clicks.

-

- Standard Bank is Africa’s largest continental lender, present in over eighteen countries from the SubSaharan region to both the East and West Coasts of Africa. More than 40% of the bank’s earnings are generated by its ex-SA business. Standard Bank’s historic presence and local know-how across many countries allow it to maintain its leading market share, superior risk standards, and pattern of generating accretive returns. Major South African corporates with increasing aspirations to expand their business across the continent frequently look to established institutions (including Standard Bank) to fund their efforts. These dynamics provide ample growth opportunities for the banks.

- Clicks is a leading health and beauty-focused retail and supply group in South Africa that operates pharmacies and is the leading national pharmaceutical wholesaler/distributor. In a meeting with the company’s CEO and CFO, they re-emphasized the accretive growth offered by Botswana, Namibia, and Portfolio Manager Alice Popescu (center) kicking the tires at the Mr. Price distribution center with Group Logistics Director, Werner Pelser (left) and Head of Distribution and Logistics, Tim Proome (right). Photo Credit: Alice Popescu Eswatini. While not a main business driver, profitability in these countries is typically better than in SA, and much of the difference is lower operating costs – lower minimum wages, less expensive pharmacists, and other favorable elements, including less theft, better rent arrangements, and FX support.

Throughout our visit, the idea of South Africa serving as a great portal to additional frontiers in Africa was reinforced. Investors in SA can access those fast-growing regions and benefit from a series of dynamic underlying growth trends in a risk-controlled and liquid manner via some of the continent’s largest, strongest, and highestquality private companies.

Risks

We returned from SA feeling excited about growth and margin improvement opportunities for many businesses, but we must remain mindful of key risks in the country. Our experience investing in emerging markets over the last few decades has taught us that if you are investing in strong franchises that have a proven ability to generate strong cash flows despite adverse economic backdrops, the risks tend to be less micro and more macro-driven: politics, the economy, and the global cycle.

- Politics – Glass Half Full: Jacob Zuma, a previously indicted president of SA, had just launched a new political party a few months before our visit, resulting in a heightened level of volatility and uncertainty surrounding the upcoming national elections on May 29th. Rather than a major risk, we view the current electoral cycle as an opportunity. Local political analysts in Johannesburg and Praetoria underscored the themes emanating from our interactions on the ground in Durban and Cape Town – namely, the advent of a coalition that can seemingly hold the leading political party’s (ANC) feet to the fire regarding growth targets, corruption measures, and more. Locals we spoke with – from drivers to baggage handlers to tour guides – seemed disappointed by the ANC’s actions and policies and therefore favored the new coalition. Interestingly, this sentiment runs contrary to Western media coverage, which has been painting the idea of a coalition in the worst possible light. Locals recognize that long-standing issues with government corruption have impeded the country’s growth and development and impacted living standards, and it seems there is an appetite for change. Beyond the coalition’s potential impact, ANC’s power will likely continue to be diluted given a populous younger generation that does not have the same affiliation with the Mandela days. These changes, while still unknown in terms of timing and scope, could present important opportunities for SA corporates.

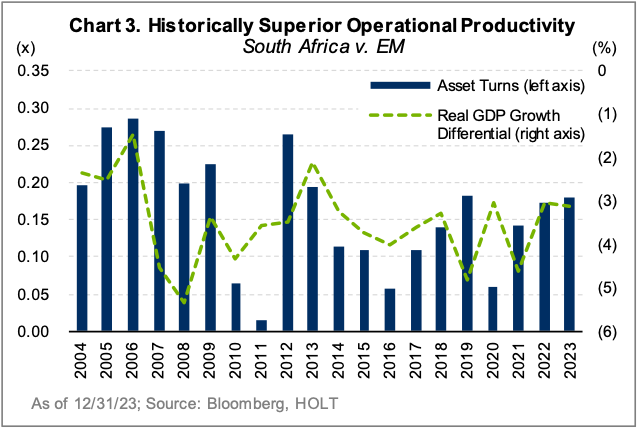

- Economy – Economic Mismanagement is a Well-Known Achilles Heel: It is very easy to develop an unappealing top-down picture of SA. Despite its young population4, the country has been hamstrung over the last decade by a high unemployment rate, a mediocre low single-digit economic growth rate, and stagnated GDP per capita. Additionally, while inflation seems to be normalizing post-pandemic, high government debt levels (71%) do not allow for large fiscal spending campaigns, and the SARB remains focused on stability. Higher inflation has been a consequence of this inaction. On a historical basis, we do not believe the South African rand is expensive but also do not foresee notably lower interest rates, leading to minimal opportunity for substantial monetary stimulus. Despite these negative top-down trends persisting for the better part of the last decade, plenty of local companies have delivered superior financial productivity and resilient earnings results relative to the broader emerging markets universe. Higher financial returns have been supported by operational prowess, as businesses have managed their asset turns well at consistently superior levels to broad emerging markets (Chart 3).

- Global Cycle – A Slowdown Could Create Real Headaches: As a key commodity and materials exporter, the global cycle is important for South Africa. Not only is it critical to see continued production growth across its mining industry, which supports the current account, but also the country must focus on improving its infrastructure and eliminating bottlenecks. Why? First, if global demand dips, SA needs to ensure that its local operations are not creating additional pressure. Delivering what has been sold is vital to success during global slowdowns. Second, greater efficiency within SA’s infrastructure will enable the country to capitalize on long-term economic growth trends and recovering macro tailwinds (particularly related to globally priced mining materials including gold, platinum, etc.).

Conclusion – Maintaining Perspective in the Savannah

The investment landscape in South Africa is one of the most mature in EM, as it has been developing and growing for decades. That said, it is also a very dynamic market that deserves careful observation and analysis, ideally informed by first-hand experiences and deep conversations with local leaders.

In conversations involving local investors, we encountered frequent bias against, and a smaller appetite for, investing in certain SA companies. Those closest in proximity to local businesses sometimes miss the broader opportunity we see. Investing in SA companies that are pursuing growth in large yet complicated places (including Nigeria on one end or Australia on the other) requires a broad perspective to understand key drivers and market dynamics. Without a global lens and nuanced understanding of different regions, some companies might appear, on the surface, to be less appealing. We see this as an opportunity to find underappreciated value by leveraging our global EM perspective, decades of experience, and time spent understanding complex emerging markets to identify quality companies with long-term drivers of sustainable growth.

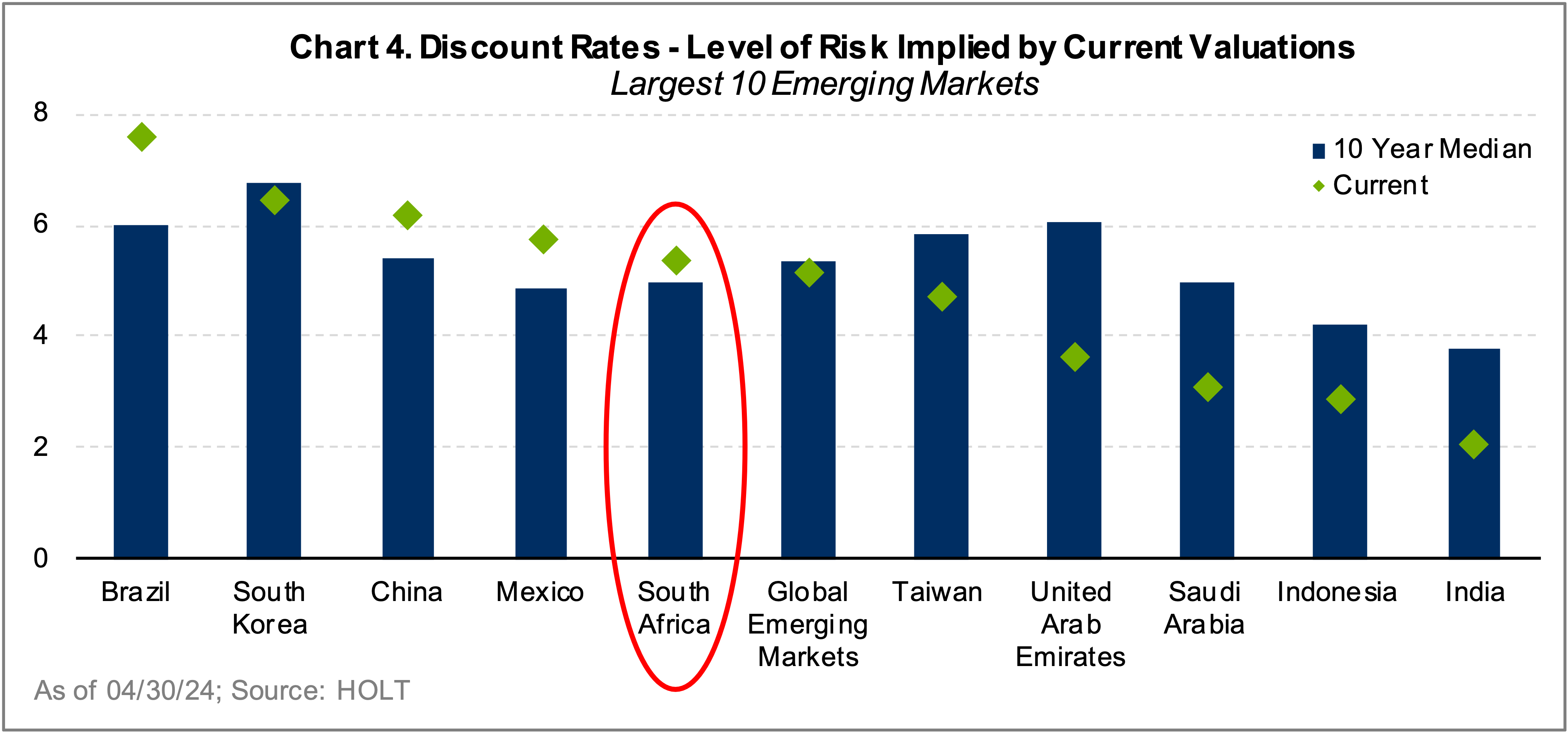

Similarly, in evaluating risk (Chart 4), we believe the average local investor too quickly focuses on areas where SA falls short (example: governance grey listing5 without assessing the broader picture – or forgetting that SA is still very much an emerging market. Largely, we believe the perception of risk is misaligned with the reality of the situation. For example, a solid track record of financial productivity could contribute to lofty domestic expectations, informed by comparisons to developed markets including the UK or Australia; underperforming these standards could lead to an overly inflated risk profile, driving valuations to unjustifiably low levels as compared to similar quality businesses in other emerging markets.

South Africa is a vibrant emerging market country with a significant demographic dividend and a highly attractive set of cash flow generative businesses. Watching some of these businesses operate in the worst of times – the post-pandemic period – has been informative and impressive. Our current overweight exposure is differentiated versus the benchmark (Table 1) and contrarian versus the consensus view. The future remains exciting; a tumultuous year of elections, a deeply discounted market (in historical and relative terms), and hesitation among foreign investors contribute to numerous compelling investment opportunities with attractive risk-reward profiles across the South African savannah.

By the Way…

While most of my time was spent in meetings, I did manage to fit in a surprisingly challenging hike up Table Mountain via the India Venster Trail (photo at top of the page). If you find yourself in Cape Town with time to kill and an appetite for a good workout, I highly recommend it. The views are amazing – just make sure you are prepared!