Many people travel to the Andes for its stunning landscapes, thrilling adventures, unique biodiversity, and ancient civilizations. For me, it is the underappreciated investment opportunities (though I also enjoy the other attractions!). Liquidity concerns and political risks have caused investors to overlook the Andean region in favor of more well-established LatAm countries including Brazil and Mexico. But I recently traveled to Chile and Peru to uncover deeper insights about an area that benefits from a less recognized, yet quite compelling, narrative. Demographic tailwinds, impressive economic growth, an increasing culture of innovation and disruption, and scalable regional expansion opportunities for both domestic players and global emerging market companies involved in the EM de-coupling movement form the basis of an exciting, under-the-radar investment landscape.

As we approach International Women’s Day, I would also be remiss not to mention the region’s impressive progress on financial inclusion and women’s economic empowerment, which I had the distinct pleasure of experiencing firsthand at the largest informal market in the Americas.i (A special feature section on the women of the Gamarra Market – and the technology fueling their advancement – is included later.)

A Compelling Foundation for Long-Term Growth Prospects

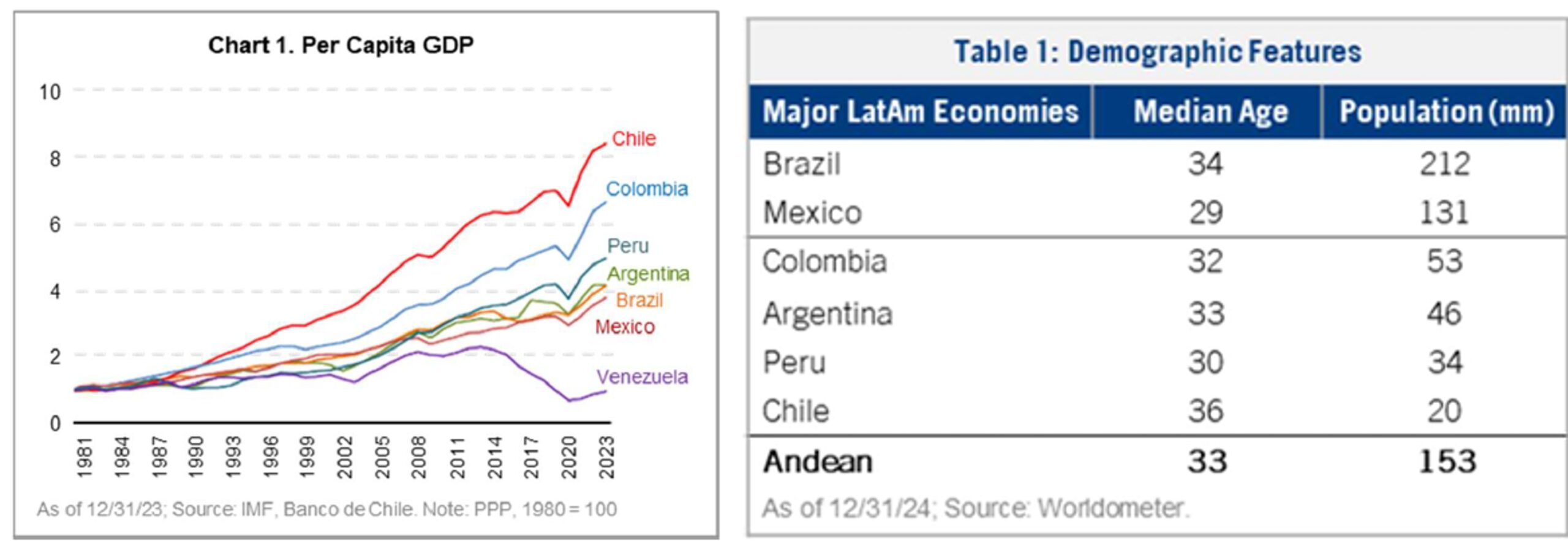

The Andean region presents appealing underlying demographic features (Table 1), which serve as a strong foundation for longer-term growth prospects. The regionii boasts a population of about 153 million, all sharing a common business language. Additionally, with a median age of 33 years, labor capital is attractive, and the consumer base is robust.

From an economic perspective, Andean economies are generating faster growth rates than other parts of the Latin American region, and per capita GDP for several Andean countries has risen above the likes of Brazil and Mexico, with notable separation over the past decade or so (Chart 1).

Given this combination of demographic and economic tailwinds, many companies have identified the Andean region as an important growth avenue, with scalable regional expansion opportunities. Penetration stories – from smartphones to financial services inclusion to the formalization of modern trade – are commonly included in the business driver narrative. We expect to see both domestic and global emerging markets companies driving and participating in this regional development story.

Our Emerging Markets Opportunities strategy currently holds two investments in the Andean regionii, equating to about 4% of our overall portfolioiii. By comparison, these countries represent less than 1% of the leading passive benchmark (MSCI EM Index). More broadly, our Andean exposure contributes to our differentiated Latin American positioning, which also includes noteworthy exposure to Brazil (8%) and Mexico (6%).

Stability, Strength, and ROE on Sale in Chile

The Chilean market is more mature than some of its Andean counterparts, presenting both challenges and opportunities. Benefits in terms of stability and strength tend to be offset by more limited topline growth versus companies operating in less mature economies. With that said, Chilean companies focused heavily on cost controls coming out of intensely competitive periods (both pre- and post-pandemic), resulting in improved financial productivity.

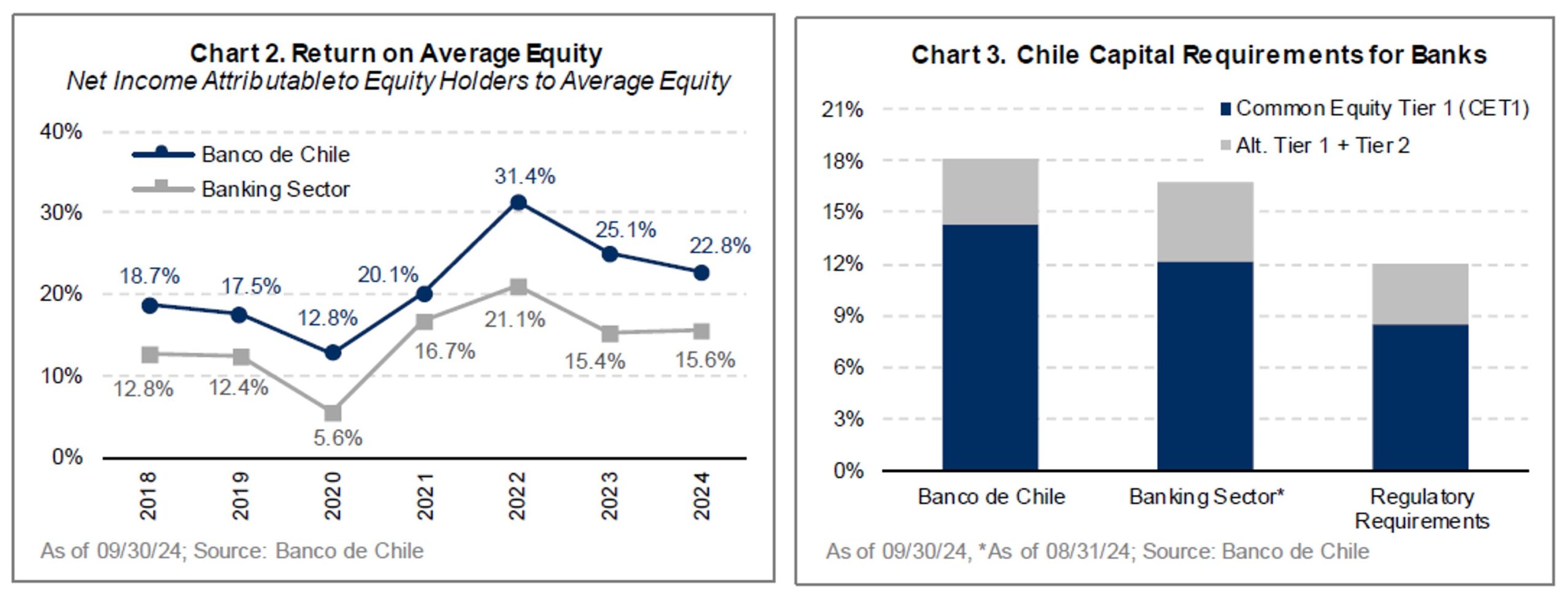

Banco de Chile, a strong banking franchise generating superior financial productivity, is one of the companies that excites us in the region. The management team’s long-term focus on growing the retail business with prudent credit underwriting has allowed the bank to stay ahead of the Chilean interest rate cycle. Stable to rising net interest margins and a thorough focus on costs have allowed Banco de Chile to generate returns on equity well above 20% for the past several years (Chart 2). We see further room for balance sheet growth and return of capital to shareholders, including potential dividends.

During this latest trip, I visited with the bank’s Treasury Director and urged further improvements regarding return of capital initiatives. Recent results show progress in this regard, which is encouraging given the bank’s historically conservative approach to capital management. The Chilean banking regulator’s goal to implement a mandatory counter cyclical buffer would increase the required minimum capital levels across the financial system. We believe Banco de Chile would be able to absorb the impact of increased capital requirements while also continuing to demonstrate more efficient capital management through asset growth or return of capital via dividends. As shown in Chart 3, the bank is well capitalized, with a CET1 ratioiv of 14.3% versus the 8.5% minimum requirement.

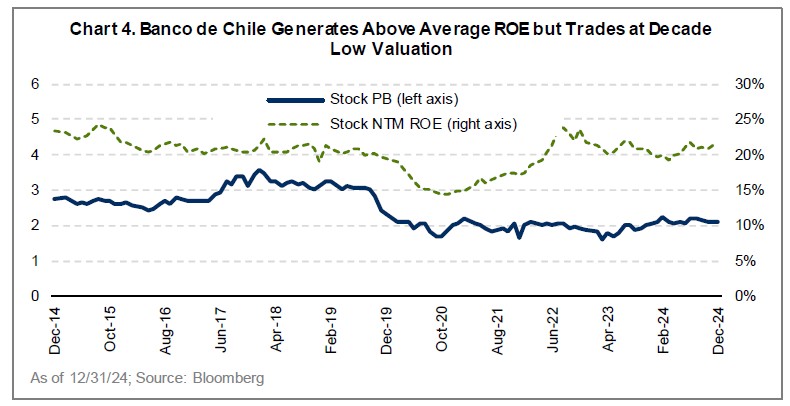

Banco de Chile serves as a good case study for the types of companies we find attractive in the Andean region – and specifically in Chile. The company generates superior profitability (ROE) while trading at decade-low valuation levels (Chart 4). A well-capitalized balance sheet and prospects for higher return of capital to shareholders make it a compelling long-term investment opportunity.

Enviable Growth Prospects and an Incumbent Disruptor in Peru

Peruvian companies represent another exciting segment in the Andean region given ample scope to participate in infrastructure development and to capitalize on low penetration levels across multiple services within a large addressable consumer market. Our enthusiasm about the structural opportunities was reinforced during my meetings with many companies across several sectors. Although we see unique pathways for earnings growth across the board, we believe the greatest investable opportunity at present is within financial services.

The Peruvian banking market operates in a disciplined oligopoly that will benefit from the tailwinds of very low credit penetration and a large unbanked population. Peru’s economy could face near-term volatility given the next presidential election is a year out. While the country has the fundamental building blocks in place to boast the fastest economic growth in the LatAm region, we expect the political merry-go-round that has plagued Peru in the past to keep capital investments at bay and economic activity at more pedestrian levels (low single digits) until political certainty is restored.

One of my stops during the Andean adventure was a two-day experience at Credicorp (BAP), Peru’s largest bank, during which I met with a wide array of teams and leaders. Based on my conversations with group executives in finance and innovation, leaders of the microfinance operation, and those in charge of the venture capital arm, I left with three key takeaways: 1) BAP is both the incumbent and the disruptor; 2) it is uniquely positioned to capitalize on the large informal economy of Peru; and 3) it benefits from a deep bench of world-class management talent.

Disrupt to Thrive

In my meeting with BAP’s Chief Innovation Officer, I was encouraged to learn about the digital initiatives underway across various operating units inside the bank. Under her leadership, these efforts have evolved to be drivers of both cost efficiencies and revenue. Yape, Peru’s leading payments operator launched by BAP in 2016, is a key example of such success. What started as a mere convenience tool to pay utility bills and top-up phone credits, Yape is now a full fledged digital finance operation, including lending products that were added to the platform in 2024. This new revenue stream provides Yape – and ultimately BAP – an unparalleled ability to reach unbanked residents, which is estimated to be 40% of Peru’s population.

Further evidence of BAP’s commitment to disruption is the governance and compensation structure created for its new business units. Segment CEOs are compensated like founders, with KPIs tied to the value of the new venture entity (i.e., Yape or equivalent). Over the long term, this model provides insight into how value is created inside the bank and how the stock valuation needs to evolve to reflect such initiatives.

In a pivot from typical boardroom meetings, I spent one morning with the CEO, CFO, and some field teams of MiBanco, Credicorp’s microfinance operation, at one of the largest trading markets in Lima. Gamarra, as it is called, consists of approximately 20,0000 small to mid-sized shops spread across 20 city blocks. Thousands of formal and informal textile businesses operate here, many of which take advantage of MiBanco credits to get started. The business owners represent a broad spectrum of the population – including people from the hinterlands and beyond, as well as some migrants – and it was apparent that everyone was working very hard. While at the market, I received a demo of the MiBanco app, which is used both by MiBanco employees (to process loans, follow up on collections, and cross-sell) and by business owners (to apply for loans, check their credit and balances, and conduct business). The app educates bank employees and clients about how credit, risk, collection, and other features are used to facilitate faster productivity in terms of both disbursing and collecting on loans. Of particular interest were the businesses of two women who started as laborers for other employers and were eventually able to establish their own formal businesses with retail storefronts. One now also runs a production hub in the hinterlands outside Lima, which employs even more people. Both business owners initially benefitted from a MiBanco credit product called “Credito Mujer,” which is geared toward empowering women entrepreneurs. Over time, they became important clients of the bank, taking advantage of multiple financial products, including mortgages.

Today, MiBanco contributes less than 10% of Credicorp group earnings, but we believe it has the ability to increase its impact with ROEs above 20% (compared to 18% mid-term targets for the overall consolidated BAP entity). The long term business case for microfinance remains intact, despite recent weakness in the segment driven by the collapse of a small savings bank and financial entity. Furthermore, the informal economy is rising, with nearly five million non banked microbusinesses in Peru and an additional nine million in Colombia, presenting an attractive and growing addressable market.

Despite already being a best-in-class operator in Peru, MiBanco has plans for continued improvement. In discussions about strategies to address cost ratios, I was pleasantly surprised to hear leaders referencing successful models from distant places (Bank Rakyat in Indonesia and ACLEDA Bank in Cambodia, among others), demonstrating strong cross border perspective.

Deep Bench and World-Class Management Team

The evolution of Yape within Credicorp and the success of the MiBanco franchise reflects the consistency and execution of management goals, driven by focused, high-quality talent. The individuals that BAP and Krealo, the venture arm of the bank, have been able to attract into leadership and advisory roles are impressive. Executives from key Brazilian and Mexican players in the fintech and consumer sectors, as well as executives from Amazon Web Services and other influential contacts from traditional banks, have been assembled. My on-the-ground observations and interactions with a vast network of leaders inside the company (including the new Credicorp Group CFO, the Chief Innovation Officer, and the CFO of Krealo, among others) solidified my conviction in the company’s leadership and strategy. Yape, for example, began as an idea inside Krealo after observing market trends and banking needs. Leaders then committed to solving those issues, bringing growth opportunities to the bank.

Another noteworthy observation was the degree of market awareness and global benchmarking pursued by all executive team members in an effort to bring best-in-class products to the markets in which Credicorp operates. My conversations with these decision-makers were comprehensive and wide-ranging, with a focus on adjusting cost structures, capital requirements, and return targets. The level of enthusiasm and commitment that was expressed by BAP leaders during my time with them was nothing short of inspiring. I left thinking, “Who wouldn’t want to join a team of this caliber?” This certainly bodes well for the company’s ability to continue attracting and retaining high quality talent and serves as a model for other LatAm companies to emulate.

We expect BAP to continue weathering the economic and political storms given its strong balance sheet, seasoned management, and disciplined underwriting. The promise of its Yape and MiBanco franchises, as well as other venture initiatives, further strengthens the thesis. Given these considerations, Credicorp’s valuation looks very attractive.

De-coupling in Action

An important component of our broad emerging markets thesis is the de-coupling of EM and the rise of South-South trade. During my time in South America, I saw evidence of increasingly strong relationships between Asian corporates (from China, India, and other countries) and Andean economies and their consumers.

In Santiago, Chile, both highways and mall showrooms are crowded with Chinese and Indian car brands. These observations are consistent with what we saw in South Africa and Mexico during other recent trips. Chinese and Indian car brands have increased in quality and technology, while being much more affordable and tailored to local Andean needs than other global brands. Additionally, growth in the local servicing networks has been a strong competitive advantage.

In Peru, evidence of EM de-coupling was primarily related to critical infrastructure. The majority of Peruvian electricity generation is owned by Chinese SOE China Southern Power Grid International (CSGI), including 100% of the generation in Lima, the country’s capital. Additionally, China has been investing over US$1.5B in the development of the deepwater port of Chancay. This will strengthen trade between South America and Asia, and it is also expected to have a significant multiplier effect on infrastructure projects for Peru and the Andean region. Lastly, several local financing companies attested to more joint financing projects with varied large Chinese banks to support ongoing infrastructure projects and future investments.

The Andean region’s development, demographics, and consumption trends present an appealing backdrop for domestic and foreign company expansion. We are encouraged by the rising level of earnings of many LatAm companies, driven by the increasing cross-border collaboration with (and competition from) other emerging market regions.

Andean Risks Breed Opportunities

My time in the Andean region reinforced the extensive opportunity for growth and development, but at every turn, I was also reminded of the significant risks percolating in these markets. We believe politics and liquidity are the most material risks for investors to consider when assessing opportunities in the region.

Political Theater and Exaggerated Security Concerns

Politics, unfortunately, remains a major concern for the Andean region. In Peru, despite a favorable demographic backdrop and a long runway for infrastructure development, the disappointing political environment is a self-inflicted issue. Ongoing political theater has overshadowed any real progress or execution on a set of clearly defined, long-term infrastructure plans, which is holding back structural growth. In my conversations with both business leaders and financial ministry officials, it was apparent that most people recognize the country’s growth potential as far higher than the paltry 3% pace of late. To paraphrase many, “Peru is a country that could sustainably grow at 5% or higher.” The next presidential elections are planned for 2026, assuming the current caretaker government remains in place until then.

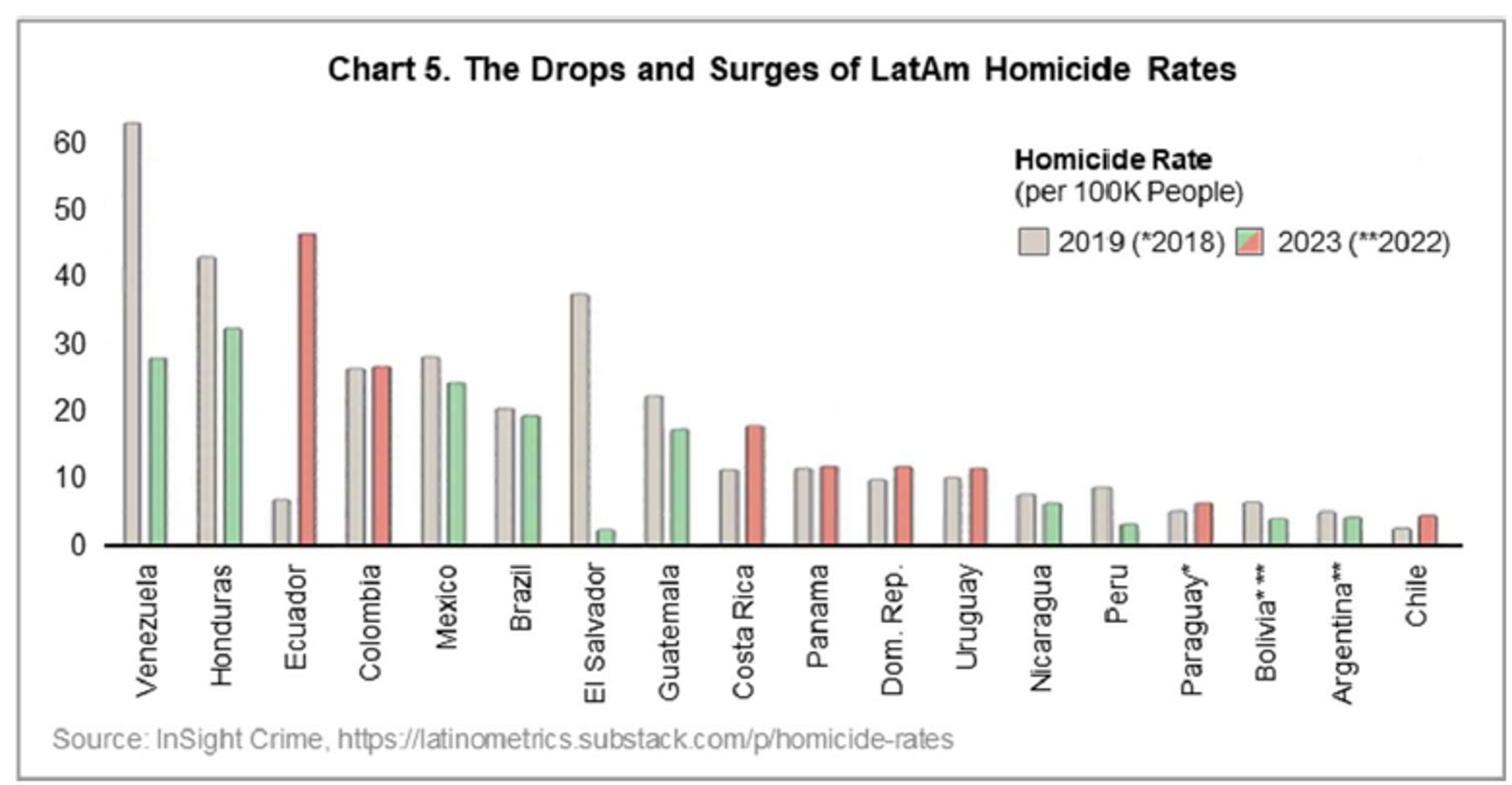

In the case of Chile, we found a clear local country bias and signs of business leaders operating with narrower perspectives. Security concerns have been a major topic in the country – including in my meetings with company executives – driven partly by recent trends in regional migration. However, Chile remains one of the safest places in South America (Chart 5). The lack of a broader perspective may lead to an overestimation of risks and undervaluation of local markets. For us, that creates an opportunity.

Another dimension adding to the challenge is a pervasive “wait and see” mindset, as the current leftist government is in its last year of service, and businesses are holding back on spending in hopes of more impactful security changes as part of a new administration. The popularity of current left-wing governments has declined substantially. The economic reality suggests that the pendulum might swing back to the other side; Argentina is just one example, with President Milei’s election in 2023. A shift to the right could be a substantial catalyst for corporate confidence, enabling a new wave of capital investments.

Liquidity Concerns Require Thoughtful Approaches

Liquidity is the other primary risk we consider in the Andean region, especially given the worsening trends over the past five years. Both Chile and Peru managed through the pandemic and their respective political cycles by allowing for pension plan withdrawals. This decision has led to restricted liquidity in local markets, making it more challenging for global investors to access great stocks. A rigorous risk approach and a focus on broader portfolio liquidity and capacity have allowed us to be nimble and access compelling, differentiated investments in these markets without compromising overall liquidity requirements.

We are optimistic about a wave of pension plan reforms that could turn this headwind into a potential tailwind over the long term. In the last year, congressional bodies in both countries have approved several policy changes,v some of which should support greater liquidity in the Andean capital markets.

Closing Remarks

The South American continent offers an array of exciting investment opportunities. Within the Andean region, our overall enthusiasm and interest in attractively valued businesses have been fueled by productive and enlightening meetings with business leaders who are focused on disruption, innovation, and smart management. My trip provided proof points that the Global South continues to carve out its own growth opportunities in an increasingly fragmented world, further supporting our EM de-coupling thesis. From a specific country perspective, Chile presents deeply discounted, high-quality companies, and Peru is foreshadowing substantial growth prospects. We look forward to seeing more Andean companies emerge with strong growth drivers, reflecting some of the characteristics of our holdings Banco de Chile and Credicorp. Low liquidity limits the current number of investable opportunities, but we expect this to change over time. In pursuit of these underappreciated and overlooked investment opportunities, we will abide by Euripides’ adage to “leave no stone unturned.”