“A sufficient measure of civilization is the influence of good women.” – Ralph Waldo Emerson

During this Women’s History Month, we are reflecting on the impact of women in emerging markets. With our Emerging Markets Opportunities portfolio approaching its three-year anniversary later this month, key differentiators and drivers of performance are top of mind. The success of many of our individual investments has been influenced by women leaders. Across policymaking, regulatory clean-ups, and corporate governance, women have made remarkable differences in the world of emerging markets investing. Highlighting and celebrating these accomplishments is warranted; as long-term investors, we are also looking ahead to determine how women will shape and influence markets and companies in new, material ways.

Policy – A Return to Orthodoxy in Turkish Central Banking

Post-pandemic, one of our key observations about the underlying fundamental drivers for companies across EM and frontier countries has been the fact that many EM policymakers have been ahead of the curve. We have seen evidence of countries becoming more proactive than, and in some cases de-coupling from, the US Fed in terms of interest rate activity.

Emerging market central bankers have traditionally been seen as less powerful, less independent, and more aligned with government priorities than sound monetary policy. One such example is the unorthodox policies pursued by Turkish central bankers for the better part of the last decade, largely acquiescing to the government’s political goals.

Against that backdrop, 2023 has been a remarkable feat. Not only did we see the appointment of the first female central banker in Turkey, but also Hafize Gaye Erkan became the first Turkish central banker in recent memory to re-direct policy toward orthodoxy. Although she recently stepped down from her role, she deserves credit for reinstating confidence in the Turkish market and laying the foundation for a new economic cycle.

Bottom-up valuations look compelling for many financially productive Turkish companies, and Ms. Erkan’s recent policy changes strengthen our conviction. A return to orthodoxy allows us to reduce some of our risk assumptions when considering investing in Turkey.

Regulatory – Tackling Chinese Real Estate

One of the most contentious topics regarding China, aside from broad geopolitical concerns, is the impact of the real estate sector on the Chinese economy. Although many privately-owned enterprises (POEs) are involved, we largely view the real estate sector as a critical tool for Beijing’s policy decisions and implementation. In the years since the pandemic, financing standards for consumers and companies were first tightened and then subsequently loosened after the situation was aggravated by the Chinese government’s tough lockdown measures.

With low consumer confidence and an anemic post-pandemic recovery, we believe real change in the real estate sector is critical, including tackling the issue of “zombie” property developers. These are overleveraged companies that are hanging on by a thread, largely surviving due to some relaxation of government policies. Addressing the inventory overhang and right-sizing corporate and consumer balance sheets will require a significant clean-up effort.

After months of a purgatory-like environment, Linda Chan, a well-reputed Hong Kong lawyer and judge, is taking action. Ms. Chan is addressing a key consumer and investor concern by issuing a liquidation order on sizable POE Evergrande, and she is likely to preside over more such cases. We believe this will be an arduous and long process, but it is a necessary step to restructure the sector and restore investor and consumer confidence. With these moves, the hottest economic topic in the country is now being managed by a well-respected female judge.

Our investments in Chinese state-owned enterprise (SOE) real estate companies are contrarian exposures. The structural trend of urbanization over the next decade should provide a healthy level of growth for select participants in the real estate sector. Our diversified portfolio of SOEs are well positioned to gain share in an unloved industry that has been facing regulatory headwinds. Balance sheet tightness over the last few years has restricted growth for some Chinese real estate companies. Our SOE holdings are among the few that have been able to buy land and initiate projects, which should underpin sector-leading earnings growth rates – and, as stated previously, we believe risks are overestimated and valuations are underappreciated

Corporate Governance – Women Leading in South Africa

Over the last few years, the South African economy has been under constant pressure from natural disasters, deteriorating internal political stability, undesirable geopolitical associations, and, most prominently, an energy shortage impacting economic activity. Amidst these unfavorable conditions in this so-called “smaller” EM market (smaller by market capitalization, not by population) we found a strong performer – Bidvest. Bidvest is an international services, trading, and distribution company that has continued to thrive in the cyclical industrial services sector. The company has grown its free cash flow and delivered double-digit increases in earnings. Strong investment discipline coupled with good governance has allowed Bidvest to deliver industry-leading capital returns and returns to shareholders.

Bidvest is a great company, underpinned by a noteworthy number of women executives and board members. The company’s board of directors is 75% women, making it the leading company on this metric across the entire MSCI ACWI universe¹ , comprised of both emerging and developed markets (Table 1). Bidvest is led by a female CEO, and women make up the majority of its executive team; this group has successfully steered the ship through challenging waters while steadily returning capital to shareholders.

More to Come from the Women of EM

Looking ahead, we remain encouraged by the increasing and more impactful role women will play in emerging markets. The electoral cycle across the EM landscape will continue to be very active in 2024 and could be one of the greatest sources of disruption – and opportunities. In Mexico, for example, the leading candidates for both the incumbent party and the opposition are women. It is highly likely that Mexico’s new president will be a woman – an unprecedented outcome.

From a bottom-up perspective, we have found many attractively valued and underappreciated companies in Mexico, leading to a significantly differentiated and overweight exposure in our portfolio. Strong domestic consumption has been a key driver of our companies’ earnings growth. We are invested in a diverse set of companies across the consumer, industrial, and financial sectors that should be able to capitalize on the increasing demand for infrastructure projects, capital funding, and the corresponding rise in income, further enabling consumption. These company-specific drivers are underpinned by Mexico becoming a key beneficiary of the structural nearshoring trend, which should promote significant FDI growth in the coming years. Given this favorable backdrop, if either of the two female candidates is elected president, she will be in a strong position to positively impact the economy and Mexican companies’ earnings growth.

It’s About Taking Action, Not Ticking Boxes

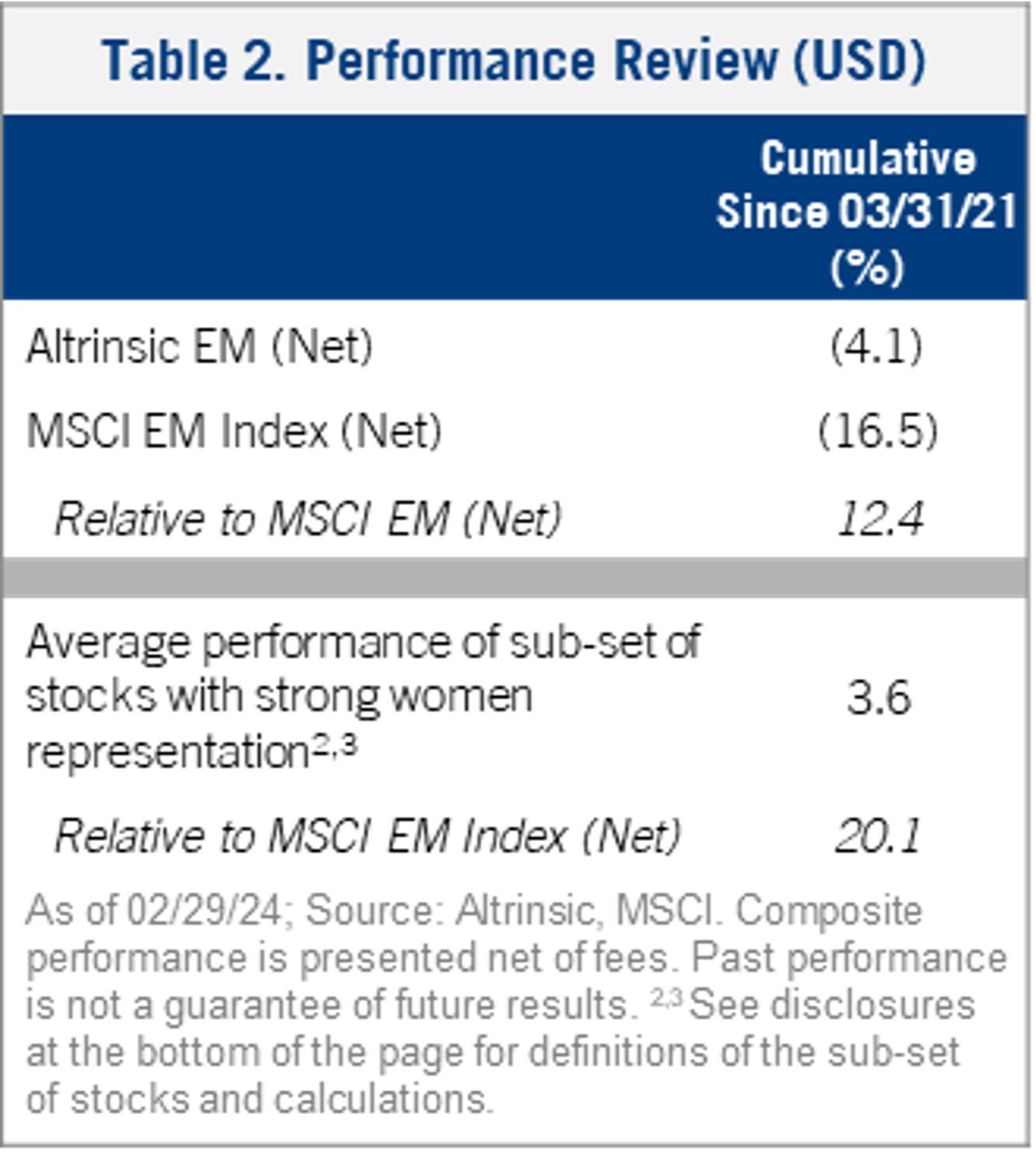

You could say that recent examples of EM women in power personify Margaret Thatcher’s 1965 call to action: “If you want something said, ask a man; if you want something done, ask a woman.” From an investment perspective, we have found higher levels of female leadership, at the board level and/or on corporate executive teams, to be a driver of outperformance.

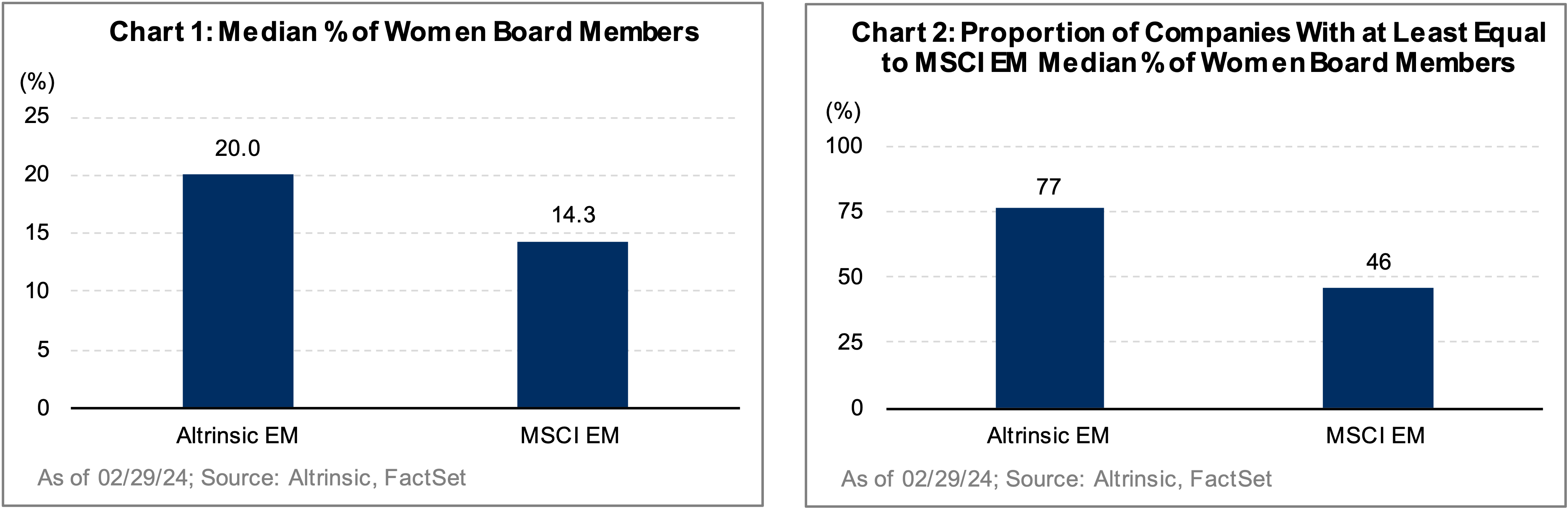

While not targeted from a top-down perspective, our portfolio companies have a higher proportion of women board members than the MSCI EM Index constituents (Chart 1). Furthermore, fewer than half of MSCI EM Index companies have a median or greater representation of women on their boards (14.3%), whereas 77% of our portfolio companies meet or exceed this threshold (Chart 2).