The Altrinsic Emerging Markets Opportunities portfolio declined 2.4% (-2.6% net) compared to the 2.9% decline of the MSCI Emerging Markets Index, as measured in US dollars.i Performance throughout the period varied markedly within emerging markets (Chart 1), with a stark divergence between EMEA and Latin America. Performance across the market capitalization spectrum also varied, with small and mid-cap EM stocks substantially outperforming the broad EM index. Overall, EM equities outperformed developed markets in the third quarter.

Perspectives

With broad volatility across sub-segments being the year-to-date theme in EM, there hasn’t been a clear driver of performance. Hungary and Egypt have emerged as unexpected leaders from a country perspective, and with geopolitics at the forefront of most EM-related discussions, it is not surprising to see energy out in front thus far from a sector standpoint. We attribute the market’s focus on information technology to global trends as opposed to themes specific to emerging markets. Regarding China, the broad narrative in the market remains consistently anti-China, ex-China, and “the other EM” in focus. Our contrarian nature leads us to question this theme.

To SOE, or to POE?

“To be, or not to be, that is the question” – William Shakespeare

The degree of confusion caused by Chinese market dynamics today echoes Hamlet’s famous “to be, or not to be” struggle. Many market participants are on edge, driven by a lack of clarity and the resulting misunderstanding and distrust. Building upon our reflections last quarter, when we described China as “de-coupling, not de-railed,” we continue to peel back the layers of its investment landscape. State-owned enterprises (SOEs 1 ) provide an interesting perspective on the investment opportunities in China. Two elements, in particular, are critical when assessing these businesses: 1) the companies could be tools for policy implementation, and 2) there is a clear pecking order, with minority shareholder rights falling at the end of the line.

SOEs controlled by the central government are frequently used for Beijing’s policy implementations. Banks routinely adjust reserve requirement ratios and quickly re-price the central bank’s interest rate changes to facilitate growth in specific sectors, including real estate and infrastructure. Looking back, we believe SOEs should have traded at substantial discounts to privately-owned enterprises (POEs), given the increased level of risk inherent in being exposed to Beijing’s directives and the possibility of swift, unexpected changes. Regarding the hierarchy of rights, it is likely shareholder considerations will always come second to policy goals unless the policy goals change in such a way that they become aligned with shareholder goals. With these factors in mind, we believe the market is more than discounting risks and over-penalizing SOEs 2 today relative to POEs and that the post-pandemic world has changed the relative attractiveness of SOEs versus POEs (Chart 2).

A year ago, before the removal of the zero-COVID policy and prior to the 20th National Congress Party in October 2022, we wrote about a likely increase in centrally driven projects, as opposed to local initiatives. Given the precarious nature of local government finances and the fact that larger projects require more funding, better balance sheets, and better capacity to execute, it seems even more likely that upcoming projects will be sanctioned by Beijing. There is also greater scope for lengthening receivables, which could weigh on productivity and returns for private companies, a topic we addressed in our letter at this time last year. This combination of factors will tip the playing field toward larger, central SOEs, leaving POEs further behind.

Recent Observations on SOE

1. SOEs are taking market share.

There has been a noteworthy proliferation of faster top line growth in the SOE segment. On average, these companies have grown their top lines almost twice as fast as Chinese listed stocks (Chart 3)3 . Since the pandemic, relative revenue growth has been even more pronounced. Oftentimes, relative to the private sector, these SOEs have gained substantial share. Most recently, we have seen this thesis play out in our SOE real estate developer stocks, CR Land and China Overseas Land. They have been able to grow their land banks and cherry-pick quality projects while private industry is consolidating substantially and reeling from overleveraged players and consistent regulatory pressures.

2. SOE balance sheets are in better shape.

While it is certainly possible (even probable) that some debt is being held in off-balance-sheet accounts, SOEs’ balance sheets are notably better than before the pandemic period (Chart 4), particularly since the last major Chinese volatility episode (the growth scare of 2015-2016). Large SOEs also demonstrate surprising discipline when it comes to investing, now more in line with the broader market (Chart 5). This restraint has not come at the expense of existing operations, as capex and depreciation ratios have continued to hover well above 1.5x 4 since the pandemic.

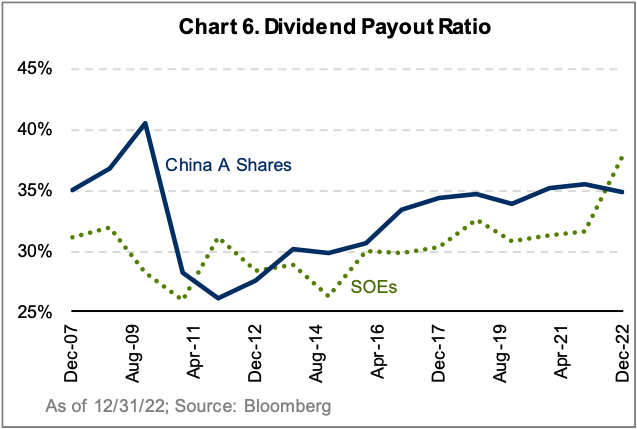

3. SOEs’ returns are picking up.

The net result of the aforementioned balance sheet improvement is better returns than expected. For the first time in over a decade, SOEs are now looking to provide greater shareholder returns via increased (and leading) dividend payout ratios (Chart 6). These increases could also be tied to recent SOE reform efforts, which are detailed below.

4. SOE reforms are grand plans.

Earlier this year, we saw the Chinese central government and SASAC 5 initiate a new wave of reforms pertaining to SOEs. One of the most interesting elements from an investor’s standpoint is the shift from using net profit as a performance indicator to using return on equity (ROE). Additionally, there is a new requirement to not only increase operating profit cash ratios but also to increase ROE, R&D, and total labor productivity. These targets are nice to see, but long-term execution will be key. As minority shareholders, we are starting to see better alignment of interests, given our focus on financial productivity as a key determinant of value.

Since the pandemic, we have watched various industry regulators proceed with widespread, aggressive, and substantial “reforms” geared toward companies in the e-commerce, education, and health care sectors, to name a few. These actions were all initiated by the government under the guise of “leveling the playing field.” The risk of continued – and greater – government intervention in the private sector has increased substantially compared to the level of involvement already expected for SOEs.

5. SOE valuations are more attractive.

Given the substantial reforms and increased government participation in private industry, we believe that a recalibration of risks and pricing is warranted to reflect the relatively worse outlook for POEs. Meanwhile, notwithstanding the overarching level of risk implied in Chinese stocks, valuations for some SOEs are looking attractive, particularly given that financial productivity has improved substantially. Compared to the Hong Kong market, Chinese SOEs deliver similar returns and superior dividend yield while trading at large discounts. Altrinsic’s China exposure is competitive in terms of valuations relative to the overall Chinese market but reflects superior returns and divided yields compared to China SOEs, China A-shares, and the MSCI EM ex. China Index (Table 1).

While some SOEs are not the highest quality companies in the realm of emerging markets or even Chinese equities, we believe that compelling value can be uncovered relative to the level of financial productivity they generate. The key is to have a keen awareness of the dynamics at play, including the inherent risks in companies controlled by the government.

Our bottom-up discipline has recently led us to more investment opportunities in China, resulting in one of the narrowest relative exposure gaps since inception (Chart 7). We currently own five SOE stocks in our Emerging Markets Opportunities strategy, representing 6.1% of the portfolio and 21% of our overall Chinese exposure.

Performance and Investment Activity

The Altrinsic Emerging Markets Opportunities portfolio outperformed the MSCI Emerging Markets Index in the third quarter. Key positive contributors were individual stock selections in the information technology (Tripod Technology, Chroma ATE Inc), communication services (Netease, Advance Info Service), and financials (Commercial International Bank of Egypt, Bank Mandiri, PICC Property & Casualty Co.) sectors.

Positive relative performance was slightly offset by stock selection in the consumer discretionary (Lojas Renner, JD.com) sector, which was affected by the volatility in underlying domestic markets, in the real estate (Vinhomes) sector, which struggled due to ongoing regulatory changes, and in the materials sector (Ganfeng, Centamin), as both stocks reflected the volatility (decline) in the underlying commodity markets of lithium and gold.

Geographically, the greatest sources of outperformance came from our stock selection in Taiwan (Tripod Technology, Chroma Ate) and South Korea (KB Financial Group), as well as our differentiated overweight exposure in South Africa (Sanlam, Bidvest, Standard Bank Group). Relative detractors came from our stock selection in Brazil (Vamos, Lojas Renner) and China (Ganfeng Lithium, AIA Group).

Portfolio activity was modest this quarter, as we exited one investment (Thai Beverage) and established one new position (Centamin). Thai Beverage is Thailand’s largest spirit producer and the leading beer operator in Thailand and Vietnam. Our confidence in the investment thesis diminished significantly over the past two years due to ineffective execution in Vietnam, inadequate communication from the management team, a lack of foreseeable cost and expense savings, and the possibility of alcohol tax hikes following the Thai election.

We initiated a position in Centamin, an Egypt-based gold miner with a low-cost, long-life asset in Sukari and a net cash balance sheet. The new management, CEO, and operating team have demonstrated two years of progress in turning around execution and have positioned Sukari to grow production substantially while also reducing cash costs. Solid execution should drive a re-rating in the stock from very depressed levels while also creating upside to dividends.

Closing Thoughts

“Fashion is architecture: it is a matter of proportions.” – Coco Chanel

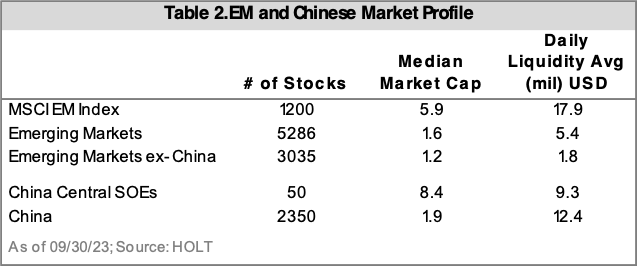

Over the past year, we have been writing consistently about the EM de-coupling trend, and we have been observing the “fashionable” pivot away from China with a dramatic rise in EM ex. China fund launches.6 This focus on EM ex. China is understandable, given the rising temperatures of the Washington D.C.-Brussels-Beijing discord, as well as the paltry returns generated in the Chinese market since the pandemic. Since our strategy launch in early 2021, and as noted in our white paper “Exploring the True DNA of Emerging Markets,” we have remained committed to casting a wide net and then digging deep to find high-quality, compelling investment opportunities beyond the popular and crowded destinations. We must consider proportions when assessing the architecture of the EM investment landscape (Table 2)7:

- Across 45 emerging and frontier countries, the investable universe is approximately 5300 stocks.

- Of these, only about 1900 have an average daily liquidity above $10mm.

- Removing all Chinese stocks shrinks the overall universe by 43% (to about 3000 companies) and the count of liquid stocks by 68% (to roughly 570 stocks).

Consider this: The average daily turnover for the broadly defined EM ex. China universe is only $1.8mm, compared to a median of $17.2mm for companies in the MSCI EM Index and $5.4mm for companies across the broad emerging and frontier market stock universe. At $1.8mm daily liquidity, the EM ex. China universe trades with just over 14% of the median Chinese stock’s liquidity.

From experience, we know that China presents a distinct, nuanced set of risks and opportunities. This perspective, and the statistics cited above, reinforce the importance of conducting an in-depth assessment of how the architecture is built for a shift away from China without a) creating greater liquidity constraints or b) chasing even more crowded, concentrated trades than the leading EM indices already do.

We remain excited about the depth and breadth of high-quality investment opportunities found in the emerging and frontier markets and continue our bottom-up, fundamental quest to find underappreciated, financially productive, and liquid companies to build a differentiated portfolio. En route!

Sincerely,

Alice Popescu