Dear Investor,

After a strong 2022, we expected that emerging and frontier markets would avoid an economic hangover, and this proved to be true. Both EM and frontier countries demonstrated stronger absolute and relative economic performance, paired with moderating inflation, active and early central bank policymaking, and relatively stable currencies. China was the primary disappointment, as its post-pandemic re-opening led to flatter-than-expected domestic activity and failed to reverberate through many countries in Southeast Asia. Meanwhile, internal consumption across EM was broadly resilient, and the trend of emerging markets decoupling from developed markets continued.

For the year, the Altrinsic Emerging Markets Opportunities portfolio gained 13.1% gross of fees (12.0% net), outperforming the MSCI Emerging Markets Index’s 9.8% return, as measured in US dollars. In the fourth quarter, the Altrinsic Emerging Markets Opportunities portfolio increased 5.9% gross of fees (5.7% net), compared to the 7.9% increase of the MSCI Emerging Markets Index.i Performance within the quarter varied markedly across emerging markets (Chart 1), with a stark divergence between Latin America and Asia – more specifically, ASEAN. Performance across the market capitalization spectrum also varied, with small and mid-cap EM stocks substantially outperforming the broad EM index.

Throughout 2023, we built the case for why the de-coupling of emerging markets from developed markets is a long-term theme driving enhanced self-reliance for many EM countries. Globalization has been under attack with intensifying protectionist policies coming to the fore in traditional free-market countries 1. In this new era of zero-sum thinking, we appreciate the concern investors may have around emerging markets that are heavy exporters. However, we counter this misconstrued hypothesis with recent observations.Over the last couple of years, EM and frontier countries and companies have increasingly diversified their trade. A recent McKinsey Global Institute report 2 showcased that in Latin America, South-South trade has grown much faster than that with the US market – in real terms and through the pandemic. (Chart 2).

In China, Brazil, India, and Vietnam, trade within emerging and frontier markets has been increasing in volume and changing in composition over the past few years. In the first half of 2023, we wrote about the changing nature of Brazil’s trade with China, marked by a migration from materials to agricultural-based products. Furthermore, recent studies3 also highlight that intra-African trade has been a greater driver of economic activity for many companies across the continent than trade outside the region. In other words, African companies are increasingly focused on internal demand and consumption, not export volumes. Over the last five years, the Africa Regional Orientation Index, a measure of the importance of intra-regional exports relative to extra-regional exports, shows only three sectors are outwarddriven (automotive, primary products, textiles, and footwear), whereas the majority of economic activity is driven by the continent itself (Chart 3).

The Altrinsic Emerging Markets Opportunities portfolio seeks to capitalize on this dynamic in Africa with investments in South African companies that are deeply exposed to trade and underlying economic trends across a range of frontier markets on the African continent. These companies are delivering high returns at substantially discounted prices, with better risk control through increased liquidity. More broadly, our portfolio has direct exposure to the structural trend of de-coupling across EM; just a few examples include Chinese handsets sold in Africa (Shenzhen Transsion), industrial and commercial vehicles built in China and sold in the Middle East (Yutong Bus), and Brazilian agricultural exports to China (Vamos Locacao de Caminhoes).

Contrarian on China

“There is no greater danger than underestimating your opponent.”

– Lao Tzu, Chinese philosopher

China currently presents one of the most compelling sets of investment opportunities across the EM landscape. The China+1 diversification strategy has had significant repercussions across many countries, particularly within the ASEAN region and Mexico. These regions have also been beneficiaries of capacity expansion efforts by global and local multinational companies – further supporting the de-coupling story.

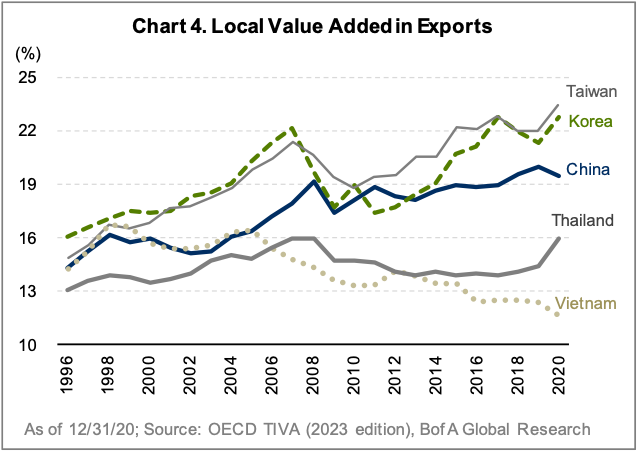

However, few places globally can rival China’s value-added productivity in the manufacturing process. Further, a key pillar in China’s 14th Five-Year Plan is an increased focus on building and upgrading intelligent manufacturing R&D centers and reaching specific digitalization targets by the end of 2025. We believe that China is focused on staying ahead, and we are not the only ones to make this observation:

“Where can I find the customers which pull me into the next level of innovation,

which are demanding, and which are looking for the next technology?

It’s China in very many cases.”

– Roland Bush, CEO Siemens (June 2023)4

Our ongoing engagements across global networks confirm that large, high-quality industrial and manufacturing companies are continuing to invest in China. Like Siemens, BMW and KION, two leading German manufacturers, are investing and ramping up production across factories in China.5 It can be said that global companies are still very much “riding the Mandarin Dragon.”

We know there are widespread questions about the risks in China – particularly related to geopolitical tensions and the broader topic of investability. While mindful of these considerations, we see the situation in a different light.

On the topic of Taiwan, the presidential election was won by the incumbent party with the lowest margin of success in 24 years. This will make it harder for the ruling Democratic Progressive Party to focus solely on the China issue. Furthermore, the country has a series of domestic economic issues to contend with – namely, lower-than-expected income growth and high property values, creating challenges around housing affordability. We would expect these topics to dominate Taiwanese policymakers’ focus in the short term. The broader geopolitical rhetoric will be driven by US-China relations and shaped by the upcoming US presidential election. It remains to be seen which party will win and how the outcome “pokes the Mandarin dragon” – or not.

Mindful of the geopolitical risks, we believe the uncertainty creates an environment ripe for investment – not an uninvestable one – given current valuation discounts. From a liquidity perspective, the median emerging market stock outside of China is about 15% as liquid as the median Chinese stock. Eliminating China from the investment opportunity set can significantly limit an EM portfolio’s liquidity profile, as we explored in our Q3 2023 commentary.

Don’t be fooled by the stocks that I got,

I’m still, I’m still from the EM block,

Used to have a little, now I have a lot,

No matter where I go, I know where I came from.

– Adapted from Jennifer Lopez’s song ‘Jenny from the Block’ 6

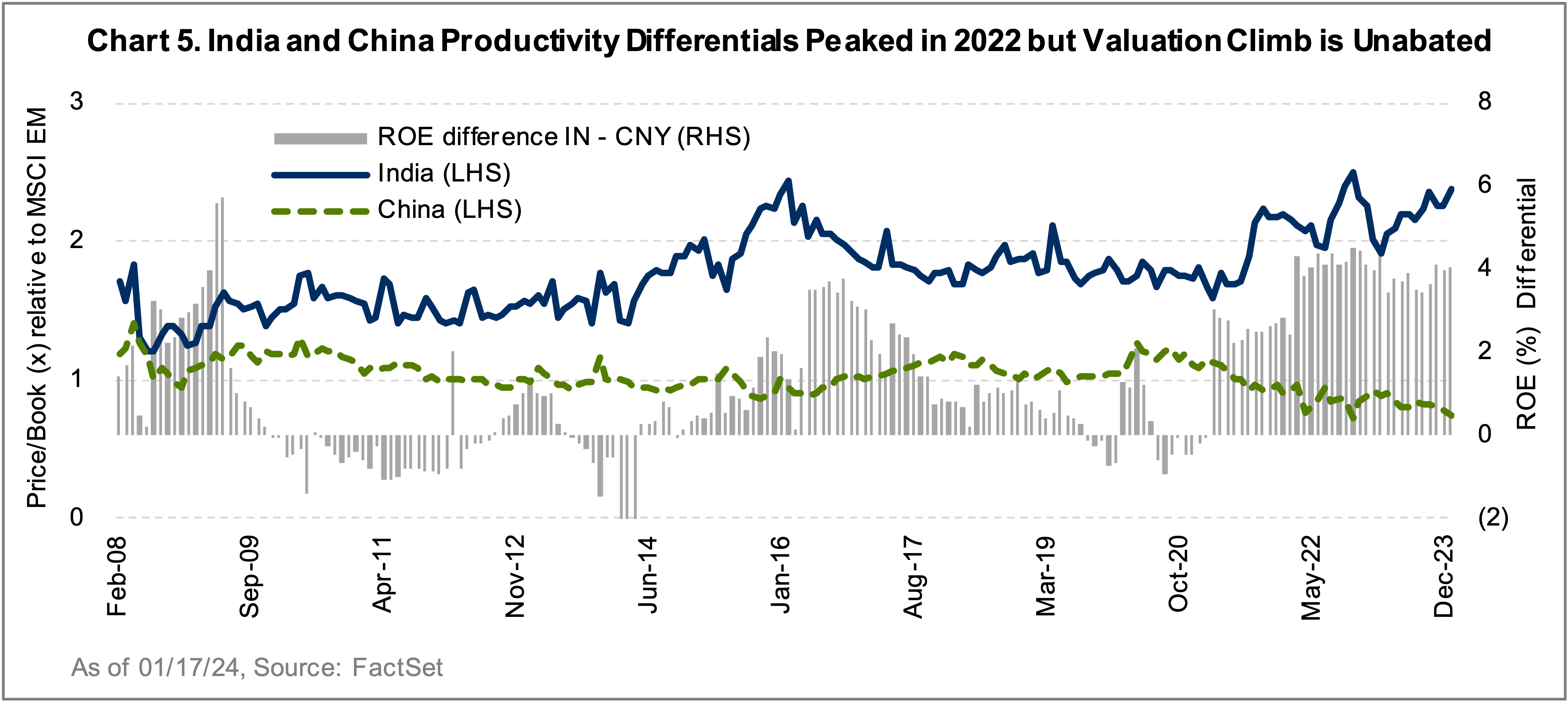

In Mexico, an expensive Real Effective Exchange for the peso, a euphoric sentiment around nearshoring, and unfettered access to the US market have created a belief that the country (and its equity market) can do no wrong. A smooth political transition is priced in – unrest or surprises could create unexpected volatility. Additionally, over the last few months, there have been a number of unexpected (and not well-understood) regulatory squabbles across various industries (new airport regulation framework; antitrust pursuit of Walmex’s supply chain). With just one or two moves, Mexico is reminding everyone not to be fooled by the stocks that it’s got, it is still from the EM block. Much like in India, from a bottom-up perspective, we continue to find select investment opportunities, but the discount to intrinsic value has narrowed and returns look less favorable relative to stocks in other markets.

Performance and Investment Activity

The Altrinsic Emerging Markets Opportunities portfolio underperformed the MSCI Emerging Markets Index in the fourth quarter. Stock selection in information technology (Chroma, Shenzhen Transsion, Samsung), real estate (China Resources Land, China Overseas Land), and materials (Anhui Conch, UPL) weighed on relative performance. Key positive contributors were individual stock selections in the financials (Commercial International Bank of Egypt, Banco Bradesco, Grupo Financiero Banorte), consumer staples (Clicks, FEMSA, Walmex), and industrials (Larsen & Toubro) sectors.

In technology, we saw profit taking from robust performance in the first nine months of the year, but we expect uneven global demand for consumer electronics and EVs to be offset by continued strength in AIrelated infrastructure. Our real estate holdings struggled due to continuing volatility in China, but we expect these companies to deliver industry-leading activity given market share gains and strong balance sheets, which support the execution of their robust project pipelines. Our materials companies faced slow recovery and agrichemical de-stock cycles, but we expect inventories to normalize throughout 2024.

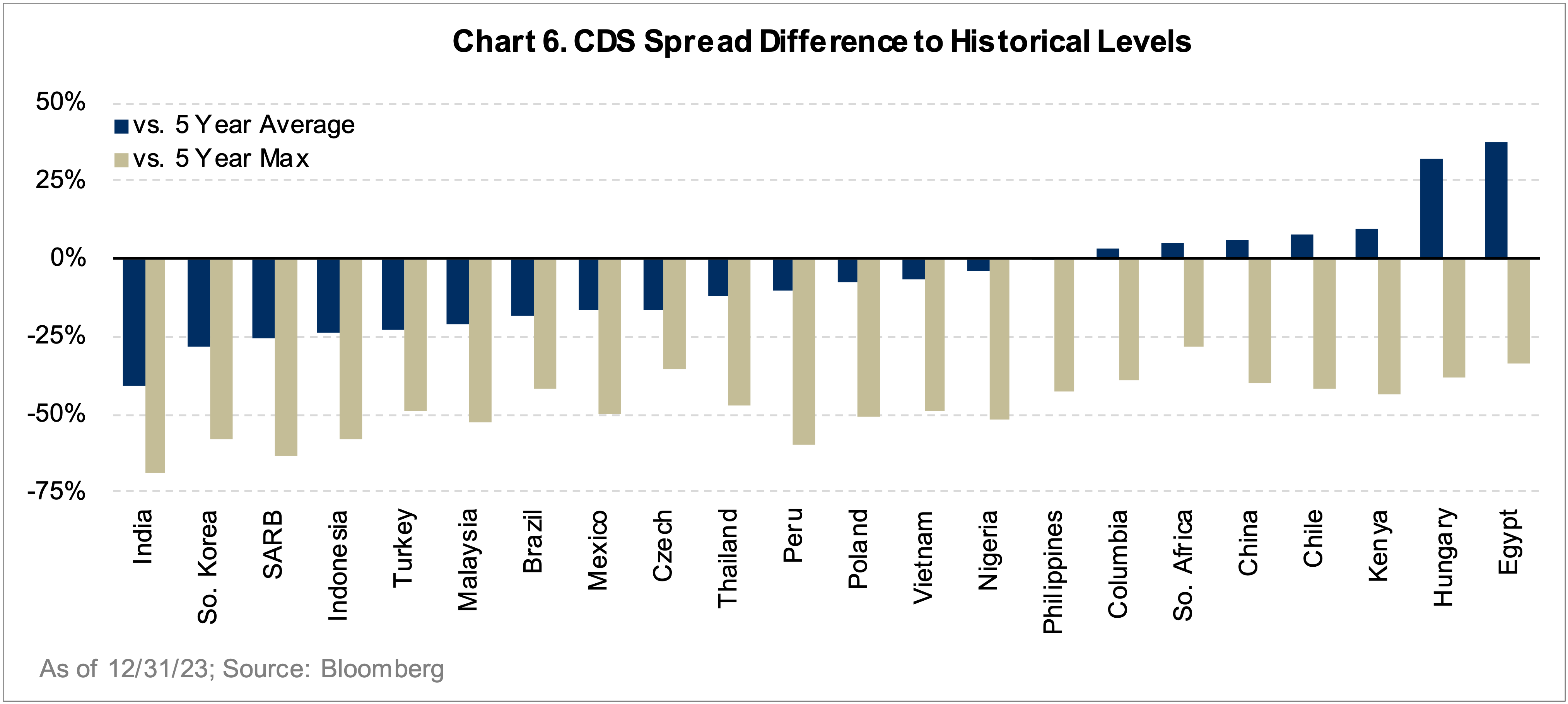

The financials sector benefitted from continued high levels of net interest margins earned by many banks (Grupo Financiero Banorte, Commercial International Bank of Egypt) and the bottoming of asset quality issues (Banco Bradesco). In consumer staples, FEMSA and Walmex capitalized on resilient Mexican -75% -50% -25% 0% 25% 50% India So. Korea SARB Indonesia Turkey Malaysia Brazil Mexico Czech Thailand Peru Poland Vietnam Nigeria Philippines Columbia So. Africa China Chile Kenya Hungary Egypt Chart 6. CDS Spread Difference to Historical Levels vs. 5 Year Average vs. 5 Year Max As of 12/31/23; Source: Bloomberg consumption, while Clicks continued to execute amidst a challenging South African environment. In industrials, Indian engineering conglomerate Larsen & Toubro continued to increase its backlog with new project announcements.

Geographically, detractors included our stock selection in Taiwan (Chroma), India (Petronet, UPL Ltd, Indraprashta Gas), and Vietnam (Vinhomes, Vinamilk). India broadly delivered weaker-than-expected results, and local regulatory cycles continued to pressure some sectors in Vietnam. The greatest sources of outperformance came from our allocation and stock selection in Mexico (Grupo Financiero Banorte, FEMSA, Walmex), Brazil (Lojas Renner, Banco Bradesco, Porto Seguro), and South Africa (Clicks, Mr Price, Standard Bank).

Portfolio activity was modest this quarter, exiting just one investment (Trip.com). Trip.com is the dominant online travel agency (OTA) in China. It has 52% market share in the overall domestic OTA arena, with even higher market share in Tier 1/Tier 2 cities, its primary area of focus. Following the elimination of China’s zero-COVID policy, Trip.com shares rebounded and reached our estimated intrinsic value – we sold our position in favor of better risk/return opportunities elsewhere in the portfolio.

Closing Thoughts – Capital Returns Hidden in Plain Sight

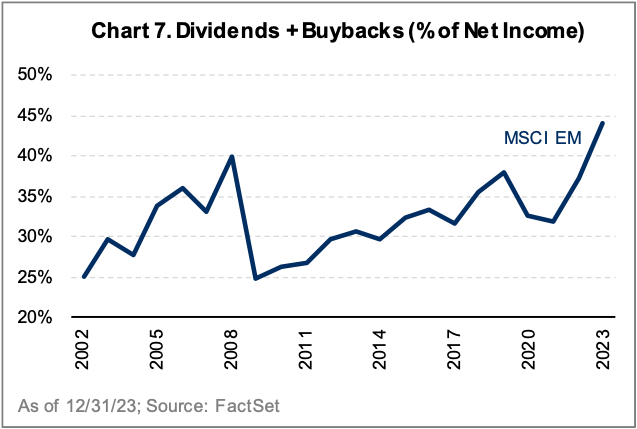

Much has been written in the last decade about the prowess of financial engineering exhibited by US companies, with capital returns (dividends and buybacks) rising to nearly 70% of net income (see our recent piece “Growth and Innovation on Sale: The Case for International Equities Now” for perspectives on this topic). In the US, capital returns still trail peak levels last seen in 2014-2015, but emerging markets companies achieved new highs in 2023 (Chart 7).

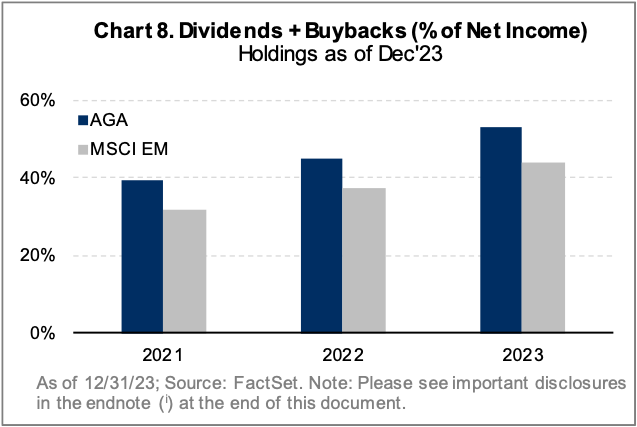

Across our portfolio, we found companies with a solid focus on cash flow generation, strong balance sheets, and, therefore, the ability to drive increasing capital returns. With financial productivity in mind, many of our investments have delivered superior capital returns to the market (Chart 8).

Our approach of casting a wide net and focusing on undervalued businesses remains consistent, as does our satisfaction with running against the tide and establishing contrarian perspectives. Unlike the popular headlines might suggest, we continue to “ride the Mandarin dragon” while scaling back on “Incredible India.”

Looking ahead, we welcome the likely volatility in equity markets, as it should provide fertile hunting ground for new, attractive investment opportunities.

Sincerely,

Alice Popescu